HSBC Life Insurance Review (Companies + Rates)

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

HSBC Life Insurance Overview

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1865 |

| Current Executive | CEO – John Flint |

| Number of Employees | 235,217 |

| Total Sales / Total Assets | $86,131,000 / $2,558,124,000 |

| HQ Address | 452 Fifth Avenue New York, NY 10018 |

| Phone Number | 1-866-586-4722 |

| Company Website | www.us.hsbc.com/ |

| Premiums Written - Individual Life | $11,338 |

| Financial Standing | $13,721,000 |

| Best For | Individual Life Insurance Policies |

Hong Kong and Shanghai Banking Company, or HSBC, is a worldwide bank that also offers life insurance policies. You don’t have to be a banking customer to take advantage of these policies. If you’re looking for the cheapest life insurance policies, this company is probably on your list.

HSBC brings its banking expertise to the life insurance industry by hiring financial experts to work on the life insurance side.

Potential policyholders meet with a financial expert on the phone or in-person to discuss their needs and get set up with life insurance.

Life insurance is an important part of your financial planning. You need this coverage so your family will be protected in the event of your premature death.

Ready to find out which life insurance companies might meet your needs? Get a FREE online quote using our tool above.

Shopping for Life Insurance Quotes

More than a third of consumers would feel the financial impact of a loved one’s death within a few months. That’s why it’s important to buy the right life insurance policy for you and your family.

Younger people often don’t buy the life insurance they need because they think it’ll be too expensive or that it’s not a top priority right now. Keep in mind, though, that no matter your age, you never know what could happen.

Accidents and catastrophic illnesses can occur at any age, so it’s important to have life insurance so that your family will be protected in the event of a tragedy.

Average HSBC Life Insurance Rates by Age

HSBC offers several life insurance products to meet your family’s needs. The table below shows the average rate you can expect to pay for life insurance:

Life Insurance Monthly Rates by Age, Gender, & Tobacco Use

| Demographics | Male Non-Smoker | Female Non-Smoker | Male Smoker | Female Smoker |

|---|---|---|---|---|

| 25-Year-Old | $15 | $14 | $27 | $21 |

| 35-Year-Old | $16 | $14 | $31 | $24 |

| 45-Year-Old | $23 | $21 | $54 | $41 |

| 55-Year-Old | $45 | $35 | $116 | $83 |

| 65-Year-Old | $109 | $75 | $278 | $189 |

You should consider all your options before buying a policy so you can get the coverage that best meets their needs.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

About HSBC Life Insurance

The Hong Kong and Shanghai Banking Corporation was founded in 1865 by Scotsman Thomas Sutherland. Sutherland was an employee at a shipping company in Hong Kong and was inspired by an article he read about Scottish banks to open a bank that would facilitate trading between Europe and Asia.

Although Sutherland quickly got the backing of 14 large Hong Kong businesses, HSBC went through some difficult times because of the world situation.

Both the Great Depression and World War II made it difficult for the young bank to do business in Asia, and it moved its headquarters to London in 1941. However, it returned to Hong Kong after the war, and Hong Kong has always been the heart of its operations.

Today, HSBC is a worldwide bank with many subsidiaries that operate globally and offers life insurance products as well as banking services. Some of the highlights of its long history:

- The company issued loans for infrastructure projects in China in the late 1800s, including the first public loan in China and the first loan financing a public railway system.

- Many British staff members were captured as prisoners of war during World War II as employees worked for as long as possible under dangerous conditions so that consumers could send money abroad.

- Chief Manager Sir Vanedeleur Grayburn died in 1943 from an illness sustained after he was captured trying to smuggle food and medicine to staff being held as prisoners of war.

- In 1959, HSBC acquired the British Bank of the Middle East, which allowed it to expand its operations.

- In 1987, HSBC took full ownership of Marine Midland Bank in the United States, solidifying its status as a worldwide bank.

- HSBC established HSBC Holdings in 1992 to oversee its expanding group of banks.

- In 1998, HSBC unified its branding worldwide, creating a logo based on the Scottish flag in tribute to its origins.

- In 2017, HSBC began operating HSBC Qianhai Securities Limited, the first joint venture company in mainland China to be owned by a foreign bank.

Although HSBC continues to be based in China, it has expanded to offer insurance all over the world and will likely continue to do so.

HSBC’s Ratings

There are few ratings available for HSBC’s life insurance products. However, several consumer and credit rating agencies have evaluated HSBC Bank.

Unfortunately, most ratings of the bank aren’t positive. HSBC bank is considered to have a negative future outlook by Moody’s and Standard & Poor’s, and most consumer reviews are negative. However, J.D. Power does give HSBC high ratings for customer satisfaction in Singapore.

Better Business Bureau (BBB)

HSBC received a mark of F from the Better Business Bureau, which tracks consumer complaints and how they are resolved. The BBB gave HSBC a failing mark because it didn’t respond to 55 complaints against its business and didn’t resolve an additional six complaints.

In addition, HSBC receives an average rating of one star from customers on the BBB website. It’s important to note, however, that most of the complaints appear to be about its banking services. There is little to no information about how consumers feel about its life insurance offerings.

Moody’s

While Moody’s doesn’t have any ratings specifically for HSBC’s life insurance, it rates its parent corporation, HSBC Holdings, at Aa3. According to Moody’s, the company’s outlook is somewhat negative.

“The negative outlook on HSBC Bank’s long-term deposit and senior unsecured debt ratings reflects Moody’s expectation that the repositioning of HSBC Bank, in particular of its European Global Banking and Markets and its French retail franchises, will entail substantial restructuring costs and net income losses over the outlook period and will increase execution risk.” – Moody’s

Moody’s is concerned with changes to the bank in European markets but again doesn’t comment on the outlook of HSBC’s life insurance products.

Standard & Poor’s (S&P)

Standard & Poor’s last gave HSBC Life Insurance Ltd a credit rating of AA+ in 2011. However, S&P reviewed HSBC Bank USA in November 2019 and gave it a credit rating of AA-, indicating a negative future outlook.

