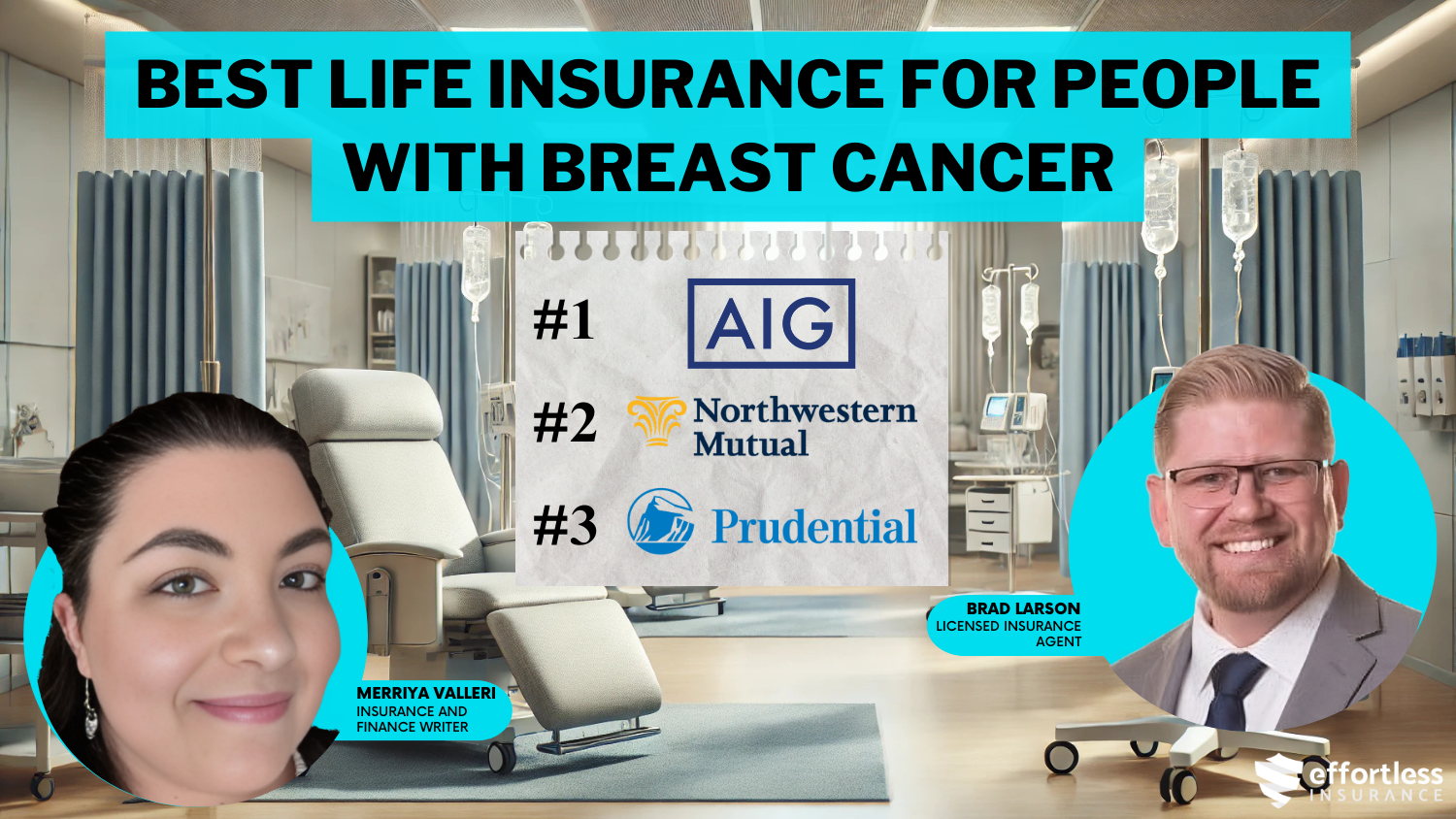

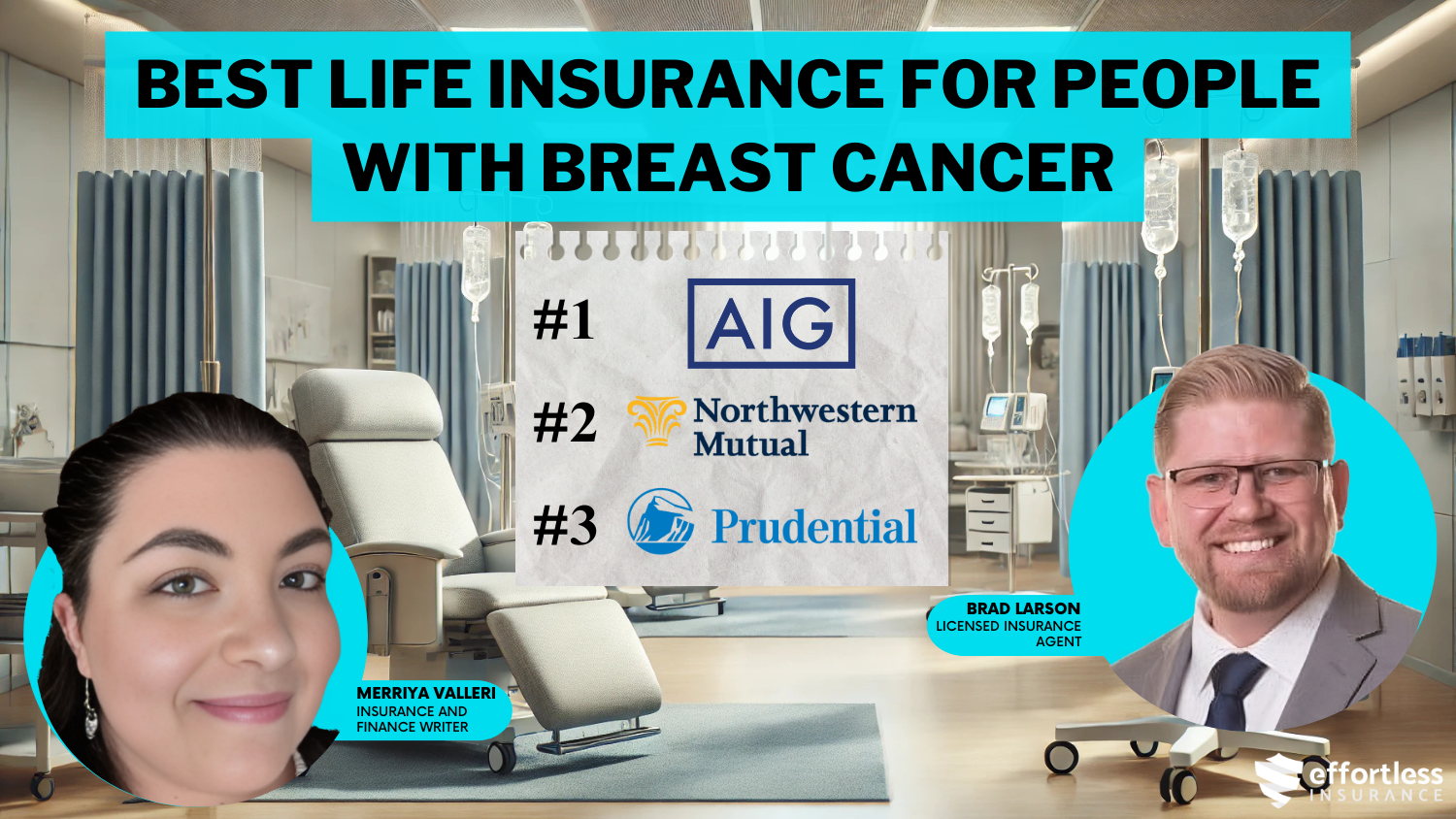

Best Life Insurance for People With Breast Cancer in 2025 (10 Standout Companies)

