Expert MIB Group Guide to Life Insurance (Companies + Rates)

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 16, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Mar 16, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Applying for life insurance can be confusing and not a little anxiety-inducing. On top of figuring out how much coverage you need and which company to choose, you also have an insurance company digging into your health and lifestyle.

You probably have privacy concerns, and you’re not alone. When you sign off on that background check, where does the information the insurance company can now access wind up?

We’ll help you understand how a company called MIB Group, Inc. collects and keeps data from the vast majority of North American life insurance companies.

You’ll learn not just who MIB Group is, but what they do and why. We’ll discuss how they gather information, what they keep on file, and who can access that file.

Odds are good you have never heard of MIB Group. If you haven’t applied for life insurance before, they’ve never heard of you, either. MIB is a company dedicated to preventing life insurance fraud by keeping all medical data on everyone who applies for life insurance in one place.

So, while they might wear black suits to work, they’re not the MIB that first comes to mind. Their work isn’t a secret, and there aren’t any aliens in the break room.

MIB, in this case, stands for Medical Information Bureau. Most life insurance companies operating in the U.S. and Canada are members of the MIB Group. Why does it matter to you? It doesn’t until you apply for life insurance.

When you apply, you sign off on those companies using MIB’s database to check on you. You also agree to allow them to submit medical record information to MIB for other insurance companies to access. And although medical is in the name, there is other data in those files, too.

That all sounds like a big violation of your privacy, but MIB is carefully regulated. Read on to find out exactly who they are, what they do, and how your data is safeguarded.

Ready to get easy life insurance quotes right now? Enter your ZIP code above to get started.

What is MIB?

Let’s start our look at MIB with where they came from and why they were created.