HSBC’s Market Share

There is little information available about HSBC’s market share over the past few years. It isn’t listed in the NAIC top 125 for 2018 and didn’t make this list in 2016 or 2017, either. This means that it holds less than .01 percent of the market because the bottom-ranked company on the NAIC list has a market share of .01 percent.

Despite its low market share, HSBC earns sizable revenues each year. HSBC Holdings, which is the parent company for all HSBC subsidiaries, took in an average of $50 billion per year from 2016–2018. HSBC USA, which is the subsidiary that sells life insurance, takes in an average of $250 million per year.

HSBC Life Insurance Revenue (2016–2018)

| Years | Total Revenue |

|---|---|

| 2016 | $218,000,000 |

| 2017 | $1,049,000,000 |

| 2018 | $586,000,000 |

HSBC is a worldwide company that’s based in Hong Kong. Over the years, it’s expanded throughout Asia as well as opening offices in Europe and North America. It has subsidiaries all over the world, many of which are overseen by HSBC Holdings Ltd in London. Its principal subsidiaries are located across the globe:

HSBC Holdings Ltd Subsidiaries Worldwide by Region

| Regions | Subsidiaries |

|---|---|

| Europe | HSBC Bank Europe HSBC Bank Malta HSBC Private Bank (Suisse) SA HSBC UK Bank plc |

| Middle East | HSBC Armenia HSBC Armenia HSBC Bank Egypt HSBC Bank Jordan HSBC Bank Middle East HSBC Bank (Turkey) The Saudi British Bank |

| North America | HSBC Bank Bermuda HSBC Bank Canada HSBC Bank USA HSBC Finance Corporation HSBC Mexico HSBC Securities (USA) Inc. |

| South Asia | HSBC Bangladesh HSBC Bank India HSBC Sri Lanka |

| Southeast Asia | HSBC Bank Indonesia HSBC Japan HSBC Korea HSBC Malaysia HSBC Philippines HSBC Singapore HSBC Taiwan HSBC Thailand HSBC Vietnam |

HSBC Holdings is ranked 49th on Forbes’ World’s Most Valuable Brands list and 21st on its 2019 Global 2000. As mentioned above, the parent company’s revenue averages in the billions, though HSBC USA doesn’t hold any significant share of the life insurance market.

HSBC is considered a moderate to severe risk for investors, most likely because of the amount of debt it carries.

For policyholders, this means there’s a significant chance that HSBC won’t have the money to pay out insurance claims at the time they are needed.

HSBC USA Life Insurance Premiums (2016–2018)

| Year | Premiums Written |

|---|---|

| 2016 | $20,000,000 |

| 2017 | $14,000,000 |

| 2018 | $11,000,000 |

The number of premiums HSBC has written has steadily fallen from 2016–2018. Life insurance premiums fell from a high of $20 million in 2016 to a low of $11 million in 2018, almost half of what they were two years previously.

Life insurance is clearly not the most profitable aspect of HSBC’s business. The company is writing fewer premiums every year, which means it’s taking less money in from life insurance over time.

Lower numbers of premiums written mean lower levels of revenue for HSBC USA’s life insurance division. In addition, the premium numbers are in the low millions. In comparison, the most successful life insurance companies take in billions of dollars of premiums each year.

Northwestern Mutual, for example, which holds the top spot on the NAIC list, writes over $10 billion worth of premiums per year.

Market Share of the Top 10 Life Insurance Companies and HSBC

| Rank | Company/Group | Market Share |

|---|---|---|

| 1 | Northwestern Mutual | 6.42% |

| 2 | Metropolitan | 6.00% |

| 3 | New York Life | 5.68 |

| 4 | Prudential | 5.57% |

| 5 | Lincoln | 5.36% |

| 6 | Massachusetts Mutual | 4.19% |

| 7 | Aegon US | 2.94% |

| 8 | John Hancock | 2.83% |

| 9 | State Farm | 2.83% |

| 10 | Minnesota Mutual | 2.70% |

| N/A | HSBC | N/A |

It’s difficult to assess exactly how competitive HSBC is since there is no data available on its precise share of the market.

However, considering the far larger number of premiums written by the top 10 companies and that HSBC’s market share isn’t significant enough to make the NAIC top 125, it’s safe to say that HSBC isn’t very competitive with major life insurance companies.

HSBC USA took in profits of $320 million in 2018.

Its annual report doesn’t indicate how much of this profit came from the life insurance agency.

In any case, HSBC USA is on the upswing again after declining profits from 2014 to 2016 and a loss of $179 million in 2017. The company’s increased profitability means it’s more likely to be able to pay out policyholders’ claims.

In contrast, the life insurance industry as a whole lost about $9 billion in 2018.

Regarding HSBC’s outlook for the future, it’s somewhat negative.

Its declining numbers for premiums written suggest that life insurance isn’t profitable for the company, and it has not cornered a significant enough share of the market to earn an NAIC ranking from 2016 to 2018.

In addition, Moody’s and Standard & Poor’s consider HSBC a credit risk because of its debt-to-assets ratio, and HSBC’s stock is declining at a time when the industry average is up 26.18 percent.

In comparison, MetLife, which holds the number 10 spot in terms of market share, saw its stock go up by 1.42 percent in December 2019.

