Brighthouse Financial Life Insurance Review (Updated)

Our Brighthouse Financial life insurance review finds that the company offers innovative insurance solutions like SmartCare, long-term insurance, and term life insurance. A 30-year-old male non-smoker can get a 10-year, $100,000 term life insurance policy for as low as $10 per month. Brighthouse Financial has earned an A rating from A.M. Best and Fitch.

Read more

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Life Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Licensed Life Insurance Agent

UPDATED: Feb 6, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Feb 6, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Brighthouse Financial Life Insurance Company Overview

| Brighthouse Financial Key Info | Company Specifics |

|---|---|

| Year Founded | 2017 |

| Current Executives | President & CEO – Eric Steigerwalt CFO – Edward Spehar |

| Number of Employees | 1,200 |

| Total Sales / Total Assets | $6,554,000,000 / $227,259,000,000 |

| HQ Address | 11225 N. Community House Rd. Charlotte, NC 28277 |

| Phone Number | 1-800-638-5433 |

| Company Website | www.brighthousefinancial.com |

| Premiums Written – Individual Life | $1,828,000,000 |

| Financial Standing | -$761,000,000 |

| Best For | Hybrid Life Insurance / Long-Term Care |

We created this Brighthouse Financial Life Insurance review to provide a first look at one of the newest life insurance companies that are leading with innovative solutions for today’s clientele. Brighthouse Financial provides retirement and life insurance solutions that combine standard products, like term life insurance, with hybrid permanent insurance products that are designed to help you achieve financial security.

After reading this article you will get a better grasp of the complexities for both retirement planning and for creating a comprehensive insurance plan.

Before you jump into this Brighthouse Financial Life Insurance review, take a moment to get a few free custom comparison quotes using our quote tool at the top of this page. Take a few seconds right now to enter your ZIP code and get a free quote in seconds.

Shopping for Brighthouse Financial Life Insurance Quotes

When you start to shop around for the cheapest life insurance quotes with Brighthouse Financial, you may find that unlike other insurance companies, quotes are not readily available.

As a financial management company, Brighthouse Financial clients work with dedicated financial advisors to obtain rate information. Even though you can’t get a direct Brighthouse Financial Life Insurance quote, we can get an idea of how competitive the company is by their place in the overall market.

According to the NAIC, Brighthouse Financial is ranked as the 22nd-largest insurer in the country.

Its place in the top 50 insurance companies and its legacy derived from the well-regarded Travelers Insurance Company have quickly positioned Brighthouse as an insurance industry leader. Based on this history with Travelers Insurance, which eventually was acquired by MetLife in 2005, some people ask, “Is Brighthouse Financial affiliated with MetLife?”

In 2017, Metlife created Brighthouse Financial as a separate spin-off company. MetLife continues to own almost 20 percent of Brighthouse Financial stock, but Brighthouse Financial operates as a completely independent company.

So, what is the difference between MetLife life insurance and Brighthouse Financial? When it comes to shopping for insurance, Brighthouse Financial provides a hands-on customer service approach by appointing a financial advisor to help you manage your overall financial health and wellness. Meanwhile, Metlife is still an insurance company at its core.

Average Brighthouse Financial Life Insurance Rates by Age

Average Brighthouse Financial life insurance costs are not available for public consumption. You will need to consult with a Brighthouse partner advisor to obtain a current quote. In the meantime, have a look at comparable quotes to get an idea of what you can expect to pay.

The following table provides average life insurance rates by age from the top 10 insurance companies. The first table provides rates for three different age groups and three benefit amounts for a single male 30-year-old non-smoker.

Average Annual Term Life Insurance Rates for a 30-Year-Old Male Non-Smoker

| Policy Amount | 10-Year Term Average Annual Rates | 20-Year Term Average Annual Rates | 30-Year Term Average Annual Rates |

|---|---|---|---|

| $100,000 | $10.85 | $12.53 | $16.36 |

| $250,000 | $13.45 | $17.45 | $24.41 |

| $500,000 | $18.56 | $26.22 | $37.93 |

Rates for female non-smokers at the same 30-year-old range are cheaper. This is a regular pricing difference with insurance since female life expectancy is longer. You can assume average Brighthouse Financial life insurance rates would fall somewhere close to the rates quoted above.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brighthouse Financial’s Life Insurance Policies

Brighthouse Financial offers financial retirement products and life insurance plans. On the financial side, the company offers a series of annuity products that, similar to life insurance, offer customers the ability to make regular premium payments for the promise of a lump payout later.