AIG, Northwestern Mutual, and Prudential offer the best life insurance for people with breast cancer, with rates starting at $250/month. These companies' underwriting processes consider individual health conditions, ensuring comprehensive protection for those living with breast cancer.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Mar 12, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Mar 12, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

0 reviews

0 reviewsCompany Facts

Whole Policy for People With Breast Cancer

A.M. Best Rating

Complaint Level

0 reviews

0 reviews 0 reviews

0 reviewsCompany Facts

Whole Policy for People with Breast Cancer

A.M. Best Rating

Complaint Level

0 reviews

0 reviewsThe best life insurance for people with breast cancer comes from AIG, Northwestern Mutual, and Prudential, starting at just $250 per month.

AIG is the best choice overall because it offers fair prices and flexible policies, making it great for budget-conscious customers. At the same time, Northwestern Mutual and Prudential provide personalized coverage options for long-term financial stability and high-risk cases.

Our Top 10 Company Picks: Best Life Insurance for People With Breast Cancer

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | A | Flexible Underwriting | AIG |

| #2 | 5% | A++ | Financial Stability | Northwestern Mutual | |

| #3 | 8% | A+ | Loyalty Rewards | Prudential | |

| #4 | 17% | B | Customer Service | State Farm | |

| #5 | 4% | A+ | Budget-Friendly | Transamerica | |

| #6 | 6% | A | Cost-Effective | Lincoln Financial | |

| #7 | 10% | A+ | Family Discounts | Nationwide |

| #8 | 5% | A+ | Quick Approvals | Mutual of Omaha | |

| #9 | 5% | A++ | Senior Coverage | AARP | |

| #10 | 5% | A+ | Simplified Underwriting | Banner Life |

This guide looks at how these companies handle the unique needs of breast cancer patients, from reviewing applications to offering tailored policy choices. Find out more by exploring this guide, “Types of Life Insurance: Find the Right Policy for Your Needs.”

Getting affordable life insurance with a medical issue can be a challenge, but it’s not impossible. Use our free quote comparison tool to find the lowest rates.

- AIG offers the best life insurance for people with breast cancer

- Northwestern Mutual provides stable, long-term coverage

- Prudential offers customized solutions with loyalty rewards

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – AIG: Top Overall Pick

Pros

- Flexible Underwriting: AIG provides flexible underwriting options for individuals with breast cancer, offering customized coverage.

- Affordable Rates: Competitive term policy rates start at $350 per month, and whole policy rates at $1,200 per month.

- Wide Coverage Options: They provide different types of insurance policies, like whole policies up to $1,200/month, to meet the unique needs of breast cancer patients.

Cons

- Higher Premiums for Whole Policies: Whole policy premiums can be higher compared to other insurers. Explore this “AIG Life Insurance Review” guide for additional insights.

- Limited Multi-Policy Discounts: It only offers a 10% bundling discount, which is lower than some competitors.

#2 – Northwestern Mutual: Best for Financial Stability

Pros

- Financial Stability: NorthWestern Mutual has a very solid financial rating of A++, which offers a sense of security for people living with breast cancer.

- Quick Approvals: A fast application process ensures coverage for individuals needing prompt insurance.

- Comprehensive Coverage: Provides higher whole life insurance coverage up to $1,600/month, perfect for those needing more protection.

Cons

- Higher Whole Policy Rates: A $1,600 per month policy might feel pretty pricey. Refer to this “Northwestern Mutual Life Insurance Review” guide for further details.

- Limited Bundling Discounts: They only offer a 5% discount, which may be lower compared to other insurers.

#3 – Prudential: Best for Loyalty Rewards

Pros

- Loyalty Rewards: Prudential provides helpful benefits for people with long-term policies, which is useful for those with breast cancer who want to keep their coverage.

- Competitive Rates: Term policies are offered at $400/month and whole policies at $1,300/month, balancing cost and coverage.

