AAA Life Insurance Review 2025 (Companies + Rates)

AAA Life Insurance has term rates as low as $7.57 a month. They offer several different policy types and a well-known brand.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Life Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Licensed Life Insurance Agent

UPDATED: Oct 27, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Oct 27, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

AAA Life Insurance Overview

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1969 |

| Current Executives | CEO – Jay DuBose CFO – Chip Lane |

| Number of Employees | 269 |

| Total Sales | $422,761,658 |

| HQ Address | 17900 N. Laurel Park Dr. Livonia, MI, 48152-3992 |

| Phone Number | 1-800-624-1662 |

| Company Website | www.aaalife.com |

| Premiums Written – Individual Life | $705,932,144 |

| Financial Standing | $679,000,000 |

| Best For | Term & No-Exam Life Insurance |

We’re all familiar with AAA, which provides roadside assistance, travel tips, and ratings for its members. But do you know that AAA Life, a different division, also offers life, travel insurance, and annuities?

Behind its iconic logo and altruistic brand, we give you more depth about AAA life insurance: what life insurance products it offers, recommendations on how to compare its rates, and tips on finding the best life insurance for you.

AAA Life is large enough to be in the top 100 life insurance companies every year in the United States. Its reliability ratings are good, but is it the best company for your family’s protection? Read on to find out.

Use our FREE quote tool above to get cheap rates in your ZIP code now.

Shopping for Life Insurance Quotes With AAA

AAA Life offers the most basic types of life insurance, as well as travel and accident insurance. Under the iconic brand of AAA, the life insurance division is large enough to cover most people’s life insurance needs throughout a lifetime.

AAA Life customers enjoy a 10 percent discount on premiums if they are already members of the auto division.

This is an appealing and convenient feature for many of its customers.

AAA is reacting well to consumer online demands. However, if the policy requires a medical exam or financial review, it must be completed using a traditional AAA Life underwriting agent.

Average AAA Life Insurance Rates by Age

Men pay higher premiums than women do for life insurance. It all comes down to statistics that don’t lie: women tend to live longer and are generally healthier for a longer period. Men are therefore costlier to insure, so insurance companies reduce their own risk by charging men higher premiums.

Premiums for both men and women increase significantly as you age, and smokers can expect up to two to three times more than non-smokers.

AAA Life Insurance Average Monthly Rates by Age, Gender, and Tobacco Use

| Age | $100,000/ 10-Year | $250,000/ 10-Year | $500,000/ 10-year | $100,000/ 30-Year | $250,000/ 30-Year | $500,000/ 30-year |

|---|---|---|---|---|---|---|

| 25-Year-Old Non-Smoking Female | $8 | $9 | $13 | $12 | $17 | $29 |

| 25-Year-Old Non-Smoking Male | $8 | $11 | $15 | $13 | $21 | $36 |

| 25-Year-Old Smoking Female | $16 | $24 | $44 | $29 | $50 | $96 |

| 25-Year-Old Smoking Male | $19 | $32 | $58 | $35 | $68 | $125 |

| 35-Year-Old Non-Smoking Female | $8 | $10 | $14 | $13 | $22 | $38 |

| 35-Year-Old Non-Smoking Male | $8 | $11 | $15 | $15 | $25 | $44 |

| 35-Year-Old Smoking Female | $17 | $29 | $53 | $40 | $72 | $139 |

| 35-Year-Old Smoking Male | $21 | $34 | $63 | $49 | $95 | $183 |

| 45-Year-Old Non-Smoking Female | $13 | $18 | $28 | $22 | $41 | $75 |

| 45-Year-Old Non-Smoking Male | $13 | $21 | $32 | $29 | $53 | $99 |

| 45-Year-Old Smoking Female | $32 | $57 | $109 | $85 | $155 | $305 |

| 45-Year-Old Smoking Male | $36 | $71 | $137 | $112 | $227 | $442 |

| 55-Year-Old Non-Smoking Female | $19 | $33 | $59 | $58 | $107 | $206 |

| 55-Year-Old Non-Smoking Male | $23 | $43 | $81 | $84 | $149 | $293 |

| 55-Year-Old Smoking Female | $57 | $112 | $219 | N/A | $236 | N/A |

| 55-Year-Old Smoking Male | $78 | $165 | $324 | N/A | N/A | N/A |

| 65-Year-Old Non-Smoking Female | $38 | $76 | $144 | N/A | N/A | N/A |

| 65-Year-Old Non-Smoking Male | $60 | $120 | $233 | N/A | N/A | N/A |

| 65-Year-Old Smoking Female | $118 | $252 | $499 | N/A | N/A | N/A |

| 65-Year-Old Smoking Male | $173 | $413 | $822 | N/A | N/A | N/A |

In this sample of AAA Life rates, non-smoking men pay between 7 and 9 percent more than non-smoking women for term insurance, depending on the benefit amount and length of the term. Both men and women (non-smokers) can buy up to a $500,000, 30-year term.

Comparing smokers’ rates, the rate differences are even higher for men than women. A 30-year-old male smoker will pay 18 percent more than a female smoker for a $100,000, 10-year term. By the time both are age 45, a male smoker will pay 31 percent more than a female smoker for a 30-year, $500,000 policy.

The most startling difference in premiums is illustrated by comparing smokers, male or female, with non-smokers.

Even at age 30, male smokers pay more than 3.5 times more for a $500,000 30-year term policy than a non-smoking male. Similarly, smoking females pay about 30 percent more than non-smoking females under the same parameters.

By age 45, both male and female smokers are paying an astounding 400 percent higher premium for a 30-year, $500,000 policy than for non-smokers of the same gender and age. And AAA Life disqualifies any smokers for a policy exceeding $250,000 after age 45.

There are obvious incentives, then, to save money on insurance and prevent health complications caused by smoking.

It also makes sense to buy insurance at a younger age to lock in better term rates.