History of MIB

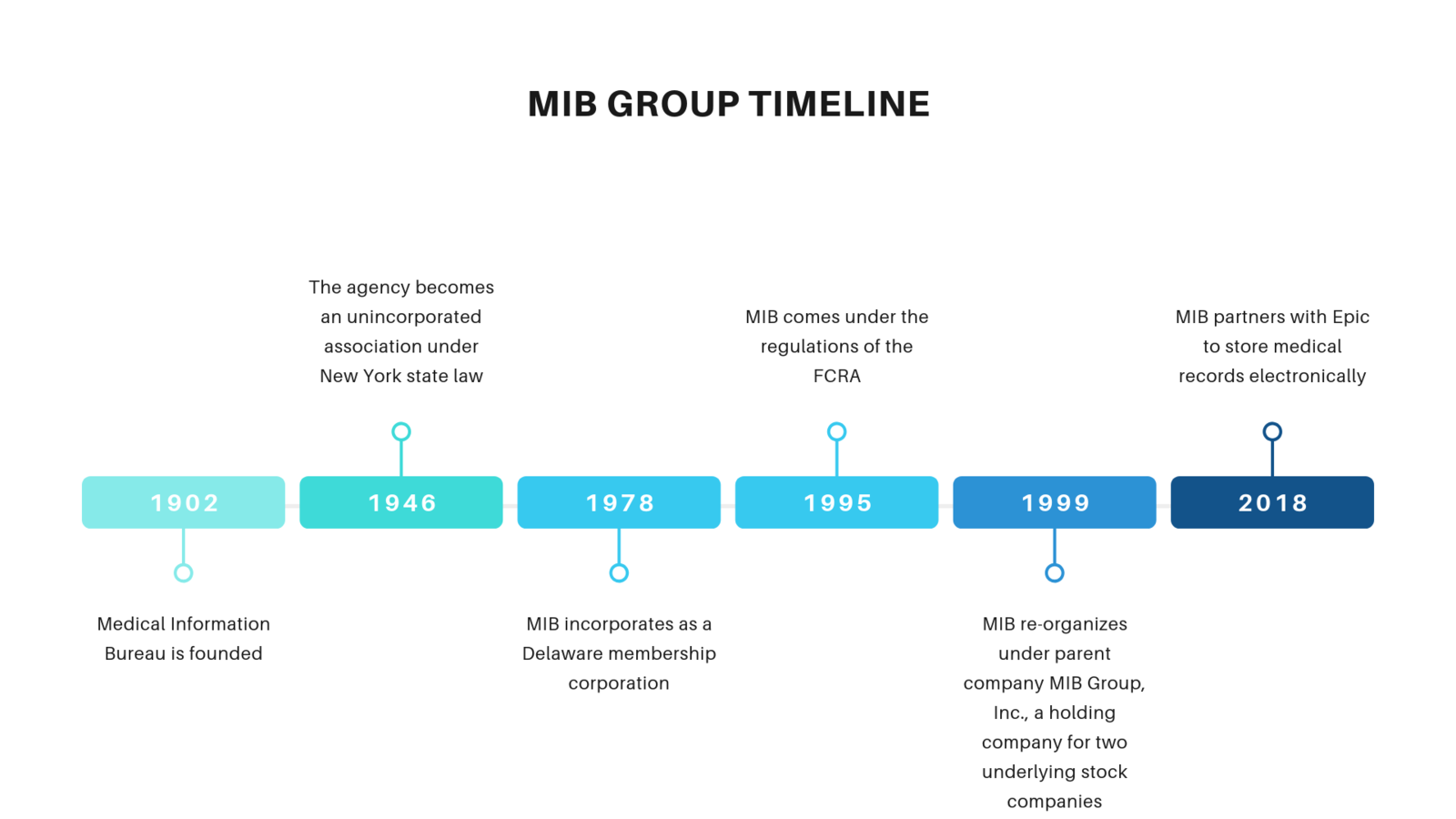

The Medical Information Bureau has been around for a long time. The company was founded in 1902, which makes them as old or older than plenty of insurance companies.

Initially, the Association of Life Insurance Medical Directors of America (AMLIMD) ran MIB through a sub-committee. That continued through 1945.

In 1946, MIB became an unincorporated association under the laws of New York State, and several decades passed before the next change. It was in 1978 that MIB became incorporated, setting itself up as a Delaware membership corporation.

In 1999, the company reorganized again, forming a parent corporation under the name MIB Group, Inc. The holding company has two stock subsidiaries. Those are MIB Solutions, Inc. and MIB, Inc.

As a membership company, MIB is owned by its members. In other words, it is owned by the insurance companies that use their services.

MIB Group’s headquarters is located in Braintree, MA.

What does MIB do?

MIB provides underwriting assistance to life insurance companies. They keep a database of coded records for everyone that applies for life insurance through a member company and provide it to any member company processing an application for that person.

They exist mainly to help prevent life insurance fraud. The data they gather tells a life insurance company whether an application is telling the truth about their medical history. They also keep records on a few other areas of interest to underwriters, including risky behaviors.

Catching errors, omissions, and outright lies on life insurance applications allows insurance companies to issue their policies more accurately.

It helps to keep the cost of life insurance down for everyone by preventing someone from lying on an application and getting a policy they shouldn’t qualify for or getting a better rate class than they should.

MIB is not a for-profit company. They aren’t selling your information to the life insurance company or making money off of it.

While there are a lot of resources a life insurance company might use to gather information about an applicant, none are quite like MIB. It’s the largest consumer reporting agency for life insurance applications, and most companies are members.

MIB Membership

According to the Federal Trade Commission, MIB member companies account for 99 percent of all life insurance policies issued in North America.

MIB itself states that they have about 430 member companies, including life, long-term care, and disability insurers. There’s no list of the member companies available, but we know it’s a lot.

That means it’s pretty difficult to find a life insurance company that is not a member. Odds are incredibly high that your life insurance application is going to wind up in that database.

How can you tell if the company you are applying with is a member? It’s in the fine print. You have to sign to give an insurance company permission to look at your records, including MIB records. If the company is using MIB, it will be noted in the fine print.

If MIB isn’t mentioned anywhere in the application, the company isn’t a member.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

MIB & Your Personal Information

If releasing your personal information to an insurance company makes you nervous, you’re not alone. With data breaches and privacy concerns all over the news, you want to know how your medical records are being secured.

In this next section, we will get into the details of MIB’s database.

We will cover how MIB gathers data, exactly what they know, and how they secure it. We’ll also talk about how you can see what’s on your record and make sure it’s accurate.

How MIB Gathers Information

First and foremost, MIB can’t do anything without your permission. You give that permission when you sign an application for life insurance.

MIB can’t access or share your data without your written permission.

MIB works reciprocally. Member companies share information with them, and can also request information from them in return. Only member companies can access the database.

The information in the MIB database comes from the research the life insurance company does as part of the underwriting process. They don’t get data on you from any other sources. It’s only what the insurance company reports back.