- Tailored Underwriting: Focuses on customized policies for individuals with breast cancer. Take a look at this “Prudential Life Insurance Review” guide for more information.

Cons

- Premium Increases: Whole policy premiums for breast cancer may be higher than other insurers.

- Limited Discount Options: Bundling discount is 8%, slightly lower than top competitors.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#4 – State Farm: Best for Customer Service

Pros

- Exceptional Customer Service: State Farm provides excellent support, making it easier for individuals with breast cancer to manage their policies.

- Affordable Rates: Term policies at $305 per month and whole policies at $1,010/month are competitively priced.

- High Bundling Discounts: They offer a 17% discount for bundling multiple policies, which is generous for individuals with breast cancer.

Cons

- Whole Policy Costs: Whole policy rates for breast cancer patients start at $1,010/month and may be higher than other insurers.

- Limited Underwriting Flexibility: May have stricter underwriting compared to competitors. For more information, explore this “State Farm Life Insurance Review,” guide.

#5 – Transamerica: Best for Budget-Friendly

Pros

- Budget-Friendly Options: Offers cost-effective term policies starting at $360/month and whole policies at $1,220/month.

- Simplified Underwriting: Provides straightforward applications for individuals with breast cancer.

- Family Discounts: Includes family discounts, offering added value for multi-family coverage. For a deeper understanding, see this guide, “Transamerica Life Insurance Company Review.”

Cons

- Limited Whole Policy Variety: Whole policy options cap at $1,220, which may not meet higher coverage needs.

- Lower Bundling Discount: They offer a 4% discount for breast cancer patients, which is lower than other insurers.

#6 – Lincoln Financial: Best for Cost-Effective

Pros

- Cost-Effective: Lincoln offers competitive rates, with term policies starting at $410/month and whole policies starting at $1,420/month.

- Accessible Coverage: They provide a variety of coverage choices, with whole-life policies that can go up to $1,420 per month.

- Reliable Financial Strength: With a strong A rating, Lincoln provides a reliable and steady option for people with breast cancer.

Cons

- Whole Policy Premiums: Whole policies at $1,420/month could be less affordable for some individuals with breast cancer.

- Limited Discounts: Offers a 6% bundling discount compared to leading insurers. Discover additional details in this “Protective Life Insurance Review” guide.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Family Discount

Pros

- Family Discounts: Nationwide makes it easy for people with breast cancer to save by offering great discounts with multiple policies.

- Reliable Ratings: Holds an A+ rating, offering dependable coverage for people dealing with breast cancer.

- Competitive Rates: Term policies start at $355 per month, and whole policies at $1,210/month.

Cons

- Premium Fluctuations: Whole policy rates may be higher compared to other competitors. Visit this guide, “Best Life Insurance Companies That Accept ITIN,” for more info.

- Limited Bundling Incentives: Offers a 10% discount for people with breast cancer, which is solid but not the highest in the market.

#8 – Mutual of Omaha: Best for Quick Approvals

Pros

- Quick Approvals: A fast approval process ensures coverage for breast cancer patients needing immediate insurance.

- Affordable Coverage: Term policies at $310/month and whole policies at $1,020/month provide excellent value for people with breast cancer.

- Reliable Financial Backing: Maintains an A+ rating for strong financial stability. For more details, view this “Mutual of Omaha Life Insurance Review” guide.

Cons

- Higher Whole Policy Rates: Whole policies at $1,020/month could be more expensive than other insurers.

- Limited Bundling: It offers a modest 5% bundling discount for breast cancer patients, which is lower than some competitors.

#9 – AARP: Best for Senior Coverage

Pros

- Senior Coverage: AARP offers personalized policies for seniors with affordable whole-life coverage starting at just $1,000 per month.

- Affordable Rates: Offers term policy rates for seniors with breast cancer at $300/month and whole policies at $1,000/month.

- Reliable Ratings: AARP’s A++ rating offers solid financial protection for breast cancer patients. For added details, explore this “AARP Life Insurance Company Review” guide.

