Prudential Life Insurance Review (Companies + Rates)

Our Prudential Life Insurance review suggests that the company is exceptionally stable, being rated A+ according to A.M. Best. Prudential Life Insurance offers a variety of life insurance products that can be customized with a wide range of riders. You can get a Prudential term life insurance policy for as low as $12 per month.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Jan 24, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 24, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Prudential offers term life and universal life insurance

- Prudential life insurance quotes start from $12 per month

- Prudential insurance rating through A.M. Best is A+

| Key Information | Company Specifics |

|---|---|

| Year Founded | 1875 |

| Current Executives | Chairman and CEO – Charles Lowrey Vice Chairman – Robert Falzon |

| Number of Employees | 49,705 |

| Total Sales / Total Assets | $62,992,000,000 / $815,078,000,000 |

| HQ Address | Prudential Plaza Newark, NJ |

| Phone Number | 1-800-353-2847 |

| Company Website | www.prudential.com |

| Premiums Written – Group Life / Individual Life | $4,074,000 / $5,806,118 |

| Financial Standing | $4,074,000 |

| Best For | Strong Financial Ratings, Demographics: Over 50 & High-Risk |

Prudential has a proven track record of both insuring individuals and offering group insurance policies. They are able to manifest strong relationships with their business clients, allowing them to do what they do best: provide insurance based on their customer’s specific needs.

As you’ll see, Prudential has expertise, tools, skills, knowledge base, and a comprehensive and variety of insurance plans that are sure to fit your specific financial and personal needs as you plan your future.

Want to see what rates you can get for life insurance? Get the cheapest life insurance quotes right now with our FREE tool above.

Prudential’s Ratings

A life insurance company’s financial ratings are important and directly affect their standing in the life insurance market. Potential customers look at a company’s ratings as part of their research for life insurance. Prudential holds high quality to superior credit ratings with all the rating agencies.

A.M. Best

A.M. Best rates an insurance company on their ability to meet their insurance obligations to their policyholders. Prudential is rated A+, a superior rating, by A.M. Best — the highest rating given by this rating agency.

Better Business Bureau (BBB)

Although Prudential is not accredited with the Better Business Bureau (BBB), they did receive a C- due to 82 complaints filed against them in the last three years. In the last 12 months, however, 54 of the complaints have been closed.

Moody’s

Moody’s rates an insurance company’s creditworthiness and ability to pay on promises made to policyholders. Prudential received an AA3, which denotes high quality with very low credit risk.

Standard & Poor’s (S&P)

Standard & Poor’s also rates the creditworthiness of a company and the likelihood a debt will be repaid. Prudential received an AA- from S&P, which shows them as having a very strong capacity to repay the debt.

Fitch Ratings

Fitch Ratings is very similar to S&P and rates a company’s creditworthiness and investment yields. Prudential received an AA, giving them a high-quality rating.

NAIC Complaint Index

The NAIC Complaint Index logs complaints against an insurance company. The median complaint ratio is 1.00, so insurance companies want their numbers below this. Prudential has a complaint ratio of .94 for individual life and .21 for group life for 2018.

J.D. Power

J.D. Power rates companies based on surveys, prices, products offered, and overall customer satisfaction and ranks Prudential three out of five stars. A score of four or higher denotes “better than most.”

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

History of Prudential Life Insurance

Prudential Life Insurance is an American Fortune 500 Company and is the largest insurance company in the United States. Prudential was originally founded in 1875 in New Jersey as the Widows and Orphans Friendly Society. In the beginning, they sold only burial insurance.

Early policyholders only paid 3 cents a week as their premium, making life insurance affordable for working-class families.

Over time, Prudential transitioned from a mutually owned company to a joint-stock company and is now traded on the New York Stock Exchange.

Prudential’s Market Share

In comparison to other insurance companies, Prudential holds a steady place rank at number five in individual life premiums with over $5 million in premiums written and holding between 4.2 and 4.5 percent market share all four years.

| Year | Market Share – Individual Life | Rank |

|---|---|---|

| 2015 | 4.2% | 5 |

| 2016 | 4.3% | 5 |

| 2017 | 4.5% | 4 |

| 2018 | 4.5% | 5 |

With regard to group life insurance, Prudential ranked higher in the top 10 market share at number two in all four years, 2015–2018, securing over $3 million in premiums written. In the years 2017 and 2018, Prudential held more than 9 percent market share, and in 2015 and 2016, they held over 10 percent market share, coming in second to MetLife Inc.

| Year | Market Share – Group Life | Rank |

|---|---|---|

| 2015 | 10.6% | 2 |

| 2016 | 10.0% | 2 |

| 2017 | 9.2% | 2 |

| 2018 | 9.2% | 2 |

Prudential holds a strong position in market share in group life policies behind MetLife Inc. and prides itself on strong relationships with employers worldwide with whom they provide insurance and other services.

| Rank | Company | Market Share |

|---|---|---|

| 1 | Northwestern Mutual | 6.42% |

| 2 | Metropolitan | 6.00% |

| 3 | New York Life | 5.68% |

| 4 | Prudential | 5.57% |

| 5 | Lincoln | 5.36% |

| 6 | Massachusetts Mutual | 4.19% |

| 7 | Aegon US | 2.94% |

| 8 | John Hancock | 2.83% |

| 9 | State Farm | 2.83% |

| 10 | Minnesota Mutual | 2.70% |

With their stronghold in fourth place, Prudential continues to prove its worthiness within the insurance industry.

Prudential’s Position for the Future

With Prudential’s high presence in the insurance industry, especially with group policies and their strong financial ratings, they have shown continued growth and the ability to remain in the top five issuers of life insurance policies.

| Year | Premiums Written – Individual Life |

|---|---|

| 2015 | $5,081,952 |

| 2016 | $5,362,282 |

| 2017 | $5,754,809 |

| 2018 | $5,806,118 |

With regard to group life policies, they hold steady at number two to MetLife Inc. and consistently wrote policies over $3 million from 2015 through 2018.

| Year | Premiums Written – Group Life |

|---|---|

| 2015 | $3,544,761 |

| 2016 | $3,202,585 |

| 2017 | $3,260,346 |

| 2018 | $3,364,765 |

As shown in the above table, Prudential has a strong presence in writing group life policies.

They are known for their strong relationships with employers and guiding their employees through their insurance needs.

Prudential’s Online Presence

Prudential has a very active and informative social media presence on Twitter, YouTube, Instagram, LinkedIn, and Pinterest. Their Twitter account has over 160,000 followers, with fairly regular tweets about what is happening with insurance and their company.

Their YouTube channel is active with videos regarding financial planning, legacy planning, income retirement, and their community involvement. Prudential’s Instagram account contains informative pictures and videos of products and services they offer, and Pinterest offers informative boards as well.

Prudential’s Commercials

Prudential is traveling across America to talk to people about their retirement and their desire for financial wellness today, including life insurance to protect the ones they love. They are showing commercials from different states visited.

One commercial in particular, “Hey Dad,” has struck a chord with many because of the importance of knowing your family is financially safe and secure should something catastrophic happen.

Their commercials address varying topics of financial wellness, such as insurance coverage, living at home, manufacturing jobs, workplace retirement plans, highest life expectancies, and women-owned businesses.

Prudential in the Community

Prudential encourages its employees to use their passions and expertise within their communities through corporate-sponsored initiatives. Through their pro bono work, volunteerism, and hard work to assist community nonprofits to reach their goals, Prudential has been named one of America’s most community-minded companies for the fourth time.

Prudential volunteers have given nearly 80,000 hours to more than 350 organizations just in the year 2017.

One particular program, Prudential Spirit of Community Awards, highlights youths for their volunteer efforts within their community.

The Spirit of Community Awards honors middle and high school students for their service to others at the local, state, and national levels. More than 130,000 students have been recognized for their efforts and how they’ve made a difference in their communities.

Is Prudential a good life insurance company?