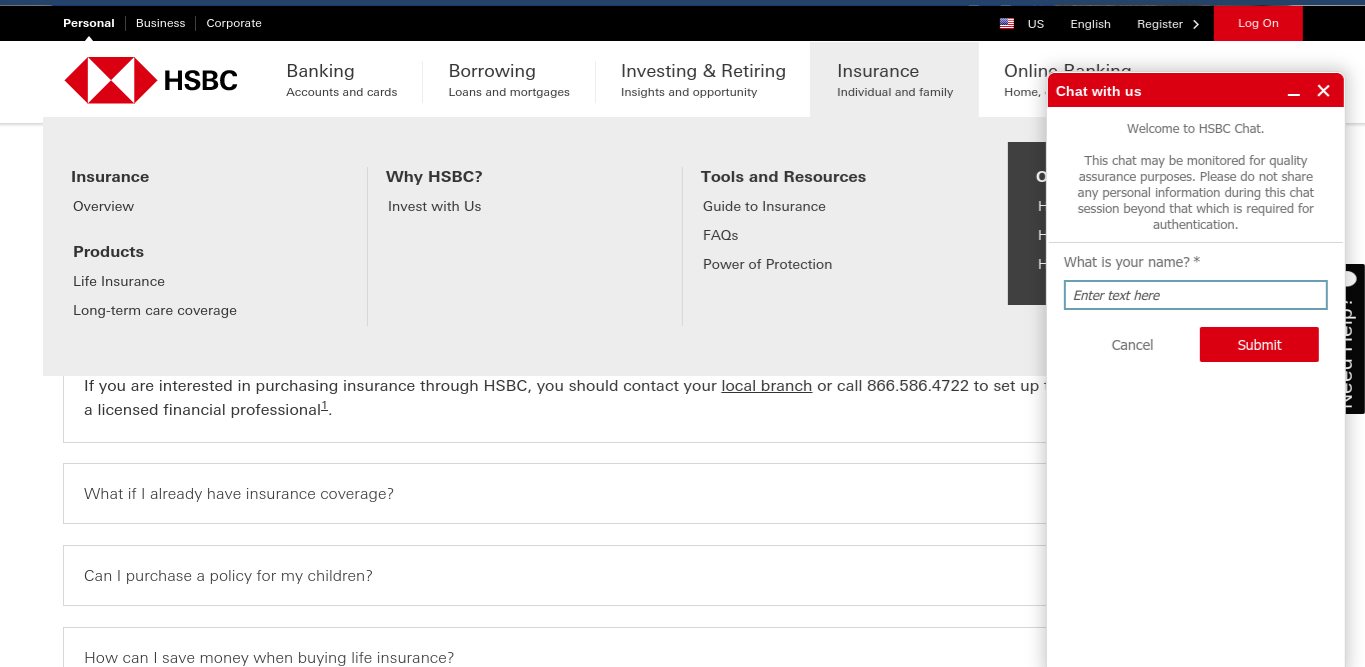

HSBC’s Online Presence

HSBC offers life insurance through a page on its HSBC USA website.

The main website is easy to navigate. Consumers can quickly find information about life insurance or other HSBC products they may be interested in, and there is a link for insurance on a menu at the top of the site.

The insurance webpage is well-organized and provides information about different life insurance products in an easy-to-read format. However, the page is rather sparse and contains no extras beyond the information about life insurance products.

The life insurance site is dedicated to turning potential customers into policyholders. Contact information is easily available, though HSBC doesn’t offer live chat with agents via its webpage.

Consumers should find it easy to focus on the information on this site, as information for investors and company news have their own pages rather than being featured on the homepage.

HSBC’s Commercials

Because HSBC considers Hong Kong its base of operations, many of its commercials are specific to Hong Kong and feature voiceovers in both Chinese and English.

One of its most effective commercials features a child in Hong Kong who has pledged to take good care of an egg. The commercial demonstrates the boy’s level of commitment to this task, but at the end, he almost drops the egg while coming off a school bus and an adult has to catch it for him.

The final seconds of the commercial feature an English voiceover encouraging viewers to purchase life insurance so that they can help their families out if a similar random mishap happens to them.

A similar commercial features a father practicing ballet so he can perform with his young daughter, who asks him in Chinese to jump higher. The father needs some help to complete the dance move successfully, and viewers are encouraged to purchase life insurance to get help reaching their highest goals.

These commercials come out of the HSBC Hong Kong life insurance department. There are no similar commercials available from HSBC USA.

HSBC in the Community

HSBC is active in communities throughout the world.

The HSBC Water Programme aims to help people around the world gain access to clean water and sanitation. This is an eight-year program that costs about $150 million and works to provide people around the world with clean water in addition to providing education and information about sanitation.

HSBC partners with Earthwatch, Water Aid, and local project partners around the world to achieve its community-related water goals.

Since the HSBC Water Programme began in 2012, significant progress has been made toward increasing access to water and sanitation in project areas.

Working together with local partners, WaterAid has reached 1.65 million people with clean water and 2.5 million people with sanitation services, as well as delivering hygiene education programs. Some 400 HSBC employees have supported WaterAid through volunteering or by taking part in personal fundraising challenges.

Many employees take part in fundraising challenges or in posting on Twitter using the #waterstories hashtag to help spread awareness about sanitation or about the work HSBC is doing in this area. HSBC and its partners encourage people to make videos answering questions such as “What does water mean to you?” and post them on Twitter using this hashtag.

HSBC also gets involved in local communities in a variety of ways. For example, in Canada HSBC is active in supporting children’s hospitals through a community fund as well as taking action to support indigenous communities.

HSBC’s Employees

HSBC Holdings, the U.K. company that oversees most of HSBC’s subsidiaries, employs over 10,000 people, according to Glassdoor.com. Employees rate the company an average of 3.1 stars out of 5, and 73 percent of employees would recommend the company to a friend.

Employees enjoy benefits such as health insurance and paid time off, though some employees complain in their reviews that their company-issued health insurance requires them to spend large amounts out of pocket before their insurance kicks in.

Most employees feel that HSBC is a good place to work and provides an appropriate work-life balance, though employee reviews state that differences in management across locations can influence how much they enjoy working at HSBC.

HSBC considers diversity to be an essential ingredient for international success and is committed to including people of diverse backgrounds throughout its branches all over the globe.

“As a business operating in markets all around the world, we believe diversity brings benefits for our customers, our business, and our people. We want a connected workforce that reflects the communities where we operate and helps us meet the needs of customers from all walks of life. Different ideas and perspectives help us innovate, manage risk, and grow the business in a sustainable way — and the difference is celebrated within our brand.” (HSBC website)

HSBC actively takes steps to maintain a diverse workforce such as:

- Hosting career fairs aimed at diverse populations

- Making a commitment to the 30 Percent Club to ensure 30 percent of its leadership positions are filled by women by the end of 2020

- Working with non-governmental organizations to ensure that opportunities are extended to marginalized populations throughout the world

The company is a Stonewall Top Global Employer for 2019 and made the Financial Times Diversity List for 2020.