The Fair Credit Reporting Act

Like any other consumer reporting agency, MIB Group is governed by the rules of the Fair Credit Reporting Act (FCRA). Enacted in 1970, the FCRA places strict regulations on how consumer reporting agencies, including credit reporting and MIB, can gather, store, and share information.

There are state-specific laws that apply to consumer reporting agencies, but they are all overruled by the FCRA. As a federal-level law, any time there is a conflict with state law, the FCRA wins.

That means it doesn’t matter where you live. The MIB can’t do anything that doesn’t fall in line with the FCRA regulations.

A large part of what that means to you is you have the right to access your MIB file. We’ll cover that a little later on.

What Information MIB Has in Their Database

So what does MIB have in that database? What kind of records?

First, MIB doesn’t have your actual medical records. You won’t find copies of x-rays, blood panels, or a doctor’s report. Everything in the files is coded, and it’s simply a report that says something is on your record, not the details of what happened.

Types of Information in MIB Files

Here’s what can be found in an MIB file:

- Credit information

- Diagnosed medical conditions

- Test results (testing positive for drugs or a specific illness, for example)

- High-risk activities including employment and hobbies (things like driving a race car, mountain climbing, motorcycling, and more)

- Habits and lifestyle that make you a higher risk (drug use, smoking, drinking, gambling)

- Adverse motor vehicle reports (tickets, accidents, violations such as a DUI)

Data is kept in a MIB file for seven years.

What MIB Can’t Access

It sounds like MIB has access to a whole lot of information about you, but it’s not that far-reaching.

MIB can only access information that was uncovered by a member insurance company as part of a life insurance application. That means they don’t have access to:

- Anything on a non-member application

- Anything on a group life or health application (through an employer, for example)

- Information provided for an auto or home insurance application

- Medical information provided on an ACA marketplace health insurance application

- Details on whether or not your insurance application was approved

- Specific details of diagnoses or treatment

Again, they don’t have any information that wasn’t provided to them by a member company.

Who Can Access the Information

Only member companies of MIB can access the information in your file.

The one exception is you or anyone authorized to act on your behalf (a guardian if you’re a minor or someone with power of attorney, for example). Under the FCRA, you have the right to access and see what is in that file.

| Person/Agency | Can they access MIB? |

|---|---|

| Member Insurance Companies | Yes |

| Non-Member Insurance Companies | No |

| ACA Marketplace Health Insurers | No |

| Auto and Home Insurance Companies | No |

| You (Person Named in File) | Yes |

| Guardian of Person Named in File | Yes |

| Person with Power of Attorney | Yes |

How does MIB work with HIPPA?

The Health Information Portability and Privacy Act (HIPPA) of 1996 was enacted to protect the security and privacy of medical information. It governs when and how medical information can be shared.

HIPPA applies to all agencies that work with medical information. Any company, from your doctor’s office to a hospital to (you guessed it) an insurance company, that works with medical records has to be compliant with the law.

Does HIPPA apply to MIB?

MIB falls under HIPPA rules, and as such must follow all the security and privacy requirements of the law. They have to protect your personal information through a series of stringent rules, including coding the data and releasing it only with your written permission.

In 2018, MIB announced it would start using an electronic service to store and share records. They partnered with top electronic health record provider Epic to digitize records. All of this must again be handled in compliance with HIPPA regulations.

Your MIB File

You’re probably wondering about your MIB file at this point. First of all, if you have never applied for insurance with a member company, you simply don’t have one.

Only individuals that have applied for life, disability, long-term care, or any other policy underwritten by a member company have an MIB file.