In fact, Brighthouse Financial’s Shield Annuity products act very much like popular indexed universal life insurance products allowing customers to select underlying investment tools to help their premiums grow at a faster rate for a higher payout later. Brighthouse Financial Shield annuity reviews show the products to be popular as a fee-based annuity.

The company has won a place on the Barron’s Best List for Shield Annuities for the past three years.

When it comes to life insurance, Brighthouse Financial focuses its efforts on life insurance for parents or life insurance for seniors. Brighthouse Financial’s product list does not include specific life insurance policies for children, but popular riders are available on plans that can extend coverage for a child, or even extend life insurance policies for spouses.

Brighthouse Financial offers standard term life insurance in addition to its popular hybrid permanent insurance and long-term care product.

Term Life Insurance

Brighthouse Financial offers standard term life insurance that will protect you for a specified period of time. Brighthouse Financial terms include 1-, 10-, 20-, or 30-year terms.

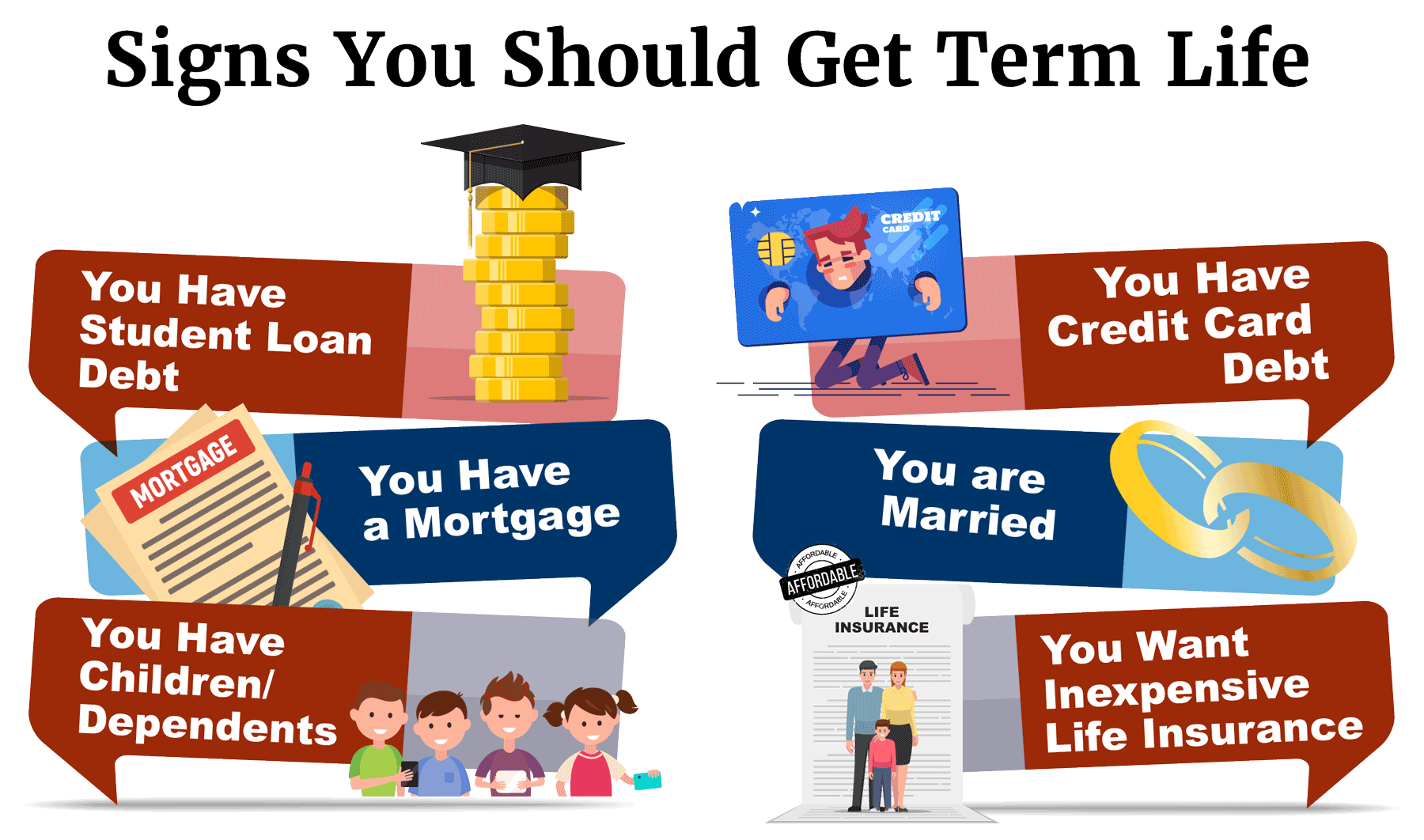

Term life insurance is recommended for clients that can afford level premiums and need the maximum amount of benefit. The graphic below provides a good overview of reasons to purchase quality term life insurance.

At Brighthouse Financial, a financial advisor will help you determine where term insurance products might fit into your overall financial plan to ensure you are paying the least amount of premium for the benefit that you require.

