Fidelity Life Association Insurance Company Review

Our Fidelity Life Association Insurance Company Review finds that Fidelity Life offers long-term care and universal life policies and has an A- rating from A.M. Best. Fidelity Life insurance rates for a 20-year term $100,000 policy average $19 per month for a 30-year-old female driver.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Life Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Life Insurance Agent

UPDATED: Jan 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Fidelity Life Insurance Company sells long-term care and universal life insurance

- Fidelity Life insurance quotes start from $19 per month

- A.M. Best rating for Fidelity Life Insurance Company is A-

Are Fidelity Life insurance reviews positive?

You will find a variety of topics covered in Fidelity Life insurance reviews. We will discuss their products and rates so that you can make an informed decision.

Fidelity Life Association was founded in 1896 as a fraternal benefit society with the goal of providing financial security to the increasing middle-class population of the Midwestern and Northern states. As the population grew, so did Fidelity Life. Fidelity Life Insurance is an insurance division of Fidelity Investments.

By 1915, their book of business reached $100 million. In 1929, Fidelity grew their assets by 100% during the worst time in US history. In 1930, they changed their name to Fidelity Life Association. In 1953, Fidelity Life converted to a mutual life company. Today, Fidelity Life has over 26 billion life insurance policies for people on the book and is licensed to sell all over the country, except for Wyoming and New York.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Fidelity Life Association Financial Ratings

According to A.M. Best, the leading provider of ratings, Fidelity Life has an A- (excellent) rating, as of June 24, 2016. Based on NAIC complaint ratios, the Fidelity Life insurance complaint ratio for 2020 was 1.42, meaning that the number of customer complaints was high.

What products do Fidelity Life offer?

Fidelity Life offers long-term care and universal life policies which can be adjusted by using numerous riders. You can use riders to improve your coverage or add covered persons. Fidelity long-term care insurance is structured as term and whole life insurance in various forms, such as final expense or guaranteed issue, as well as AD&D insurance policies (accidental death benefit).

Universal life policies offer permanent coverage. In addition to paying a death benefit, its cash value grows over time, at a set rate or it may be tied to a stock market index. A whole life insurance policy is designed to cover long-term care costs while a policyholder is alive. Term life insurance offers term life policyholders a set death benefit in case something happens during a predetermined period of time.

Let’s find out if Fidelity Life can meet your needs.

RAPIDecision Life

Fidelity Life came up with a great idea here. Generally speaking, it can take 8-12 weeks to get a life insurance policy issued. With most policies, there is an interview and an exam as part of the life insurance underwriting process. Some also require an APS (attending physician statement). If you buy a no-exam life insurance policy like Sagicor, you could have this issued in a few days, but the face amount can’t be higher than $500,000, and you will pay more for it.

Fidelity Life came up with a “hybrid methodology” intended to solve this issue. They provide a term life insurance policy that will cover any type of death, along with an accidental death benefit that will only pay if your death is accident-related. This policy is issued in 24-48 hours or less, and some are issued with 100% “all-cause” coverage right from the start.

This process allows the client to take an exam for up to six months (if one is required), and based on the exam, Fidelity may increase the all-cause portion and reduce the accidental death portion proportionally. This allows you to get a policy very quickly, while also giving you time to go through an exam. Once the policy is issued, even if the exam reveals your health isn’t as good as stated on your application, Fidelity can’t change the ratios for the worse.

Product Highlights

- 10-, 15-, 20-, and 30-year terms are available.

- The blended coverage is a term policy with accidental death.

- Issued in 24–48 hours through a non-medical underwriting process. (The insurance company decides on the ratio.)

- You have 6 months to go through an exam to potentially qualify for an improved blended policy benefit.

- All causes death benefit is renewable on a yearly basis (after the term contract is over), up to age 95.

- Issue ages 18–65.

- Face amount $50,000–$1,000,000.

- This is a not convertible product, which means you can’t convert it to a whole life policy at the end of the term contract.