Prudential employees state overall satisfaction with their work environment and employee relationships. They feel managers care about them and they are recognized for good work that leads to promotion. Employees report that health care coverage is strong, retirement benefits are excellent, and family leave policy is good.

The company culture is friendly and fast-paced. Prudential provides solutions for its diverse client base. Their employees are treated with respect and offered flexible work schedules and challenging work.

Shopping for Life Insurance

For many, purchasing life insurance is done online. Individuals research companies, use life insurance calculators and online quote tools to predict how much coverage they may need — so much so that about half of adult consumers visit a life insurance company to gain information before making a final decision.

When considering buying a life insurance policy, the younger you are, the more cost-effective the policy will be.

There are different strategies you can use when you’re ready to purchase, such as buying a term policy that you convert to permanent later, purchase both a term and permanent policy to address different financial needs, or customize a policy with additional riders that address specific needs.

Prudential’s premiums tend to run slightly higher than average, especially for those in good health no matter the age bracket. However, they do have favorable underwriting for many health conditions and pre-existing medical conditions. These won’t automatically prevent you from obtaining life insurance, but always discuss these with your agent to get the best rate.

Purchasing life insurance ensures your family’s financial security should something happen to you through a death benefit payout. In the past, purchasing a life insurance policy was a two- to three-week time period. However, today, with online options, research, knowledge, and simple steps, the process is much quicker and simpler.

Average Prudential Male vs Female Life Insurance Rates

When purchasing life insurance, men are at a disadvantage when it comes to cost. Life insurance is more expensive, typically because men live shorter lives than women, making their increased mortality a higher risk for insurance companies.

Other factors contributing to their higher rates are dangerous occupations, higher-risk hobbies and lifestyles, and higher societal risk. The table below compares the rates between genders by age for a 20-year $250,000 term policy.

20-Year, $250,000 Term Life Insurance Monthly Rates for Males and Females Through Prudential

| Age | $250,000/20-Year Term Male Monthly Rates | $250,000/20-Year Term - Female Monthly Rates |

|---|---|---|

| 20 | $21.28 | $17.50 |

| 25 | $22.31 | $17.72 |

| 30 | $23.41 | $19.25 |

| 35 | $24.28 | $19.69 |

| 40 | $28.87 | $23.41 |

| 45 | $35.44 | $30.84 |

| 50 | $54.47 | $44.41 |

| 55 | $87.06 | $62.21 |

| 60 | $158.59 | $108.28 |

| 65 | $243.42 | $194.25 |

Women can hold dangerous occupations and participate in higher-risk lifestyles and activities, but men are more likely to push the limits than women.

Coverage Offered

Before deciding on the type of life insurance insurance policy that’s right for you, there are a few questions you should consider.

- What and who do you need your coverage for?

- How long do you need coverage?

- What is your budget?

- What amount of coverage will you need?

These will help guide your research, especially when it comes to temporary and permanent policies. Prudential has many different options available for your specific needs.

Types of Coverage Offered

Prudential offers many different types of insurance policies, both individual and group life. However, they don’t offer whole life policies, but as evidenced below, what they do offer is comprehensive and can be customizable to fit your needs.

Term

Term life insurance offers you a policy that covers you for a period of time while you make regular payments.

Your premium won’t change during the coverage period, and if you die during your coverage time, your beneficiary receives the death benefit.

Once your term ends, your coverage ends. However, most insurance companies do offer options like converting your policy to a permanent one or renewing your term policy for another year or another term. These policies don’t offer a cash value component.

Prudential offers different three types of term life policies.

- Term Essential – One of Prudential’s most affordable insurance products. Policyowners can customize their policies with riders to meet their specific needs. The death benefit paid out is also tax-favored, meaning the beneficiaries should not have to pay taxes on those funds. Term Essential offers both a conversion option to a permanent policy without the need for another medical exam and also a Living Needs Benefit that pays out a portion of your death benefit if you become terminally ill.

- Term Elite – This policy is similar to Term Essential, except if you convert to a permanent policy within the first five years, you’ll receive a credit on the first year premium. The remaining features of this policy are basically the same as Term Essential.

- Simply Term – An affordable option that can be purchased online and is cost-effective. Coverage can be for 10, 20, or 30 years. Simply Term isn’t available in all states, however. You can complete the entire application process online and receive your approval response from Prudential within days with the next steps.

Universal

Universal insurance offers flexibility with your premium payments and coverage amounts. Universal life does come with a cash value component with the ability to earn interest but at a minimum interest rate.

- PruLife Universal Protector – Comes with a death benefit guarantee. You can customize this guarantee to be long-term or short-term. The shorter the death benefit guarantee, the lower your premiums will be. You can also customize this policy with additional riders, as well. PruLife Universal Protector gives you the flexibility you may need.

- PruLife Essential UL – Provides a death benefit with a tax-deferred cash value component along with features you can access while you’re still living. You can customize this policy with add-on riders to meet your specific needs. If you increase your premium amount, you’ll have faster cash value accumulation. Also, this policy offers a competitive 2 percent credit rate. The cash value offers you access to the funds through withdrawals or tax-free loans, but these will decrease death benefit payout. This policy is a good investment as it allows for a steady cash growth without the worry of a fluctuating market.

- PruLife SUL Protector – Covers two lives, which is cost-effective if you don’t want to purchase two separate policies, and pays out the death benefit to whom is listed as beneficiary when the second insured dies. A rider that can help customize this policy would be the Guaranteed Policy Split Rider, which splits the policy into two, and the Estate Protection Rider, for estate planning purposes.

Indexed Universal Life

Indexed Universal Life insurance offers a death benefit guarantee and is permanent life insurance, but cash value is based on a financial index like the stock market, so it’s riskier. It does offer greater growth potential but with the risk of a lower rate of return.

Even though it’s risky, there is a safeguard in place that protects you from a loss if the stock market suffers an extreme loss, but there is also a cap as to how much will be credited to your account in the case of an extreme gain occurs. Index Universal Life policies also offer flexible premium payments, as well. Prudential offers three types of Index Universal Life policies:

- PruLife Founders Plus UL – Offers a death benefit with an adjustable guarantee for as long as you need it. With this policy, you can build cash value fairly aggressively based on the performance of the S&P 500, but with some risk. You do have the option of sticking with a fixed and more basic interest rate for your cash-value account if you’re not comfortable with a more riskier investment choice. This type of policy, however, does not pay out dividends to its policyholders.

- PruLife Index Advantage UL – Has the highest potential to build cash value and you can keep your coverage safe against lapse for up to 20 years. As with the other policies, this policy can be customized with additional riders. This policy has four options to grow your cash value: a fixed interest rate or three other plans that are based on how the S&P 500 performs.

- PruLife Survivorship Index UL – Covers two people and pays out the death benefit when both insured have died. It allows the insured to create and protect a legacy for their heirs. This policy can build cash value but with a minimum interest rate.

Variable Universal Life

Variable Universal Life offers a death benefit along with an investment feature to accumulate a greater cash value return. As the policyholder, you take on a more active role in the investment piece of the policy, and this is done when you make payments beyond the cost of your insurance.

That overage goes into your chosen investments that will grow your cash value, which is tax-deferred. Be advised, though, they may decrease in value, depending on the market. There are three types of VUL that offer a guaranteed death benefit, are flexible in how you set them up, and offer riders to customize the policy, as well.

- VUL Protector – This policy offers protection for your family or loved ones with a cash value component that involves moderate risk with low to moderate return. An attractive and valuable feature of this policy is its no-lapse guarantee that will keep your life insurance in place in the event of a loss or inability to pay. You can also customize the policy with riders to fit your specific needs.

- PruLife Custom Premier II – This policy is good for the protection of family and loved ones but also for long-term growth that one is willing to take on a higher level of risk for greater returns on investment and higher cash value growth. Due to the higher risk and low value in the early years, this policy offers two no-lapse guarantee periods with one period giving protection during the early years of the policy.