You’ll already have some financial security in case of the unexpected, and you can always make adjustments as you get older. Also, remember that premiums must be paid on time to keep the rates (and the policy itself) secure.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

About AAA Life Insurance

AAA Life Insurance Company was created in 1969 as a new entity of AAA (American Automobile Association) to provide life insurance products and annuities to its membership. More than 50 years later, AAA Life manages over 103 million policies.

While buying insurance doesn’t require membership in AAA, many premium discounts are available for members.

It’s headquartered in Livonia, Michigan, with a large customer service center in Omaha, Nebraska. Today, AAA Life offers simplified applications online through its website, as well as traditional agents for policies that may require medical exams and personalized interviews.

AAA Life also offers accident insurance for AAA members.

AAA Life Insurance’s Ratings

Life insurance ratings by independent researchers help consumers find out more about a company’s financial standing and creditworthiness. Ratings are about the company’s overall reputation — not specific insurance products.

Here are reports from the most respected ratings companies typically used when referring to insurance companies.

AAA Life Insurance Financial Ratings

| Ratings Agency | AAA Life's Ratings |

|---|---|

| A.M. Best | A |

| Better Business Bureau | A+ |

| NAIC Complaint Index - Group Life | 0.36 |

AAA Life Insurance A.M. Best Rating

One of the most trusted names for ratings data is A.M. Best, which focuses solely on the insurance industry. Its rating system provides an in-depth evaluation of an insurance company’s overall financial strength and performance.

AAA Life Insurance’s rating of A, meaning excellent indicates that it’s expected to meet its financial obligations and that it’s in good standing with its creditors.

AAA Life Insurance Better Business Bureau (BBB) Rating

The Better Business Bureau (BBB) is one of America’s most trusted consumer watchdog organizations. Its ratings are based on reported consumer complaints, and on how well businesses respond to them. The BBB was founded over 100 years ago as a nonprofit corporation to ensure its neutrality.

The A+ results for AAA Life reflect consumers’ high regard for service and complaint resolutions. This rating is for AAA Life’s corporate location in Livonia, Michigan. Check the BBB’s website for a specific AAA office location.

AAA Life Insurance’s Market Share

AAA Life’s ratings have consistently been in the top 100 in the country each year.

Top 10 Life Insurance Companies and AAA Life by Market Share

| Rank | Company/Group | Market Share |

|---|---|---|

| 1 | Northwestern Mutual | 6.42% |

| 2 | Metropolitan | 6.00% |

| 3 | New York Life | 5.68 |

| 4 | Prudential | 5.57% |

| 5 | Lincoln | 5.36% |

| 6 | Massachusetts Mutual | 4.19% |

| 7 | Aegon US | 2.94% |

| 8 | John Hancock | 2.83% |

| 9 | State Farm | 2.83% |

| 10 | Minnesota Mutual | 2.70% |

| 54 | AAA Life | 0.43% |

In 2018, sales increased by about 11 percent from the previous year. It’s best known for its parent company, AAA, which offers comprehensive auto insurance, roadside assistance, and many other travel benefits.

Here is a comparison of AAA Life’s market share from 2016–2018.

AAA Life Insurance Market Share (2016–2018)

| Year | Rank | Direct Written Premiums | Market Share % | Cumulative Market Share % |

|---|---|---|---|---|

| 2018 | 55 | $705,932,149 | 0.42% | 88.37% |

| 2017 | 56 | $633,668,294 | 0.38% | 88.36% |

| 2016 | 57 | $566,181,853 | 0.35% | 85.33% |

AAA Life averaged $635,260,765 in direct premiums written during the three-year period.

AAA Life Insurance’s Position for the Future

Life insurance ownership in the United States has declined in recent years, from 63 percent in 2011 to 57 percent in 2019, according to an annual study by Life Happens and LIMRA. Both of these organizations follow consumer trends in the insurance industry.

Sales of annuities, on the other hand, are increasing.

This is most likely because many baby boomers are looking for ways to receive supplementary income during their retirement years. The trend may also be related to longer life expectancy and the resulting change in financial needs. Many people opt to buy annuities as a supplement to life insurance.

On its Facebook and webpages, AAA Life targets younger consumers to buy term and whole life products at momentous points of life, such as marriage or the birth of a child.

Although it still advocates for traditional products and agents, AAA Life has made adjustments for consumers who prefer the convenience of purchasing life insurance online. It now offers ExpressTerm, a simple online application with quick approval and limited medical history inquiries.

AAA Life Insurance’s Online Presence

In a 2019 study on life insurance trends, 67 percent of consumers say they would not do business with an agent or advisor with an out-of-date website. About 47 percent indicated an interest in simplified underwriting versus traditional, which allows them to buy insurance themselves with a quick turnaround and no medical exam.

AAA Life seems to be watching closely and adapting its website to engage its visitors more. It has a large number of resources, including topical blog posts, FAQs, and online forms.

AAA Life Insurance’s Commercials

AAA Life doesn’t advertise on traditional media outlets, but it does have a small presence on social media. Its Facebook video page appears more engaging than the website, where only two outsourced videos appear.

Most of its marketing is leveraged straight from the parent company, AAA, which has over 58 million members nationwide.

AAA Life Insurance in the Community

AAA Life is mostly active in the communities of the headquarters of Livonia, Michigan, and its customer service center in Omaha, Nebraska. The company is active in annual United Way employee drives, Relay for Life, American Cancer Society, and American Diabetes Association. In 2018, employees raised more than $30,000 for Relay for Life.

AAA Life Insurance’s Employees

AAA life has 269 employees. Employment search and review giants Glassdoor and Indeed give AAA Life an average rating of three out of five stars. Indeed’s employee reviews rated the company subcategories, which range from a low of 2.8 for management to a high of 3.6 for pay and benefits.

AAA Life Insurance Policies

AAA Life offers term, whole, and universal life insurance products. It also offers accident insurance. You can customize most plans to a degree. Because of its longevity and solid reputation, you can expect reliable service from AAA Life.

However, buying life insurance through a large carrier might be a drawback for people who want to work with an agent who understands their entire financial picture, or how their individual needs will change over their lifetime. AAA Life’s agents are qualified to make recommendations, but on their employer’s products only.