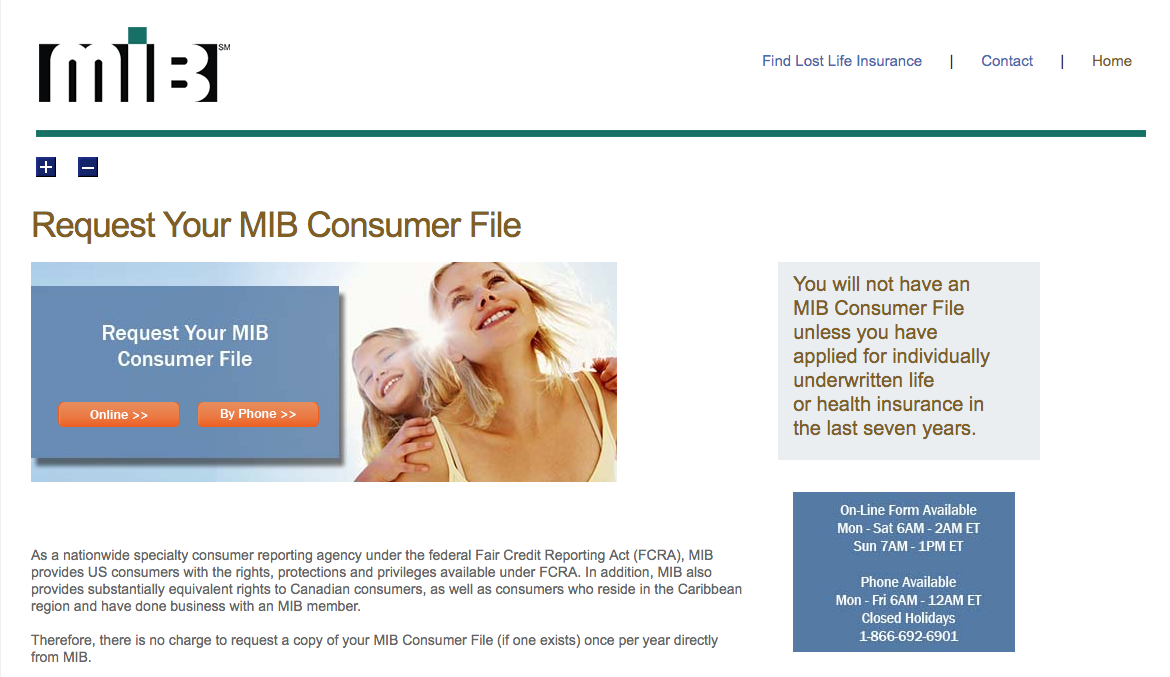

If you’re still not sure if you have a file, you can submit a request to MIB to see whatever they have on you. If you don’t have one, MIB will respond with a letter telling you there is no file in your name.

If you do have a file, you will receive a copy. While everything in their database is coded, your copy of your record won’t be. You’ll get a copy that tells you exactly what each code means.

