Assurity Life Insurance Review 2025 (Companies + Rates)

Assurity Life Insurance Company offers term life for as low as $12.40/month. Assurity even has lower rates for smokers than most other life insurance companies.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Life Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Licensed Life Insurance Agent

UPDATED: Dec 16, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Dec 16, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Assurity Life Insurance Company Overview

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1890 |

| Current Executive | CEO – Tom Henning |

| Number of Employees | 350 |

| Total Sales / Total Assets | $318,000,000 / $2,600,000,000 |

| HQ Address | 2000 Q Street Lincoln, NE 68503 |

| Phone Number | 1-402-476-6500 |

| Company Website | www.assurity.com |

| Premiums Written - Individual Life | $128,333,401 |

| Financial Standing | $271,400,000 |

| Best For | Strong Financial Ratings; Accelerated Underwriting up to $500,000 |

Finding the right life insurance company is just as important as deciding you are buying term life versus whole life. Our Assurity life insurance review covers everything you need to know about the company and its policies.

So, are you wondering if Assurity is right for you? Use the FREE quote tool above to compare Assurity life insurance rates below against other top life insurance companies.

Shopping for Assurity Life Insurance Quotes

No one enjoys shopping for life insurance, but having it can benefit your loved ones. Our review includes many sample rates for term life. For personalized rates, get a quick life insurance quote right here at the top of this page.

Average Assurity Life Insurance Rates by Age

How much does life insurance cost? Below are eight different tables displaying sample life insurance rates by age. The first set of average Assurity life insurance costs are monthly rates for non-smoking males buying term life insurance.

Assurity Term Life Insurance Monthly Rates for Male Non-Smokers by Age

| Term Life Policy | Age 30 | Age 40 | Age 50 | Age 60 |

|---|---|---|---|---|

| $100,000/10-year | $9.22 | $10.88 | $20.10 | $44.20 |

| $100,000/20-year | $9.83 | $14.62 | $31.06 | $80.21 |

| $100,000/30-year | $12.53 | $20.01 | $46.72 | NA |

| $250,000/10-year | $13.92 | $18.05 | $35.24 | $81.13 |

| $250,000/20-year | $15.44 | $25.45 | $57.20 | $150.73 |

| $250,000/30-year | $21.32 | $37.63 | $93.53 | NA |

| $500,000/10-year | $21.75 | $30.02 | $61.77 | $141.81 |

| $500,000/20-year | $24.80 | $44.81 | $98.75 | $265.35 |

| $500,000/30-year | $35.67 | $66.99 | $168.35 | NA |

A 30-year-old non-smoking male can get a 10-year/$100,000 policy for $9.22 a month, perfect for singles with student loan debt. It’s important to buy life insurance early because a 60-year-old man would spend $44.20 on the same policy. Life insurance for smokers is more expensive.

Assurity Term Life Insurance Monthly Rates for Male Smokers by Age

| Term Life Policy | Age 30 | Age 40 | Age 50 | Age 60 |

|---|---|---|---|---|

| $100,000/10-year | $14.27 | $25.58 | $67.69 | $211.06 |

| $100,000/20-year | $20.10 | $39.06 | $110.58 | $301.63 |

| $100,000/30-year | $25.23 | $53.07 | $142.07 | NA |

| $250,000/10-year | $24.58 | $46.11 | $130.07 | $401.07 |

| $250,000/20-year | $35.24 | $73.08 | $217.07 | $583.12 |

| $250,000/30-year | $48.29 | $105.92 | $291.89 | NA |

| $500,000/10-year | $43.07 | $83.96 | $225.77 | $707.31 |

| $500,000/20-year | $63.95 | $132.24 | $376.28 | $1,034.43 |

| $500,000/30-year | $86.57 | $194.01 | $515.04 | NA |

So 30-year-old men who smoke would pay $86.57 a month for a 30-year/$500,000 policy while non-smokers would only pay $35.67 a month. Next, see how gender affects rates.

Assurity Term Life Insurance Monthly Rates for Female Non-Smokers by Age

| Term Life Policy | Age 30 | Age 40 | Age 50 | Age 60 |

|---|---|---|---|---|

| $100,000/10-year | $7.57 | $9.74 | $16.53 | $32.71 |

| $100,000/20-year | $8.70 | $12.44 | $24.71 | $56.64 |

| $100,000/30-year | $10.53 | $16.44 | $35.58 | NA |

| $250,000/10-year | $9.79 | $15.23 | $28.06 | $59.16 |

| $250,000/20-year | $12.40 | $21.32 | $44.59 | $105.05 |

| $250,000/30-year | $16.75 | $30.02 | $69.60 | NA |

| $500,000/10-year | $13.49 | $24.36 | $49.59 | $103.10 |

| $500,000/20-year | $18.71 | $36.54 | $77.00 | $184.88 |

| $500,000/30-year | $26.97 | $52.64 | $124.85 | NA |

A 30-year-old female non-smoker would pay $7.57 a month for a 10-year/$100,000 policy. Let’s compare to female smokers.

