John Hancock Life Insurance Review 2025 (Companies + Rates)

Our John Hancock life insurance review finds the company with an A+ rating from A.M. Best. A 25-year-old single, female, non-smoker can expect to pay an average of $14 per month for a John Hancock life insurance policy. John Hancock offers different types of life insurance policies, including term life, universal life, and final expense.

Read more

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Dec 11, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Dec 11, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

John Hancock Life Insurance Overview

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1862 |

| Current Executive(s) | Marianne Harrison (President and CEO) |

| Number of Employees | 6,700 |

| Total Sales / Total Assets | $251,360,000,000 / $609,760,000,000 |

| HQ Address | 197 Clarendon St., 4th Fl. Boston, MA 02116 |

| Phone Number | 1-800-732-5543 |

| Company Website | www.johnhancock.com |

| Premiums Written - Individual Life | $4,817,849,577 |

| Financial Standing | Total assets up 5.34% from 2018 |

| Best For... | Strong financial ratings, term with vitality program |

So you’re searching for the right life insurance, and you’re considering a top 10 life insurance company like John Hancock. You probably have so many questions: What type of life insurance policy should I get? Who has the best life insurance? Who is the best life insurance provider? How do these rates compare to others?

Is buying term life right for you? Who are the best life insurance companies? Maybe you’ve even seen other company’s ads and you wonder, how does John Hancock compare to Northwestern Mutual life insurance? What is the best life insurance policy?

In your John Hancock life insurance policy search, we want to support you. It sounds like a John Hancock life insurance review is exactly what you’re looking for. Our guide will walk you through everything you need to know about the company before deciding whether to take your business there.

Before we dive into this John Hancock life insurance review, check out our tool at the top of this page to help you get FREE life insurance quotes. Just enter your ZIP code and you’re good to go.

Average John Hancock Life Insurance Rates by Age

There’s a difference in premiums for those who engage in high-risk activities and lifestyles and those who don’t. Smoking is considered a high-risk activity because it increases your risk of dying prematurely.

Here’s a breakdown of average John Hancock life insurance rates by age chart in a non-smoker versus smoker rates for both John Hancock rates and for the average national rates, as compiled by the NAIC. You might be wondering, how much is John Hancock life insurance? Read below to find out more.

Non-smokers:

John Hancock Average Annual Life Insurance Rates for Non-Smokers

| Non-Smoker Demographics | John Hancock Average Annual Life Insurance Rates | Average Annual Life Insurance Rates |

|---|---|---|

| 25-Year-Old Single Female | $172.50 | $164.50 |

| 25-Year Old Single Male | $178.30 | $183.61 |

| 35-Year Old Married Female | $178.30 | $170.47 |

| 35-Year Old Married Male | $189.80 | $190.40 |

| 45-Year Old Married Female | $241.50 | $247.50 |

| 45-Year Old Married Male | $292.10 | $274.59 |

| 55-Year Old Married Female | $407.10 | $417.01 |

| 55-Year Old Married Male | $533.60 | $543.23 |

| 65-Year Old Single Female | $937.30 | $898.76 |

| 65-Year Old Single Male | $1,380.00 | $1,308.00 |

As you can see, John Hancock’s rates are higher than the national average. Comparing the two 25-year-old rates, John Hancock’s premiums are 4.6 percent higher than the national average. And when you get all the way to 65-year-old rates, that’s a 5.5 percent difference between John Hancock and the national average.

Smokers:

John Hancock Average Annual Life Insurance Rates for Smokers

| Smoker Demographics | John Hancock Average Annual Life Insurance Rates | Average Annual Life Insurance Rates |

|---|---|---|

| 25-Year-Old Single Female | $326.30 | $248.90 |

| 25-Year Old Single Male | $440.20 | $328.31 |

| 35-Year Old Married Female | $353.40 | $289.34 |

| 35-Year Old Married Male | $461.90 | $366.70 |

| 45-Year Old Married Female | $523.10 | $494.59 |

| 45-Year Old Married Male | $777.10 | $648.16 |

| 55-Year Old Married Female | $949.00 | $999.43 |

| 55-Year Old Married Male | $1,536.90 | $1,386.70 |

| 65-Year Old Single Female | $2,184.50 | $2,267.36 |

| 65-Year Old Single Male | $4,091.90 | $3,333.99 |

For the premiums that smokers would pay, there’s a whopping 31 percent increase between the John Hancock inflated rates and the national average.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

John Hancock’s Life Insurance Policies

John Hancock offers life insurance policies aimed at adults and adults with children. What is the best life insurance policy? Well, the best for you might not be the best for someone else, so “best” is really based on your needs. Read below to find out more.