Accessing Your File

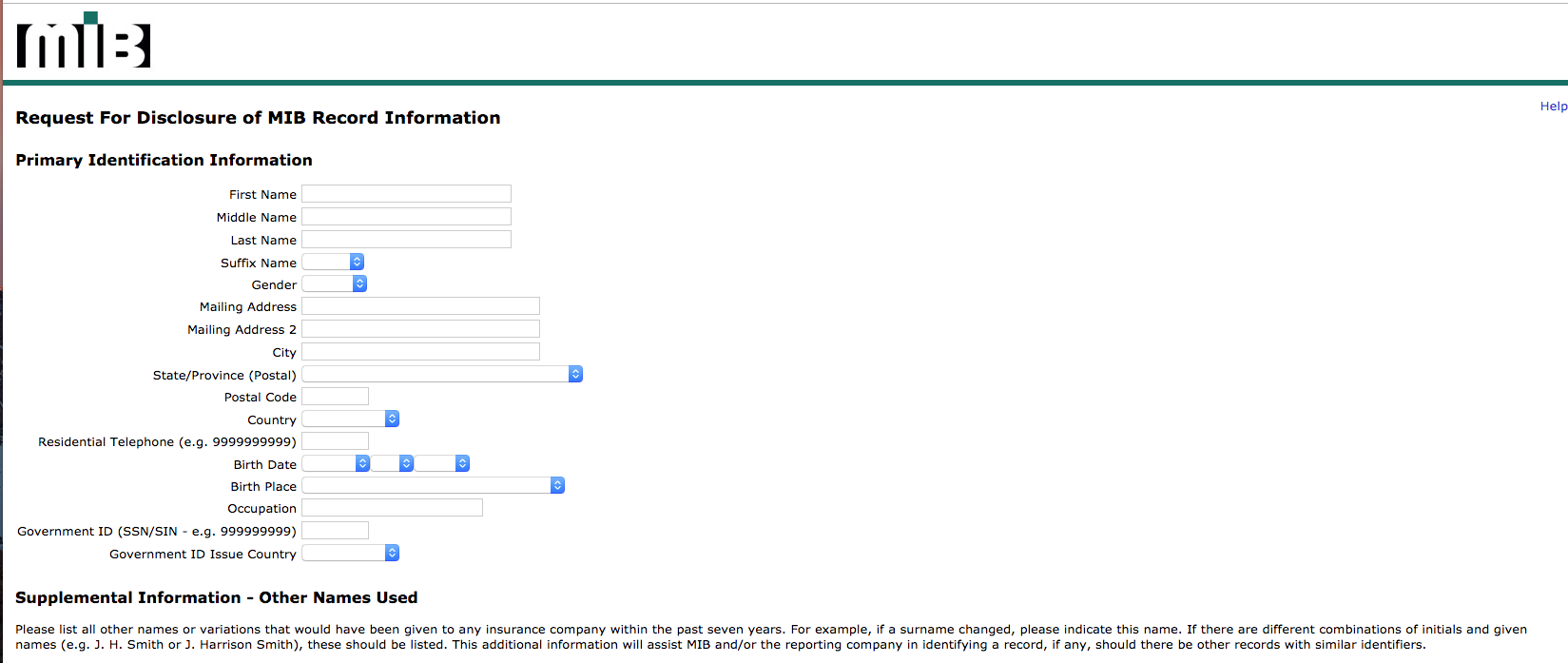

MIB makes it easy to request access to your file. Simply fill out the request form found on their website. You can also call them to request a copy.

You can request a copy of your report for free once a year. Additionally, you can receive a copy after an adverse decision, for instance, if you are turned down for life insurance.

You will need to provide some personal information to request the file. This includes your name, address, birth date, and social security number. This is all required to confirm your identity.

Incorrect Information on Your Record

If you find something on your record that you don’t think is accurate, you can request that MIB correct it. A Request for Reinvestigation form will be included with your file when it is sent to you. You’ll need that form to dispute information on the report.

There is no online form, but you can contact MIB via email at [email protected].

You can also make your request in writing via regular mail. According to MIB, you’ll need to provide the following information:

- Your full name, including middle initial and any suffix

- Your address

- Your date of birth

- Your place of birth

- Social security number

- List of items on your MIB Consumer File you believe to be inaccurate or incomplete with a specific reason for disputing the information.

MIB doesn’t charge any fees for reinvestigating your file. The time for an investigation to be completed is up to 45 days.

MIB states that only 1-2 percent of files have to be amended due to inaccurate or incomplete information. Fortunately, they do make it easy to request a change.

How MIB Data Affects Your Life Insurance Application

Data provided by the MIB is only one of the many pieces of information an insurance company uses to issue a life insurance policy. It does, however, have an impact on your approval and your rates.

Medical history is an important part of underwriting a life policy.

It’s probably the most important part. Insurers use this information to find out what kind of risk you represent.

A healthy person is less likely to pass away than someone with a serious illness or an unhealthy lifestyle. Insurance companies weigh all the risk factors when deciding who will qualify for life insurance as well as what they will pay in premiums if they are approved.

Here are some of the major risk factors that are considered during underwriting:

- Age

- Weight/height ratio

- Current medical conditions

- Medical history

- Occupation

- Hobbies

- Driving record

- Smoking and drinking

- Family medical history

Some of these are reported by MIB and some from other sources.

How Insurance Companies Use MIB Data

As we have already stated, only a member company will use MIB data as part of the underwriting process.

The main reason for using MIB is to make sure everything on your application matches up with what has been reported in the past.

Let’s say we have an individual who applied for life insurance a few years ago. At the time, that person had been diagnosed with cancer and was turned down for coverage. Now cancer-free, the same person decides to apply again but doesn’t mention the previous diagnosis in hopes of getting a better rate.

Since the diagnosis code was added to the file at the time of the first application, it will be reported to the member company as part of the underwriting process.

An insurance company can’t deny you coverage based solely on an inconsistency in your current and previous applications. They can, however, ask more questions and investigate the discrepancy.

MIB data is used for any life insurance application offered by the company. (Unless, of course, the company isn’t a member.)

| Type of Life Insurance | Medical Exam | Medical History/Questions | MIB File | Driving Record | Rx Records | Lifestyle Data |

|---|---|---|---|---|---|---|

| Traditional Term | Yes | Yes | Yes | Yes | Yes | Yes |

| Traditional Whole | Yes | Yes | Yes | Yes | Yes | Yes |

| No-Exam | No | Yes | Yes | Yes | Yes | Yes |

| Guaranteed Issue | No | No | Yes | Yes | Yes | Partial |

No-Exam & Guaranteed-Issue Policies

So what about those “no exam” policies that are advertised? Can they still use MIB data?