The type of life insurance you need may change several times during your life.

A general rule of thumb is to make sure you have between seven to 10 times your annual income in your death benefit.

You should also re-examine your current insurance portfolio every time there is a major event and make adjustments if necessary. Examples include marriage, the birth of a child, buying a home, any major illness or loss of job, retirement, divorce, or death of a spouse.

Before we get into the types of life insurance offered by AAA Life, take a look at this video where a representative of the company discusses common misconceptions about life insurance.

Now that you know pretty much everyone needs life insurance or could use life insurance, let’s see what AAA Life offers.

AAA Term Life Insurance

As its name implies, term life is a policy in effect for a set period of time. It’s usually the most affordable life insurance available and is a good product for young couples and families. It can be used to pay for a child’s education or a family’s loss of income in the event of an unexpected death.

Your premiums don’t fluctuate for the duration of the term you choose, and neither does the death benefit if you should die unexpectedly during the term. You can also convert the policy to whole life at the end of the term, or you may cancel it and choose a different kind of policy that suits you at that time.

AAA Life offers policies ranging for 10-, 15-, 20-, or 30-year terms. There are two kinds of term policies offered:

- ExpressTerm Life Insurance

- Apply online without an agent

- Immediate coverage if approved

- No medical exam (although a health questionnaire is required)

- 10-, 15-, 20-, or 30-year terms

- $25,000 to $500,000 in coverage

- Can be converted into whole life at the end of the term or at age 65

- Policy expires at age 95

- You may be denied for pre-existing conditions

- Traditional Term Life Insurance

- Apply with AAA agent

- Must be between ages 18-75

- Premiums are locked in during term period

- Can be converted into whole life

- Return of premium rider available at end of the term (no interest accrued)

- 10-, 15-, 20-, 25-, and 30-year terms

- $50,000 to $5 million or more in coverage

- Policy expires at age 95

- An accelerated death benefit is included in case of a terminal illness, allowing you to withdraw up to 50 percent to pay expenses

- AAA discount offered on home or auto insurance

AAA Whole Life Insurance

As its name implies, whole life insurance is a policy that remains in effect for your entire life. Your premiums remain the same throughout your lifetime but must be paid regularly and on time to keep the death benefit in effect.

Many people buy whole life to help their families pay for burial and final expenses such as estate taxes and other debt.

The maximum policy payouts are only $5,000–$25,000 but do feature an accelerated death benefit of up to 50 percent of the policy value in case of a terminal illness diagnosis.

Another appealing feature of whole life is its built-in cash value that you can borrow from if necessary.

AAA Life also offers add-on riders to its whole life policies, including up to $5,000 coverage per eligible child, automatic payment of premiums if you become totally disabled, and an additional $25,000 benefit for serious injury or accidental death, including while traveling.

AAA Life offers two types of whole life:

- Simple Whole Life Insurance

- Face value of $5,000–$25,000

- Issued from ages 15 days to 80 years old

- No medical exam

- Permanent coverage without a waiting period

- Premiums remain level but must be paid until age 100 (no payment required after that)

- Guaranteed Issue Life Insurance

- Face value up to $25,000

- Guaranteed acceptance and no physical exam

- No health questions (ideal for people who are concerned about their current physical condition or family history)

- Issued to ages between 45 and 85 years old

- Accelerated death benefit included up to 50 percent of benefit while still living

- Builds a cash value

- AAA members can save up to $60 annually

- Premiums remain the same until age 100, which is an important feature for seniors in excellent health

AAA Life’s Guaranteed Issue policy offers immediate acceptance but will not pay the death benefit in full if the death occurs within the first two years of the start date. If that were to happen, your beneficiaries’ payment would be graded, depending on the manner of death.

AAA Universal Life Insurance

Universal Life is a permanent policy with cash value that grows — tax-free — over time, and has a guaranteed death benefit to your survivors. Universal life offers more flexibility than whole life because it allows you to change your coverage throughout your lifetime.

For example, if you finally pay off your mortgage and your grown children are financially independent, you can adjust both your premium payments and perhaps lower your death benefit to better suit your current cash flow and lifestyle.

AAA Life offers two types of universal life coverage:

- LifeTime Universal (or Accumulator Life Insurance)

- Policy value begins at $100,000

- Premiums are guaranteed not to change despite interest rate fluctuations

- Can accumulate cash value

- Must apply with an agent

- Medical exam required

- Because the policy is underwritten by an agent, AAA may be able to offer more competitive premiums

- Accelerator Universal Life Insurance

- Coverage between $100,000–$5 million or more

- Permanent life insurance

- Medical exam and waiting period up to six weeks

- Must apply through an agent

- Adjustable premiums throughout the lifetime

- Available discounts on additional insurance products through AAA

- Accrues cash value

- Income is tax-free

- Able to withdraw up to 50 percent (or $500,000 max) if diagnosed with a terminal illness

AAA Life Insurance Riders

Life insurance riders are add-on benefits to enhance your coverage. Note that riders are not available on all plans.

- Child term

- Disability waiver of premium

- Accidental death

- Travel accident

Factors That Affect Your AAA Life Insurance Rate

Premiums are generally affected by the following factors:

- Age – the younger you are, the more affordable life insurance is

- Gender – men in general pay significantly more than women for life insurance

- Marital status – premiums can be lower for married couples, especially if both are employed

- Height and weight – insurers are calculating rates based on this and your Body Mass Index (BMI) to predict longevity

- Overall health – your general overall health is scrutinized for lifestyle factors, such as smoking

While you can’t do anything about your gender and age, you can be proactive with things such as your lifestyle, health, and occupation. The more you know about your own factors, the easier it is to find affordable life insurance.

Your life insurance needs at age 35 are likely far different than what they will be at age 60.

So even though you can’t throw back the calendar, you can find the most comprehensive product at the best or cheapest rate.

AAA Life does offer informative blog articles, such as buying life insurance at various life stages, but does not offer direct quotes from its website based on these rate factors.