Term Life Insurance

See the major benefits of John Hancock’s term life insurance below:

Term life insurance comes with these benefits:

- Terms come in 10, 15, and 20-year packages.

- You can apply easily and conveniently and receive an instant quote, possibly without exams applicable

- Get rewards for living healthily

As we discuss term life, please note that 20-year term life insurance packages are the most common.

Universal Life Insurance

Universal life insurance is a flexible policy that has lifetime protection and allows you to customize both the timing and amount of your premium. Read on for more information:

Key benefits:

- The amount and frequency of the premium payments can be adjusted.

- The policy account value grows based on a credited interest rate.

- You can withdraw and borrow cash from your policy, but be sure to pay the funds back.

- The policy contains protections which are tailored to your needs.

A key component of universal life is that you can withdraw and borrow from your policy, but remember to pay back funds. Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Indexed Universal Life Insurance

You might be wondering, is IUL worth it? Indexed universal life is like universal life in that it offers premium payment flexibility with a lifetime of coverage, but it also has opportunities to grow your cash value. It can be worth it if it’s the right fit for you. More information on indexed universal life insurance can be found below.

Key benefits:

- The policy does not directly participate in any stock or equity investments.

- You can withdraw and borrow cash from your policy, but remember to repay funds.

- You have the flexibility to switch between different premium allocation options as your needs change over time.

It’s important to remember you can have the flexibility to switch between different premium allocations as your needs change over time.

Variable Universal Life Insurance

Variable universal is like other universal policies (flexible and offers lifetime protection) but allows you to grow your policy with the most cash value. Read below for more information:

Key benefits:

- This has the largest cash value growth potential.

- You can withdraw and borrow cash from your policy, but be sure to pay it back.

- You can transfer funds among different investment opportunities.

More can be found on variable life insurance here.

Final Expense Life Insurance

Let’s look at the major benefits of John Hancock’s final expense life insurance:

Final Expense life insurance comes with these benefits:

- A simple application process with a payment schedule that works for you

- Have peace of mind by knowing your loved ones are protected

- Guaranteed life insurance policy

- Rewards, like other policies, for healthy living

The simple application process with a flexible schedule makes this policy attractive to us.

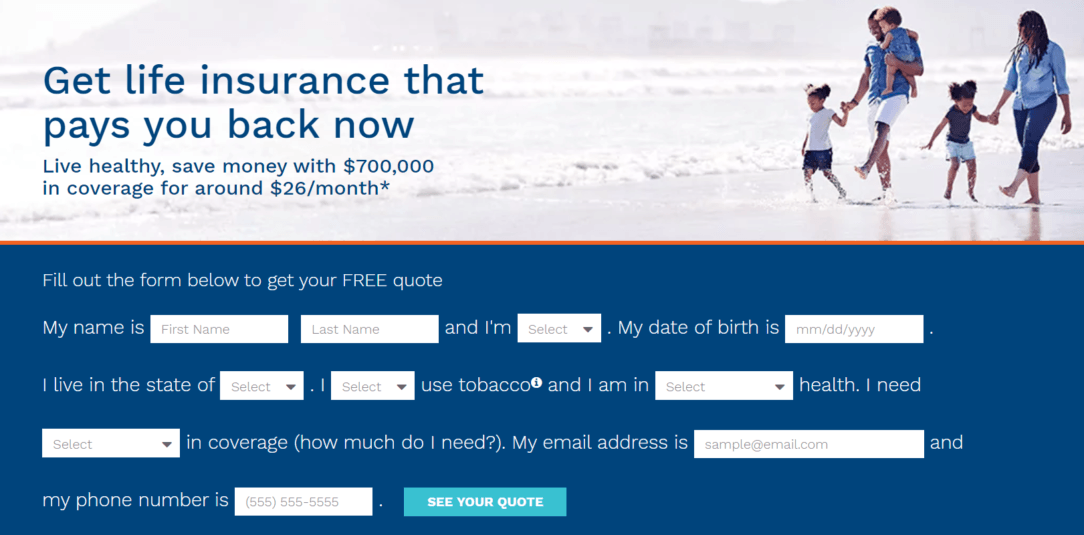

How to Get a Quote Online With John Hancock

Curious about how to get the cheapest life insurance quotes online? For term life under $5 million, you can get an online quote of a John Hancock policy by using their calculator tool. To do so, follow the steps below:

First, you’ll go to JohnHancock.com. You’ll want to start here. Then, you’ll select “Insure” on the left-hand side of the page. The “Insure” button is second from the top left and contains a small umbrella icon.