Universal Life Insurance

What is the best life insurance policy that Brighthouse offers?

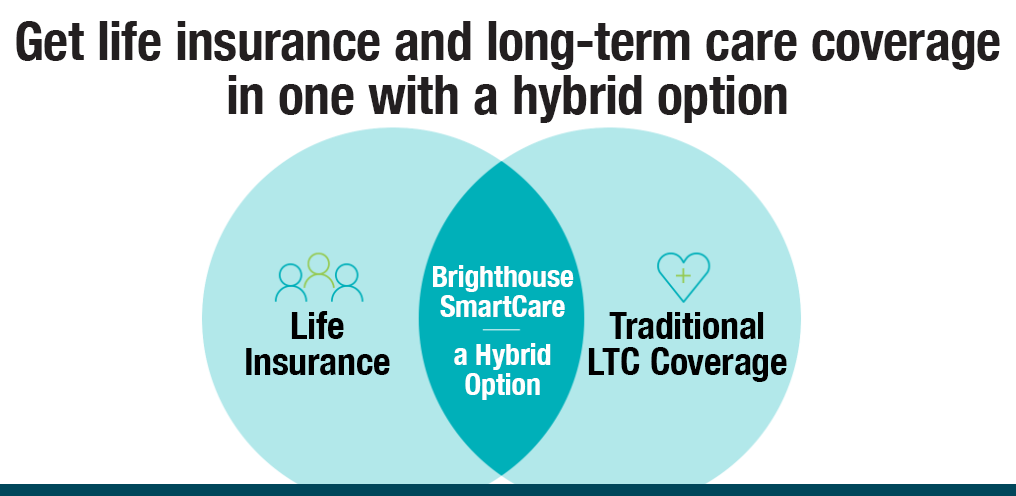

Brighthouse Financial offers an innovative new life insurance type to meet the changing needs of a retiring population of baby boomers. Since many people are approaching retirement and expect to have longer life expectancies, the Brighthouse SmartCare Plan offers both life insurance and long term care.

The video below provides a clear explanation of the Brighthouse SmartCare Plan.

Here’s a summary of the features of this Brighthouse SmartCare plan:

- Premium contributions provide for a death benefit or four to six years of long-term care expenses

- Policyholders can opt for a guaranteed return which will grow money at a defined interest rate or choose to pin the return against a stock market index for maximum growth

- If a policyholder uses all value in the fund for long term care, a reduced benefit will still be available to loved ones

- The plan has a cash value component which policyholders can withdraw if they decide to cancel the policy

The Brighthouse SmartCare plan is similar to other products that offer indexed life insurance with an accelerated death benefit rider, although the Brighthouse Financial product provides more flexibility in how you can use your funds. So how much does Brighthouse Smartcare cost?

This depends on your specific needs, the amount of premium you can afford, and the amount of benefit you are looking for from the plan.