Here is an example of AAA’s online resources:

Here’s how you can use your particular situation to your advantage.

Demographics

Where you live (urban or rural), your driving record, and the type of policy you are purchasing each have an effect on your rates.

In general, people in urban areas can expect to pay more for life insurance rates.

Current Health & Family Medical History

During a medical questionnaire or exam for life insurance, you can be expected to provide a thorough medical history of yourself and your immediate family. Factors such as cancer, heart disease, height and weight, blood pressure, and current medications will all be considered. Even your prescribed medications will be considered in your life insurance application.

You need to be honest with your answers, since withholding information may complicate claims or even disqualify you from coverage. Often, your physician will be asked to provide further information.

Pre-existing health conditions may result in being declined coverage or in paying substantially more for certain life insurance.

If you’re looking for a policy without a required medical exam, you can expect to pay significantly more for less coverage.

High-Risk Occupations

In this video, insurance companies’ rejection of certain occupations (or general lifestyles) is explained

People with high-risk occupations such as heavy equipment operators, airline pilots, commercial drivers, and firefighters can expect to pay higher premiums because of the risk involved while working. If such employees are fortunate enough to have group life or disability insurance, it will help to reduce life insurance costs.

People working in high-risk occupations can expect higher premiums , and should also be prepared to have additional life insurance coverage for accidental death.

High-Risk Habits

As discussed previously, smoking is the biggest health and risk factor. Many insurers will not underwrite policies over a certain value for people who smoke since their risk of premature death is markedly higher. The good news is that lifestyle changes such as smoking cessation, losing weight, and abstaining from drugs and alcohol can reduce your high-risk status.

Other habits and lifestyle factors may also adversely affect your rates, such as substance abuse, skydiving, mountain climbing, or even a poor driving record.

Veteran or Active Military Status

AAA Life doesn’t advertise any specific programs for veterans, but the AAA parent company does offer military membership discounts and other incentives that could add up to substantial savings over a lifetime.

It may be worth contacting a local chapter of AAA’s parent organization to check for additional military service or veteran incentives that may be offered at a local chapter.

How to Get the Best Rate With AAA Life

The following video explains the basics of getting the appropriate life insurance — and therefore the best possible rate — whether you are purchasing from AAA Life or any other carrier.

https://youtu.be/R_wTA2-uCf4

What you need to keep in mind with AAA is that your chances of the best rate increase when you become a member of the organization. It may also allow you to “bundle” all of your insurance needs: life, auto and homeowners.

Consider becoming a member of AAA to take advantage of discounts, buy life insurance as early as you can, and discuss all your options with a AAA Life agent before you decide. Remember that they are AAA employees and can only sell you AAA Life’s products.

If you’re armed with comparative rates after speaking with a few independent agents, you may find a AAA Life product that may be more affordable and appropriate for your needs.

Staying healthy and paying your premiums on time is essential.

So is keeping track of your policy information for your loved ones in the event of your unexpected death.

AAA Life is an easy choice for purchasing term life at a young age because it can be converted to a whole life policy easily at the end of the term. AAA Life also guarantees a return of premium reimbursement on certain policies at the end of the term if the policyholder is still living. However, the premiums do not accrue interest.

If a policyholder is already a AAA member, then there are definite benefits to being with AAA Life. The Express feature is innovative because of its instant approval process, but it’s not recommended for people with pre-existing medical conditions that may result in a coverage denial.

How to Get a AAA Life Insurance Quote Online

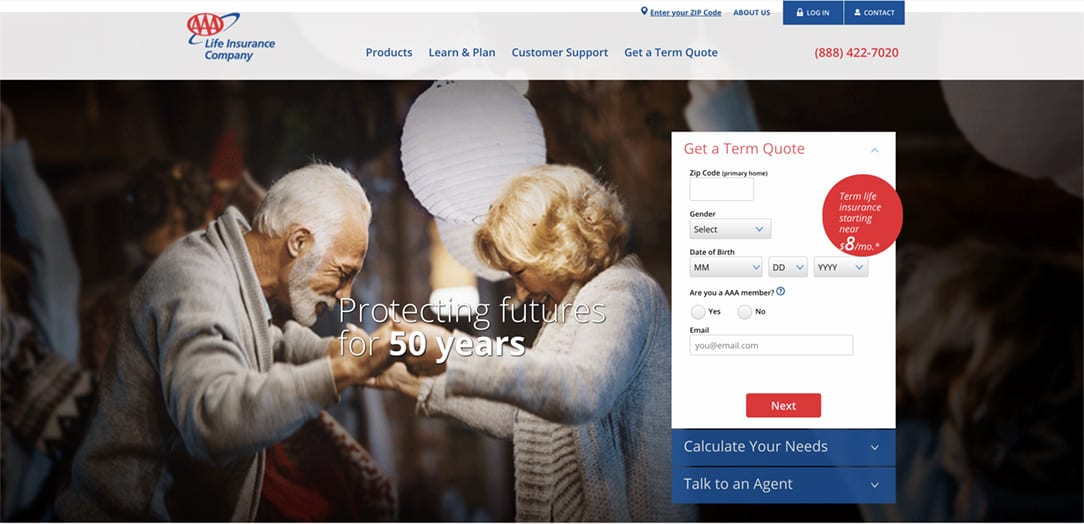

The AAA Quote Online page is a simple start to the application process. It begins on the home page of aaalife.com.

You can begin by either clicking on Get a Term Quote in the menu or simply using the Get a Term Quote box on the home page, which we outline here step-by-step here.