- PruLife SVUL Protector – This is a survivorship policy that covers the lives of two people so the death benefit isn’t paid out until the second person has died. This policy focuses on leaving a legacy for the next generation. With this policy, you can choose the amount of risk and potential reward and cash value growth. You can also choose riders to customize your policy, but two specifics to this policy are the Guaranteed Policy Split Rider and the Estate Protection Rider.

Group Term Life

Prudential Group Term Life Insurance allows employers to offer their employees two options.

- Employer-Paid Basic Term Life Insurance – This plan can be offered on its own or in conjunction with employee-paid life insurance. This type of policy allows the employer to base it on salary multiples, flat amounts, length of service or employee class.

- Employee-Paid Optional Term Life Insurance – This plan can be offered on its own or in conjunction with employer-paid life insurance. This insurance is available to qualified spouses/domestic partners and dependents. It’s based on salary multiples or in incremental amounts.

Prudential’s strength is getting to know a company’s employees, their business, and the employers themselves. Doing this allows the employer to focus on business and not worry about the ins and outs of employee insurance.

Prudential provides smart technology and a caring customer experience that expedites evidence of insurability and the claims process.

Standard features to their policies include:

- Conversion Provision – If any employee leaves the company, they can convert their policy to a Prudential individual policy without further health questions or medical exams.

- Accelerated Benefit – If an employee becomes terminally ill, they can receive a portion of their insurance benefits while still living.

Prudential also offers two beneficial optional features to their policies as well.

- Portability Provision – When an employee’s employment ends, they can continue a certain level of group coverage.

- Waiver of Premium – If an employee qualifies as disabled, life insurance will pay the premium.

Other group life insurance products offered by Prudential:

- Group Universal Life

- Group Variable Universal Life

- Executive Group Variable Universal Live

Factors That Affect Your Rate

Life insurance companies determine the cost of life insurance for someone by estimating the rate or pattern at which one dies, or their mortality rate. The insurance company looks at several factors to determine this pattern such as age, health, occupation, family and medical history. This is also called the underwriting process.

Demographics

As you age, you’re more likely to become ill and the closer you become to passing away, as well. It’s in your best interest to purchase your policy when you’re younger and more likely to be healthier, which in turn will save you money on your premiums. Also, women tend to pay less for their life insurance than men because they have a higher life expectancy than men.

Current Health & Family Medical History

A medical exam may be required, along with an examination of health records. Insurers look at many factors such as your weight, cholesterol levels, and blood pressure as predictors of possible health issues and how these can affect your premiums. A medical history of cancer, heart problems, or diabetes, for example, will increase premiums, as well.

A family medical history of illness, even if you’re healthy, can still negatively affect your premium.

High-Risk Occupations

As part of the underwriting process, you’ll be asked about your occupation. People who work in what are considered high-risk occupations may pay a higher premium due to a higher mortality rate.

Some insurance companies won’t insure someone if they fall into a high-risk category, but other companies will insure you, just at a higher rate, or will charge you a flat rate in addition to your monthly premium.

These professions include police officers, firefighters, extraction workers, loggers, fishermen, construction workers, and pilots.

High-Risk Habits

As with high-risk occupations, insurers will also ask you questions about your hobbies and activities, including your smoking history. Activities such as skydiving, mountain climbing, and scuba diving place you in a riskier class and may make it even difficult to get insurance.

Smoking is also considered a high-risk habit and will increase your premium as evidenced in the table below.

| Demographics | $100,000/10-Year Term – Male | $100,000/20-Year Term – Male | $100,000/10-Year Term – Female | $100,000/20-Year Term – Female |

|---|---|---|---|---|

| 25-Year-Old Non-Smoker | $13.83 | $14.70 | $12.25 | $12.87 |

| 25-Year-Old Smoker | $25.90 | $28.27 | $20.65 | $22.14 |

| 30-Year-Old Non-Smoker | $13.92 | $15.32 | $12.25 | $13.13 |

| 30-Year-Old Smoker | $26.87 | $29.93 | $21.35 | $23.37 |

| 35-Year-Old Non-Smoker | $13.92 | $15.49 | $12.25 | $13.13 |

| 35-Year-Old Smoker | $27.57 | $33.17 | $22.23 | $25.64 |

| 40-Year-Old Non-Smoker | $15.67 | $17.50 | $13.30 | $15.49 |

| 40-Year-Old Smoker | $35.00 | $44.45 | $27.39 | $34.48 |

| 45-Year-Old Non-Smoker | $17.68 | $20.39 | $16.28 | $19.17 |

| 45-Year-Old Smoker | $46.38 | $61.52 | $39.12 | $48.74 |

| 50-Year-Old Non-Smoker | $21.88 | $26.95 | $21.27 | $23.89 |

| 50-Year-Old Smoker | $63.62 | $92.58 | $56.35 | $69.30 |

If you smoke, quitting is in your best interest.

Veteran or Active Military Status

Veterans’ Group Life Insurance (VGLI) program allows veterans to continue their coverage once they leave active service. Prudential has administered this coverage since VGLI started in 1974.

Under VGLI, you receive lifetime coverage even if there are changes to your health or occupation as long as you pay your premiums. There are no exclusions to VGLI with regard to mental health, post-traumatic stress disorder, or traumatic brain injury. You’re also not excluded because of your occupation or recreational activities.

As long as you apply within 240 days of your date of separation from active duty, there will be no medical questions asked for coverage. After the 240 days, however, you have to show proof of good health to acquire VGLI coverage.

Prudential highly values veterans and active military members, and this is one way they make a difference in their lives.

Getting the Best Rate With Prudential

Searching for the best life insurance policy can be confusing and expensive, so how does one find the best rate for what they need? Consider what your needs are as far as protection for your family. A whole life policy covers you for your entire lifetime, and this coverage can be expensive.

However, if your coverage goals are geared more toward protecting your family during your prime income-earning years, then consider term life insurance as a more cost-effective option.

Here are some other ways to get the best rate on your insurance.

- Risky behavior and habits – Lowering or even eliminating risky behavior and habits will impact your premiums and put you into a lower risk class for insurance carriers.

- Discounts – Ask your insurance company if they offer any discounts for paying the annual premium upfront or receiving statements online.

- Riders – Riders are add-ons that allow you to customize your policy to your specifications, but most come at an additional price. However, if all you’re primarily looking for is providing for your family if you should pass, then riders may be an expense you can cut from your cost.

- Smoking – Stop smoking once and for all if you’re a smoker of any type. This will improve your health, but also save you money. To get the best rate possible, most insurance companies would like to see you smoke-free for at least two years.

- Lose weight – If you’re overweight, losing weight can help save money on your premiums. Being overweight can lead to a host of other costly medical conditions that in turn lead to a lower life expectancy, causing insurers to adjust their policy price for this.

- Shop around – Make sure you shop for the best insurance company. Just because one company is a big-name company doesn’t necessarily make it any better than a lesser-name insurer. Do your research, find out their credit rating, and see what companies can offer you a policy for your specific needs, especially if there is a medical condition or smoking history involved.

- Group life insurance – See if your company offers group life insurance. If you have a medical condition or smoking history, group life insurance may be a more cost-effective option as an individual policy will be more costly, and you may even be uninsurable.

- Term life – Consider term life as a shorter option for insurance coverage for the years you most need coverage.

- Reduce your death benefit – Another option is reducing your life insurance death benefit should you suffer a job loss or major life event and need to reduce coverage to save money. Some policies have a one-time reduction written into their policies, while others will do it on request.

- Bundling your policy – Bundling your life and other insurance policies can give you a discount, as well. Some insurance companies will give you a multi-policy discount if you add a second or third policy if they offer life insurance as one of their products. This can come in the form of a discounted rate or possibly an additional policy, with a low life insurance face value on someone in your family.