The answer is yes.

Even without a medical exam, there is still an underwriting process, and the insurance company will still gather medical information on you. That includes pulling your MIB record.

If the policy is a “no health questions asked” guaranteed issue plan, your MIB file is still fair game. While the insurer may not be comparing your answers to health insurance questions, they’re still looking at the data.

If you’re not sure whether MIB data will be used, remember to check the fine print for that disclosure.

MIB & Life Insurance Rates

Life insurance rates are based on a wide variety of factors, and all of them can change the final rate you are asked to pay for a policy. After all the research is done, the life insurance company will assign you a risk class that determines what you pay.

If the life insurance company finds something in your file with MIB that doesn’t match up to what was in your application, they can change the quoted rate as a result. That’s true of anything they find during the underwriting.

Rate quotes are created based on the information you provide in the initial quote process to the insurance company. The underwriting process will then verify all of the information and check a variety of sources for further information. That can result in a different rate that will be offered to you for the policy.

The best way to ensure you wind up with the same rate you were quoted is to make sure everything on your application is complete and accurate.

What happens if you get a different rate than you were quoted and you aren’t happy about it? First of all, you never have to accept the rate. The insurance company is making an offer on a policy to you at that rate, and you can simply choose not to sign.

If you feel there has been a mistake in the records the insurance company checked on you, you can request to see your MIB file and any other medical records and dispute them as necessary.

In most cases, there isn’t a lot of wiggle room on the rate quote from the life insurance company. You can choose to wait, take steps to improve your health and try again at a later date. Bear in mind that age also impacts rates, so don’t wait too long.

You can also accept the policy, get the coverage in place, and then request a reconsideration of your rate down the line. If your health improves in that time, you can often get the rate reduced by the insurance company.

Some of the things you can do in the meantime are:

- Lose weight

- Change your eating habits

- Quit smoking

- Quit drinking

- Get high blood pressure and cholesterol under control

The time passed can also put a medical event further into your past, which means it will have a lesser impact on your rate.

MIB Codes

Like all agencies working with medical records, MIB codifies everything in your file. These codes tell insurance companies what is on your medical record, but not any specific details.

MIB uses the same coding system as the rest of the medical field, found in the International Statistical Classification of Diseases and Related Health Problems 10th Revision (ICD-10). They’re the same codes your health insurance company uses to communicate with your doctor’s office for billing and coverage purposes.

These codes are not made available to the public.

Codes don’t have any personal identifiers attached to them, so they can’t be used for medical identity theft. They provide the insurance company with the meaning of the code as outlined in the code list.

A code can tell an insurance company:

- What you were diagnosed with

- Date of the diagnosis

- Results of a test, including lab results and drug tests

- What violations are on your driving record

- What dangerous or unhealthy habits you have reported in the past

Codes can’t tell an insurance company:

- Doctor’s notes on your medical file

- Specifics of medical examination reports

- Specifics of test results other than positives, negatives, or elevated levels

- Prescription drug history

- Credit information

- Health plan member identification numbers

Your file may contain a code for high blood pressure. This only tells the insurance company that you had a blood pressure test, and the results were higher than normal.

It doesn’t tell them what your actual blood pressure reading was or what the doctor had to say about it, including possible reasons for the high blood pressure reading.

Denial of a Life Insurance Application

A life insurance company can deny you coverage if anything in their underwriting report fails to meet their standards for insurability. That includes data in the MIB file, but decisions are not made solely on that data.

Remember that the main purpose of the MIB file is to verify what’s on your application against what has been part of a previous application. If you’ve been honest and open in your application, there shouldn’t be anything in the MIB file that causes any change in the underwriting process.

Anything the insurance company finds in the MIB file was already uncovered during the underwriting process by another company. If there is anything in there that warrants a denial, odds are very good that information would have been uncovered during underwriting with or without MIB.

Just because one company denies you coverage doesn’t mean you might not be approved by another company. MIB doesn’t record the results of the application itself. A company with different underwriting rules may accept you after being denied elsewhere.

Appealing a Denial

If you have been denied a life insurance policy, there are a few steps you can take.

First, get your hands on all the information used to determine your ineligibility for coverage with that company. Start by requesting the insurance company provide you with a detailed reason for the denial. You have the right to know what they have uncovered about you.