Life Insurance Riders

Standard life insurance riders are available with Brighthouse Financial term and hybrid plans. In an effort to make policy charges transparent, an itemized breakout of rider charges is provided annually.

Compare Quotes From Top Companies and Save Secured with SHA-256 Encryption

How to Get a Quote Online With Brighthouse Financial

Unlike many other insurance companies, Brighthouse Financial does not provide a quote tool online. If you are wondering how to get life insurance quotes online, it is as easy as using our free quote tool at the top of this page for a quick custom quote.

The best way to get life insurance quotes from Brighthouse Financial is to meet with a financial advisor. We suggest that you use our tool as a way to get multiple life insurance quotes before you meet with an advisor, so you can compare and negotiate the best life insurance rate.

Canceling Your Life Insurance Policy

Signing the dotted line on a life insurance policy may seem like a huge commitment. One concern is if you are locked in with a term or permanent plan can you cancel your life insurance policy?

The simple answer is yes. In figuring out how to cancel my Brighthouse Smartcare plan, I had to alert my advisor and determine the best way to have the cash value returned to me from my plan. I had to pay tax on any gains in interest or market returns on the cash value returned.

I chose to cancel my plan because with my kids out of college and doing quite well for themselves, I didn’t need the benefit amount I was paying for. Instead, I canceled my plan and found a plan with less coverage.

How to Cancel

To cancel a term life policy with Brighthouse Financial, you will need to contact a representative at the company and possibly submit a request in writing. After that, it might be as simple as stopping premium payments. Of course, when you do cancel, all paid premiums will be lost and you will be exposed without coverage.

For more complex products, you will need to work with your insurance company and a financial advisor to understand any implications in cashing out on the cash value in the plan, and determining if there are early withdrawal or surrender fees. Most indexed universal life plans will carry some fees.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Make a Claim With Brighthouse Financial

The best way to make a life insurance claim with Brighthouse Financial is to contact your financial advisor or to reach out to Brighthouse Financial at the contact numbers below:

Brighthouse Life Insurance phone number contacts:

- Annuity Contract Servicing – 1-800-638-7732

- Life Insurance Policy Servicing – 1-800-638-5000

You will need to request the proper forms to file your claim. In addition to the forms, you will likely need a copy of the original life insurance policy and a death certificate for the deceased.

How long does it take to make a life insurance claim? And equally important, how long does it take to get life insurance money?

This depends on how straightforward your claim is. If there are multiple beneficiaries, questions around the circumstances of death, or any investigation that might be required, it can take a while. Many insurers try to expedite claims for simple cases and claimants can receive life insurance proceeds in a few weeks on a standard claim.

Brighthouse Financial Customer Experience

Brighthouse Financial operates through a network of dedicated financial advisors. Because of this, it does not provide any self-service tools for customers on its site. The company’s contact page provides contact numbers to direct you to support contacts.

- Life Insurance Policies – 1-800-638-5000

- Individual Annuities – 1-800-638-7732

- Disability Policies – 1-844-405-1390

- Total Control Account – 1-800-638-7283

In order to get a sense of how Brighthouse Financial serves its customers, we reviewed some of the worst customer experience reviews on the Better Business Bureau site. There are approximately 41 Brighthouse Financial complaints that mainly revolve around the mishandling of customer requests from changes to indexed fund allocations to policy cancellations.

Brighthouse Financial’s Programs

Brighthouse Financial offers a learning center on its website that features articles and a few tools to help customers plan for retirement. Most tools are intended to help with wealth management.

Since Brighthouse Financial serves customers through dedicated financial advisors, most questions you have would be answered by your advisor.

Design of Website/App

Overall, Brighthouse provides a thorough site but is more focused on holistic wealth management than life insurance. At this time, there is now Brighthouse Financial App, but customers do have a dedicated login for policy management and to make Brighthouse Life Insurance payments.

Compare Quotes From Top Companies and Save Secured with SHA-256 Encryption

About Brighthouse Financial Life Insurance

Brighthouse Financial headquarters are located in Charlotte, North Carolina. The history of Brighthouse Financial is rooted with Metlife Insurance Company. In 2013, Metlife relocated its headquarters from New York City to Charlotte, North Carolina.