HSBC’s commitment to diversity includes respect for neurodiversity and targeted efforts to hire people with autism.

Awards HSBC has received include:

- Stonewall Top Global Employer – 2015–2017; 2019

- Stonewall Global Trans Inclusion Award – 2017

- Financial Times Diversity Leaders List – 2020

- Company of the Year at the European Diversity Awards – 2017

- EuroMoney Market Leader – 2020

- Europe Financial Bond House of the Year – 2019

- Western Europe Issuers Bond House of the Year – 2019

- Asia Bond House of the Year – 2019

- Inflation Derivatives House of the Year – 2020

The company has also received awards from a multitude of financial and risk management organizations.

HSBC’s Life Insurance Policies

HSBC’s focus is on offering life insurance products to help with your long-term financial goals. Its philosophy involves the belief that people’s needs change as their stage of life changes, and insurance specialists want to help you find the best products to prepare you for the future.

HSBC offers several insurance products for individuals and families. Whether you’re a young person just starting out in life or nearing retirement age, HSBC wants to be able to meet your financial needs.

HSBC Life Insurance Products

| Product | Who It's Best For |

|---|---|

| Term life | Individuals/families looking for basic life insurance |

| Whole life | Older people who want a guarantee of permanent protection |

| Universal life | People who want flexible coverage and the ability to get benefits while still alive |

| Variable universal life | People who have knowledge about investments and want to invest their life insurance funds |

| Long-term care | People who want to protect their assets in the event of a permanently disabling medical condition |

If you have a family history of serious diseases such as diabetes or heart disease, have suffered a stroke or heart attack yourself, or otherwise expect that you may need assistance with daily tasks as you get older, long-term-care coverage may be an option for you.

Long-term care coverage can give policyholders peace of mind. It covers the cost of assisted living, including home health aides, so you don’t have to worry about how you’ll afford medical assistance should the need arise.

While many older people take advantage of this policy, anyone can purchase it, and it may be cheaper to buy when you’re younger and at less risk of needing to make a claim.

However, many young people find that they benefit most from term life insurance. This type of insurance covers your family’s financial needs should you die within a specified period of time. This type of coverage is cheaper, especially if you’re under 35 years of age, but it only covers you for the specified term, so you won’t be covered if you die after the policy expires.

For example, if you purchase a 10-year policy and die 16 years after you purchase it, your family won’t be covered.

HSBC offers several types of life insurance. This company’s focus is on helping you plan and provide for your family in the future.

Term Life Insurance

Term life insurance covers you for a specific period of time — in HSBC’s case, 10, 20, or 30 years. You pay a monthly premium during that time, and if a tragic event occurs your family will be covered.

The advantage of term life insurance is its price.

Term life insurance premiums are generally far cheaper than whole life insurance premiums. However, keep in mind that term life insurance is only good for a specified period of time.

Many life insurance companies offer the option of converting term life to whole life at the end of the term.

HSBC doesn’t mention this option on its website but does encourage policyholders to review their term life insurance policies every few years and update them if needed.

It’s best to contact HSBC directly if you have questions about your options for extending or converting a term life insurance policy.

Whole Life Insurance

Whole life insurance offers policyholders permanent coverage. Most often, older people take advantage of this type of insurance, especially because it may be difficult for people over 50 to get term life insurance at a reasonable rate.

However, anyone can purchase whole life insurance, though most companies don’t insure people over the age of 85, and it may be cheaper to do it when you’re younger.

Some of the advantages of whole life insurance include:

- You’re covered for the rest of your life. There’s no expiration date on whole life insurance like there is with term life insurance, so if you’re fortunate enough to live another 50 years your family will still be covered.

- You can borrow against the cash value of your policy. So if you have an emergency such as a medical crisis, you can borrow funds from your policy’s current cash value to cover it.

Some insurance companies offer no-exam whole life insurance policies. No-exam policies are helpful if you have a pre-existing medical condition, as many insurance companies don’t want to insure people who they consider at high risk of dying soon.

It isn’t clear from HSBC’s website whether this is the case, so you’ll have to contact the company directly to find out if this is an option.

Universal Life Insurance

Universal life insurance is a type of permanent life insurance that’s a bit more flexible than whole life insurance.

This type of insurance is similar to whole life insurance in that your premiums help to build up the policy’s cash value and you can borrow against the policy’s current value if you need to.

Indexed Universal Life Insurance

HSBC’s indexed universal life insurance offers flexible payments. You can overpay one month to build up the policy and underpay the next if you wish, as long as you maintain the minimum cash value.

The flexible payment schedule is especially attractive if you’re a small business owner or your income fluctuates from month to month for other reasons.

In those scenarios, you can reduce your financial stress by buying a universal life insurance policy. If you have a bad month, you can just pay less on your policy that month.

In addition, HSBC invests the funds you put into your policy, which allows the policy’s value to grow exponentially. In this way, universal life insurance can function similarly to a 401(k) or another retirement fund.

Some people prefer to use universal life insurance to save for retirement, as they can borrow against the policy’s cash value easily and their final expenses are also covered should they die before retirement.

Variable Universal Life Insurance

HSBC’s variable universal life insurance policy differs from standard or indexed life insurance in that it offers policyholders the opportunity to invest in higher-risk stocks, bonds, and mutual funds.

Policyholders can choose to allocate their funds to one or several investment vehicles, which gives you control over how your funds are invested and how much your policy’s cash value grows.

This type of insurance is best for experienced investors who understand the risks involved. If you invest unwisely, you could lose cash value instead of gaining value, so it’s important to know what you’re doing.

Greater risk means greater rewards, however, so if you have the investment knowledge and are willing to take the risk, you could end up with a sizable amount of money to cover your expenses and provide for your family in the event of a critical illness or your death.

Long-Term Care Insurance

HSBC offers long-term care insurance as one of its life insurance options. This type of insurance covers you if you become critically ill or need medical assistance to complete daily tasks.

If you’re young and in good health, you might not have considered this type of coverage.