Assurity Term Life Insurance Monthly Rates for Female Smokers by Age

| Term Life Policy | Age 30 | Age 40 | Age 50 | Age 60 |

|---|---|---|---|---|

| $100,000/10-year | $11.22 | $21.75 | $52.03 | $145.38 |

| $100,000/20-year | $15.83 | $33.50 | $86.48 | $221.24 |

| $100,000/30-year | $19.92 | $44.54 | $111.01 | NA |

| $250,000/10-year | $18.92 | $38.50 | $98.75 | $275.36 |

| $250,000/20-year | $27.19 | $61.99 | $168.35 | $425.87 |

| $250,000/30-year | $37.19 | $88.09 | $225.77 | NA |

| $500,000/10-year | $31.76 | $70.47 | $171.83 | $485.46 |

| $500,000/20-year | $48.29 | $111.80 | $291.89 | $755.16 |

| $500,000/30-year | $66.12 | $160.52 | $401.51 | NA |

A 60-year-old female smoker would pay $425.87 a month for a 20-year/$250,000 policy; a non-smoker would only pay $105.05 a month. Next up, are average Assurity whole life insurance monthly rates for non-smoking males.

Assurity Whole Life Insurance Monthly Rates for Male Non-Smokers by Age

| Whole Life Policy | Age 30 | Age 40 | Age 50 | Age 60 |

|---|---|---|---|---|

| $100,000 | $110.14 | $152.16 | $223.07 | $330.95 |

| $250,000 | $238.16 | $348.22 | $532.66 | $801.27 |

| $500,000 | $470.67 | $690.78 | $1,059.66 | $1,596.89 |

A 50-year-old male non-smoker would spend $223.07 a month on a $100,000 whole life policy or $1,059.66 a month on a $500,000 policy. Take a look at some smoker rates.

Assurity Whole Life Insurance Monthly Rates for Male Smokers by Age

| Whole Life Policy | Age 30 | Age 40 | Age 50 | Age 60 |

|---|---|---|---|---|

| $100,000 | $138.33 | $200.88 | $311.37 | $494.51 |

| $250,000 | $313.20 | $479.59 | $771.47 | $1,234.10 |

| $500,000 | $620.75 | $953.52 | $1,537.29 | $2,462.54 |

A male smoker age 50 would pay $311.37 a month for a $100,000 policy, and $1,537.29 a month for a $500,000 policy. The next table lists monthly rates for female non-smokers.

Assurity Whole Life Insurance Monthly Rates for Female Non-Smokers by Age

| Whole Life Policy | Age 30 | Age 40 | Age 50 | Age 60 |

|---|---|---|---|---|

| $100,000 | $98.14 | $134.50 | $192.01 | $279.62 |

| $250,000 | $207.71 | $303.41 | $454.14 | $670.55 |

| $500,000 | $409.77 | $601.17 | $902.63 | $1,335.45 |

A 50-year-old non-smoking female would only pay $902.63 a month for a $500,000 policy. That’s $157.03 less a month than a non-smoking male. This last table has monthly rates for female smokers.

Assurity Whole Life Insurance Monthly Rates for Female Smokers by Age

| Whole Life Policy | Age 30 | Age 40 | Age 50 | Age 60 |

|---|---|---|---|---|

| $100,000 | $125.45 | $178.87 | $267.26 | $407.94 |

| $250,000 | $279.71 | $421.30 | $656.63 | $1,008.55 |

| $500,000 | $553.76 | $836.94 | $1,307.61 | $2,011.44 |

A 50-year-old female smoker would spend $1,307.61 a month for a $500,000 policy — $400 more a month than non-smokers. Now that we went over what typical Assurity life insurance rates by age look like let’s talk about the company.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

About Assurity Life Insurance

The history of Assurity begins in Lincoln, Nebraska, where it was established in 1890. In 2007, it was rebranded when it merged with Lincoln Direct Life and Security Financial Life Insurance Company. Today, the Assurity headquarters remain in Lincoln. Check out this introduction.

Now let’s talk ratings.

Assurity’s Ratings

Ratings help consumers decide which product and where from. Below are Assurity’s life insurance ratings for 2019 from two rating agencies.

Assurity Life Insurance Company Ratings

| Ratings Agency | Assurity's Ratings |

|---|---|

| A.M. Best | A- (Excellent) |

| Better Business Bureau (BBB) | A+ |

Let’s learn more about Assurity’s financial strength ratings.

A.M. Best insurance company ratings are professional opinions about companies’ creditworthiness. Assurity is seen to have an excellent ability to fulfill its financial obligations — thus, the A- rating.

The Better Business Bureau ratings focus on the interactions between businesses and consumers. Assurity was given an A+, meaning that the BBB is extremely confident that Assurity operates in a trustworthy manner.

Assurity’s Market Share

The life insurance industry is full of competition. Take a look at the direct premiums and market share for typical Assurity life insurance competitors as well as Assurity.