In 2016, Metlife decided to streamline part of its U.S. retail operations and started branding products with the Brighthouse Financial name and Brighthouse Financial logo. In 2017, Brighthouse Financial officially spun off as a separate entity and became a publicly-traded company, Brighthouse Financial is now a Fortune 500 company.

Brighthouse Financial’s Ratings

As you review Brighthouse Financial, it’s helpful to see how the company ranks with its financial strength ratings. Considering ratings from the A.M. Best insurance company ratings service, or other financial industry rating companies, can help you determine if your insurance company will be around for the long haul.

Whether you are comparing the best life insurance companies or are looking to avoid the worst life insurance companies, these ratings give a good indication of where you stand.

Brighthouse Financial Ratings

| Ratings Agency | Brighthouse Financial Ratings | Brighthouse Financial Rankings |

|---|---|---|

| A.M. Best | A/Excellent | 3rd highest out of 16 |

| Fitch | A/Strong | 6th highest out of 19 |

| Moody's | A3/Upper Medium | 7th highest out of 21 |

| S&P | A+/Strong | 5th highest out of 22 |

Brighthouse Financial ratings indicate the company is fiscally strong and reliable.

Brighthouse Financial’s Market Share

The chart below shows you the top 10 insurance companies by market share and includes Brighthouse Financial. Reviewing companies by market share can help you answer questions like, “Is Metlife in financial trouble?” or “Is Brighthouse Financial legitimate as an insurance provider?”

Top 10 Life Insurance Companies & Brighthouse Financial by Market Share

| Rank | Companies | Direct Premiums | Market Share | Cumulative Market Share |

|---|---|---|---|---|

| 1 | Northwestern Mutual | $11,278,801,822 | 6.48% | 6.48% |

| 2 | New York Life | $11,053,776,227 | 6.35% | 12.38% |

| 3 | Metropolitan Life | $10,767,189,668 | 6.19% | 19.01% |

| 4 | Lincoln National | $9,651,117,072 | 5.54% | 24.56% |

| 5 | Prudential | $9,642,360,389 | 5.54% | 30.1% |

| 6 | Mass Mutual | $7,984,470,423 | 4.59% | 34.69% |

| 7 | Aegon | $4,868,457,551 | 2.8% | 37.48% |

| 8 | John Hancock | $4,817,849,577 | 2.77% | 40.25% |

| 9 | State Farm | $4,797,872,970 | 2.76% | 43.01% |

| 10 | Minnesota Mutual | $4,724,702,591 | 2.71% | 45.72% |

| 22 | Brighthouse Holdings | $2,385,778,456 | 1.37% | 66.02% |

There is a significant difference between Brighthouse Financial market share compared to the competition. However, it is helpful to realize the company’s model is different from top insurance companies. Brighthouse Financial is a financial advisory services provider first.

Brighthouse Financial’s Online Presence

Brighthouse Financial is one of the top insurance companies using social media today. The company has a very active Facebook page with over 14,000 followers. Brighthouse Financial also uses Youtube very effectively by uploading quality produced educational content on their own channel like this video.

A host of brief videos are available explaining products and services.

Brighthouse Financial’s Commercials

Brighthouse Financial doesn’t produce the standard insurance company TV commercials that you see from larger insurance competitors. The company focuses its commercials on retirement services and overall wealth management and longer-term financial care.

We haven’t seen many Brighthouse Financial commercials on television but the company does produce high-quality video content that is available at the company’s Youtube channel.

Brighthouse Financial in the Community

When it comes to examples of businesses giving back to the community, Brighthouse Financial is definitely one of them. In August 2018, the company launched the Brighthouse Foundation which offers financial support to non-profit organizations with the intention of helping the larger community.

Brighthouse Financial’s Employees

Brighthouse Financial Life Insurance reviews by employees indicate a positive atmosphere with high regard for the company’s management. Glassdoor reviews by actual Brighthouse Financial employees deliver a 3.8/5 start review of the company overall, with high approval ratings for the company CEO.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros & Cons of Brighthouse Financial Life Insurance

A quick review of Brighthouse Financial Life’s pros and cons can help you decide if the company is right for you.

