American Memorial Life Insurance Company Review

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Licensed Agent & Financial Advisor

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

If you are inquiring about final expense products from the American Memorial Life Insurance Company, this review is for you. American Memorial Life Insurance or AML is a legal entity of Assurant Solutions and is licensed in 49 states to sell its final expense products. AML isn’t on our top 20 final expense companies, however, we received a few calls from curious consumers and decided to go over their products and services to see how they stake to the best in our industry.

Who is American Memorial Life Insurance Company?

American Memorial Life is subsidiary of Assurant Solutions, who as been serving clients since 1959 by offering specialty insurance products and risk management solutions. Assurant Solutions is part of Assurant, a giant in the health insurance business which closed its doors in October 2015 and exited the health insurance business due to the Affordable Care Act (ACA) losses.

Now they specialize in the property and casualty arena, but its subsidiary, Assurant Solutions, is partnered with American Memorial Life to offer final expense products. American Memorial is rated A- (Excellent) by A.M Best and is committed to its clients by offering superior customer service for those who are seeking final expense products.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Which final expense products do they offer?

For starters, final expense life insurance is for those who seek protection for one primary goal which is to resolve end-of-life obligations such as burial and funeral service, casket, or cremation among several others. The death benefit or face value is usually $25,000 or lower, and unlike term life insurance, final expense policies are whole life and also have the potential to build cash value.

Additionally, final expense policies are a simplified issue, which involves answering yes or no to a few questions and does not require completing a medical exam as part of the approval process. American Memorial offers two different types of funeral insurance product. These are level and modified death benefits, which you can qualify for based on your health.

What is a Level Benefit Immediate Death Benefit?

A level benefit, also called Preferred Plan, means that your policy has no waiting period in which the policy goes into effect. This means, if you have a $10,000 policy, you will not have to wait for any period of time to receive your benefits; whether you die two days after purchasing the policy or two years, the policy would pay the acquired death benefit amount at the time of death, in this case, $10,000.

It’s worth mentioning that, to be eligible for this plan, you must be in good health without any significant health issues. You may find there are additional qualification terms as well with some carriers. Your premium payments remain the same for your entire life, and the face value will never decrease even if your health deteriorates.

- Ages 0–60 can get $5,000 to $50,000

- Ages 61–70 can get $3,000 to $25,000

- Ages 71–80 can get $3,000 to $25,000

- Ages 81–85 can get $3,000 to $20,000

Note: If you buy the policy over the phone instead of face to face, you will only be able to get $15,000 in death benefit.

What is a Modified Benefit Graded Death Benefit?

A modified death benefit plan is also called a return-of-premium plan. This plan has a three-year waiting period after which they pay the full death benefit. If you die in the first two years, not accident-related, the plan will pay your premium paid plus 10% in interest. Those who can’t get approved for the level benefit plan may be eligible for a modified plan. Your premiums will also remain fixed, and the policy will build a cash value just like the level benefit one.

- Ages 40–60 can get $5,000 to $15,000

- Ages 61–70 can get $3,000 to $15,000

- Ages 71–80 can get $3,000 to $10,000

Note: If you can’t qualify for the level benefit plan, do not apply for the modified plan before you compare rates from other companies first. All insurers have different ways which they use to classify an applicant. Where one company gives you graded benefit, another may provide you with level, but you need to know which one.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

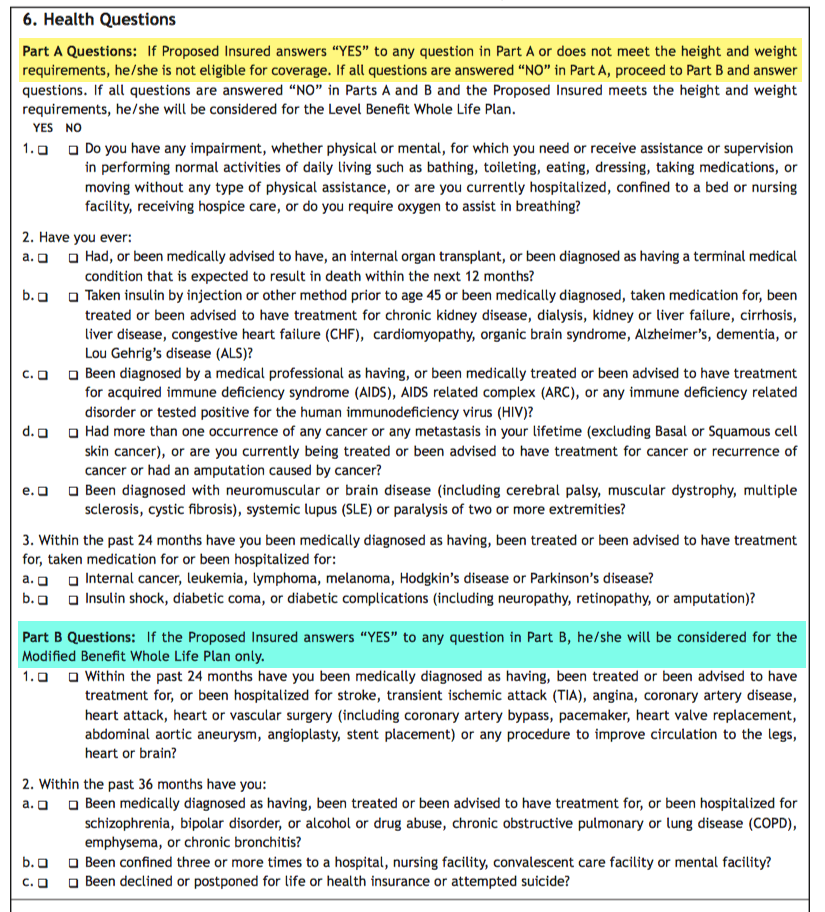

What are Knockout Questions?

