Columbian Mutual Life Insurance Company Review

According to our Columbian Mutual Life Insurance Company Review, you can get a $10,000 whole life insurance policy for $29 per month. Columbian Mutual Life is the parent company of the Columbian Financial Group. Its life insurance products include term, whole, and universal life insurance.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Life Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Life Insurance Agent

UPDATED: Jan 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Columbian Mutual Life is the parent company of the Columbian Financial Group

- Columbian Mutual Life Insurance Company offers term, whole, and universal life insurance

- Columbian Mutual Life insurance quotes start from $29 per month

Unbiased reviews are a rare thing in the internet age. We all have agendas, whether it’s selling more of the products for which we get paid the most, or companies who give us a free trial of some sort so that they can be in front of readers such as yourself. When it comes to life insurance companies review, it’s different because we at Effortless Insurance represent the client and not the carrier.

In other words, we are not trying to convince you to go with one company over another. In fact, they all pay us if you choose to buy from us, so our job as brokers is to place you with the right company based on your health history and financial goals and not based on one company we’d rather sell (we represent more than 50 companies).

Today, we review Columbian Mutual Life Insurance Company. They are known for their final expense life insurance products. I will look at the rates and underwriting process and compare them against the best in final expense companies. Let’s get to it!

Related: Best final expense companies for seniors

Columbian Mutual Life Insurance History

Colombian Mutual Life is the parent company of the Columbian Financial Group and has been around for more than 130 years. Their main goal is always to put clients first and keep up with the financial changes in the insurance industry in order to meet policyholder obligations.

- In 1882, Colombian Mutual is incorporated as the American Protective Association in Brooklyn, New York.

- In 1907, name changes to Columbian Protective Association.

- In 1952, they became a mutual company.

- 1970–1990, Colombian Mutual Life is licensed to sell insurance in 50 states.

- In 2011, they merge with Unity Mutual Life Insurance which results in $1.4 billion in assets and more than $100 million in capital.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Columbian Mutual Life Insurance Company Ratings

According to A.M. Best, Colombian Mutual Life Insurance Company has a BB+(Good) rating. It was downgraded from A- in June 2015. The downgrade reflects capital and operating performance fluctuations according to A.M. Best.

Products Offered by Columbian Mutual Life

Columbian Mutual Life offers term, whole, and universal life insurance products. It also has term life insurance without exam as part of their portfolio. In this review, I will only look at the final expense product offerings.