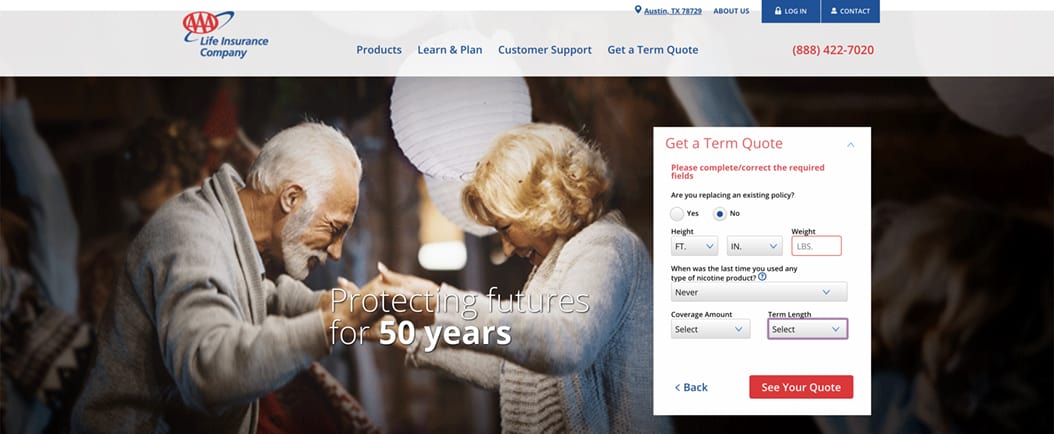

#1 – Enter Your Information

Enter your information in the Get a Term Quote box and click Next.

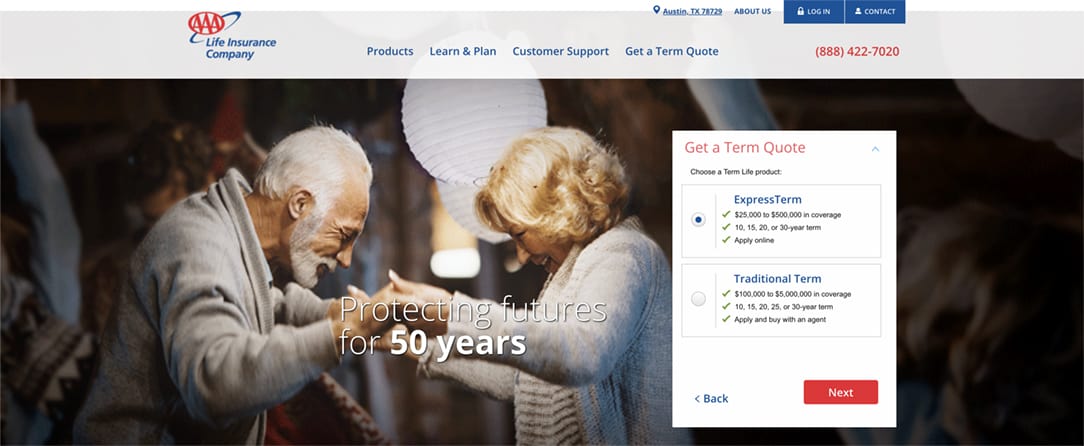

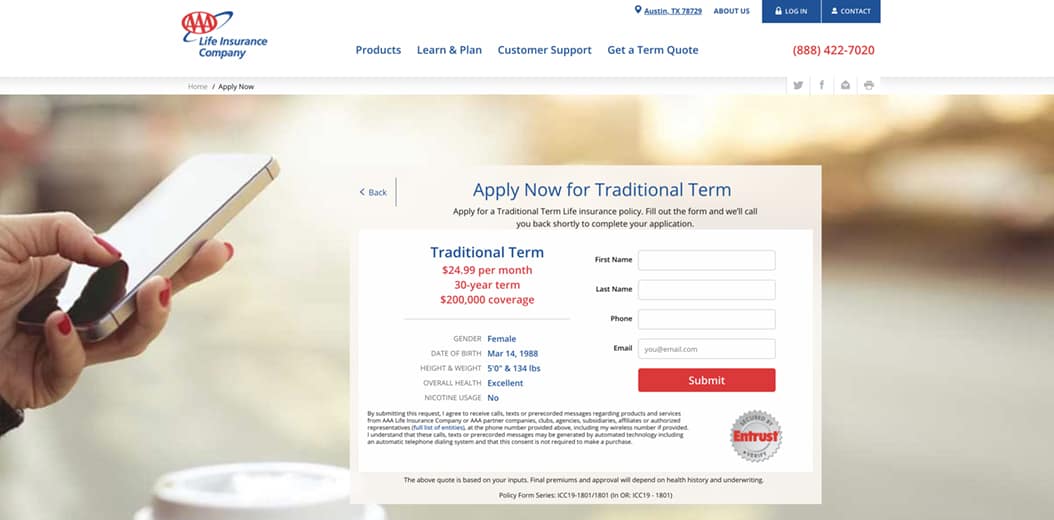

#2 – Choose ExpressTerm or Traditional Term Life Insurance

You can apply to get a quote and apply online for ExpressTerm life for quick acceptance without a medical exam.

For traditional term, you must apply with an agent and discuss choices, but you can use their online quote for an estimate.

#3 – Choose the Coverage Amount and Length of Time

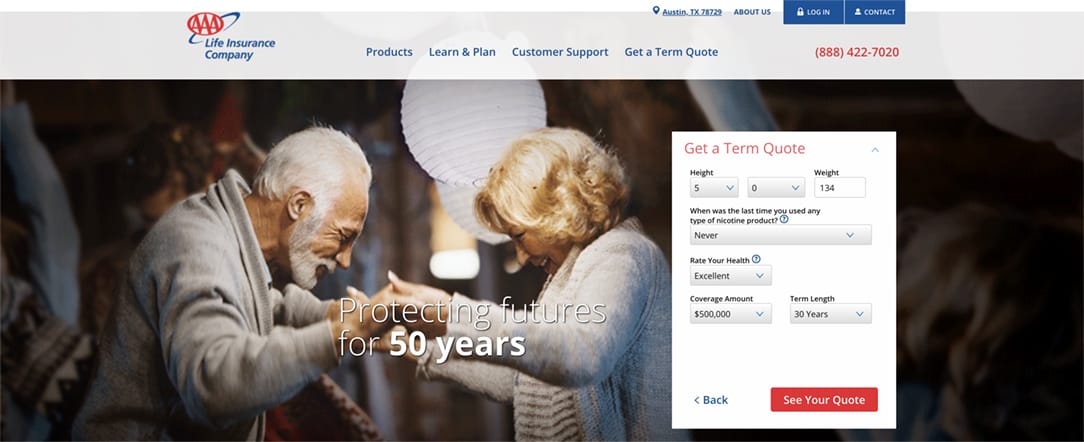

You will need to enter your height, weight, and tobacco use for both the ExpressTerm and Traditional Term Life quote. Below is what this looks like when you select ExpressTerm Life.

