How Much Does Whole Life Insurance Cost?

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Life Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Licensed Life Insurance Agent

UPDATED: Mar 19, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Mar 19, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Do you want to purchase life insurance that will pay a death benefit when the insured dies whenever that time arrives? If you answered yes, whole life coverage might be what you were seeking.

Whole life, also called cash-value life insurance, is a type of permanent protection that lasts as long as you do. Unlike term life, which is only intended to remain in effect for a specified duration, whole life continues for your entire life as long as you pay the premiums.

Regardless of the kind of coverage you buy, the purpose of life insurance remains the same: To provide financial security for those you love in the event of your death.

In this post, I will cover the whole life insurance policy and the estimated costs based on age.

Whole Life Insurance Costs by Age

- Whole Life Prices for Ages 20–29

- Whole Life Prices for Ages 30–39

- Whole Life Prices for Ages 40–49

- Whole Life Prices for Ages 50–59

- Whole Life Prices for Ages 60–69

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Whole Life Insurance Basics

Whole life insurance solves the fundamental problem with term life insurance: its expiration argument. Since term life is purchased for a fixed period, the beneficiary doesn’t collect the death benefit unless the insured dies during that initial term period.

Whole life is permanent coverage that provides guaranteed premiums and death benefit to be paid tax-free to the beneficiary upon the insured’s death.

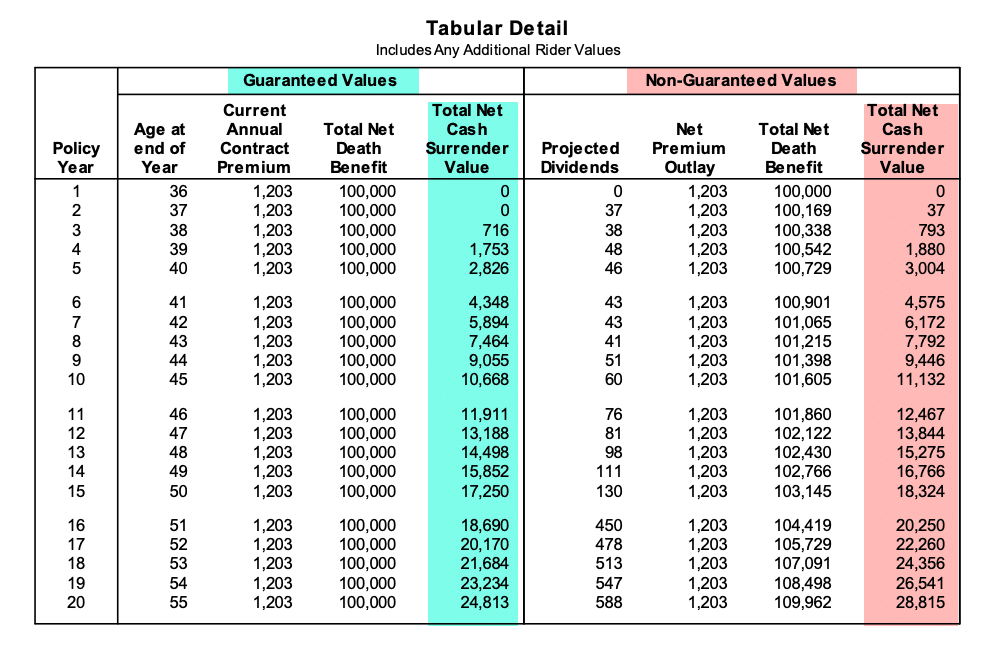

Each time you pay the premium, a portion goes to pay the cost of insurance, and the remainder is allocated into a designated cash account that belongs to the policy owner and earns guaranteed interest rates and dividends (non-guaranteed).

The Cash Value Component

The cash value account is similar to having a savings account within the policy. The cash grows on a tax-deferred basis and can be accessed through a loan, withdrawal, or if you surrender the policy.

To accumulate cash value, the policyholder can remit payments more than the scheduled amount (subject to IRS limits); however, the main two methods in increasing the value are:

- Interest rate: The insurer invests the money in the cash value account for the owner. The government regulates this by regulating the companies where they can invest it. A large portion of the insurance portfolio, about 90%, goes into highly rated bonds and mortgages. The return of these investments has yielded 5%–6% for the last 75 years. However, your interest rate in the account is fixed, typically 2%–3%. If they make more, the insurer will keep the excess because it must cover the difference when interest rates are low in the future. Nonetheless, your guaranteed interest rate is outlined in the life insurance illustration when you first purchase the policy and will remain in force for as long as you own the policy.