Pros of Brighthouse Financial Life Insurance

First, let’s take a look at the benefits of choosing Brighthouse Financial.

- Brighthouse Financial offers more than life insurance and helps customers plan for overall financial security in their later years.

- Brighthouse Financial offers innovative life insurance solutions that can provide benefits for loved ones or funding for long term care if needed.

- Brighthouse Financial is stable and has high ratings from all of the leading insurance company ratings providers.

If you’re looking for a stable company that has more to offer than life insurance, Brighthouse Financial might be your one-stop shop.

Cons of Brighthouse Financial Life Insurance

Now, let’s consider the disadvantages.

- Brighthouse focuses only on a few core products and does not offer a selection of permanent life insurance policies.

- Brighthouse doesn’t provide price transparency with online quotes or rate tables. A customer must work with a financial advisor to get a competitive quote.

- Some customer complaints indicate that customer care handling of claims or service requests more time than is usually necessary.

Now that you’ve read through this Brighthouse Financial life insurance review, it’s time to obtain an affordable custom quote that will meet your specific needs. Use our free quote tool at the top of this page. Simply enter your ZIP code and receive a life insurance quote in minutes.

Brighthouse Financial Life Insurance: The Bottom Line

Brighthouse Financial is more of a financial advisory company than a pure life insurance company. The bottom line is if you are looking only for insurance and are used to shopping online, you may be better suited with a larger insurance company. However, if you would like personalized service, comprehensive financial advice, and competitive prices, Brighthouse Financial’s model may be well suited for you.

Do you have other questions do you have when it comes to life insurance? Leave a comment at the bottom of the page.

Frequently Asked Questions

What is Brighthouse Financial Life Insurance?

Brighthouse Financial Life Insurance is a type of life insurance offered by Brighthouse Financial, a leading provider of annuities and life insurance solutions. It provides financial protection to your loved ones in the event of your passing, offering a death benefit payout to your designated beneficiaries.

What types of life insurance does Brighthouse Financial offer?

Brighthouse Financial offers various types of life insurance, including term life insurance, universal life insurance, and indexed universal life insurance. Each type has its own features and benefits, allowing you to choose the coverage that aligns with your specific needs and financial goals.

What is term life insurance?

Term life insurance is a type of life insurance that provides coverage for a specific period, typically ranging from 10 to 30 years. If the policyholder passes away during the term, the designated beneficiaries receive the death benefit. Term life insurance is often more affordable compared to permanent life insurance.

What is universal life insurance?

Universal life insurance is a type of permanent life insurance that offers both a death benefit and a cash value component. It provides lifelong coverage and allows flexibility in premium payments and death benefit amounts, within certain limits. The cash value grows over time, potentially earning interest at a specified rate.

What is indexed universal life insurance?

Indexed universal life insurance is a type of permanent life insurance that offers a death benefit and a cash value component. The cash value growth is linked to the performance of a stock market index, such as the S&P 500. Indexed universal life insurance provides the potential for higher returns, but also comes with a certain level of risk.

What are the advantages of choosing Brighthouse Financial Life Insurance?

Brighthouse Financial Life Insurance offers several advantages, including:

- Flexibility: Brighthouse Financial offers a range of life insurance products to suit different needs and preferences.

- Financial Protection: The death benefit payout provides financial security to your loved ones.

- Customization: Some policies allow you to customize premium payments and death benefit amounts.

- Potential Cash Value Growth: Permanent life insurance policies offered by Brighthouse Financial have a cash value component that can grow over time.

How can I apply for Brighthouse Financial Life Insurance?

To apply for Brighthouse Financial Life Insurance, you can visit their official website or contact their customer service. An agent or representative will guide you through the application process, explain the available options, and help you select the most suitable policy for your needs.

How are premiums determined for Brighthouse Financial Life Insurance?

Premiums for Brighthouse Financial Life Insurance are determined based on several factors, including the type and amount of coverage you choose, your age, gender, health status, lifestyle habits, and other life insurance underwriting criteria. It’s important to provide accurate information during the application process to ensure your premiums are appropriately calculated.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Life Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Licensed Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.