After a life insurance application is denied, you have the right to request a copy of your MIB file. You can also see all the medical test results and any other information gathered during the underwriting process.

Remember, this information is about you; you have every right to see it.

Sometimes the results of your medical exam can come as a shock. You didn’t lie on your application, you just didn’t know. As mentioned above, you can let some time pass to put that medical issue in the past and improve your health, and then try again.

Unless you can prove something in your underwriting data is inaccurate, you will have to abide by the company’s decision. If you think a medical test was wrong, you can ask to have it repeated.

If you feel something is wrong, you do have the right to appeal the decision in writing and request reconsideration. Remember that life insurance companies are very thorough, and it’s rare to get a denial overturned.

If the appeal fails, your best bet is to work with an agent to help you find an insurance company that will accept you or to simply wait until your health improves to apply again.

Life Insurance Fraud

Insurance fraud is a very serious issue, and it costs millions of dollars each year. While it’s common to see insurance fraud as a victimless crime, the truth is it hurts everyone.

Fraud means insurance companies lose money, and when they lose money they need to make it back. That means higher premiums. The FBI estimates an increase of between $400-$700 a year in premiums for the average U.S. family.

Whenever someone defrauds an insurance company, they are causing the rest of us to pay more for our insurance.

Why You Should Never Lie

In every state, insurance fraud is a crime punishable by law. In some cases, the penalties for fraud can be very severe. The Insurance Information Institute outlines what laws each state has in place regarding insurance fraud.

Fraud isn’t just things like making false claims. Lying on a life insurance application also constitutes fraud. Insurance companies know that sometimes it’s just a mistake or an oversight, but if you’re suspected of engaging in purposeful fraud on your application, you could face charges.

If you’re convicted, depending on the state in which you live, you could face penalties including:

- A prison sentence

- Fines

- The requirement to pay back the defrauded amount

Since insurance companies are very thorough, they usually catch lies on an application before the policy is issued. In most cases that simply means they’ll deny you coverage.

Life insurance policies also have a contestability period. It’s usually two years, and if you die during that time, they can reinvestigate before paying out the claim to make sure there wasn’t a lie on the application they somehow missed.

Let’s take a look at an example of life insurance fraud.

A person is applying for coverage and decides to leave out the fact they like to go sky-diving regularly. They do this on purpose because they know it will increase the rate or might get them denied.

Let’s say this gets past underwriting. The policy is issued, Six months later, the insured person dies in a sky-diving accident. Upon investigation, the insurance company discovers this person has been an avid sky-diver for years but failed to mention it on the application.

In this case, the insurance company can simply deny the claim and refuse to pay the death benefit. They’re well within their rights, since they issued the policy based on false information.

Here, the perpetrator of the fraud obviously can’t be charged, but their loved ones will be left without the needed income of a life insurance policy.

Of course, there are also incidents of much more serious types of life insurance fraud, although they are rare. And not all insurance fraud is on the part of the insured.

Faking death to file a life insurance claim is incredibly difficult to pull off. Those that decide to try it will find themselves more likely to be facing felony fraud charges than sitting on a beach in Bermuda counting the payout.

MIB & Fraud

MIB’s primary function is to watch out for and prevent fraud. They accomplish this by allowing insurance companies to compare what is disclosed on life insurance applications.

Let’s say our skydiving applicant above decides to be honest on the application and gets turned down because of the risky hobby. They then apply at a different company, thinking they are wiser now and won’t mention they jump out of airplanes for fun.

Thanks to MIB, the new insurance company is going to find out right away about the sky-diving, preventing a policy from being issued without that knowledge, and preventing the scenario above where the beneficiaries are denied a payout on the claim from ever happening.

Fraud Statistics

According to a Reinsurance Group of America (RGA) study, life insurance companies estimate that 1-3 percent of life claims are investigated for fraud. About 20 percent of life insurance claims are denied during the contestability period because fraud is found.

That same report states that the MIB saves the life insurance industry $1 billion per year.

Life insurance companies list “medical misrepresentation” as the type of fraud that most concerns them.

Across all lines of insurance, the Coalition Against Insurance Fraud estimates a cost of $80 billion a year. That makes preventing fraud an important task in the insurance industry.

Rules That Help Prevent Fraud

In addition to using a wide variety of services to help prevent fraud, there are also rules in place that prevent people from taking out questionable policies in the first place.