For a Traditional Term quote, you will also need to rate your health, and you won’t be asked if you are replacing a current policy.

After entering the policy information, click on See Your Quote.

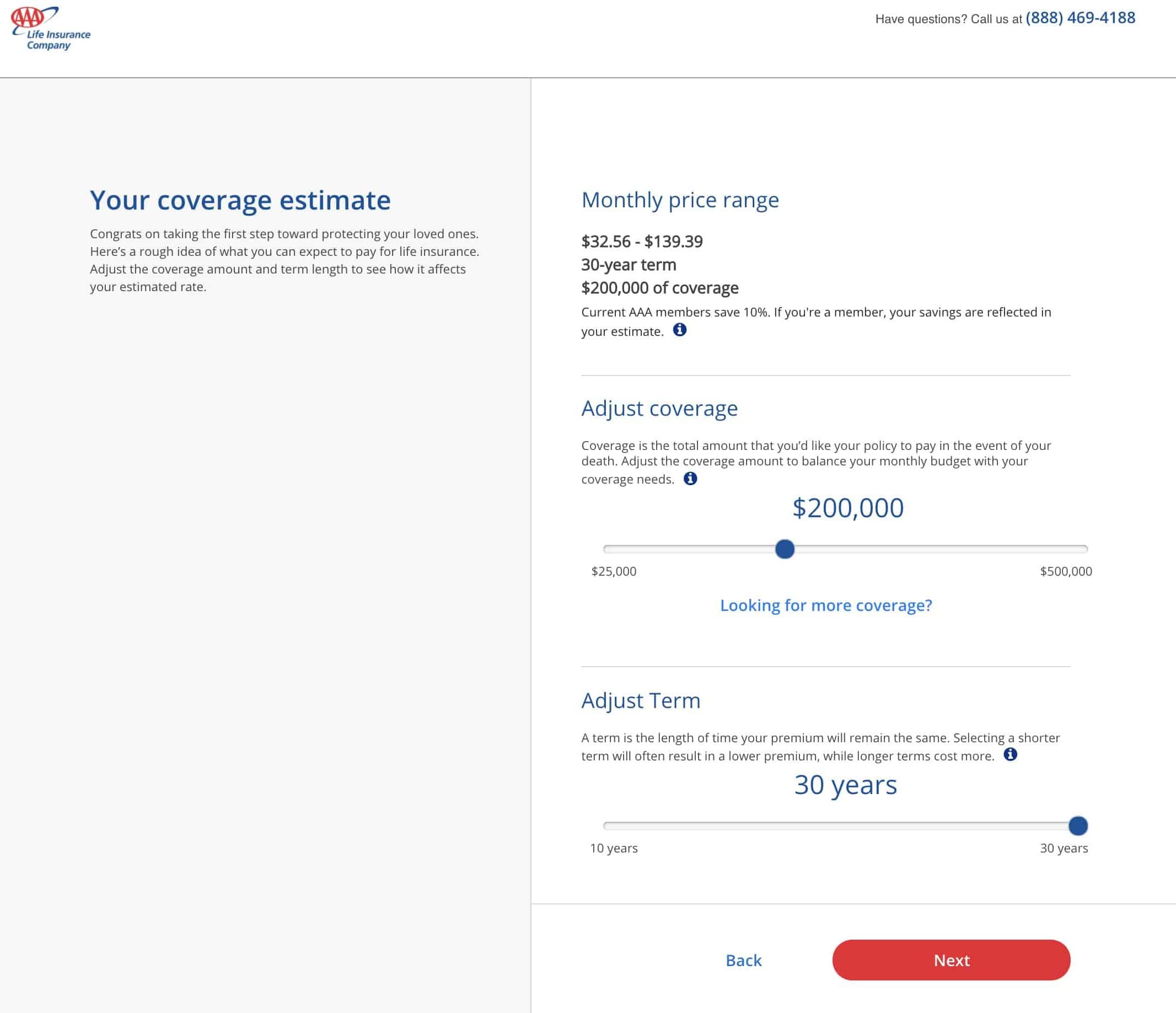

#4 – View Your Quote

For the ExpressTerm quote, you can make adjustments to your coverage before clicking Next.

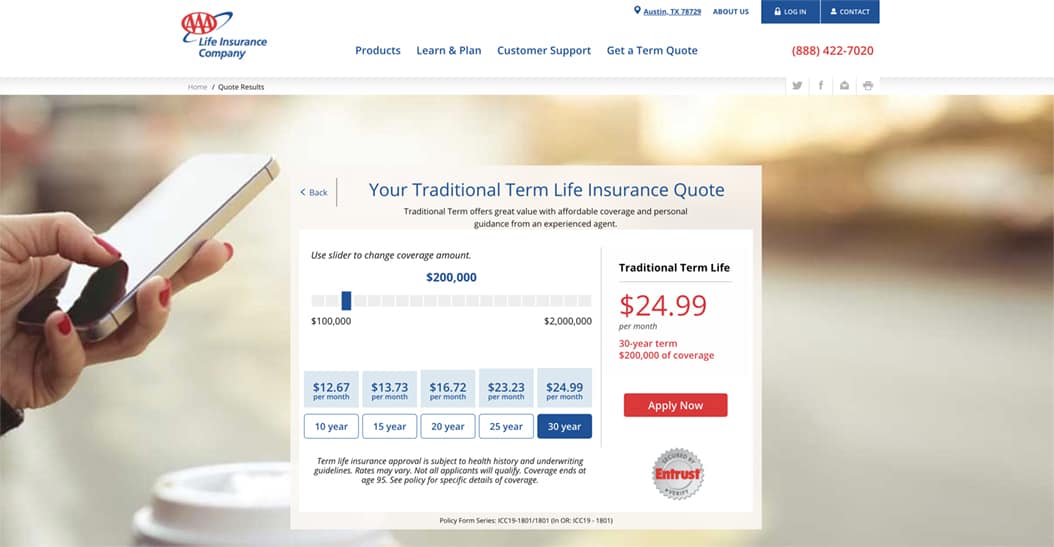

You can also make adjustments for the Traditional Term quote. Once you’re satisfied, click on Apply Now.