Prudential’s Programs

Prudential offers a 10-week summer internship to students from across the country. They join Prudential to gain experience and exposure to growth and business opportunities. They can network with senior executives, attend professional development, and become actively involved in volunteer events.

Interns leave the program with tangible skills, knowledge, and specific projects to add to their resumes, as well as the personal and professional relationships that will help them in the future.

Prudential is one of the most successful, stable companies in the world, and they believe in creating a culture that fosters entrepreneurship, leadership, collaboration, and many opportunities for personal growth.

Through collaboration, Prudential encourages their employees to push each other to the next level to recognize skills and experiences in one another and strengthen each other into the leadership roles Prudential is known for.

There are a lot of opportunities for professional development to enhance and broaden employees’ skill sets. Employees are encouraged to pursue training that will help them advance their careers and broaden their business disciplines

Lastly, new employees are empowered to try new bold ideas to build a better and stronger financial future for their clients. Prudential offers its new hires an accelerated development program to give them the chance to develop these necessary skills under the security of the Prudential umbrella.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Canceling Your Policy

When you purchase a policy with Prudential, you can surrender it instead of actually canceling the life insurance policy. Here are the steps to follow to surrender both a term and a permanent policy.

How to Cancel

Term life policies are easier to surrender than permanent life because you build up cash value with permanent life, and if you’ve maximized that benefit, you’ll have a nice cash value surrender amount coming back to you. The steps for permanent life policies aren’t difficult but do require you to fill out a form and pull together your policy information.

#1 – Surrendering a Term Policy

For a term policy, stop making the premium payments and the policy will be automatically surrendered. If your payments are drafted from a bank account, contact your bank to stop these draft payments.

#2 – Gather Information for Your Permanent Policy

For a permanent policy, you’ll need to first gather all of your policy information with the policy number and the most recent statement showing an up-to-date cash value amount.

#3 – Request Proper Surrender Form

You’ll need the Prudential Life Insurance Surrender Form, which can be downloaded or requested by phone at 1-800-778-2255. This form, once completed, allows you to receive the cash surrender value of your policy.

#4 – Complete the “Life Insurance Surrender” Form

Fill out the Life Insurance Surrender Form with your policy information, including cash value surrender value, name, address, Social Security number, and bank account information if you would like cash surrender value money deposited into a bank account. Sign, date, and make a copy of the form for your file and mail it back to Prudential. It can take up to 30 days to receive your funds.

How to Make a Claim

To file a claim with Prudential, the easiest option is online through their website at www.prudential.com. Once there, you can begin the online claims process.

Prudential understands this is a difficult time for anyone who has lost a loved one, so they’ve made the claim process as simple and as straightforward as possible. It typically takes less than 10 minutes to complete.

There are three situations, however, in which the online claim form is not available:

- Deceased lived or died outside of the United States

- Beneficiary currently lives outside of the United States

- Beneficiary lives in, or the deceased lived in Kentucky, Minnesota, New Hampshire, New Jersey, Oklahoma, or Rhode Island

For these situations, you’ll need to contact Prudential directly and talk with a representative at 1-855-277-8061, Monday–Friday, between 8 a.m. and 8 p.m. EST.

#1 – Gather Documents & Information

You’ll need the following information to help you complete the online form:

- Policy and Social Security numbers

- Name of insured

- Date of birth

- Date of death

- Funeral home name and phone number

#2 – Complete Initial Online Form

Once you’ve gathered the necessary information, complete the initial online form and click “Submit.” From there, you’ll be asked further questions to complete the online form process.

If you would rather speak with a representative instead of using the online claim form process, you can reach them at 1-855-277-8061, Monday–Friday between 8 a.m. and 8 p.m. EST.

What to expect with the online claim form process:

- You’ll be guided through each section of the claim process.

- The more information you can provide, the faster the claim can be processed.

- To ensure your initial online claim has been received, make sure you click submit and receive a confirmation of receipt.

- Claim submission will be reviewed by a claims representative. If additional forms are needed to process your claim, they will be sent to you. Fill these out and return so your claim can be finalized.

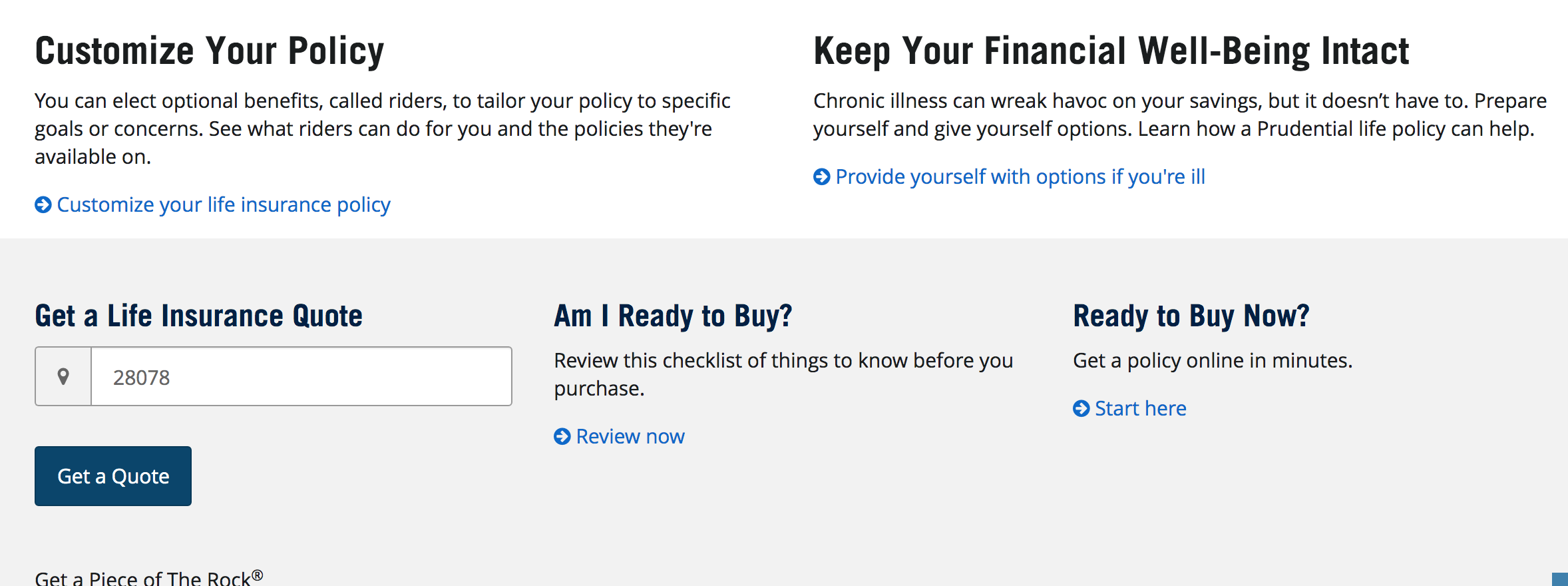

How to Get a Quote Online

Prudential does offer an online quote tool on their website under their “Find a Life Insurance Policy” section. Once you decide on the type of policy you’re looking for and the amount of coverage you need, you can get a quote and then even purchase your policy online with Prudential.

#1 – Get Started

To get started, scroll to the bottom of the Find a Life Insurance Policy page to the Get a Life Insurance Quote box, input your ZIP code and click “Get a Quote.”