Cons

- Limited Policy Options: It mainly provides coverage for seniors, making it harder for younger people with breast cancer to find options.

- Lower Whole Policy Limits: Whole-life policies limited to $1,000 per month may not be enough to meet the higher coverage needs of seniors with breast cancer.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#10 – Banner Life: Best for Simplified Underwriting

Pros

- Simplified Underwriting: Banner Life simplifies the application process for people with breast cancer.

- Affordable Coverage: Term policies at $250/month and whole policies at $900/month provide excellent value for breast cancer patients.

- Stable Financial Standing: Maintains an A+ rating for secure financial backing. Learn more through this “Banner Life Insurance Company Review” guide.

Cons

- Limited Whole Policy Coverage: Whole policy limits capped at $900/month may be restrictive for some people with breast cancer.

- Bundling Discounts: Offers a 5% bundling discount, which is lower compared to top insurers.

Life Insurance for Breast Cancer Patients

Securing life insurance after a breast cancer diagnosis can be challenging, but it is possible depending on individual circumstances. Insurance companies assess breast cancer cases carefully to determine eligibility and premiums.

Life Insurance Monthly Cost for Breast Cancer Patients by Provider

| Insurance Company | Term Policy | Whole Policy |

|---|---|---|

| $300 | $1,000 | |

| $350 | $1,200 |

| $250 | $900 |

| $410 | $1,420 | |

| $310 | $1,020 | |

| $355 | $1,210 |

| $500 | $1,600 | |

| $400 | $1,300 | |

| $305 | $1,010 | |

| $360 | $1,220 |

Can you get life insurance after breast cancer? Yes, it is possible, but getting life the insurance after breast cancer process typically involves a thorough evaluation of your health history.

Factors like the stages of cancer, treatment history, and years since remission all play a significant role in the underwriting process. This guide provides essential information to help you navigate the process and understand what to expect. For more details, view this guide, “How does life insurance work?”

Breast Cancer and Life Insurance Eligibility

Breast cancer is the second most common cancer affecting women, after skin cancer. The average chance for a woman to develop breast cancer is 12% (or 1 in 8). While rare, men can also develop breast cancer, with less than 1% of cases occurring in males.

Can I get life insurance if I have breast cancer? It depends on your circumstances; you may be eligible but expect detailed medical evaluations.

Navigating life insurance with breast cancer requires understanding your policy and coverage options.Tim Bain Licensed Insurance Agent

When applying for life insurance, individuals with a history of breast cancer undergo a detailed evaluation. Insurers consider the cancer stage at diagnosis, treatments received, time since treatment ended, years in remission, and overall health, including other medical conditions.

Generally, individuals who have successfully completed treatment and remained in remission for several years may qualify for life insurance, though at higher premiums. In some cases, guaranteed issue or simplified issue policies may be an option for those who do not meet traditional underwriting criteria. Get more insights from this guide, “Life Insurance Underwriting Process.”

The patients may also ask, Does life insurance payout for breast cancer? Most policies do, but it’s essential to review the policy details to understand any conditions that may apply.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Types of Life Insurance Available

When considering life insurance options, individuals with specific health conditions, such as early-stage breast cancer, have several types to choose from based on their needs and eligibility.

- Traditional term or whole life insurance: It is the best option for those in remission. It requires full underwriting, including a review of medical records and sometimes a physical exam, but it offers robust coverage options.

- Guaranteed issue life insurance: It provides an alternative with no medical exams or health questions, though it comes with lower coverage limits and higher premiums.

- Simplified issue life insurance: It offers a middle-ground option with fewer medical questions and no physical exam. This results in a faster approval process, but the coverage amounts are usually smaller.

Each type of policy has its purpose to help people with breast cancer find the right option for their needs and offer them financial peace of mind. For more information, review this guide, “Dos and Don’ts of Life Insurance.”