Top 10 Life Insurance Companies & Assurity Market Share

| Rank | Company | Direct Written Premium | Market Share |

|---|---|---|---|

| 1 | Northwestern Mutual Life | $10,517,115,452 | 6.42% |

| 2 | Metropolitan Group | $9,821,445,953 | 6.00% |

| 3 | New York Life | $9,295,848,300 | 5.68% |

| 4 | Prudential | $9,128,805,060 | 5.57% |

| 5 | Lincoln National | $8,769,303,174 | 5.36% |

| 6 | MassMutual | $6,854,713,057 | 4.19% |

| 7 | Aegon | $4,809,856,650 | 2.94% |

| 8 | John Hancock | $4,640,905,017 | 2.83% |

| 9 | State Farm | $4,633,004,963 | 2.83% |

| 10 | Minnesota Mutual Group | $4,422,100,028 | 2.70% |

| 100 | Assurity | $128,268,717 | 0.08% |

Minnesota Mutual, in the number 10 spot, has over 33 times the amount of market share as Assurity at number 100. In 2017, Assurity was ranked 102nd with a 0.08 percent market share. In 2016, Assurity was ranked 99th with a 0.09 percent market share.

Assurity’s market share compared to the competition has not changed in recent years and probably won’t change much over the next few years.

Compare Quotes From Top Companies and Save Secured with SHA-256 Encryption

Assurity’s Online Presence

Insurance companies that use social media are acting out of necessity. Assurity has a profile on Facebook, Instagram, Twitter, LinkedIn, and Youtube. The company pays the most attention to its Facebook page, where it posts roughly three times a week and has 3,084 followers.

An insurance company’s social media campaign is an integral part of the insurance company’s strategy to stay competitive.

Let’s move on to Assurity’s commercials.

Assurity’s Commercials

Insurance company TV commercials are meant to be informative and impactful. Assurity life insurance TV commercials are more impactful because of the catchphrase: helping people through difficult times.

The first commercial tells you what life insurance covers, the different kinds of policies, and cash value. Many insurance company TV ads tell a story like this next commercial.

https://youtu.be/esqpQB_Z2Xg

The first commercial is quick and concise; the second commercial tells a story that people can relate to. Variation within commercials helps connect with a wider range of people.

Assurity in the Community

Assurity likes to give back directly to the community its apart of. Businesses that help the community often get more back from their employees. Every Friday, Assurity pays employees to be involved in cleaning up around Union Park Plaza. The company also partners with other companies that do good for the community.

Even though Assurity wasn’t named one of the best workplaces for giving back to the community in 2019, the company is still proud of its impact on the community.

Examples of businesses giving back to the community often relate to sustainability. Assurity received the “Recycling Lincoln” Leadership Gold Level Award, which means it recycles or composts 60 to 89 percent of the waste it generates.

Headquarters is also a Leader in Energy and Environmental Design (LEED) Gold Certified building, which was purposefully located in an urban renewal area.

Assurity’s Employees

Assurity life insurance company employee reviews are a great way to get to know the company. The ratings below are from Glassdoor, Indeed, and Payscale.

- Culture and values – 3.2/5 stars

- Work/Life balance – 3.6/5 stars

- Senior management – 3/5 stars

- Pay and benefits – 3.2/5 stars

The Assurity life insurance company employee benefits include a 401(k), maternity leave, health insurance, and paid vacation. Also, the average salary is $65,650 a year. Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Assurity’s Life Insurance Policies

Almost everyone should have a life insurance policy. A young couple who just bought their first home should look into life insurance policies for spouses. If they plan on having children, life insurance policies for children can often be added as a rider to a standard policy.

Death benefits are to replace income making life insurance policies for adults are the main priority.

There are also life insurance policies for parents with children soon off to college and life insurance policies for seniors with retirement to think about. Let’s examine the types of policies Assurity sells.

Term Life Insurance

Term life has coverage is for a specified amount of time — 10, 20, or 30 years. The monthly premiums are low and the guaranteed death benefit is the face value of the policy. Sometimes a one-time lump sum payment can be submitted instead of monthly.

Assurity gives term policyholders the option to convert to whole life. It also offers accelerated underwriting for term life to get fast approvals. About 50 percent are approved instantly by applying online.

Without the requirement of a medical examination for approval, life insurance rates for this type of policy are much higher than standard term life insurance.

Whole Life Insurance

Whole life insurance is coverage lasts for the duration of your life as long as the premiums are paid. Just like term life, premiums can be paid monthly or a one-time installment and there is a guaranteed death benefit. However, whole life policies can have an increasing death benefit.

Increasing death benefits grow over time due to a portion of the premium being allocated there. There is also a savings component that grows and can be borrowed from tax-free. These extra features cause whole life policies to be more expensive.

Group Whole Life

Many Americans get group life insurance through work, which can be more expensive than an individual policy. The upside is that everything is guaranteed, including approval and no medical exam is required. Also, in most cases, if you switch jobs, your policy will stay with you.

Universal Life Insurance

Universal life insurance is much more flexible than whole life. A major difference is that with universal life, you can adjust when and how much your premiums are. A universal life policy is more involved in the stock market, which requires the policyholder to be more involved, as well. The market may cause the cash value to fluctuate.

Assurity Burial Insurance

While Assurity may not offer a direct burial insurance product, any of the previous policies are capable of covering final expense costs with the death benefit as well as the cash value if there is one.

Now, let’s take a look at life insurance riders.

Life Insurance Riders

Riders are add-ons used to customize a policy for additional benefits. A few common riders include accelerated death benefit rider, accident-only disability income rider, children’s term insurance rider, and critical illness rider. If you’re unsure about adding a rider, seek the advice of an insurance agent. With other big companies like Colonial Life, critical illness insurance reviews are another way to get informed about the various types of riders.