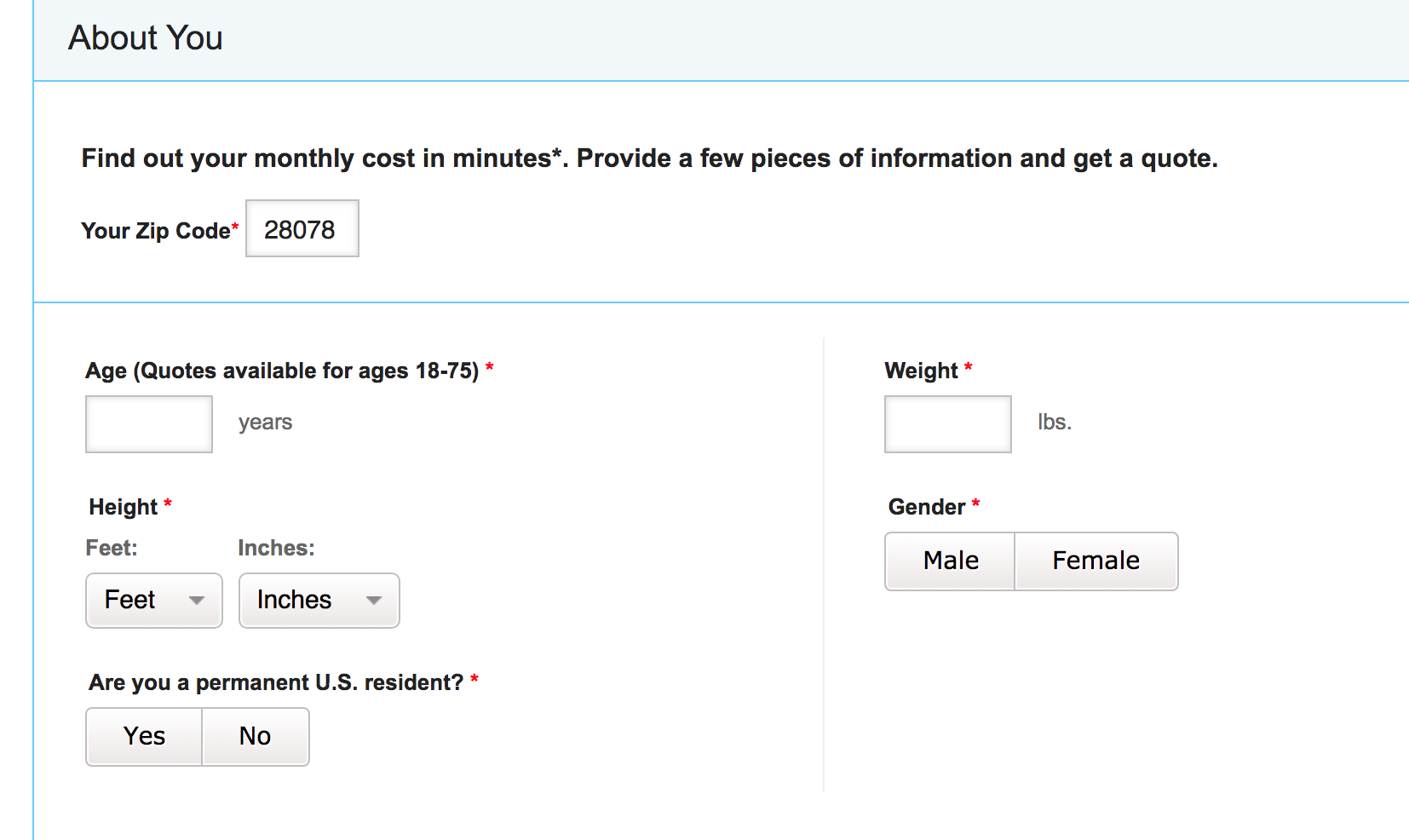

#2 – Complete “About You” Section

You’ll fill in basic information about yourself including age, weight, height, gender, and whether you’re a permanent resident of the United States.

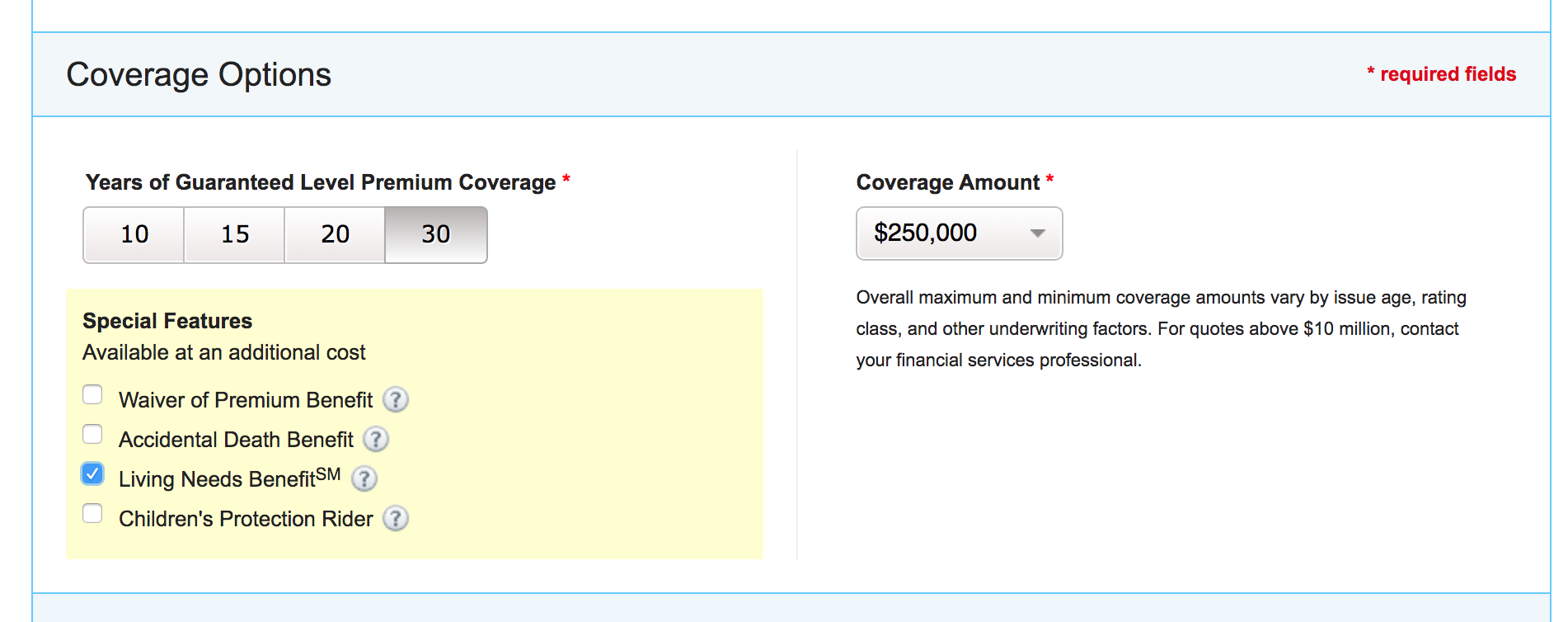

#3 – Coverage Options

Choose your coverage length, coverage amount, and any additional riders you’d like to add to your policy. Note, however, that riders will come at an additional cost to the policy.