We all know that murder mystery plot where the killer had a secret life insurance policy on the victim worth millions. If they get away with murder, they’ll walk away as a millionaire. That isn’t real life, and here’s why.

Two of the most important requirements for issuing a life insurance policy on another person are insurable interest and financial qualification.

Insurable interest means that you have to prove you would be financially impacted in some way by the insured person’s death. If your husband’s death would make it difficult for you to pay your mortgage and other bills, you have an insurable interest in him.

You can’t take out a life insurance policy on a random person in whom you have no insurable interest, and the insurance company will confirm this.

Financial qualification means you can only take out an insurance policy in an amount that is justified by the economic loss that person’s death would cause.

You can’t take out a $10 million policy on your retired grandmother who lives on social security. Even if you have an insurable interest in your grandmother, she won’t qualify financially for that amount of money.

Finally, you can’t take out an insurance policy on anyone, in any amount, without their signature. They have to agree and they have to sign off on it.

We’d like to say this all makes it impossible to take out an insurance policy on someone else, but it does happen.

Frequently, it happens in cases of elder abuse. Still, it’s not easy, it’s very rare, and it won’t make you a millionaire. Any policy with that kind of face value will be carefully underwritten.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Bottom Line

The very existence of a company like MIB can raise concerns about privacy and who has access to your medical records, and that’s understandable. But the job they do is very important, and it’s saving you money.

MIB’s records save insurance companies billions in fraud, which is passed on to you, the honest customer, in lower premiums.

MIB doesn’t have access to anything you aren’t signing off on providing for life insurance underwriting. They can’t do anything with their records without your written permission. They are strictly regulated and safeguard all personal information carefully.

If you have concerns about your privacy, you can reach out to MIB directly. And remember, MIB is working to prevent fraud and make sure you get a fair rate on your life insurance. That’s good for everyone in the long run.

Now that you’re in the know, it’s time to start comparing quotes. We’ll get you started with just your ZIP code in the quote tool below.

Frequently Asked Questions

What is the MIB Group?

The MIB Group, also known as the Medical Information Bureau, is a not-for-profit organization that collects and maintains medical and non-medical information on individuals who have applied for life, health, disability, or critical illness insurance.

Why is the MIB Group important for life insurance?

The MIB Group plays a crucial role in the life insurance industry by providing insurers with access to a vast database of applicant information. This database helps insurers assess risk and make informed decisions regarding underwriting and policy pricing.

How can the MIB Group guide me in choosing a life insurance company?

The MIB Group does not directly guide individuals in choosing a life insurance company. However, insurance companies that are members of the MIB Group have access to comprehensive information about applicants, which allows them to offer competitive rates and make informed underwriting decisions.

Are all life insurance companies part of the MIB Group?

Not all life insurance companies are part of the MIB Group. However, many major insurers are members of the MIB Group and utilize its services for underwriting and risk assessment purposes.

How can I find life insurance companies affiliated with the MIB Group?

The MIB Group does not maintain a public list of its member companies. However, you can visit the MIB Group’s official website or contact individual insurance companies directly to inquire about their affiliation with the MIB Group.

Does the MIB Group determine life insurance rates?

The MIB Group does not determine life insurance rates. It collects and shares applicant information with member insurance companies, which then use that information along with other factors to determine rates based on their own underwriting guidelines.

Can the MIB Group provide me with specific life insurance rates from different companies?

The MIB Group does not provide specific life insurance rates to individuals. Insurance rates are determined by individual companies based on various factors, including age, health, occupation, lifestyle, and coverage amount.

How can I compare life insurance rates from different companies?

To compare life insurance rates from different companies, it is best to contact multiple insurers directly or work with an independent insurance agent or broker. They can help you obtain quotes from different companies and provide guidance based on your specific needs.

Is the MIB Group involved in the claims process?

The MIB Group is not directly involved in the claims process. Its primary role is to provide insurers with applicant information for underwriting purposes. Once a policy is in force, the claims process is handled by the insurance company according to their specific procedures.

Can I access my personal information held by the MIB Group?

Yes, as a consumer, you have the right to request and access your personal information held by the MIB Group. You can contact the MIB Group directly to inquire about the process for accessing your information and any applicable fees or requirements.

Does the MIB Group impact my credit score?

No, the MIB Group does not impact your credit score. It primarily collects and shares medical and non-medical information related to insurance applications. Credit scores are determined by credit reporting agencies based on your credit history and financial activities.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.