The next step will help you begin the application process.

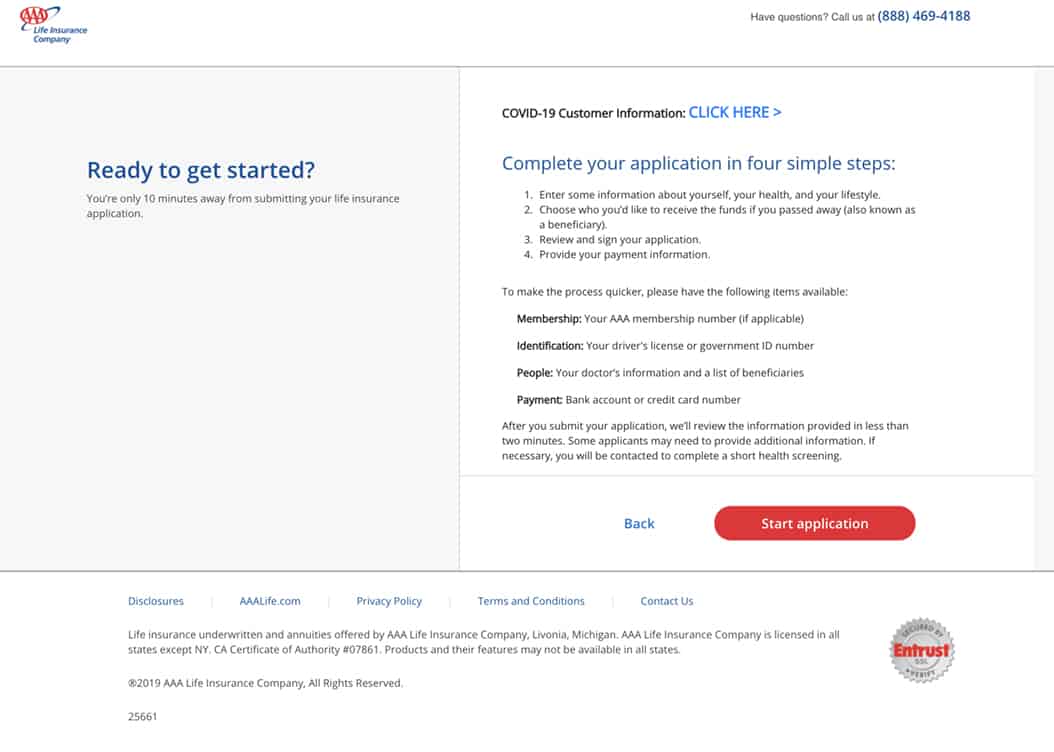

#5 – Apply and Get Approved for AAA Life Insurance

For the ExpressTerm policy, you will be provided instructions for starting the online application.

Fill out each of the following screens:

- My Health

- More Information

- Review

- Final Steps

Be prepared to provide information such as your physician’s phone number, your prescriptions, release of information disclosures, and beneficiary information.

With the Traditional Term policy, an AAA life agent will contact you to complete the application process.

Once your application is approved, payment options will be discussed or set up.

However, to get access to multiple quotes, not just from AAA Life at once, check out our FREE quote tool below.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Canceling Your AAA Life Insurance Policy

You may choose to cancel your life insurance policy for several reasons, including major changes in financial or marital status, or switch to another life insurance product. To make the process as seamless as possible, first, gather as much information about your policy.

How to Cancel With AAA

AAA Life requires a written request to cancel most life insurance policies. You need to provide:

- The policy or certificate number being canceled

- Signature from the policy or certificate owner

- The date the cancellation request was signed

The cancellation request can be mailed or faxed to:

AAA Life Insurance Company

17900 N. Laurel Park Dr.

Livonia, MI 48152-3985

1-888-223-6534 (customer service)

1-888-223-1509 (claims)

How to Make a Claim With AAA Life

Making a claim for life insurance can be an emotional and confusing process. Here’s how you do it.

- Locate the life insurance policy.

- Contact the insurance company. A company representative will walk you through what you’ll need to do. Generally, the company will require a certified death certificate and a completed claim form to pay the death benefit.

- Choose how you’d like to receive the payment. The proceeds are typically paid to the beneficiary in a lump sum. There may also be an option for you to receive installment payments or have the amount held in an account that earns interest. A tax advisor or attorney can help you decide which option makes sense for you.

- Await payment, usually within a few weeks.

- Note: if you can’t locate the policy information, your state’s insurance commissioner’s office can help you, or you can use the NAIC Policy Locator service.

This video explains the importance of keeping good records of your policies and beneficiary information for life insurance. Your family will appreciate your diligence, if they cannot find your records.

AAA Life’s Customer Experience

The vast majority of AAA customers who have reported their experience online have had a favorable experience. Those who report less than favorable experience say that their results with AAA stemmed from the difficulty in getting appropriate, or personalized customer service.

Not having an insurance agent that actually knows you personally seems to be a key factor in their negative commentary.

NAIC Complaint Index

The National Association of Insurance Commissioners (NAIC) represents every state and U.S. territory in regulatory matters of the insurance industry. For consumers, it provides research tools and contact information. It also maintains an annual report, based on an index of expected complaints, where 1.0 represents the national average.

The 2018 AAA Life index of 1.57 percent indicates a higher-than-average rate of complaints for the year based on the market share (size) of the life insurance industry.

