Medical Information Bureau (MIB) Explained

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Whether you apply to a fully underwritten or no-exam life insurance policy, the carrier’s underwriter will request access to your MIB file, provided you have one.

The Medical Information Bureau provides consumer reports (not credit reports) for the exclusive use of insurance companies which are members of MIB Group, Inc.

In a nutshell, the MIB helps insurers in charging and classifying applicants based adequately on mortality risk and therefore keep rates affordable.

In this post, I’ll go over the questions we get from potential clients about the MIB’s role in the life insurance underwriting process.

What Is MIB?

MIB Group, Inc. has been around since 1902 and has operated on a not-for-profit basis in the United States and Canada. It acts as “nationwide specialty consumer reporting agency” under the federal Fair Credit Reporting Act (“FCRA”) because it provides consumer reports to its members (insurance companies) during the underwriting process and consequently assisting them in the risk and eligibility assessment.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Does MIB Do?

In essence, the MIB maintains a database of confidential information, safeguarded in a coded format, about underwriting risks such as medical conditions, hazardous hobbies, and unfavorable driving records which can have an adverse effect on one’s insurability.

These records, which are collected with your permission, alert insurance underwriters to potential errors, omissions, or misrepresentations that were collected during a phone interview, the medical exam, or answers on the application.

By maintaining that information and alerting companies for potential red flags, they assist insurers to avoid insuring individuals who pose an increased risk and to charge at the proper risk class for those who aren’t in good health but are insurable.

By mitigating unwanted risks, insurers can keep prices affordable and reward those who are eligible for preferred rates.

Let’s review a few of the questions about the MIB.

Does MIB Collect and Store My Actual Medical Records?

Absolutely not!

MIB doesn’t collect or store any information from your medical exams, lab test results, or reasons for denial of insurance. Instead, codes are provided by its members about significant risks to the underwriting process.

Think of these codes like encryption and their sole purpose is to signify different medical conditions that affect one’s insurability.

For instance, if you had a stroke and reported it on the application, a carrier may report it the MIB, and it will be coded as a stroke but without the actual doctor’s records or any other test results.

Does Everyone Have an MIB Record?

No. Only if you applied in the last seven years with an MIB member company for underwritten health (prior to the ACA), life, disability income, long-term care, or critical illness insurance and if you have an adverse condition that can impact your mortality or morbidity.

After seven years, MIB removes information reported about you to comply with the prohibition in the FCRA against reporting obsolete information. Furthermore, if you applied and got preferred or standard health class ratings, you will not have a file with the MIB because your health doesn’t affect your insurability.

What Is in My MIB Record?

As mentioned above, the MIB does not store any medical records, test results, or attending physician statements (APS). Instead, after your underwriting process, a member (insurer) may report significant health conditions using codes in broad general categories.

The codes do not reveal the amount of insurance applied for or any action the insure took concerning your application, such as a rate up, approval, or denial.

Lastly, underwriters are prohibited from making the final ascertainment about your application solely from the data they have gathered from the MIB because the information is neither complete nor in-depth. Simply put, carriers are just alerted about your health condition to investigate further.

Who Can Obtain a Copy of My MIB Record?