Factors That Affect Life Insurance Premiums

There are several factors influencing life insurance costs that companies assess on an individual basis. Many of those factors are based on lifestyle choices, but some things that affect life insurance rates are out of anyone’s control. Let’s examine all the main factors that affect the cost of life insurance.

Demographics

The younger you are, the more life you still have ahead of you, and the longer it would be before a death benefit would need to be issued. Companies give lower rates, to lower risks.

Buy life insurance while you are young to lock in low rates.

According to the World Health Organization, women live longer than men, and therefore men pay higher premiums than women. The next section discusses how pre-existing conditions are likely to raise rates — or be cause for denial.

Current Health & Family Medical History

Most life insurance policies require a medical exam prior to agreeing to insure you. A typical medical exam will include taking your blood pressure, checking your heart, as well as taking blood.

The risk of having a heart attack is a primary concern but having a pre-existing condition sends a huge red flag to the life insurance underwriter. Diabetes is a unique situation when it comes to pre-existing conditions. First, diabetes has become completely manageable, which can put a life insurance company more at ease.

Second, those with Type 1 diabetes generally pay more than those with Type 2 diabetes. Type 1 diabetes is usually diagnosed at a young age, causing life insurance rates to be high for life. Type 2 diabetes is often diagnosed later in life and can often depend on one’s lifestyle.

Finding life insurance with pre-existing conditions can be hard. With manageable conditions, healthy habits and control over your condition can help keep rates lower.

Complicated family medical history — stroke, heart disease, cancer, etc. — affect your life insurance rates even if you have a clean bill of health.

High-Risk Occupations

Dangerous occupations increase the risk of a fatal accident. Insurance companies will most definitely charge you more if your life is in danger while on the clock.

When we think about dangerous occupations, our minds tend to go to law enforcement or firefighting, but we can’t forget pilots, race car drivers, truck drivers, and even construction workers.

Life insurance companies want to know the risks you are taking whether you get paid or not.

High-Risk Habits

If you’re regularly putting your life in danger, you’ll pay more in life insurance premiums. Habits such as smoking or excessive drinking can cause insurers to increase rates. Smoking is a major behavior that every life insurance company evaluates. Also, getting life insurance with a DUI on your record will be expensive.

Engaging in high-risk activities such as skydiving or racing cars causes insurance companies to charge higher rates. Some policies become void if death occurs via skydiving or during the first couple of years of the policy being in place.

Veteran or Active Military Status

The U.S. Department of Veterans Affairs (VA) assists veterans and their families with health and life insurance as well as final expenses. Those who are active within the military are automatically enrolled in Servicemembers’ Group Life Insurance. Veterans who had an SGLI policy are eligible to convert that into Veterans’ Group Life Insurance. There is a maximum of $400,000 worth of coverage.

The option to be buried in a national cemetery is free for you and your family. If you wish for the burial to take place elsewhere than a national cemetery, the VA will still cover the cost of the burial. The VA’s office will also pay a burial allowance to the deceased’s survivors to cover funeral expenses.

How to Get the Best Life Insurance Rate with Assurity

Due to state laws, rates may differ all across the county. The NAIC has set forth a model as a suggestion to how states should regulate life insurance, but that does not always mean it’s adopted by each state.

Before buying a life insurance policy, you should make sure you have all the facts. If you don’t fully know what you’re buying, how could you possibly know you’re getting the best rate?

Don’t choose a policy with only the features of that policy in mind, and don’t choose a policy strictly based on cost. Sometimes the perfect policy is in the middle. Now let’s look at how to get the best rate on whole life insurance by comparing Assurity and other life insurance companies. The table below shows the monthly rates for male non-smokers.

$250,000 Whole Life Insurance Company Comparison of Monthly Rates for Male Non-Smokers by Age

| Company | Age 30 | Age 40 | Age 50 | Age 60 |

|---|---|---|---|---|

| Illinois Mutual | $201.96 | $281.16 | $401.06 | $638.44 |

| Minnesota Life | $202.03 | $301.36 | $455.97 | $768.05 |

| Foresters Financial | $216.52 | $326.33 | $499.36 | $802.33 |

| Assurity | $238.16 | $348.22 | $532.66 | $801.27 |

| State Farm | $260.14 | $375.62 | $578.12 | $988.97 |

In the above table, Assurity is the second most expensive company next to State Farm. However, Foresters Financial charges 60-year-olds more. This next table depicts monthly rates for male smokers.

$250,000 Whole Life Insurance Company Comparison of Monthly Rates for Male Smokers by Age

| Company | Age 30 | Age 40 | Age 50 | Age 60 |

|---|---|---|---|---|

| Illinois Mutual | $247.50 | $355.96 | $533.72 | $857.78 |

| Minnesota Life | $261.67 | $393.66 | $609.25 | $1,037.40 |

| Assurity | $313.20 | $479.59 | $771.47 | $1,234.10 |

| State Farm | $325.17 | $455.44 | $683.39 | $1,158.19 |

| Foresters Financial | $325.89 | $505.27 | $853.96 | $1,402.58 |

Assurity charges male smokers less than Foresters Financial at all ages and less than State Farm for 30-year-olds. By now we know that females pay less than males. Here are some whole life monthly rates for non-smoking women.