A critical illness can occur at any time in your lifetime, so you may want this type of insurance regardless of your age or health. That said, the majority of people who take advantage of this type of insurance are senior citizens, as Alzheimer’s and other debilitating illnesses strike older people more frequently.

Long-term care insurance provides for a full-time home health aide or therapist as well as covering the cost of a nursing home or assisted living facility. Policyholders can choose the facility or home health aide that best meets their needs.

Riders

HSBC does not offer any riders to its insurance. However, you can purchase long-term care insurance if you want any expenses related to a debilitating illness or injury to be covered.

Factors That Affect Your Rate

Every insurance company has its own formula for calculating insurance rates. However, there are several factors that almost always affect your rates: age, gender, occupation, hobbies, and health history, especially whether or not you smoke.

Demographics

Demographic factors such as age and gender often affect your rates.

The older you are, the higher your rate is likely to be. Life insurance rates are based on how likely you are to die soon. People are living longer, and some people are as active in their 70s, 80s, and even 90s as people in their 30s and 40s. But since we all die eventually, the older you are, the closer you are to the end of your life, and your rates will reflect that.

Women also tend to outlive men. As a result, rates for men are going to be a little higher than for women. This is generally true even for women who smoke. Their rates may be higher than for non-smoking women but will still be lower than rates for men who smoke.

Your marital status also affects your life insurance rates. There is some evidence that married people live longer than those who are single or divorced, so your rates may be slightly higher if you’re unmarried.

Current Health & Family Medical History

Current health is one of the primary factors affecting life insurance rates. Remember, your rate is based on how likely it is that you’re going to need to file a claim anytime soon. So if you have a serious condition such as Type 2 diabetes, cancer, or heart disease, your rates are going to be higher.

HSBC will also look at your family’s medical history because that history can influence your likelihood of developing a serious or fatal disease.

If diseases such as cancer run in your immediate family — for example, if a parent or sibling has suffered from one of these diseases — your rate may be higher.

In some cases, it can be hard to get life insurance because of pre-existing medical conditions. Many insurers offer a no-exam option for whole life insurance so that people who have pre-existing conditions can still get coverage.

In general, though, you’ll have to have a medical exam and get your cholesterol level, blood pressure, and other vital indicators of health checked.

Even if you buy a no-exam policy, insurance underwriters still will have access to your prescription records and will be able to look at your Medical Insurance Bureau records.

Your past medical records are confidential, but when you apply for insurance you’re required to give consent to the underwriters to access your MIB records. These records are encrypted medical information records that underwriters can use to help them assess the level of risk before they insure you.

High-Risk Occupations

What you do for a living can affect your life insurance rates. In general, if it’s reasonable to assume your job will lead to serious injuries or premature death, you can expect to pay more for life insurance. For example, if you’re a stunt double, you’re risking life and limb regularly on the job, so you’ll pay more for life insurance.

Check out the video to find out about other occupations that you may not have realized were high-risk.

As you saw from the video, other high-risk occupations include being a pilot or a roofer.

High-Risk Habits

If you engage in high-risk habits that may shorten your life, you can expect to pay more for life insurance. Some hobbies are high-risk, so if you go skydiving, mountain climbing, or bungee jumping, you can expect higher life insurance rates.

Smoking almost always results in higher life insurance rates.

This habit puts you at risk of developing lung cancer, heart disease, or other serious illnesses, which makes you a higher risk for a life insurance company to insure.

Other high-risk habits include:

- Having a poor driving record. If you have a history of serious accidents or have ever been arrested for driving under the influence, you’re considered a greater risk.

- Having a history of drug abuse. If you abuse alcohol or drugs, it’ll be difficult, if not impossible, to get life insurance. However, if you’ve abused drugs in the past, you might be able to get insurance, but the rates may be higher depending on how long you’ve been clean and sober. Most life insurance companies ask how long it has been since you last used to try to gauge the risk.

Veteran or Active Military Status

You may have joined the military to serve the United States, but you’ll pay higher life insurance rates. This is because active military members often take risks with their life, especially if you’re stationed in a combat zone.

Veterans also often pay higher rates because many service members come back with physical and mental disabilities that can affect both the quality and the length of their lives.

There is a high rate of post-traumatic stress disorder among veterans, and veterans may have also lost limbs or sustained other serious injuries in combat.

In addition, sometimes veterans develop illnesses years after their service is complete because of exposure to chemicals or other environmental risks while they were serving.

Getting the Best Rate with HSBC

Life insurance rates are set on a state-by-state basis. Each state can best ascertain the risks, needs, and expenses associated with death and burial for residents of that state, and rates can vary based on your geographical location.

However, NAIC has provided model laws for each state to follow, and your state’s guidelines might be based on that model. New York, for example, sets its insurance rates based on three factors: the average mortality rates for the state, the average interest rates for investments, and the average expenses related to running an insurance company.

Your state might have slightly different criteria, but the principle is still the same: rates are determined by your risk level and how much the insurance company can expect to spend on providing insurance to all its policyholders versus how much it expects to earn by investing the revenue it takes in.

Your life expectancy is the determining factor in how much you’ll pay for life insurance.

All the factors discussed in the section above boil down to one thing: how long does the insurer think you’re likely to live? The longer your life expectancy, the lower your risk. That’s why younger people usually get lower rates than older people and why smoking or a history of drug use can make rates skyrocket.

You can sometimes mitigate the effects of age or other risk factors by purchasing less coverage or a shorter-term life insurance policy. Keep in mind, though, that the most important thing is to get the coverage that you’ll need, and that these solutions could put your family at risk of inadequate or non-existent coverage after your death.

The best ways to get a good rate with HSBC include:

- Stay healthy – Visit your doctor regularly, follow medical advice, and exercise as much as your medical provider thinks is healthy for you. If you have a reversible condition such as pre-diabetes, talk to your doctor about what you need to do to change that condition and do it before you buy life insurance.

- Don’t smoke – Smoking is a primary factor that raises life insurance rates, so if you smoke, the best thing you can do for your rates (and your health!) is quit. If you don’t currently smoke, don’t start.