Brokers use knockout questions to determine which plan benefit an applicant can qualify for. It is also useful for the applicant to see the questions, so they will not waste time applying for a product they can’t get accepted for. Of course, if you have a broker, you should let them do the due diligence based on your health history and come up with a plan that fits you.

As mentioned before, every life insurance company has a different risk threshold for which they underwrite a potential client, therefore they have different questions on the application that, based on your circumstances and health, will lead to either a level or graded benefit plan. You should never assume that no company will offer a level benefit because of your health history.

Your goal is always to get a level benefit plan that pays an immediate death benefit no matter when you pass away. Different providers will have a different time frame in which they allow benefits to be paid. Because these policies are designed to help your family cover the cost of your funeral, the sooner it pays out, the better. Below is a screenshot from American Memorial’s application with the questions you need to answer and what will dictate a level or graded plan.

American Memorial Life vs. Other Carriers’ Sample Monthly Rates

*All rates quoted on this page are for a super-preferred healthy individual who does not use tobacco. Monthly rates are updated as of Sep 2018 and are subject to underwriting approval.*

What is the Bottom Line?

American Memorial Life has a few advantages:

- If you are 80 or over and looking for final expense policy, they are very competitive price-wise. The maximum face value is $25,000, but that is a sufficient amount for most who are looking for burial insurance.

- They offer up to $75,000, where most final expense companies provide up to $50,000. Keep in mind if you buy it over the phone, the maximum benefit is only $15,000.

- Individuals with diabetes with prescribed insulin after the age of 40 can qualify for the level benefit plan.

American Memorial has a few disadvantages:

- If you buy their plan over the phone, you will only be able to purchase up to $15,000 in benefit, which isn’t enough for most.

- They are way overpriced if you are under the age of 80. Check out the table rates above.

- They don’t offer any riders such as terminal illness or living benefit riders, which most companies offer without additional cost.

As a consumer, you must do your homework before choosing a company to apply to. Buying a life insurance product based on the monthly premium alone should never be your goal. Instead, find a company that can issue a level benefit plan at the lowest possible price.

We at Effortless Insurance know that life insurance is baffling for most, this is why we recommend using the quote engine on our site where you can get the quotes in under 30 seconds.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Frequently Asked Questions

What is American Memorial Life Insurance?

American Memorial Life Insurance is a company that provides life insurance coverage to individuals and families. They offer various types of life insurance policies to meet different needs and budgets.

What types of life insurance policies does American Memorial Life Insurance offer?

American Memorial Life Insurance offers a range of life insurance policies, including term life insurance, whole life insurance, and universal life insurance. Each type of policy has its own features and benefits, allowing individuals to choose the coverage that suits their specific requirements.

What is term life insurance?

Term life insurance is a type of life insurance policy that provides coverage for a specified period, typically 10, 20, or 30 years. If the insured person passes away during the term of the policy, the designated beneficiaries will receive a death benefit payout. Term life insurance is often more affordable compared to other types of life insurance.

What is whole life insurance?

Whole life insurance is a type of life insurance policy that provides coverage for the entire lifetime of the insured person. It offers a guaranteed death benefit payout to the beneficiaries upon the insured’s passing. Whole life insurance also includes a cash value component that accumulates over time and can be accessed or borrowed against during the insured’s lifetime.

What is universal life insurance?

Universal life insurance is a flexible type of life insurance policy that combines a death benefit with a cash value component. It allows policyholders to adjust the death benefit and premium payments over time to meet their changing needs. Universal life insurance also offers the potential for the cash value to grow through investment options selected by the policyholder.

How can I apply for a life insurance policy with American Memorial Life Insurance?

To apply for a life insurance policy with American Memorial Life Insurance, you can visit their website or contact their customer service directly. They will guide you through the application process, which typically involves providing personal and health-related information, completing a medical questionnaire, and possibly undergoing a medical examination.

Can I customize my life insurance policy with American Memorial Life Insurance?

Yes, American Memorial Life Insurance offers customization options for their life insurance policies. Depending on the type of policy, you may have the flexibility to choose the coverage amount, duration of coverage, premium payment frequency, and additional riders or benefits to enhance your policy’s protection.

How are premiums determined for American Memorial Life Insurance policies?

Premiums for American Memorial Life Insurance policies are based on various factors, including the type and amount of coverage, the insured person’s age, health condition, lifestyle, and other risk factors. Younger and healthier individuals generally have lower premiums compared to older individuals or those with pre-existing medical conditions.

Can I change my life insurance policy with American Memorial Life Insurance after purchasing it?

Depending on the type of policy you have, American Memorial Life Insurance may offer options to make changes to your life insurance coverage after purchase. These changes could include increasing or decreasing the death benefit, adjusting premium payments, or adding additional riders. It is recommended to contact their customer service for specific details and assistance.

How can I file a claim with American Memorial Life Insurance?

In the event of a policyholder’s passing, beneficiaries should contact American Memorial Life Insurance to initiate the claims process. The insurance company will guide them through the necessary steps and documentation required to file a claim. It’s important to notify them as soon as possible to expedite the processing of the claim and receive the death benefit payout in a timely manner.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Licensed Agent & Financial Advisor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.