$250,000 Whole Life Insurance Company Comparison of Monthly Rates for Female Non-Smokers by Age

| Company | Age 30 | Age 40 | Age 50 | Age 60 |

|---|---|---|---|---|

| Illinois Mutual | $177.32 | $242.66 | $337.70 | $518.32 |

| Minnesota Life | $180.69 | $260.08 | $386.86 | $639.03 |

| Foresters Financial | $188.96 | $277.99 | $429.14 | $700.83 |

| Assurity | $207.71 | $303.41 | $454.14 | $670.55 |

| State Farm | $234.24 | $321.24 | $470.02 | $769.94 |

Again, Assurity is the second-most expensive company listed, except in the 60-year-old column. Every company charges female non-smokers $30 to $220 less a month than male non-smokers.

$250,000 Whole Life Insurance Company Comparison of Monthly Rates for Female Smokers by Age

| Company | Age 30 | Age 40 | Age 50 | Age 60 |

|---|---|---|---|---|

| Illinois Mutual | $215.82 | $305.36 | $470.36 | $705.98 |

| Minnesota Life | $237.57 | $347.82 | $537.63 | $912.27 |

| Assurity | $279.71 | $421.30 | $656.63 | $1,008.55 |

| Foresters Financial | $280.18 | $411.99 | $650.08 | $1,018.89 |

| State Farm | $300.14 | $421.09 | $621.39 | $964.39 |

For 30-year-old female smokers, Assurity is cheaper than Forester Financial and State Farm, but the most expensive option for 40 and 50-year-olds. You may be wondering how to get the best rate on term life insurance. You can start by comparing the rates below. The rates are based on a 20-year term policy with a $250,000 death benefit. First, male non-smokers.

$250,000/20-Year Term Life Insurance Company Comparison of Monthly Rates for Male Non-Smokers by Age

| Company | Age 30 | Age 40 | Age 50 | Age 60 |

|---|---|---|---|---|

| Banner | $12.96 | $19.31 | $40.16 | $110.17 |

| AIG | $12.97 | $18.12 | $41.68 | $124.42 |

| Protective | $13.00 | $18.02 | $40.92 | $108.89 |

| Lincoln | $13.22 | $17.94 | $40.82 | $109.80 |

| Mutual of Omaha | $13.55 | $20.64 | $45.80 | $134.59 |

| Principal | $14.00 | $18.55 | $40.86 | $109.81 |

| North American | $14.30 | $20.02 | $43.56 | $115.06 |

| Assurity | $15.44 | $25.45 | $57.20 | $150.73 |

| Transamerica | $15.48 | $26.66 | $50.96 | $113.95 |

| Prudential | $20.35 | $24.50 | $45.50 | $129.07 |

| American Amicable | $26.10 | $40.28 | $87.75 | $190.35 |

For a 30-year-old man, rates range from $12.96 to $26.10 a month. Assurity charges $15.44 a month. For a 60-year-old man, rates range from $108.89 to $190.35 a month. Assurity charges $150.73 a month. Let’s move on to the rates for male smokers.

$250,000/20-Year Term Life Insurance Company Comparison of Monthly Rates for Male Smokers by Age

| Company | Age 30 | Age 40 | Age 50 | Age 60 |

|---|---|---|---|---|

| Assurity | $35.24 | $73.08 | $217.07 | $583.12 |

| Transamerica | $39.13 | $69.88 | $169.42 | $402.91 |

| Banner | $39.77 | $69.05 | $158.38 | $370.01 |

| AIG | $42.32 | $69.25 | $158.39 | $400.57 |

| North American | $43.56 | $71.28 | $163.02 | $378.62 |

| Prudential | $46.38 | $78.32 | $178.72 | $419.57 |

| Lincoln | $48.13 | $94.29 | $204.54 | $605.28 |

| Principal | $50.95 | $77.99 | $199.20 | $510.47 |

| Mutual of Omaha | $55.47 | $78.69 | $185.33 | $449.78 |

| Protective | $59.29 | $100.52 | $247.78 | $510.85 |

| American Amicable | $60.75 | $143.10 | $315.00 | $613.80 |

A 30-year-old male smokers rates range from $35.24 to $60.75 a month. Assurity has the cheapest rate for 30-year-old male smokers. However, for 60-year-olds, Assurity offers the third most expensive rate. The next table has rates for female non-smokers.

$250,000/20-Year Term Life Insurance Company Comparison of Monthly Rates for Female Non-Smokers by Age

| Company | Age 30 | Age 40 | Age 50 | Age 60 |

|---|---|---|---|---|

| Banner | $11.53 | $15.33 | $31.52 | $79.04 |

| AIG | $11.54 | $16.09 | $32.02 | $87.21 |

| Protective | $11.59 | $15.58 | $30.52 | $76.94 |

| Lincoln | $11.75 | $15.60 | $31.42 | $82.47 |

| Mutual of Omaha | $12.26 | $17.63 | $35.69 | $101.91 |

| Assurity | $12.40 | $21.32 | $44.59 | $105.05 |

| Principal | $12.42 | $16.19 | $32.07 | $77.18 |

| North American | $12.76 | $16.94 | $34.10 | $81.84 |

| Transamerica | $13.55 | $21.93 | $41.93 | $110.51 |

| Prudential | $17.28 | $22.53 | $40.03 | $89.91 |

| American Amicable | $19.35 | $31.05 | $58.50 | $136.35 |

Women age 30 who don’t smoke are charged anywhere from $11.53 to $19.35 a month for term life insurance. Assurity charges $12.40 a month for 30-year-old females. Lastly, the table below shows rates for female smokers.