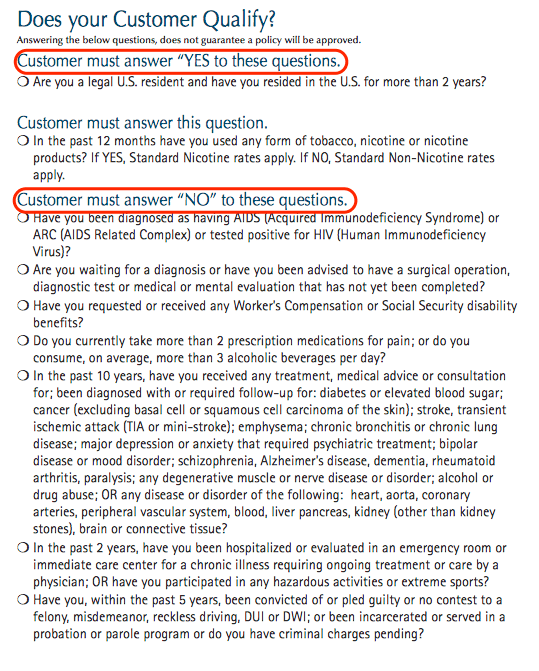

RAPIDecision Express

This product is a simplified issue with no exam, body fluids, or medical records involved. These type of policies can be issued in a few days. They have no waiting period or delays. Keep in mind that no exam doesn’t mean everyone will be approved. There are still health questions you must answer on the application.

Product Highlights

- 10-, 15-, 20-, or 30-year term periods available.

- Level death benefits and premiums.

- Guaranteed annual renewable term (ART) rates after the contract expires.

- Issue ages 18–65.

- Face amounts $25,000–$250,000.

RAPIDecision Express Health Questions

RAPIDecision Senior Life Term & Whole Life

This type of life insurance policy is designed to suit the needs of individuals ages 50 to 85. This product offers term life insurance, which is also called “pure coverage,” or a whole life policy that provides a cash benefit value. Keep in mind these are graded benefit policies that only offer coverage in year four and after.

“Graded benefits” means you don’t get the full death amount (only partial) if you die in the first four years, and only if you die after year 4 are you eligible for the entire amount for which you bought the policy. This is a simplified life policy that doesn’t require a medical exam, and only has a few health questions on the application.

Senior Life Term Highlights

- Issue ages 50–70.

- Face amounts $10,000–$150,000.

- Term length of 10, 20 and 30 years.

- Guaranteed level premium.

Senior Life Whole Life

- Issue ages 50–85.

- Face amounts $10,000–$150,000.

- The policy starts paying the full benefit after year 3.

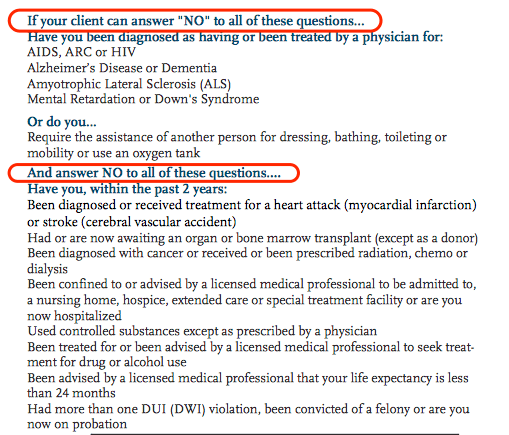

RAPIDecision Final Expense

Final expense insurance (or burial insurance) is a type of life insurance that can help with one’s final or last expenses, which include funeral costs and debts that are associated with it. This is permanent life insurance that has no expiration date and has a cash benefit value to the policy.

The coverage amounts with Fidelity Life are from $5,000 to $35,000. There is no medical exam and the application has only a few health questions. Upon approval, full coverage starts immediately and the premium and death amounts are guaranteed to stay level (the same).