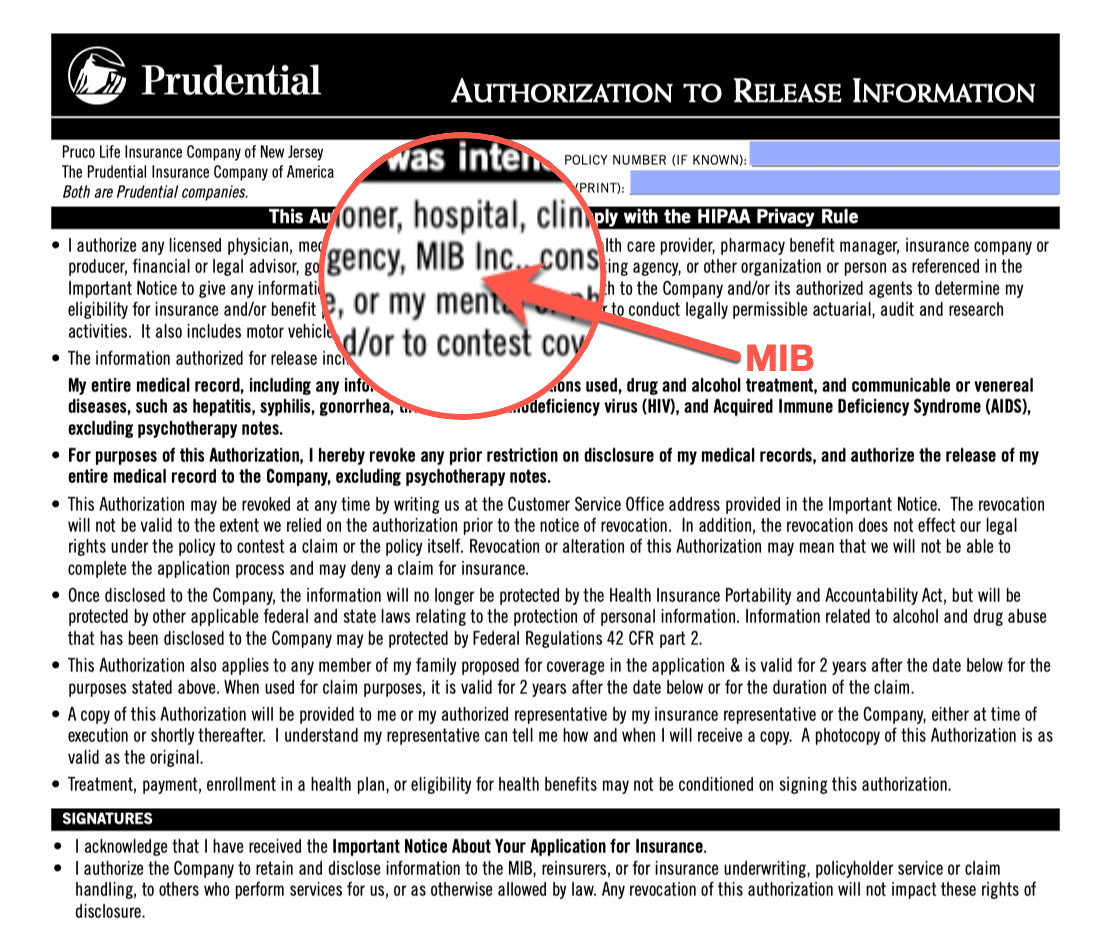

MIB will only release information to its members after they have your signed authorization. Keep in mind that, when you apply for an underwritten life insurance policy, there is a section that called “Authorization to release information”, which gives the carrier the right to order medical records and obtain information from third-party sources to determine your eligibility for insurance. The request to access your MIB file is also included in that section.

Can I Get a Copy of My MIB Record?

Absolutely! Provided you have one, you may do so by calling MIB at 866-692-6901, or you may complete your request online. You will need to provide some personally identifying information, and to certify that your provided information is accurate.

You can request this file free of charge once a year, and you should get it within 15 days. The MIB will translate all the codes to something you can understand along with the names of companies that made an inquiry in the last 24 months and lists of the members that received your MIB file in the prior 36 months.

MIB Functions in a Highly Regulated Environment

The MIB is directly regulated under the federal Fair Credit Reporting Act (“FCRA”) which promotes accuracy, privacy, and fairness among consumer reporting agencies.

MIB is also subject to many other laws they must comply with in order to allow its members to use the service they provide. Hence, they must maintain a secure and confidential database for the sole use of the members.

If, for some reason, you believe your file contains inaccurate information, you can dispute it using this link.

Case Studies: Utilizing Medical Information Bureau (MIB) in Insurance

Case Studies: Leveraging Medical Information Bureau (MIB) for Enhanced Risk Assessment

Case Study 1: Life Insurance Underwriting

A 45-year-old individual applies for a life insurance policy. During the application process, the applicant discloses a previous history of heart disease and a recent heart surgery. Being a member of the Medical Information Bureau (MIB), accesses the MIB database and discovers that the applicant had not disclosed these medical conditions in previous applications with other companies.