Insurance Companies for Insuring Breast Cancer Survivors

Life insurance underwriting is all about risk assessment. It’s the process in which the insurance company decides your health class rating, which will ultimately determine your rates.

From a breast cancer standpoint, the less invasive the cancer prognosis was, along with the stage and how much time has passed since your last treatment will be the foundation of your consideration for coverage.

Life Insurance Discounts From the Top Providers for People With Breast Cancer

| Insurance Company | Available Discounts |

|---|---|

| Bundling, Senior, Automatic Payment, Wellness Program | |

| Multi-Policy, Healthy Lifestyle, Family Bundle, Wellness Rewards |

| Multi-Policy, Annual Payment, Accelerated Underwriting, Electronic Enrollment |

| Bundling, Family Coverage, Healthy Habits, Early Enrollment | |

| Multi-Policy, Long-Term Policy, Wellness Program, Non-Smoker | |

| Bundling, Family, Safe Living, Health Engagement |

| Multi-Policy, Long-Term Policy, Loyalty Reward, No-Tobacco | |

| Multi-Policy, Healthy Lifestyle, Legacy Loyalty, Family Protection | |

| Bundling, Safe Driver, Financial Bundle, Good Health | |

| Multi-Policy, Annual Payment, Senior Perks, Healthy Living |

The insurance company will order an attending physician statement (APS), so they can confirm the stage, size, and treatment. Can you get life insurance if you have cancer or can a cancer survivor get life insurance? The answer is generally yes, though it may come with limitations or higher premiums. Cancer survivor life insurance has been tailored to reflect these variables.

The Date of Diagnosis

The date of diagnosis, along with your age at the time of diagnosis will be the first questions you will need to answer. The reason is that the younger a woman is, the higher the likelihood of survival. Anytime you were diagnosed over the age of 40, and the longer time that has passed since you were first diagnosed, the better your rates will be.

Recurrence

For breast cancer, the recurrence rates are in direct proportion to the original size and stage of cancer. Woman with a low-grade stage has a 10% risk of cancer spreading in the next 15 years, compared to a 40% risk of spreading for those high-grade cancers.

We’ve launched our new Transamerica FE Express Solution – lifetime protection with a digital buying experience that takes customers from quote to policy delivery in as little as 10 minutes.

Read more here: https://t.co/FAfjcoT5dD pic.twitter.com/WY65OwaGdI

— Transamerica (@Transamerica) September 18, 2024

For this reason, the insurance company will be interested to know if there have been any recurrences of your breast cancer.

Life Insurance for Breast Cancer Survivors

Getting life insurance after a breast cancer diagnosis can be challenging, but it’s achievable with the right timing and understanding of insurer requirements. Eligibility and rates depend on the cancer stage, grade, size, and treatment history.

- Stage 0 – Low-grade and estrogen receptor (ER) positive. This means that estrogen, not progesterone, is the cause of cancer. Stage 0, with at least two years since the end of treatment, will get you a standard rate.

- Stage 1 – Low-grade, ER-positive, diagnosed at age 40 or under, tumor size 1.1-10mm. Two years after the end of treatment, this low grade will get you a standard rate.

- Stage 2 – Tumor size 2.1- 5cm with no positive nodes. You can get table B after a 5-year waiting period. If, however, 1 to 3 nodes were positive, you will have to wait 10 years before applying.

- Stage 3 and 4 – You must wait 15 years before anyone will consider you for coverage.

You may also face an extra flat premium based on different cancer sizes and if you were node-positive. Node-positive means that cancer has spread in the lymph nodes in the armpit area. It will dramatically increase your rates between $5-$10 per $1000 coverage for 3- 6 years.

Having a clear understanding of your breast cancer diagnosis helps in selecting the right life insurance coverage.Heidi Mertlich Licensed Insurance Agent

Can I get life insurance after breast cancer? Yes, but it’s important to work with knowledgeable agents who understand this specialized area. You need to rely on your insurance agent to steer you in the right direction when applying for a policy. For added details, explore this guide, “10 Best Life Insurance Companies.”