The index fluctuates annually. You can find more information on the types of complaints on the NAIC website. For your reference, AAA Life’s NAIC identification code is 71854.

AAA Life’s Programs

As we stated earlier, being a member of AAA may provide you with additional benefits when shopping for life insurance — which can add up to substantial savings over the course of a lifetime policy. Some policies also allow for AAA auto and homeowners insurance discounts.

AAA does not offer group life, health insurance or disability insurance like some much larger life insurance companies do.

However, they do offer annuities (not covered in this review) which are often used in combination with other life insurance products in retirement planning (see universal life).

Another program unique to AAA Life is its Member Loyalty® accident insurance, which helps members pay for loss of life and medical care in an accident. No medical exam is required, and typically, emergency care is paid from the first day of treatment. This can supplement a person’s own emergency health care insurance. You can apply for it over the phone or at a local AAA office.

Design of AAA Life Insurance Website/App

The home page immediately promotes the Get a Quote feature.

The website for AAA Life is navigation-friendly, especially if you’re new to life insurance in general. It offers a comprehensive selection of blog articles, simplified explanations of insurance products, and plenty of answers to frequently asked questions.

The Getting Started page provides a good springboard into a comprehensive list of products and other useful life insurance resources.

It also features a comprehensive help page to point customers in the right direction.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros & Cons of AAA Life Insurance

AAA Life may be a choice of convenience for some, but it may not be comprehensive enough for others. Remember that its agents are only going to try to sell you AAA Life products, so you should look around at the competition.

AAA Life Insurance Pros

The AAA name has been an icon of safety for more than a century, and its life insurance service by all appearances is as well. Most of its ratings are good to excellent, and the availability of agents across the country works well for customers who have a handle on what they want and expect from a life insurance company.

AAA Life’s website provides plenty of information for customers in several scenarios: newly married, new family, approaching retirement, etc. And it doesn’t have a hard-sell approach.

The links to reputable insurance industry watchdogs also provide reassurance of its integrity as a company.

If you’re looking for a quick application process for term life, ExpressTerm may be for you. But it has policy limitations and isn’t recommended if you have certain medical conditions that might cause a denial.

AAA Life Insurance Cons

AAA Life’s products are comprehensive enough for most people’s income protection. However, if you already have a professional relationship with an independent insurance agent, you may be able to find a larger variety of products and better rates elsewhere.

AAA Life is rarely cited as having highly competitive rates in agent and customer reviews. What you are paying for seems to be the company’s iconic name and its reliable (but mediocre) coverage options.

Despite its high ratings for financial stability, there are a handful of vocal customers on social media complaining about a lack of prompt attention or slow claims processing. One reviewer suggested that when it comes to life insurance, AAA “is best suited to rescuing automobiles, and should stay in their lane.”

The Bottom Line

With a trustworthy name and reputation, AAA Life offers convenience when purchasing life insurance and annuities. Many of its term life policies are now available online with an expedited application process.

Rates are fairly competitive, and AAA members can enjoy premium discounts of 10 percent on certain policies, which can add up to significant savings over a lifetime. AAA Life’s large size allows you many good choices, plus a wide range of add-ons.

On the other hand, AAA Life may feel too large for some customers who prefer more personalized service, especially as their families and circumstances change over a lifetime.

AAA’s term policies are easily converted to whole life as they expire, and there are enough policies to choose from, no matter what stage of life you’re in. If you’re looking for this kind of flexibility, then it’s worth comparing AAA Life with companies about the same size. Like all insurance companies, AAA encourages younger people to get an early start with life insurance.

Don’t wait! Check out our FREE tool below to get cheap rates in your ZIP code now.

Frequently Asked Questions

What types of life insurance does AAA Life Insurance offer?

AAA Life Insurance offers the most basic types of life insurance, including term insurance, as well as travel and accident insurance.

Do AAA Life Insurance customers receive any discounts?

Yes, AAA Life Insurance customers who are already members of the auto division can enjoy a 10 percent discount on their premiums.

Are there any differences in premiums based on gender and age?

Yes, premiums for life insurance can vary based on gender and age. In general, men tend to pay higher premiums than women due to statistical factors. Premiums also increase significantly as you age.

How do smoking habits affect life insurance rates with AAA Life Insurance?

Smoking habits can have a significant impact on life insurance rates. Smokers can expect to pay higher premiums compared to non-smokers. The rate differences are even higher for male smokers compared to female smokers.

Are there any benefits to buying life insurance at a younger age?

Yes, buying life insurance at a younger age can have several benefits. It allows you to lock in better term rates, potentially saving money in the long run. It also provides financial security in case of unexpected events. Additionally, buying insurance at a younger age can help prevent health complications caused by smoking and ensure eligibility for higher coverage amounts.

Does the location of my home affect my rates?

Yes, where you live is factored into your rate calculation. Some parts of the country have a higher cost of living or a higher death rate, which could affect your rate. With this in mind, you need to notify your agency if you move, as it could affect your rate.

What kind of insurance is best to ensure that my family can cover expenses for a funeral and estate taxes?

Although AAA Life doesn’t label its insurance products specifically as burial and final expenses like other insurance companies do, its whole-life policies are usually best suited for these expenses, since you are locked into premium rates. The benefit amount is usually lower, which in turn makes it affordable insurance that protects your family at a difficult time.

Can a policy be reinstated if premiums have lapsed?

This depends on the particular policy and the insurance company. AAA Life honors grace periods, especially with extenuating circumstances, but with few exceptions, it is essential to pay premiums on time to avoid cancellation or denial of a benefit.

Do I need to be a member of AAA (Auto Division) to purchase AAA Life?

No, AAA membership is not required to purchase life insurance, since AAA Life is a different division. However, discounts of up to 10 percent on premiums are available on most policies, and only AAA members are eligible for accident insurance while traveling.

How do I locate a lost relative’s policy information?

If you’re trying to locate a AAA Life policy, start by contacting their customer service. If the policyholder is deceased or incapacitated, AAA will have a record of the original policy. The NAIC also has a policy locator and guide.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Life Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Licensed Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.