- Dividends: Participating policies usually pay dividends. Dividends are a portion of the company’s profit that are paid to its policyholders instead of Wall Street investors. Although it’s not guaranteed, you should always check how much and how often they have paid dividends to predict its future likelihood to follow suit. You have a few options to take dividends:

- Cash from the insurer

- Premium reduction

- Left in the cash value account to earn more interest

- Purchase more insurance

Check out the illustration below for guaranteed vs. non-guaranteed cash value accumulation values.

The Death Benefit

After the insured’s passing, whether two days or 50 years after buying the policy, the insurer will pay the death benefit only. The death benefit (also called face value) is the sum of money that was agreed upon when you signed for coverage minus any outstanding loans or withdrawals.

If you have accumulated cash value in your account, your beneficiaries WILL NOT receive that amount. The insurer uses the cash value amount to lower the amount it must pay to your heirs.

For instance, if a person buys $100,000 whole life policy and has $40,000 in the cash value account at his death, the insurer will only pay the $100,000 not $140,000 ($100,000 + $40,000).

Whole Life Prices for Ages 20–29

Whole Life Prices for Ages 30–39

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Whole Life Prices for Ages 40–49

Whole Life Prices for Ages 50–59

Whole Life Prices for Ages 60–69

*All rates quoted on this page are for a super-preferred healthy individual who does not use tobacco. Monthly rates are updated as of Jun 2019 and are subject to underwriting approval.*

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Whole Life Insurance Pros

- A financial solution that lasts as long as you live, and pays the death benefit to your heirs when you die.

- The premium payments remain fixed throughout your life.

- The policy’s cash value grows each year on a tax-deferred basis and can increase considerably if your insurer pays dividends.

- The rate of return in your cash value account is guaranteed by the insurer.

- You can take a loan against the value of your policy.

- Permanent coverage can be an essential tool in estate planning.

- As with all policies, the death benefit is paid tax-free to your beneficiaries.

Whole Life Insurance Cons

- Whole life is probably the most expensive coverage you can buy.

- The guaranteed rate in your cash value account is typically 2% and most can give a much better return.

- Not knowing when you’ll die isn’t a good reason to buy whole life.

- It takes 5–15 years for whole life policy to accumulate cash value to just break even to where your paid premiums equal the value of your coverage.

- 30% surrender their policies within five years, and 50% in the first 10 years. The point is that most can’t afford to keep it.

The Underwriting Process

Most whole life policies will require the applicant to undergo an exam, complete a phone interview, and authorize the insurer to look into third-party reports from MIB, MVR, and prescription database. The underwriting process can take two to eight weeks.

If you seek burial or final expense type of coverage (which are also whole life), with less than $40,000 in face value, you will not undergo an exam.

These policies are issued on a simplified issue basis, meaning there are only a few health questions you need to answer, phone interview, and third-party reports. This type of underwriting process can take under a week with most companies.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Whole Life Insurance Costs

Case Study 1: Young Family Planning for the Future

John and Emily, both aged 30, are a young couple with a growing family. They recently purchased their first home and are concerned about their financial security in case of unexpected events. They want to secure a whole life insurance policy that will provide lifelong coverage and a death benefit to support their family if either of them passes away.

John and Emily are looking for a policy with a $500,000 death benefit to ensure that their mortgage, outstanding debts, and their children’s future expenses are covered. John and Emily decide to go ahead with the whole life insurance policy to safeguard their family’s financial future, ensuring that their loved ones are protected even if the unexpected happens.

Case Study 2: Retirement Planning and Legacy

Michael, aged 55, is approaching retirement and wants to secure a life insurance policy that will serve as a financial legacy for his children and grandchildren. Michael aims to purchase a whole life insurance policy that not only provides a death benefit but also accumulates cash value over time, allowing him to supplement his retirement income.