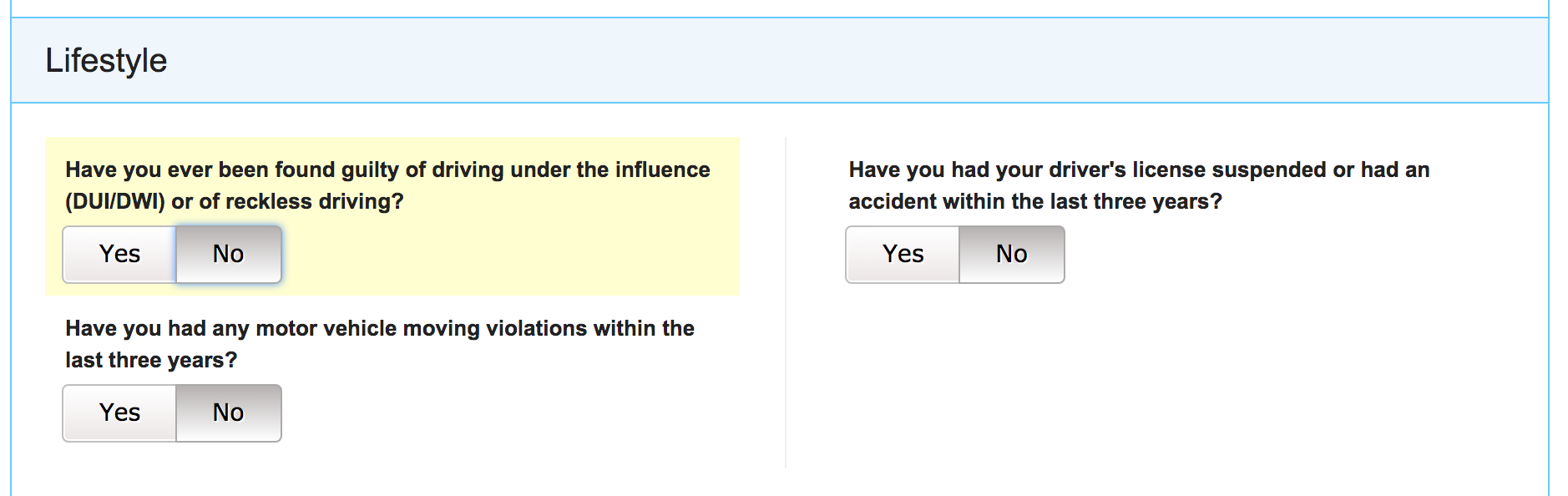

#4 – Lifestyle

You’ll be asked three questions about your driving history. These questions will discern whether you’re placed in a higher risk class based on your answers.

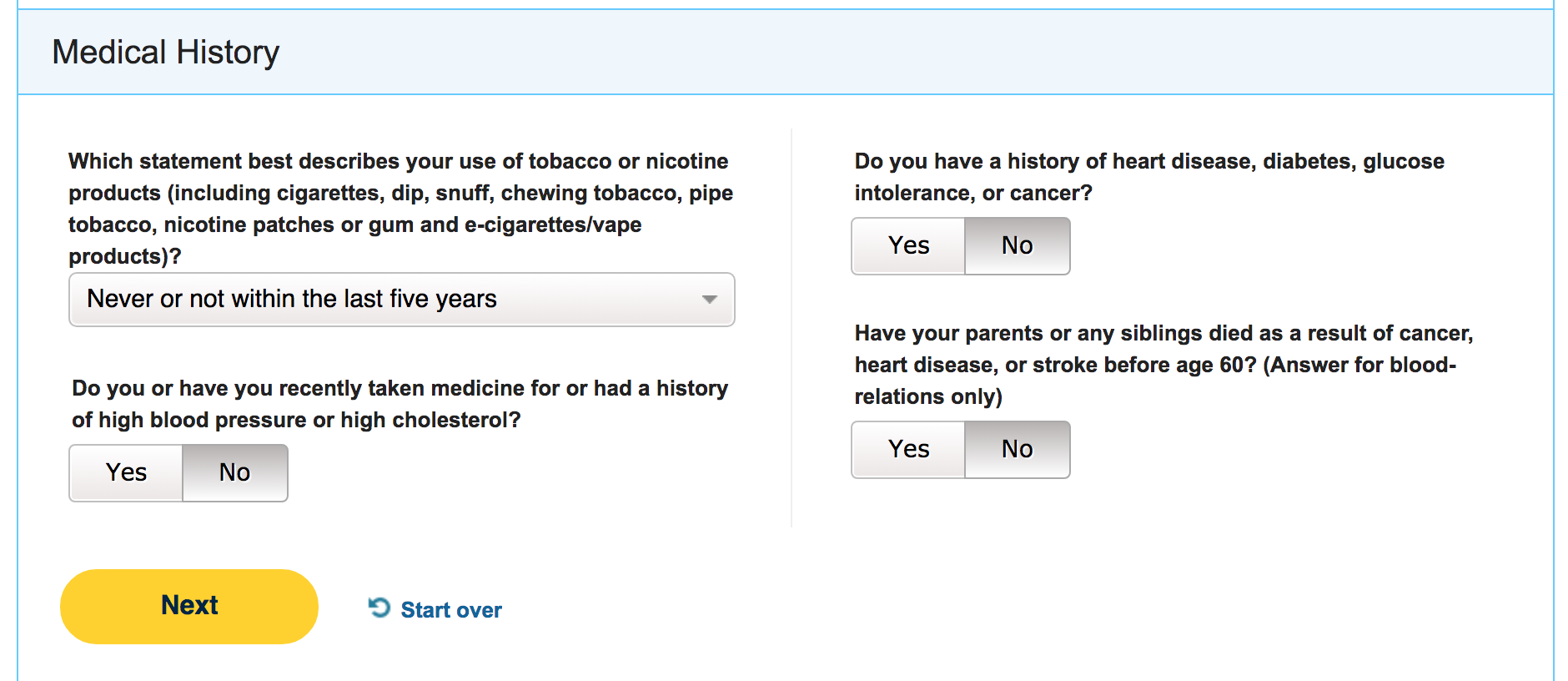

#5 – Medical History

There are four questions about your medical history, one specifically addressing a smoking history. The other three questions will ask about medications, family history, and if there is any history of specific illnesses or diseases.