Dignified Choice—Level Benefit

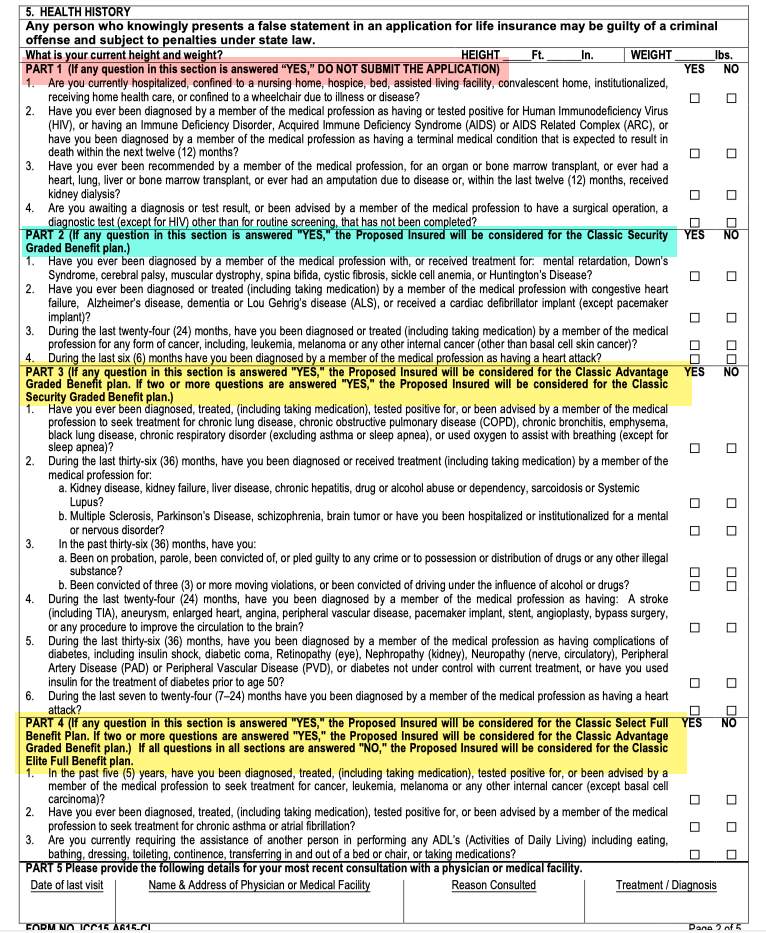

Columbian Mutual Life’s level benefit plan comes in two forms: Classic Elite and Classic Choice. For starters, the level benefit plan means that there is no waiting period in which the coverage goes into effect. Whether the insured dies two days or twenty years after the policy is issued, Columbian Mutual will pay the full death benefit amount.

Additionally, these policies are simplified issue whole life policies. Simplified issue means that you don’t need to complete an exam as part of the medical evaluation for coverage. Columbian Mutual will run a Medical Information Bureau (MIB) check and prescription database report to validate the answers on the application. You will also undergo a phone interview as part of the life insurance underwriting process.

With whole life coverage, your premium and death benefit remain level (same) through your lifetime. Whole life also offers cash value accumulation on a tax-deferred basis, which you can withdraw in the future or collect if you surrender the policy. Find out how much whole life insurance costs.

Dignified Choice—Classic Elite

To qualify for this plan, you must be able to answer “no” to all the health questions on the application. In other words, you must be in good health to get the best rates for the immediate death benefit plan.

Dignified Choice—Classic Select

To qualify for this plan, you can answer “yes” to part 4 on the application and still qualify for the level death benefit, however, at an increased cost.

Plan Highlights

- Issue ages:

- 25–44: $5,000–$35,000

- 45–80: $2,500–$35,000

- 81–85: $2,500–$25,000

- Whole life with a full death benefit

- Simplified issue underwriting without an exam

- All health questions answered “no” for Classic Elite plan

- Any Part 4 health question answered “yes” for Classis Select plan

- Medical Information Bureau check

- Prescription database check

- Motor Vehicle Report for ages 25–35

Available Riders

- Children’s term insurance

- Accidental death benefit

- Accelerated death benefit

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dignified Choice—Graded Benefit

Columbian Mutual Life’s graded benefit plan also comes in two forms: Classic Advantage and Classic Security. Graded benefit plan doesn’t pay the full life insurance death benefit amount in the first two years of coverage. Instead, Columbian Life will pay your beneficiaries your total paid premiums plus 6% interest. Only in year three onward will they pay the full death benefit amount.

This product is tailored for those with a few health challenges who can’t get approved for a level benefit plan due to health history or the current one. It is also simplified issue whole life coverage with guaranteed premium payment through your lifetime and a cash value accumulation component.

Dignified Choice—Classic Advantage

To qualify for this plan, you can answer “yes” to any part 3 health questions and two or more in part 4.

Dignified Choice—Classic Security

To qualify for this plan, you can answer “yes” to any part 2 health questions and two or more in part 3.

Plan Highlights

- Issue ages: 45–85

- Face value: $2,500–$20,000

- Simplified issue underwriting without an exam

- Medical Information Bureau check

- Prescription database check

- Graded benefit period is three years

- Full death benefit paid if death is accident related

- Return of premiums plus 6% if death occurs during the first three years

Available Riders

- Children’s term insurance

- Accelerated death benefit

Knockout Questions

Guaranteed Issue Whole Life

Columbian Mutual Life’s guaranteed issue life insurance is for those who can’t qualify for any type of life insurance due to serious health issues. Note, this coverage isn’t intended for terminally ill individuals or those who are confined to an assisted living facility, hospital, hospice, or another facility.