- Pay on time – Late payments can result in late fees as well as in lapses in coverage, so make sure you pay your bill before its due date every month. If you’re having a financial problem, contact HSBC to discuss your options so that you won’t get hit with big late fees.

- Research your needs before you buy – It’s more expensive to buy additional coverage after the fact than to buy the right amount of coverage to begin with. So talk to a financial advisor, research burial and other costs, and discuss it with your family before you get your first quote.

- Buy as early as possible – The younger you are, the lower your rate is likely to be. Don’t put off buying life insurance until you’re older.

HSBC provides life insurance products for people of all ages. However, its products are geared toward people who want to use life insurance as part of a comprehensive plan to increase their wealth or save for retirement.

For this reason, the first step in applying for life insurance via this company is to talk to a financial advisor who works for HSBC. This person helps new applicants formulate financial goals, understand different offerings, and choose the life insurance package that’s best for their needs.

This isn’t to say that people who have already retired can’t take advantage of HSBC’s life insurance programs. However, these products aren’t geared toward this population as much as they are toward younger people.

However, HSBC does offer whole life insurance, which is often more suitable for older people who want to make sure they are covered regardless of how much longer they live.

As of January 2020, there’s no specific information available about HSBC’s rates for term or whole life insurance.

How to Get a Quote Online

HSBC doesn’t offer quotes online.

Instead, the company requests that potential policyholders contact them by phone so that one of their financial advisors can walk you through the process of deciding what type of insurance policy you want to buy, provide you with a quote, and possibly make the sale that day.

HSBC requires potential policyholders to call them for a quote. Alternatively, you can meet with a financial advisor face-to-face at your local HSBC branch.

Before contacting HSBC, make sure you have the following information:

- Personal information such as your full legal name, date of birth, and gender

- Contact information such as one or two phone numbers you can be reached at and your email address

- Information about your medical history, such as diseases you and your family suffer from and any medications you might be on

- Information about how much coverage you want and what type of policy you’re interested in. If you aren’t sure, you can ask your HSBC representative to help you understand your options, but it’s best to have this information ahead of time so that you make the best decision.

Once you’ve gathered all your information, give HSBC a call and a representative will help you understand your options and provide a quote.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Canceling Your Policy

Hopefully, you’ll be happy with your HSBC life insurance policy after you buy it. But sometimes, no matter how much research you do, you realize after the fact that the policy you’ve purchased isn’t the right policy for you. If that happens, you need to know how to cancel your policy.

In general, it’s easier to cancel a term life policy, but you should be able to cancel any policy you hold with HSBC by contacting the company.

In many cases, you can also convert a term life policy into a whole life policy or change your coverage amount, though these options may result in additional expenses.

HSBC may cancel your term life policy if you fail to pay your monthly premiums, but this isn’t the best way to cancel because it could harm your credit. It’s better to contact HSBC and ask that your policy be canceled.

How to Cancel

HSBC doesn’t allow policyholders to cancel their policies online. A representative will help you over the phone or in person if you need to cancel your policy.

In most cases, you won’t get a refund. If you have whole or universal life insurance, you can ask your representative whether you’re entitled to the cash value of the policy once you cancel.

#1 – Contact HSBC By Phone or Visit the Nearest Branch of HSBC Bank

The easiest way to cancel your policy is to contact HSCB’s insurance division at 1-866-586-4722. When you’re connected with a representative, tell them that you’d like to cancel your policy.

Alternatively, you can visit an HSBC branch and speak to an HSBC financial professional in person. Use the branch locator to find the closest branch to where you live.

#2 – Ask Your HSBC Representative for Any Needed Forms

Your HSBC representative will tell you what your next steps are after you confirm that you want to cancel your policy. Ask the representative to send you any necessary paperwork via mail or fax.

#3 – Fill Out Any Necessary Paperwork, & Send It Back

Once you get the paperwork you need, fill it out and send it back to complete your cancellation. It’s a good idea to fill out the forms as soon as possible after you receive them. If it’s close to when you have to pay your premium, you’ll want to process your cancellation before the due date so that you don’t get charged for another month.

#4 – Confirm That Your Cancellation Has Been Processed

Call HSBC again after you’ve sent back any necessary paperwork and confirm that your cancellation has been processed. If you’re charged for your monthly premium after your cancellation is complete, contact HSBC as soon as possible and ask that the money be refunded.

How to Make a Claim

When a loved one dies, it can be hard to think about all the things you need to do to take care of their burial and settle their estate. Filing your life insurance claim with HSBC will help, as you’ll get the benefits you need to pay for final expenses and support your family financially during this difficult time.

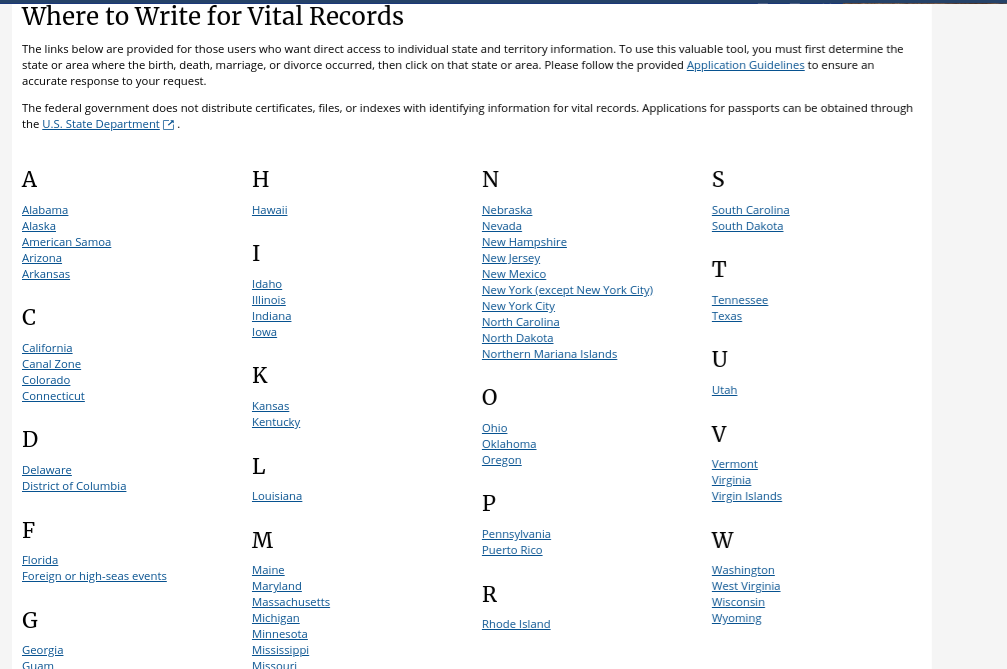

#1 – Obtain the Death Certificate

The first step in making any claim is to get a death certificate for your loved one. The death certificate contains information about your loved one’s death that HSBC will need to process your claim.