RAPIDecision Final Expense Health Questions

RAPIDecision Guaranteed Issue

This is a guaranteed issue whole life insurance policy that requires no health questions on the application or an exam. It is available for individuals ages 50-85, with max face amounts up to $20,000. All will qualify if they are within this age group.

Keep in mind, every guaranteed issue policy has graded benefits, and with Fidelity Life, it has a reduced death benefit in the first three years. The premium is guaranteed to stay the same, and the full coverage starts in year 4.

RAPIDecision Accidental Death Benefit

I never consider this type of coverage as a life insurance. Accidental coverage protects you in case you die as a result of an accident. So, if you die from cancer, diabetes, or any lifestyle-related issue, the policy will not pay. Fidelity Life offers coverage from ages 20-59, with limits of $50,000-$250,000.

Fidelity Life Riders

- Dependent Child Riders: available for eligible dependents for up to $25,000 in death benefits. Expires when the child turns age 23, or the insured turns 65, whichever is earlier.

- Accidental Death Riders: life benefit $25,000 to $250,000, issue ages 20-65.

- Accelerated Death Benefit Riders: this rider is included with universal life insurance at no additional cost and will pay up to 50% of your death benefit upon the insured being diagnosed with a terminal illness that reduces his/her life expectancy to less than 12 months.

Related: Life insurance riders explained.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Fidelity Life Association vs. Other Carriers’ Sample Monthly Rates

*All rates quoted on this page are for a super-preferred healthy individual who does not use tobacco. Monthly rates are updated as of Feb 2017 and are subject to underwriting approval.*

Is Fidelity Life Association a Good Choice?

Fidelity Life is a great company with strong financial strength ratings. Like any other company we review, it’s very difficult to recommend an insurance company to everyone without knowing their health history and the type of policy they are after. Their hybrid type of policy is a great idea if you need a policy very quickly and don’t have time to take the medical exam now (they give you up to six months). While many life insurance companies require medical exams for all policies, including term life policies and final expense insurance, Fidelity Life doesn’t require them. Customers can feel confident because the company can provide beneficiaries with the death benefits covered by the policy.

However, if you need a large coverage amounts for your family, you should look for other life insurance companies, because their coverage is limited. The maximum coverage amount for term life insurance options is $1 million, whereas whole life policies stop at $150,000.

Their guaranteed issue has a 3-year graded benefits timeframe, while others, such as Gerber Life Insurance Company, have only 2 years. They are very competitively priced for the ages of 70-80. Fidelity is only one company from over 50 that we represent. You can go ahead and use the quoter on this page to see ballpark rate estimates.

Frequently Asked Questions

Are Fidelity Life Insurance reviews positive?

Fidelity Life insurance reviews cover a range of topics, including their products and rates. These reviews aim to provide you with the necessary information to make an informed decision.

What financial ratings does Fidelity Life Association have?

According to A.M. Best, a leading ratings provider, Fidelity Life has an A- (excellent) rating as of June 24, 2016. However, the complaint ratio for Fidelity Life in 2020 was relatively high, based on NAIC complaint ratios.

What products does Fidelity Life offer?

Fidelity Life offers long-term care and universal life policies with various riders that can be customized to meet your needs. They also provide term life insurance, final expense insurance, and accidental death benefit coverage.

What is RAPIDecision Life offered by Fidelity Life?

RAPIDecision Life is a term life insurance policy provided by Fidelity Life. It offers a quick and streamlined application process, with policy issuance within 24-48 hours. It also includes an accidental death benefit component.

Is Fidelity Life Association a good choice for life insurance?

Fidelity Life is a reputable company with strong financial ratings. They offer unique policies, such as RAPIDecision Life, that can be beneficial for those who need coverage quickly without a medical exam. However, the coverage amounts for larger policies are limited compared to some other insurance companies. It’s essential to consider your specific needs and compare quotes from multiple insurers to make the best choice.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Life Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.