It bears repeating that guaranteed issue policies have three years’ graded benefit that will pay the paid premiums plus 6% interest should the insured die during the first three years. The advantage of this product is that it’s available for ages 25 and over. With most guaranteed issue policies, you must be 50 years old or older to apply.

Plan Highlights

- Issue ages:

- 25–80: $5,000–$10,000 (50–75 in NY)

- 45–80: $2,500–$25,000

- No health questions

- No exam

- Whole life coverage

- Guaranteed rates

- Graded benefit for the first three years

- Return of premiums plus 6% if death occurs during the first three years

Columbian Life vs. Other Carriers’ Sample Monthly Rates

*All rates quoted on this page are for a super-preferred healthy individual who does not use tobacco. Monthly rates are updated as of March 2018 and are subject to underwriting approval.*

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Bottom Line

When it comes to Columbian Mutual Life’s prices, they aren’t the most competitive. There are much better options with Assurity Life Insurance Company and Mutual of Omaha Life Insurance Company. The graded benefit plans don’t offer the best payout option because, for the first three years, the benefit equals paid premiums plus 6% interest, while many others offer 40% payout for the first year, 75% for the second year, and 100% at year three.

I think the biggest elephant in the room is their financial rating having been downgraded to BB+. They do have one great benefit unfound in other companies: they offer guaranteed issue life insurance for individuals at the age 25 years while many others require you to be 50 years old.

Choosing the best carrier for your specific needs and overall health is challenging, especially if you only get a quote from one company. Don’t bang your head against the wall trying to find the best company by reading life insurance company reviews.

We represent more than 50 insurers and know which one would be best for you. Run the cheapest life insurance quotes yourself on this page. Just enter your information on the right-hand side of the page, and the quotes will display instantly.

Frequently Asked Questions

Where can I find customer reviews and ratings for Columbian Mutual Life Insurance Company?

You can find customer reviews and ratings for Columbian Mutual Life Insurance Company through online platforms, consumer review websites, and insurance industry forums. Additionally, independent rating agencies such as A.M. Best provide assessments of the company’s financial strength and stability, which can indirectly reflect customer satisfaction.

Are there any drawbacks to consider with Columbian Mutual Life Insurance Company?

While Columbian Mutual Life Insurance Company has its advantages, there may be potential drawbacks to consider. These could include specific policy limitations or exclusions, varying customer experiences, or availability in certain regions. Researching and reading reviews can help assess potential drawbacks specific to your needs.

Can I purchase life insurance from Columbian Mutual online?

Columbian Mutual Life Insurance Company typically allows individuals to purchase life insurance online. Their website provides resources and tools to explore coverage options, request quotes, and initiate the application process. However, you may also choose to work with an insurance agent to assist you with the purchase.

How does Columbian Mutual Life Insurance Company handle claims?

In the event of a claim, policyholders or their beneficiaries should contact Columbian Mutual Life Insurance Company directly to initiate the claims process. The company will provide guidance on the necessary steps and documentation required to file a claim and receive the policy’s death benefit.

How can I obtain a quote for life insurance from Columbian Mutual Life Insurance Company?

To get a quote for life insurance from Columbian Mutual Life Insurance Company, you can visit their official website or contact their customer service. Provide relevant information, such as your age, desired coverage amount, and any specific preferences, to receive a personalized quote.

Can I customize my life insurance policy with Columbian Mutual?

Columbian Mutual Life Insurance Company often allows policyholders to customize their life insurance policies. Depending on the policy type, you may have the flexibility to choose the coverage amount, policy duration, and add optional riders or benefits to tailor the policy to your specific needs.

What are the advantages of choosing Columbian Mutual Life Insurance Company?

Some potential advantages of choosing Columbian Mutual Life Insurance Company include their long history and experience in the industry, a variety of life insurance options to choose from, competitive premiums, a strong commitment to customer service, and a focus on meeting policyholder needs.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Life Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.