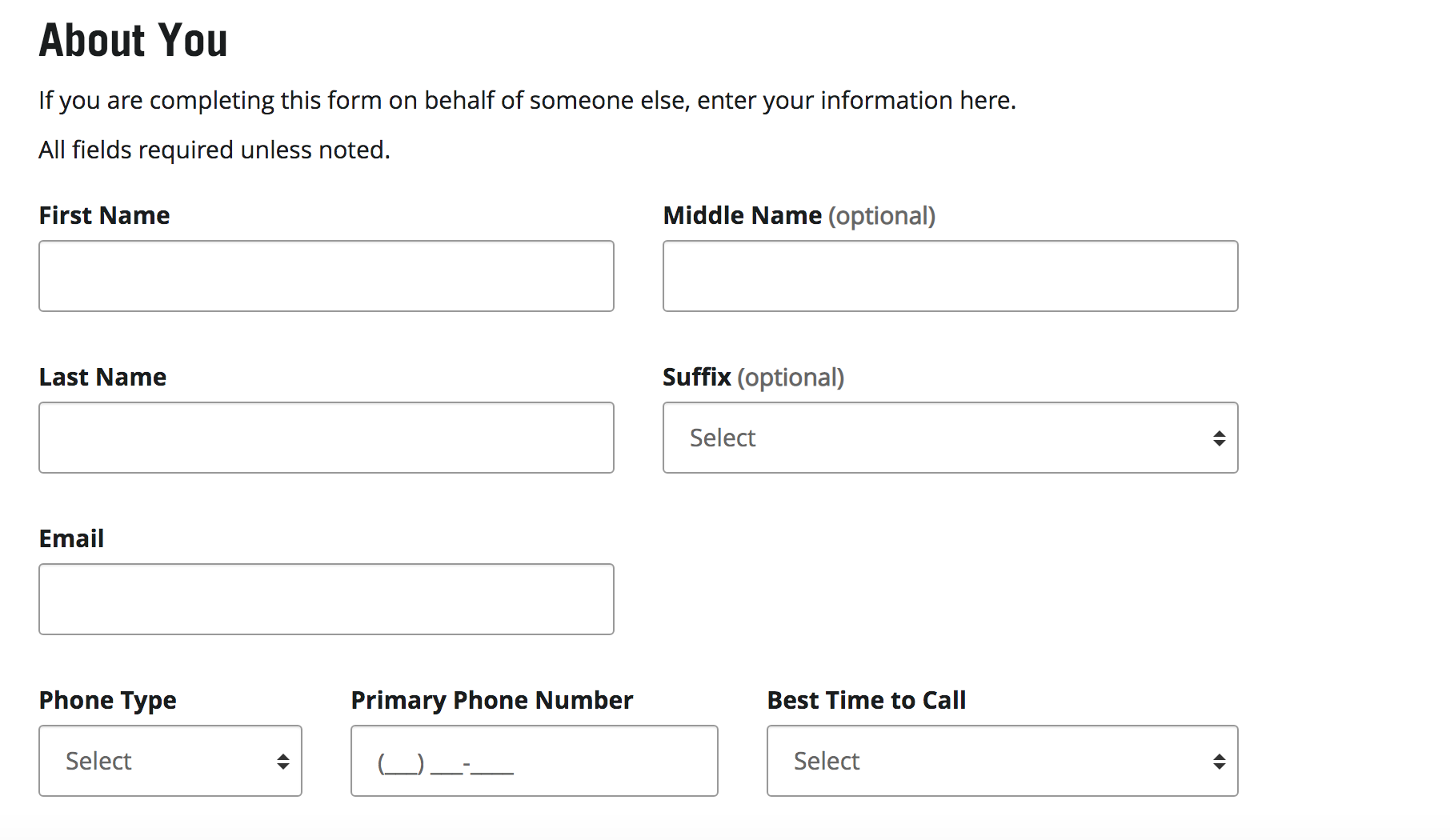

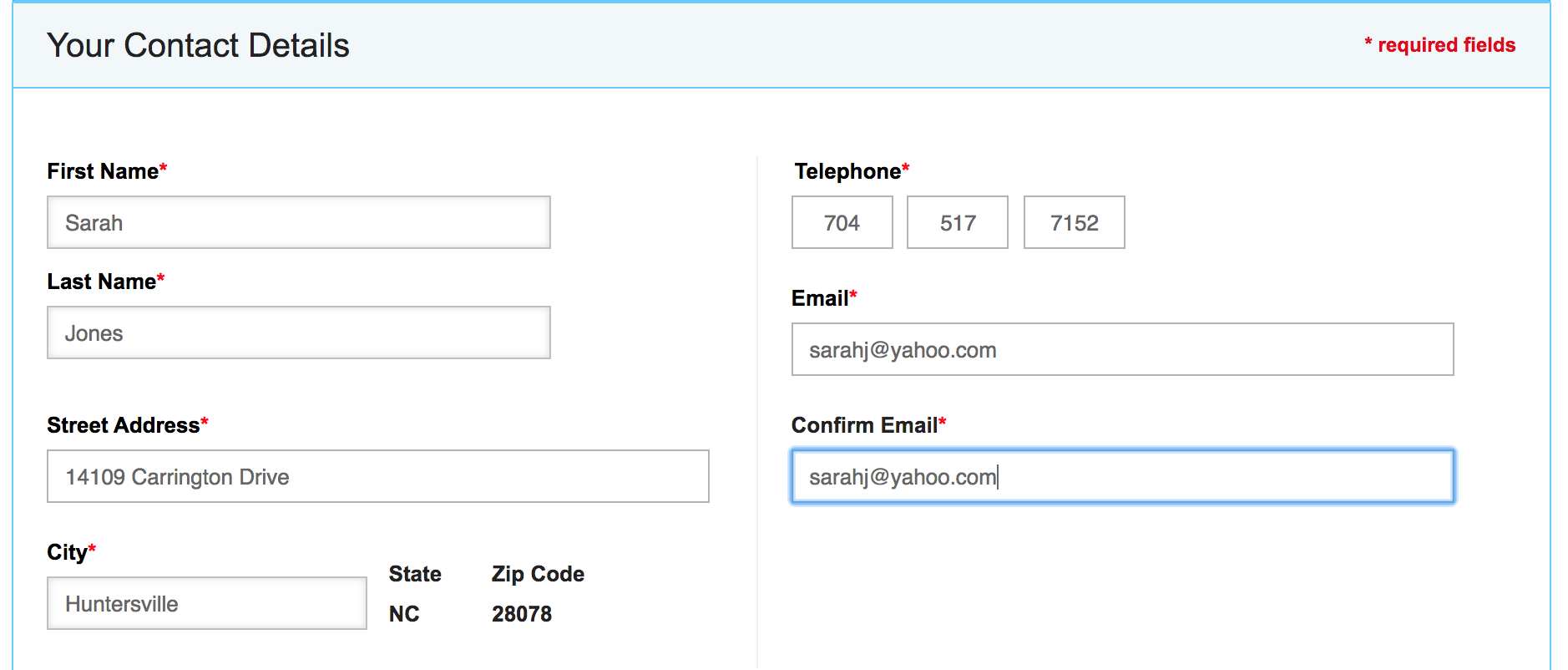

#6 – Contact Details

Complete all questions accurately so a representative can reach you with any further questions and help with the next steps of obtaining a life insurance policy with Prudential. Once you’re done with this step, click “Submit.”

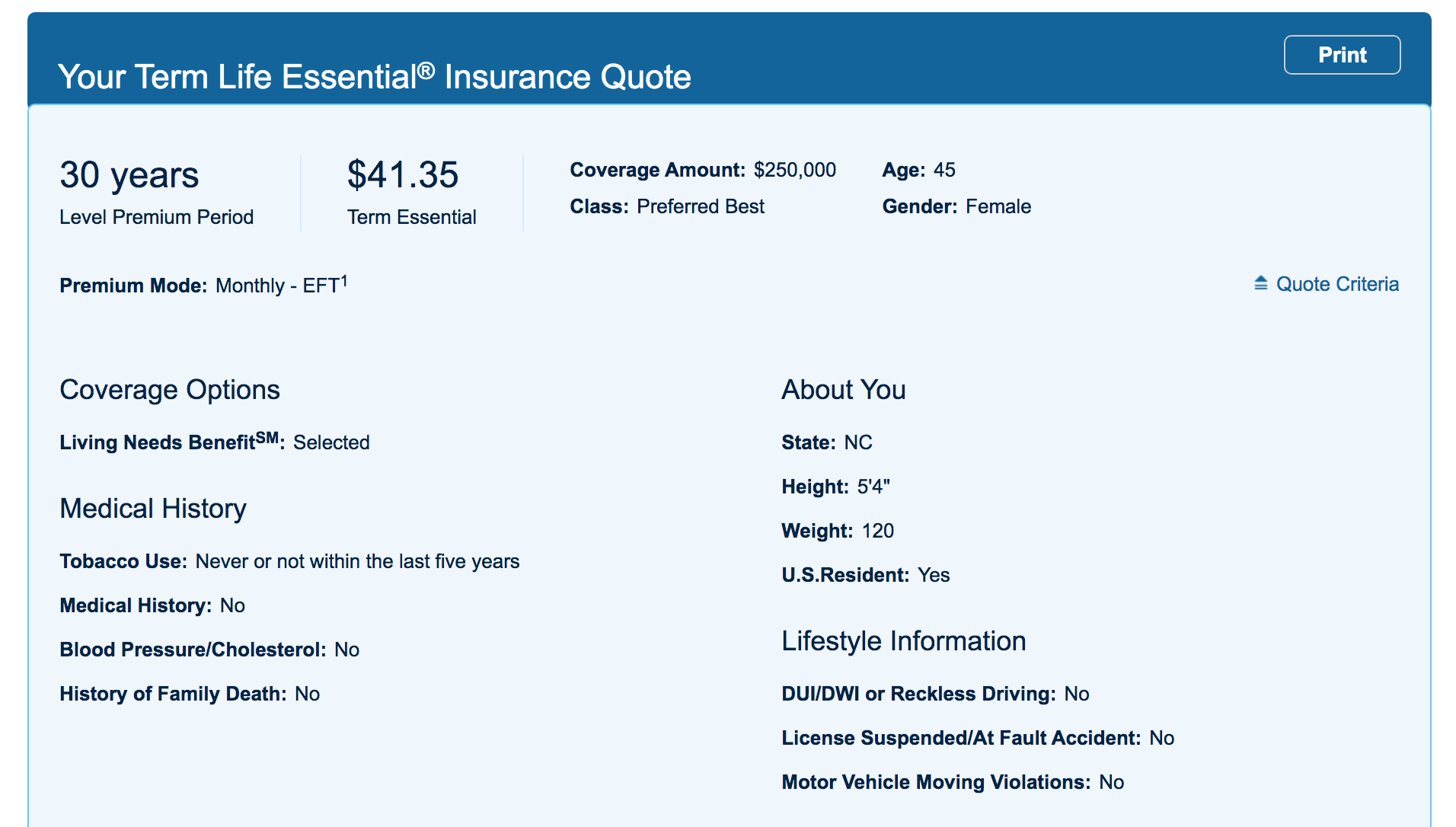

#7 – Review Your Quote Online

Look over your quote and all information shown to get an understanding of costs at the coverage length you chose as well as the cost at other coverage lengths. Having this information in front of you when you speak with a representative is very helpful with information in hand.