$250,000/20-Year Term Life Insurance Company Comparison of Monthly Rates for Female Smokers by Age

| Company | Age 30 | Age 40 | Age 50 | Age 60 |

|---|---|---|---|---|

| Assurity | $27.19 | $61.99 | $168.35 | $425.87 |

| Transamerica | $31.80 | $59.77 | $129.65 | $291.54 |

| Banner | $32.03 | $55.66 | $119.05 | $270.93 |

| AIG | $33.98 | $56.00 | $119.06 | $272.53 |

| North American | $36.08 | $57.64 | $122.54 | $280.50 |

| Lincoln | $37.41 | $75.04 | $132.13 | $373.84 |

| Prudential | $38.28 | $63.00 | $136.72 | $293.40 |

| Principal | $42.55 | $62.34 | $138.60 | $305.81 |

| Protective | $47.18 | $83.09 | $179.57 | $449.23 |

| Mutual of Omaha | $47.52 | $60.85 | $132.23 | $311.75 |

| American Amicable | $54.90 | $106.20 | $234.90 | $456.30 |

Assurity has the cheapest rates for young smokers but is on the expensive side for older smokers. How to choose the best life insurance starts with you getting a personalized quote of your own. The tool right below this section generates multiple quotes for you to compare. Next, we’ll focus on how to get a quote from Assurity, and you will see why our tool is a better option.

Compare Quotes From Top Companies and Save Secured with SHA-256 Encryption

How to Get a Quote Online with Assurity

Figuring out how to get life insurance quotes online can be a daunting task. If you know how to get multiple life insurance quotes, shopping for life insurance becomes super easy. The best way to get life insurance quotes is by using a quote tool, like the one on this site, rather than an insurance company website.

However, since this is an Assurity company review, let’s walk through how to get a quote directly. When you go to the company’s webpage, Assurity.com, you will find a “Get A Quote” button on the bottom left in the red navigation bar.

The first question you encounter is: Which quote would you like to get? In this case, choose “Term Life.” It is best to answer any of the following questions honestly to get the most accurate quote. You will be asked eight questions:

- What state do you live in?

- How old are you?

- Do you use nicotine products?

- What is your gender?

- What is your height & weight?

- How is your health?

- Would you like to complete a needs assessment?

- If yes, you’ll be directed to a life insurance calculator.

- How much coverage do you need?

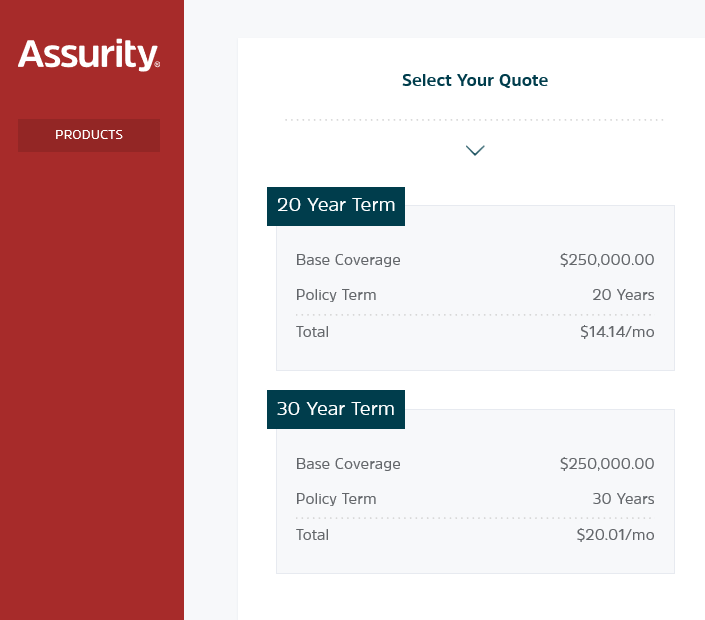

Assurity allows you to enter an amount ranging between $25,000 and $10 million but, the most common coverage amounts range from $100,000 to $500,000. Once you have entered your desired coverage amount, you will be redirected to a page, similar to the one below, with a couple of quote options of differing term lengths.

After all that work to get a quote from only one company, anyone can see why using our quote tool is a faster and more efficient option.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Canceling Your Life Insurance Policy

Can you cancel your life insurance policy? Yes, but not always for free. With permanent life insurance, many policies will deduct a fee from the cash value if the policy is canceled within the first seven years. Other charges may occur. You may be asking: how do I cancel my Assurity life insurance?