After that, you’ll select “Term life insurance” on the pop-out. You can also select “Final Expense Insurance” as well. For John Hancock final expense insurance, go to the “Final Expense life insurance” button and click on the “Get your quote” button.

You can also call John Hancock at 1-800-586-5792. For Term life insurance, go to “Get Your Instant Quote” under “Term Life Products.” After the pop out you’ll be taken to this page where you can select “get your instant quote.”

In reviewing the online quote function, we’re making the assumption that you have less than $5 million in coverage. Then, you’ll fill out the boxes for a quote. This will take you to the John Hancock quote page About halfway down the page, you’ll see this form:

There aren’t too many boxes to fill out on this page, and as you can see it’s mostly demographic, financial, and contact information-based questions. Finally, you’ll review your quote.

After you fill out all the boxes, you can click “See Your Quote” to receive more information. Or alternatively, you could also get a quote by calling or reaching out to a John Hancock team member through this John Hancock contact form.

Canceling Your Life Insurance Policy

Say you get a life insurance policy, but you’re not satisfied with it. Can you cancel your life insurance policy? Yes, you can.

How to Cancel

According to JohnHancock.com, to cancel your life insurance policy, you’ll need a Policy Surrender Form. Mail the forms back to John Hancock with either the original contract or the Statement of Lost or Destroyed Policy section completed.

If your address has been updated within the last 30 days, the form will need to be notarized. General processing time is 7 to 10 business days for traditional policies and seven calendar days for variable policies once the paperwork is received.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Make a Claim With John Hancock

You might be wondering how long you have to make a life insurance claim. Its page was unclear about a timeline but advocated sooner rather than later. The following information is according to John Hancock’s webpage, titled “Death Claim”:

First, you’ll notify John Hancock.

Report the death to John Hancock by either:

- Using the notification form OR

- Contacting John Hancock at 1-800-387-2747 (USA) or 1-888-267-7784 (NY)

Don’t complete a claims form if it’s the first death of a survivorship policy. Only a notification is needed.

Second, you’ll complete the Claim Form.

Communication is key to settling your claim quickly and seamlessly. If you need more help, please contact John Hancock with any questions, weekdays between 9 a.m. and 5 p.m. Eastern Time at 1-800-387-2747 (USA) or 1-888-267-7784 (NY).

Forms can be viewed, completed, e-mailed, and printed from John Hancock’s site.

NOTE: There may be other requirements depending on various circumstances (you will be notified of any other requirements when the death report is received).

Third, you’ll submit the requirements.

Submit all requirements to the Claims Department at the address found on the claim form.

Finally, you’ll receive the proceeds.

The death benefit will be disbursed via check, Safe Access Account (not available for John Hancock New York), or electronic funds transfer (depending on the amount and your preference). The disbursement will include interest. EFT is only available for policies issued after December 31, 2004.

If you have questions or need more information, call John Hancock’s Customer Service Center at 1-800-387-2747 (USA) or 1-888-267-7784 (NY).

John Hancock’s Customer Experience

John Hancock seems to have pretty good customer experience, based on their ratings with Moody’s, A.M. Best, and the like — landing between an A and a B on the American A-F scale.

Although according to the NAIC Complaint index, the standards for complaints are on a scale of 1.0, and John Hancock is at 0.36, meaning they are well below (half is 0.5) the national average for company complaints.

John Hancock’s Programs

You might be wondering about John Hancock 401(k) reviews. 2018 and 2019 reviews on the page ConsumerAffairs.com, in addition to reviews since 2010, of their 401(k) plan, are rated under two out of five stars.

There are a plethora of one-star reviews recently, so we recommend keeping this in mind when considering John Hancock for your 401(k) needs. The same goes for John Hancock retirement 401(k) reviews; this search also returns back abysmal ratings.

On the flip side, there are great travel insurance reviews for John Hancock. So, if you’re asking “Is John Hancock good travel insurance?” then the answer is yes. According to this Forbes article, Forbes named John Hancock the “Best Insurance for Solo Travelers” and cites John Hancock as being on top of their game. They continue to say: “You can choose between their Bronze, Silver, and Gold plans that start at $24 per trip. Every plan includes the following benefits at no additional charge:

- Single Occupancy Supplement

- Terror Attack Coverage

- 24/7 Emergency Travel Assistance”

So while the 401(k) programs might be disappointing, it might be time to take a vacation and shell out that $24 per trip with John Hancock for travel insurance.

Design of Website/App

John Hancock has a few apps on the Apple and Google Play app stores. They are:

- MyLifeNow – Financial planning app for retirement data and information

- John Hancock Vitality – Fitness tracking app and Vitality Points tracking app

- CareGiver – An app for caregivers to track their sessions with clients

But, unfortunately, they do not have a life insurance app to review. There are no best or worst customer experience reviews to highlight as the app doesn’t exist.