He decides on a policy with a $1,000,000 death benefit to leave a substantial financial gift to his family. After exploring different options, Michael finds a suitable policy with a premium of $550 per month. Satisfied with the coverage and potential cash value growth, Michael chooses the whole life insurance policy to secure his family’s future and build a financial legacy for generations to come.

Case Study 3: Securing Business Succession

Sarah, aged 40, is a successful entrepreneur and the sole owner of a thriving business. She is concerned about her business’s continuity and wants to ensure a smooth succession plan. Sarah is interested in a whole life insurance policy that can provide funds for her business partners to buy out her share in case of her untimely death. This ensures that her business can continue to operate without financial strain.

Sarah aims for a policy with a $2,000,000 death benefit to cover the value of her business share. After consulting with an insurance agent, Sarah finds a policy that meets her requirements, with a premium of $800 per month. Recognizing the importance of business continuity, Sarah chooses the whole life insurance policy to protect her business partners and secure the future of her company.

Bottom Line

This post isn’t about the constant ongoing debate over which one is better: term or whole life. I merely wanted to present you with the prices for whole life coverage with some necessary information about whole life policies.

Life insurance policies, just like ice cream, come in various flavors, and what fits one may not match the other. Your job as a consumer is to make sure you align your financial needs with the best life insurance option.

If you need a permanent policy but refuse to pay the exorbitant costs, be sure to check universal life or guaranteed universal insurance.

Frequently Asked Questions

What is whole life insurance?

Whole life insurance is a type of permanent life insurance that provides coverage for your entire lifetime, as long as you pay the premiums. It offers a death benefit to your beneficiaries upon your passing, as well as a cash value component that grows over time.

How much does whole life insurance cost?

The cost of whole life insurance can vary depending on several factors, including your age, health, gender, coverage amount, and the insurance company you choose. Generally, whole life insurance tends to have higher premiums compared to term life insurance, but it provides lifelong coverage and a cash value component.

How is the premium amount determined for whole life insurance?

Whole life insurance premiums are typically determined based on various factors, including your age, gender, health condition, lifestyle habits (such as smoking), the coverage amount you choose, and the insurer’s underwriting guidelines. Insurance companies assess these factors to estimate the risk they assume by insuring you.

Can the premium amount change over time with whole life insurance?

The premium amount for whole life insurance is usually fixed and remains the same throughout the life of the policy. However, some whole life insurance policies may offer flexible payment options, allowing you to adjust the premium payment schedule to better suit your needs.

What is the cash value component of whole life insurance?

The cash value component of whole life insurance is a savings feature that accumulates over time. A portion of your premium payments goes into the cash value account, which grows on a tax-deferred basis. You can access the cash value through policy loans or withdrawals, which can be used for various purposes, such as supplementing retirement income or paying premiums.

Can I borrow money from my whole life insurance policy’s cash value?

Yes, one of the advantages of whole life insurance is that you can borrow money from the cash value component of your policy. Policy loans allow you to access a portion of the cash value while keeping the policy intact. However, it’s important to repay the loan with interest to avoid reducing the death benefit or potentially lapsing the policy.

Is whole life insurance suitable for everyone?

Whole life insurance may be suitable for individuals who have long-term financial needs and want lifelong coverage. It can be used to provide financial protection for loved ones, accumulate cash value over time, and potentially serve as an estate planning tool. However, it’s essential to assess your financial goals, budget, and personal circumstances before deciding on the type of life insurance that best meets your needs.

Can I convert a term life insurance policy to whole life insurance?

Some insurance companies offer the option to convert a term life insurance policy to a whole life insurance policy. Conversion typically allows you to switch to permanent coverage without undergoing a medical exam or proving insurability. However, it’s important to check the terms and conditions of your term policy and consult with your insurance provider to understand the conversion options available to you.

Are the premiums for whole life insurance tax-deductible?

No, the premiums paid for whole life insurance policies are generally not tax-deductible. Life insurance premiums are considered personal expenses and are not eligible for tax deductions under most circumstances. However, the death benefit paid out to beneficiaries is usually received tax-free.

Can I cancel my whole life insurance policy if I change my mind?

Yes, you can generally cancel a whole life insurance policy if you change your mind or decide it no longer suits your needs. This is known as surrendering the policy. However, it’s important to review the terms and conditions of your policy, as there may be surrender charges or penalties associated with early surrender.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Life Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Licensed Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.