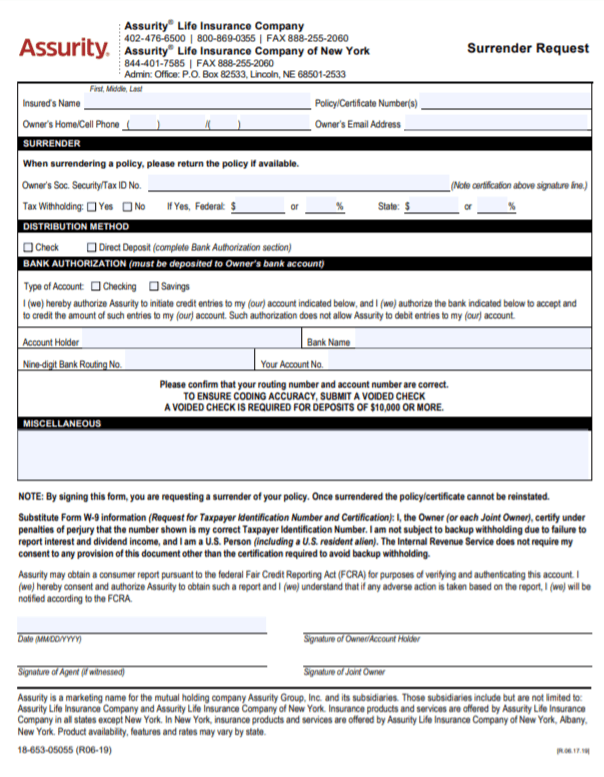

How to Cancel

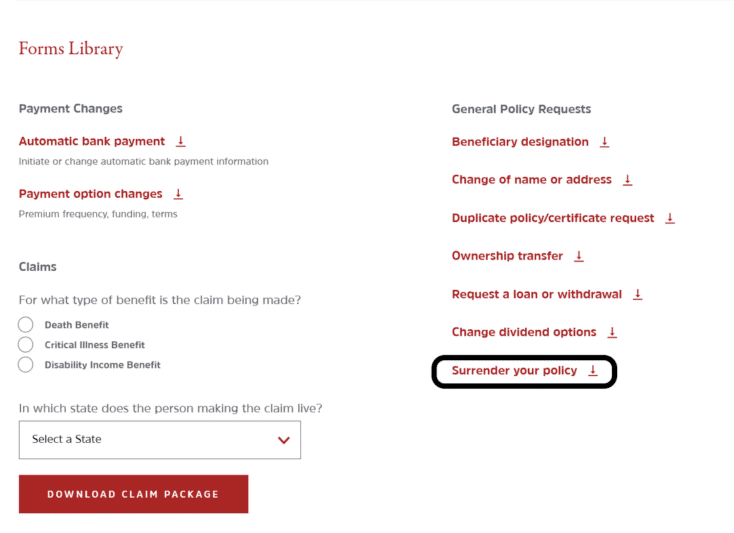

Talk to an agent to make sure the cancellation process is properly executed. On the main page of Assurity’s website, above the “Get A Quote” button is a link for “Forms.” To get the Assurity life insurance surrender form necessary for cancellation, you’ll click “Surrender your policy”.

The form will look like the one below. Read and fill out the form carefully before mailing or faxing the form to Assurity.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

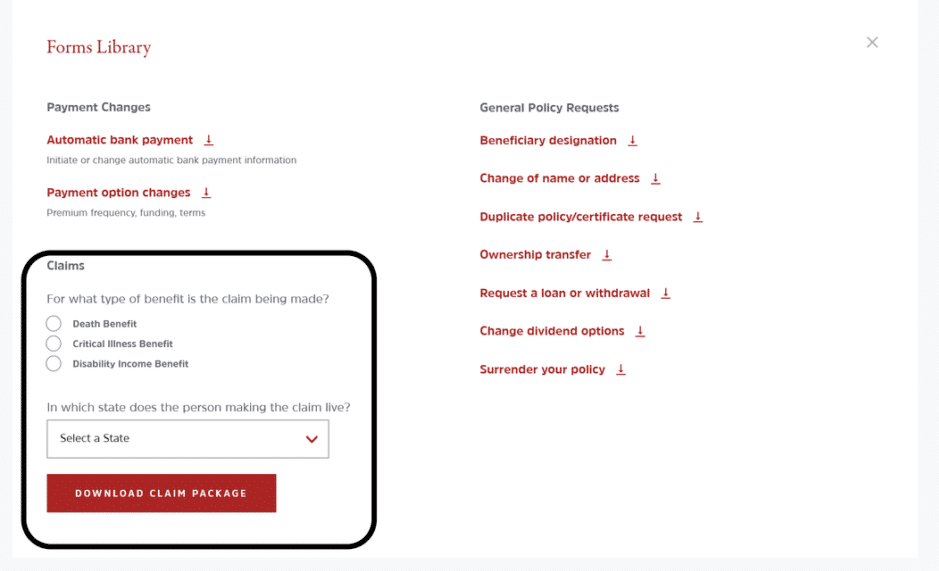

How to Make a Claim with Assurity

A common question is: How long do you have to make a life insurance claim? There is no time limit, s long as the company is still operating and you have all the necessary paperwork. On Assurity’s homepage, there is a “Forms” link on the left-hand side that brings you to this page:

The claim package lists items the life insurance company needs to process the claim, including:

- Notification of death (form attached)

- Requests for proceeds form

- Certified death certificate

- Original copy of the insurance policy

So, how long does it take to make a life insurance claim? The gathering of the information should take you no time at all, but after sending in the documents to Assurity, it takes about 60 days to receive a payment. The best way to make a life insurance claim is by having frequent contact with your insurance agent to monitor the process.