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Discover the Best Life Insurance for Breast Cancer

These case studies show how AIG, Northwestern Mutual, and Prudential provide tailored life insurance solutions for people with breast cancer. To learn more, look at this guide, “How a Pre-Existing Conditions Affects Life Insurance. ”

- Case Study #1 – AIG Delivers Low Rates for Early-Stage Cancer: Jane, 45 years old, chose a 20-year term life insurance policy with AIG for $350 per month after being diagnosed with Stage 1 breast cancer.

- Case Study #2 – Northwestern Mutual Provides Comprehensive Whole Life Coverage: Mary, 52, has been in remission for five years. She picked a whole-life policy that provides coverage and helps her build her savings over time.

- Case Study #3 – Prudential Supports Higher-Risk Applicants: Sophia, a 58-year-old who had Stage 2 breast cancer in the past, found life insurance through Prudential’s flexible underwriting process. It is easier for her to get coverage specialized to her health history.

These cases highlight how these top companies offer affordable and reliable options for the diverse needs of breast cancer patients. Simplify your life insurance shopping by entering your ZIP code into our free quote comparison tool and find coverage that fits your budget and needs.

Frequently Asked Questions

Which company offers the lowest rates for breast cancer survivors?

Banner Life offers the lowest term policy rate at $250 per month and simplifies the application process for breast cancer survivors.

Why is AIG a top choice for high-risk applicants?

Many people who seek life insurance for breast cancer wonder how their condition may affect coverage. AIG specializes in flexible underwriting, making it a reliable option for applicants with advanced or recurrent breast cancer. If you need life insurance coverage, enter your ZIP code into our free tool to save time and money.

What role does age play in securing life insurance with breast cancer?

Age, combined with the cancer stage and treatment history, influences rates and eligibility, with younger applicants often receiving better terms. For more information, view this guide, “Life Insurance Cost by Age: How Your Age Impacts Life Insurance Premiums.”

What makes Northwestern Mutual a good option for life insurance?

Northwestern Mutual is ideal for those seeking comprehensive whole life policies with investment growth and robust long-term benefits.

How does remission status affect life insurance eligibility?

The time since remission significantly impacts eligibility and rates, with more extended remission periods often resulting in better terms. Can I get life insurance if I have breast cancer is a question that many facing diagnosis ask, and while challenging, the answer is not impossible. Life insurance after cancer diagnosis is not a guarantee but an option for many.

Is term life insurance the most cost-effective choice?

For many breast cancer survivors, term policies, such as those offered by AIG, provide affordable coverage for specific periods. There are term life insurance for breast cancer survivors options that can help cover the unexpected. With a breast cancer survival rate improving over time, more options are becoming available. Find more information in this guide, “Pros and Cons of Term Life Insurance.”

Are whole life policies worth considering for breast cancer survivors?

Whole life policies, like those from Northwestern Mutual, offer lifelong coverage and financial planning benefits, making them valuable for many. Life insurance for cancer survivors includes careful consideration of the time since diagnosis and current health status.

How do life insurance companies approach Stage 1 or Stage 2 breast cancer?

Insurers like AIG and Prudential often offer competitive rates and tailored policies for early-stage cancer survivors with good health records. Breast cancer-related life insurance options are available, but they may have varying terms and conditions depending on the specific details of the breast cancer and the underwriting process for life insurance.

Can breast cancer survivors find policies without a medical exam?

For those who have been treated and are now in remission, life insurance for breast cancer survivors can provide peace of mind and financial security. Some insurers offer no-exam policies, which can simplify the process but may have higher premiums and lower coverage amounts. For further details, refer to this “No Exam Life Insurance” guide.

How can I choose between AIG, Northwestern Mutual, and Prudential?

Consider your priorities—AIG for affordability, Northwestern Mutual for comprehensive plans, and Prudential for flexibility with high-risk cases. Compare term life insurance rates by entering your ZIP code into our free tool today.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.