The MIB report helps identify the undisclosed information and assess the applicant’s risk accurately. Based on this information, Company X adjusts the premium and offers coverage that is appropriate for the applicant’s medical history.

Case Study 2: Health Insurance Underwriting

A 30-year-old individual applies for health insurance. During the underwriting process, the applicant reveals a pre-existing condition, such as asthma, but fails to disclose a recent hospitalization for a severe allergic reaction. Being an MIB member, accesses the MIB database and finds a record of the hospitalization that the applicant had not mentioned.

This additional information allows to make an informed decision regarding coverage and premium rates. By utilizing the MIB report, the company ensures that the applicant’s health risks are adequately assessed, and the policy terms are adjusted accordingly.

Case Study 3: Disability Insurance Underwriting

A 35-year-old self-employed individual applies for disability insurance. The applicant discloses a previous back injury that required surgery, but fails to mention ongoing physical therapy sessions. As an MIB member, accesses the MIB database and discovers the additional information about the ongoing therapy.

This knowledge allows to accurately assess the applicant’s risk and determine appropriate coverage and premium rates for disability insurance. By leveraging the MIB report, the company ensures that the applicant’s health history is thoroughly evaluated, leading to fair and appropriate underwriting decisions.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Bottom Line

You should know by now that insurers must use everything in their arsenal to make sure they don’t go under by insuring the uninsurable but also being able to keep prices at bay if a person deserves so.

The MIB assists insurance companies in figuring out an additional piece to the underwriting puzzle by operating as an “information exchange database” and allowing its members to report adverse risks which could affect one’s insurability.

In other words, if you applied to one company and disclosed that you have cancer, or it was discovered through the exam or medical records and, therefore, were denied coverage, even if you apply to another company and never disclosed it, they will be able to find the condition through the MIB report and will ask you to provide more information.

It goes without saying but is worth repeating: be honest when you apply for life insurance, and if you are, there is nothing to worry about.

Frequently Asked Questions

What is the purpose of the Medical Information Bureau (MIB)?

The primary purpose of the Medical Information Bureau (MIB) is to provide insurance companies with access to shared medical information about applicants. It helps insurers assess the risk associated with an applicant’s health history and make informed underwriting decisions.

ow does the Medical Information Bureau (MIB) collect information?

The Medical Information Bureau (MIB) collects information from insurance applications and supplemental questionnaires submitted by individuals when applying for insurance coverage. The information is voluntarily provided by the applicants and includes details about their medical history, conditions, and treatments.

Who has access to the information in the Medical Information Bureau (MIB) database?

Only authorized member insurance companies have access to the information stored in the Medical Information Bureau (MIB) database. These companies must be members of the MIB and adhere to its guidelines and regulations. The information is not accessible to the general public.

What type of information does the Medical Information Bureau (MIB) collect and store?

The Medical Information Bureau (MIB) collects and stores information related to an applicant’s medical conditions, medications, surgeries, treatments, hospitalizations, and other health-related details disclosed during the insurance application process.

How long does the Medical Information Bureau (MIB) keep information on file?

The Medical Information Bureau (MIB) retains information on file for a period of seven years. After that time, the information is removed from the database and is no longer accessible to insurance companies.

Can individuals request a copy of their Medical Information Bureau (MIB) report?

Yes, individuals can request a copy of their Medical Information Bureau (MIB) report by contacting the MIB directly. They can review the report to ensure the accuracy of the information stored and dispute any errors if necessary.

How can individuals dispute inaccurate information in their Medical Information Bureau (MIB) report?

If individuals find inaccurate information in their Medical Information Bureau (MIB) report, they can file a dispute with the MIB. The MIB will conduct an investigation and work with the insurance companies involved to correct any errors found.

Does the Medical Information Bureau (MIB) impact an individual’s ability to get insurance?

The Medical Information Bureau (MIB) does not directly impact an individual’s ability to get insurance. It serves as a resource for insurance companies to access shared medical information. However, the information in the MIB database can affect an individual’s insurance application if it reveals significant health risks or pre-existing conditions.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.