If you are looking for an Assurity hospital indemnity claim form, contact the Claims and Reporting Services at 800-869-0355 Ext 4484 or [email protected]

Assurity’s Customer Experience

The National Association of Insurance Commissioners (NAIC) Complaint Index is the number of complaints divided by the number of premiums written. Assurity has an index of 0.91, meaning the company has fewer complaints than average. To compare, Guardian life insurance complaints occur even less with an index of 0.10 to prove it.

Most of the worst customer experience reviews revolve around receiving payments that were less than discussed or expected. The best customer experience reviews lack detail or highlight behavior from specific employees.

Additionally, according to the BBB, Assurity has had only three customer complaints. To compare, the Colonial Life critical illness insurance reviews are much different, as the company has had 70 complaints over the past three years.

Assurity’s Programs

Assurity does not have any programs or additional resources linked to its website. The company is a very basic kind of insurance provider without any of the additional features that are common today.

Design of Website/App

Assurity doesn’t have an app for your phone. The website is straightforward with links to Assurity’s customer service, forms, careers, and more. The simplistic setup makes it easy to navigate.

There is an online service called MyAssurity, where you can monitor your account and connect with your Assurity agent. Login requires an email and password after you set up your account.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros & Cons of Assurity Life Insurance

A review isn’t complete without a pros and cons list. The pros and cons of life insurance companies are just as important as the pros and cons of life insurance policies.

Assurity Life Insurance Pros & Cons

| Pros of Assurity Life Insurance | Cons of Assurity Life Insurance |

|---|---|

| Active in the local community of Lincoln, Nebraska | A weak social media campaign |

| Cheaper rates for younger people than the majority of companies | Employee and customer reviews illustrate a mediocre company |

| Easy-to-navigate website | Rates for older age groups are considerably more expensive than most other companies |

Now it’s up to you to decide if the good outweighs the bad.

Assurity Life Insurance: The Bottom Line

So, there you have it, the complete review of Assurity Life Insurance Company. Do you think we missed anything? Now you’re ready to start comparing quotes from other companies.

To compare the Assurity life insurance rates above to other local life insurance companies, enter your ZIP code below.

Frequently Asked Questions: Assurity Life Insurance

Life insurance company FAQs and answers are a great way to learn more about a company. Here are some Assurity focused insurance company FAQs.

#1 – What types of life insurance does Assurity offer?

Assurity has term, whole, and universal life products. There is also a group whole life option.

#2 – Can I convert my term policy from Assurity into a whole life policy?

Absolutely. Assurity allows all its term policyholders to convert to a whole life policy if they so wish.

#3 – How can you contact Assurity?

You can contact Assurity by phone at 1-800-869-0355. Lines are open Monday through Thursday from 7 a.m. to 6:30 p.m. and Fridays from 7 a.m. to 5 p.m. You can also email the company either at [email protected] or [email protected] depending on your concern.

References:

- https://www.who.int/gho/mortality_burden_disease/life_tables/situation_trends_text/en/

- https://www.niddk.nih.gov/health-information/diabetes/overview/managing-diabetes/4-steps

- https://www.health.harvard.edu/a_to_z/type-2-diabetes-mellitus-a-to-z

- https://www.va.gov/burials-memorials/eligibility/

- https://www.naic.org/cis_refined_results.htm?TABLEAU=CIS_COMPLAINTS&COCODE=71439&REALM=PROD

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Frequently Asked Questions

What is Assurity Life Insurance?

Assurity Life Insurance is a reputable insurance company that offers a range of life insurance products and solutions. They provide coverage options to individuals and families, helping to protect their financial security and provide peace of mind.

What types of life insurance policies does Assurity Life Insurance offer?

Assurity Life Insurance offers various types of life insurance policies, including:

- Term Life Insurance: Provides coverage for a specific period, typically 10, 20, or 30 years.

- Whole Life Insurance: Offers lifelong coverage with a cash value component that can accumulate over time.

- Universal Life Insurance: Provides flexibility in premium payments and potential for cash value growth.

What are the benefits of choosing Assurity Life Insurance?

Choosing Assurity Life Insurance comes with several benefits, including:

- Flexible coverage options: Assurity offers a variety of policies to suit different needs and budgets.

- Financial strength and stability: Assurity Life Insurance is a financially strong and stable company with a solid reputation.

- Excellent customer service: Assurity is known for its exceptional customer service, ensuring policyholders receive the support they need.

- Competitive rates: Assurity strives to offer competitive rates for their life insurance policies.

How can I apply for Assurity Life Insurance policies?

To apply for Assurity Life Insurance policies, you can contact an authorized Assurity agent or visit their official website. The application process typically involves providing personal information, medical history, and selecting the desired coverage amount and policy type.

How much does term life insurance from Assurity cost?

Assurity offers term life insurance starting from as low as $12.40 per month.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Life Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Licensed Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.