Contact the Department of Vital Records for your state to get the death certificate. Depending on your state, this department may be called by a different name, such as the Department of Births, Deaths, and Marriages.

You can find your state’s Department of Vital Records via the Centers for Disease Control and Prevention’s website.

Make sure you get multiple copies of the death certificate. Never send your only copy in the mail, as it could get lost. Instead, get multiple certified copies of the certificate so that you can keep one for your records.

#2 – Call HSBC’s Life Insurance Department

HSBC does not offer any forms online, so you’ll have to contact the company by phone to begin the claims process.

The claims representative will walk you through the process of making a claim. Make sure you have the following before you make the call.

- The policyholder’s full legal name

- The policy number

- The policyholder’s birth and death dates

The claims representative will need this information to file the claim on your behalf.

#3 – Fill out Needed Paperwork

Your HSBC claims representative will tell you which paperwork you need to fill out and help you get copies of the forms. As soon as you get the forms, fill them out and return them. The sooner you fill everything out, the sooner your claim can be processed.

HSBC makes every effort to get claims processed as soon as possible after a death so that you can get the funds you need right away. In general, it takes about seven days to get benefits, although it can take longer if HSBC has any questions about the information you submit.

HSBC’s Customer Experience

Of the top rating agencies, J.D. Power stands out for its emphasis on customer service. Regarding HSBC, J.D. Power’s 2019 Singapore Retail Banking Satisfaction Survey shows that consumers in Singapore gave the company the highest ratings of all banks. HSBC received a ranking of 769 out of 1,000 and five circles on its Power Circle Ratings™.

Most of HSBC’s customer service is delivered over the phone. Customers need to contact this company by phone to get a quote or file a claim.

However, potential policyholders can get some information about life insurance or HSBC online.

HSBC’s Programs

HSBC offers a guide to life insurance on its website. The guide explains the differences between term and whole life insurance and offers scenarios in which each product would be better.

The guide also offers general information about how to assess your financial needs when considering different types of life insurance policies and questions to ask yourself to help you determine the best way to reach your financial goals.

In addition to this brief guide, HSBC offers a Frequently Asked Questions section on its website, which features answers to general questions about different life insurance policies, how to apply for life insurance, and how to file a claim.

HSBC doesn’t offer any interactive tools such as an insurance calculator online but has recently added a live chat function.

While browsing its website, you can start a chat with an agent by clicking on the GET HELP button located on the side of the screen. The chat program requires you to provide basic information such as your name and your question before connecting you with an HSBC representative.

HSBC doesn’t offer any enrollment or other forms you may need online. You have to contact a representative by phone if you need to obtain a form.

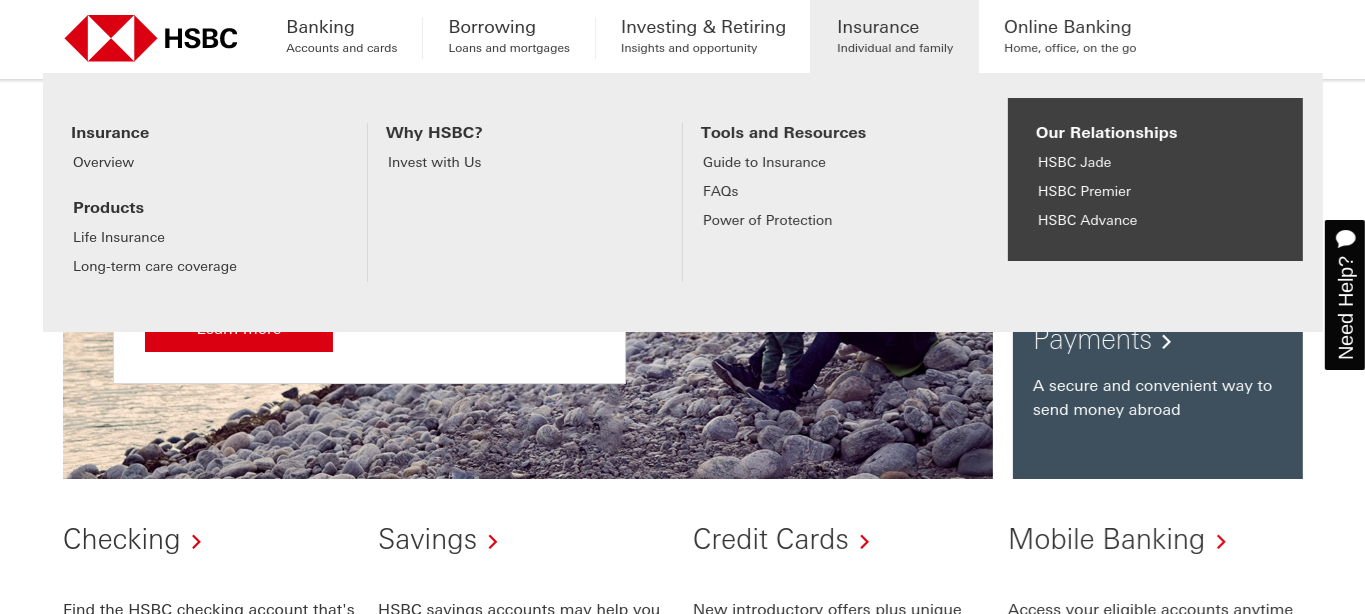

Design of Website/App

HSBC’s website isn’t particularly user-friendly, nor does it offer a ton of information or resources online.