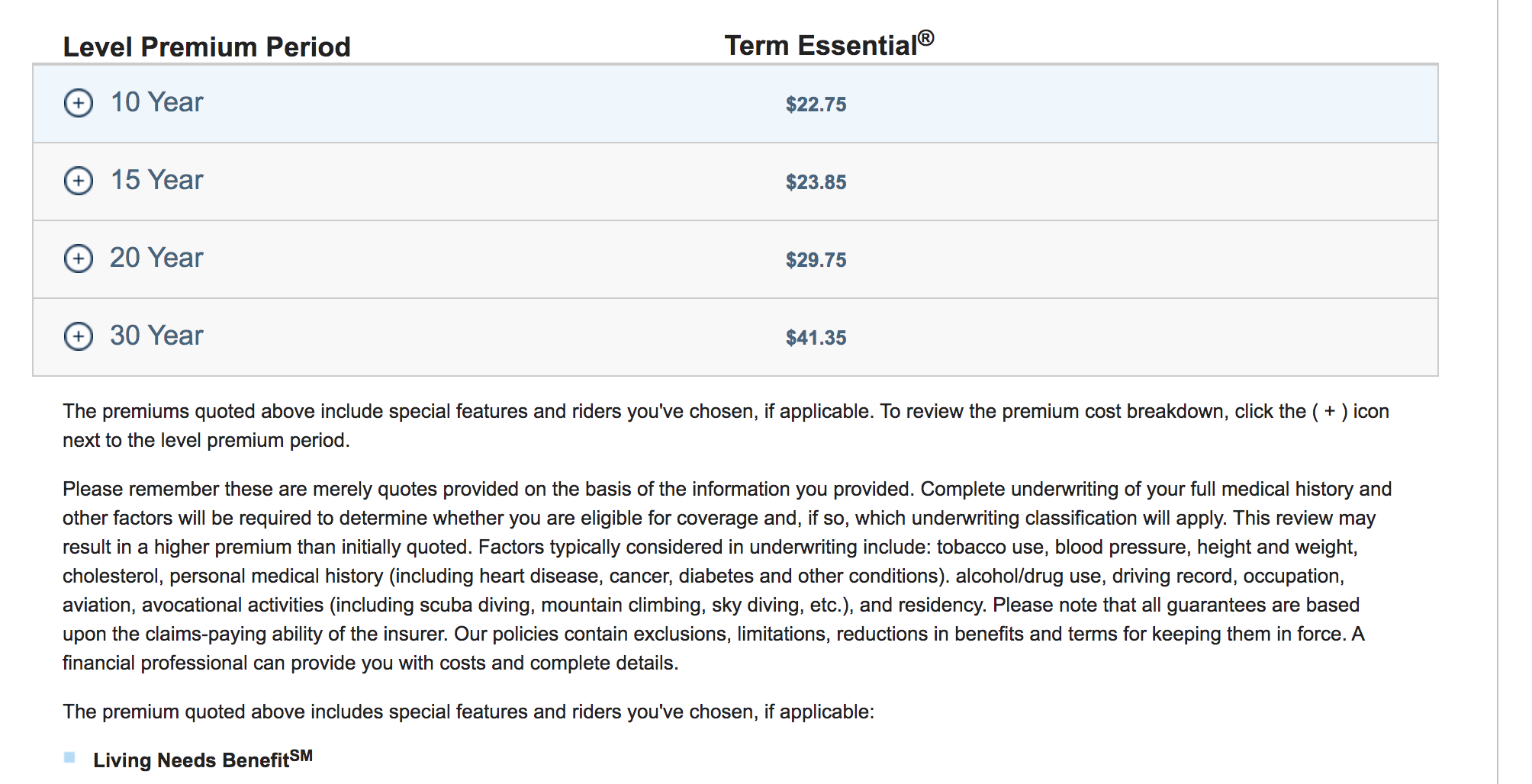

Cost of Term Essential at different coverage periods:

The online quote page informs you that a representative will reach out to you to further help with your application. Prudential underwriters will review and process the application. If you’re approved, they’ll help finalize your chosen policy.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Design of Website/App

Prudential’s website is laid out in such a way that from the homepage, you can easily access what you need as an individual, advisor, employer, or institution. If you’re a Prudential member, you can easily log in and navigate to where you need to be.

From their website, you can access comprehensive information about their life insurance policies, annuities, investments, and retirement information.

Prudential does have an online quote tool, but it’s only available for their 10-, 15-, 20-, or 30-year term life policies. You’ll need to go through their representative for quotes for other types of policies.

Lastly, their website offers comprehensive articles for every stage of life to financial wellness to annuities and investments. Prudential’s website is easy to navigate offers what one is looking for when planning their future.

Prudential’s website on the cellphone is a little less straightforward, but you can access the quote tool from the home page. Those visiting Prudential’s website would be better able to navigate and access what they need via the website or through a tablet.

Prudential’s app receives a 2.8 out of 5 stars mainly due to login issues. However, those that are able to log in can check their balances and performances of funds but can’t change funds or contribution amounts.

Pros & Cons

There are many considerations when searching for a life insurance policy, so here is a quick overview of the pros and cons.

Pros

- Online quote tool

- Website is easy to navigate with comprehensive information for first-time buyers

- Customizable options on their policies that aren’t found with other company policies

- Superior financial strength rating

Cons

- Doesn’t offer whole life insurance options

- Can only use online quote tool for term policies; must purchase any other type of policy through an agent

- Can be more expensive than competitors

The Bottom Line

Planning your financial future to make sure your family is protected for the long term is a difficult task to consider but a necessary one. With so many policies that can be customizable to your specific needs, Prudential is ready to help you plan all your life insurance needs.

Ready to see what life insurance rates you can get? Click now to get a fast, FREE quote for life insurance.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Frequently Asked Questions

Can I make an online payment to my life insurance policy?

Yes, Prudential offers online payment options for their life insurance policies. You can log in to their website or use their mobile app to make payments securely and conveniently. Alternatively, you can contact their customer service for assistance with making online payments.

What do I do if I’ve lost my policy?

If you have lost your Prudential policy, you should contact their customer service immediately. They will assist you in retrieving a copy of your policy or provide guidance on the necessary steps to take.

How can I check the status of a death claim?

To check the status of a death claim with Prudential, you can contact their claims department directly. They will provide you with the necessary information and guide you through the process of checking the claim status.

How do I change my beneficiary?

To change your beneficiary on your Prudential policy, you will need to complete a beneficiary change form. Contact Prudential’s customer service or visit their website to obtain the form. Fill it out with the updated beneficiary information and submit it according to their instructions.

How do I take a loan out against my Prudential policy?

To take a loan against your Prudential policy, you will need to contact Prudential directly. They can provide you with the necessary information and guide you through the loan application process.

How can I protect my business with insurance?

Consult with an insurance agent or broker who specializes in commercial insurance to assess your business risks and determine the appropriate coverage types, such as general liability insurance, professional liability insurance, property insurance, and workers’ compensation insurance.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.