This company is primarily a bank, so HSBC’s homepage is dedicated to banking.

There is a tab on the top of the page that’s labeled “Insurance.” You must hover over this tab to open a menu and click on the word Overview to get to the life insurance homepage.

To get to the insurance page, hover over “Insurance” and click “Overview.”

Don’t click where it says “Life insurance” instead of “Overview,” as this brings you to a page with information about term life insurance, with no links to get you back to the main insurance page.

If this is confusing, don’t despair. You can get to the insurance home page by bookmarking http://us.hsbc.com/insurance.

The life insurance page contains tabs and links for each type of insurance as well as links to an FAQ and a guide to life insurance.

Once you get to the insurance homepage, you can get some basic information about each life insurance product that HSBC offers. You can click the links for more information. However, each section only has basic information about the life insurance product; there are no links or buttons to get quotes, forms, or tools.

HSBC’s website is designed for potential policyholders. There is no members-only section or information about filing claims, other than a brief mention on the FAQ site that you’ll need to call HSBC to do this.

There’s live chat available on the FAQ page, but not on other areas of the site, and you need to look at the FAQ to find contact information for the life insurance department.

Hopefully, HSBC will improve this in the future, as their sister site for HSBC UK’s life insurance department contains a lot more information, including links to downloadable forms and a page dedicated to existing customers.

HSBC has an app for mobile banking services, but not for its life insurance services. Its website is easier to navigate on a mobile device than on a computer, as menus are collapsed and you can easily find what you’re looking for.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros & Cons

Deciding which life insurance company to go with is one of the most important decisions you’ll ever make. It’s important to evaluate the pros and cons of buying life insurance with HSBC before putting any money down.

Pros

There are several advantages to buying insurance with HSBC.

- HSBC is a worldwide company, which means that your family will be covered regardless of where in the world you live at the time of your death.

- HSBC employs full-time financial advisors who can help you figure out the best life insurance policy to help you meet your financial goals and can help you plan for retirement as well as assist with estate planning.

There are some negatives to the company, too, however.

Cons

Some of the drawbacks to working with HSBC include:

- HSBC doesn’t offer any services online. You have to call or come into a branch to buy a life insurance policy, file a claim, or even just get a quote.

- Life insurance isn’t its main business. HSBC is a bank that offers life insurance rather than a life insurance company, so it may not give you the superior customer service that a company fully dedicated to life insurance might give you.

- HSBC’s financial outlook isn’t great, which means that it may not always pay out claims on time.

It’s important to consider both the pros and cons before deciding whether HSBC is the right life insurance company for your needs. The lack of online services and focus on banking rather than life insurance may bother some customers, while others don’t see it as a big deal — it’s all up to you.

The Bottom Line

HSBC is a bank that offers a line of life insurance products. Its offerings are standard for the life insurance industry, but it doesn’t offer anything special.

The main advantage of buying life insurance from HSBC is that the company approaches insurance the same way it does banking. The process of becoming an HSBC customer involves talking to a financial specialist, choosing the right product for yourself, and signing on the dotted line in person or over the phone.

This is similar to how you might open a new bank account or apply for a loan.

However, it can be inconvenient to have to go into the bank or call a representative if you’re busy, and there’s no option to take care of your HSBC life insurance application or account online.

Many life insurance companies require you to contact them to finalize your purchase or claim, but most offer online quotes and/or forms online, which HSBC does not. However, if you’re already an HSBC customer, you may find it convenient to purchase life insurance where you do your banking.

The bottom line is that HSBC offers standard products, but its website offers substandard information and options, which means that you really have to know what you want before you sign up for insurance.

In addition, its failure to provide anything beyond the bare minimum on its website implies that life insurance isn’t HSBC’s top priority, so you can expect that you won’t get the customer service you might get elsewhere.

You need to keep a certain amount of money in your policy so that your family’s expenses will be covered after your death, but can also use the cash value of the policy the way you would the funds in your retirement savings account.

Ready to find out what your life insurance options are? Use our FREE online quote tool to get started.

Frequently Asked Questions

What types of life insurance does HSBC offer?

HSBC offers term life insurance, which provides coverage for a specific period of time, such as 10, 20, or 30 years.

Does HSBC offer whole life insurance?

No, HSBC does not offer whole life insurance. They primarily focus on term life insurance policies.

How can I get a quote for HSBC life insurance?

You can get a free online quote for HSBC life insurance by using the tool provided on their website.

Is HSBC a competitive life insurance company?

HSBC’s market share in the life insurance industry is not significant, and it is not considered very competitive compared to major life insurance companies.

What are the average rates for HSBC life insurance?

The average rates for HSBC life insurance depend on factors such as age, marital status, gender, and tobacco use. It is recommended to consider all options and discuss your specific needs with a financial expert to get the coverage that best meets your requirements.

I have a serious health condition. Does HSBC have a life insurance policy that suits my needs?

HSBC doesn’t have any specific information about no-exam whole life insurance or other options for people with chronic and serious health conditions on its website. However, it does state that certain policies — most likely whole life insurance for people over 50 — don’t require exams, and suggests you call them for more information about this.

You might also want to consider long-term care insurance, which will cover your expenses if your disease progresses to the point that you need a home health aide or live in an assisted living or nursing facility.

Are there any upper or lower age limits for who can purchase life insurance via HSBC?

Generally speaking, anyone over the age of 18 can purchase life insurance, although different insurance companies have different upper age limits.

In many cases, companies offer coverage for people up to the age of 85, though this upper age limit may vary based on the company. HSBC doesn’t offer any information about upper age limits on their website, so you’d have to call them to find out specifics.

I’m interested in using life insurance as part of my retirement planning. How does that work?

HSBC offers universal life insurance, which you can use similarly to the way you use your 401(k) or other retirement savings account. With universal life insurance, you choose how much you want to pay each month and HSBC invests your premiums.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.