About John Hancock Life Insurance

John Hancock Life Insurance Company (U.S.A.) was established in 1862 in Boston, Massachusetts. John Hancock’s headquarters are still in Boston. John Hancock has been around for over 150 years. The company was named after John Hancock, the prominent American patriot.

John Hancock as a company has a wealth of financial resources available. They offer retirement services, investment services, and insurance services to consumers.

Back in 2004, John Hancock completed a merger with Manulife Financial Corporation in Toronto, Canada, and afterward, John Hancock became a subsidiary of Manulife Financial.

John Hancock Life Insurance Ratings

Most financial institutions are ranked by A.M. Best, Moody’s, and so forth. We’ll dive into these ratings in this section.

A.M. Best ranks John Hancock with an A+ (Superior) score. These ratings have been “assigned to insurance companies that have . . . a superior ability to meet their ongoing insurance obligations.” This would be equivalent to an “A” on the A-F American scale. It’s high, but not as high as an A+, since the highest possible A.M. Best score is an A++.

For the Better Business Bureau (BBB), John Hancock is rated an A+ which is the highest grade one can receive.

Moody’s is another rating agency. Moody’s gave John Hancock an A2, and that has been consistent over the last 10 years. Moody’s labeled John Hancock with a stable performance. An A2 is considered to be an “upper-medium grade and subject to low credit risk.” We’d say an A2 is like an A- in the A-F grading scale.

Standard & Poor’s (S&P) has rated John Hancock an AA-. According to S&P, “The obligor’s capacity to meet its financial commitments on the obligation is very strong.” An AA- would be equivalent to a B on an A-F grading scale.

Fitch Ratings is another rating agency. They gave John Hancock an A+, which is equivalent to a B+ on the A-F scale.

Overall, John Hancock’s financial strength ratings seem pretty good, landing between an A and a B on the A-F scale.

John Hancock’s Market Share

Below is a table that breaks down the last few years of data about John Hancock’s market share. Typical John Hancock life insurance competitors would be companies like New York Life, State Farm, Prudential, and MassMutual. Data in the table is from the NAIC.

John Hancock's Market Share (2016–2018)

| Year | John Hancock's Rank | John Hancock's Direct Premiums Written | John Hancock's Market Share |

|---|---|---|---|

| 2018 | 6 | $4,651,894 | 3.60 |

| 2017 | 6 | $4,593,432 | 3.60 |

| 2016 | 7 | $4,561,320 | 3.70 |

As you can see in this table, John Hancock’s ranking goes up a notch, from number seven to number six nationally, as its market share drops from 3.70 to 3.60 percent. Over the years, the amount of direct premiums written goes up slightly.

In combination with the rating systems listed above and the data in the market share table, we’d estimate that John Hancock is a stable company with a good outlook.

John Hancock’s Online Presence

Insurance companies using social media is a common practice, and John Hancock is no exception. The company has a YouTube page, a Twitter feed, an Instagram account, a Facebook page, and a LinkedIn page (see below).

John Hancock’s Commercials

Insurance company TV commercials are common marketing tactics. John Hancock has a series of commercials: planning for the future, Boston Marathon racer stories, life insurance commercials, and many more. Here’s an example of one of their life insurance programs, Vitality, below:

Here’s another commercial showing comedian Pete Holmes acting goofy for a solid three minutes:

This video is one of John Hancock’s most popular on their YouTube channel.

John Hancock in the Community

John Hancock has a few programs listed on their website. They are:

The MLK Scholars Program

John Hancock has an MLK Scholars Program for Boston youth. The program addresses a need in the city for summer jobs for city youth. Each summer, John Hancock sponsors the employment of over 600 Boston teens at nearly 60 local nonprofit organizations within Boston. They also sponsor seminars and financial literacy programs to better educate youth. Many of the nonprofits that benefit from this program are local.

Corporate Giving & Community Investment

John Hancock also has a corporate giving program where they give to 501(c)(3) non-profits that fit their criteria, such as:

- Giving back centers around the two following themes: health and well-being and economic opportunity.

- Nonprofits are based in the Boston area and benefit the community.

For the community investment portion, John Hancock invests in programs, projects, or initiatives that focus on the same theme of health and well-being and economic opportunity.

John Hancock’s Vitality Program

How does Hancock Vitality work? There are two types of this Vitality Program: Vitality GO and Vitality PLUS. Both are add-ons to your existing life insurance policy; GO at no cost, PLUS starting at as little as $2/month. In both programs, you get points or rewards for making healthy living choices, such as exercising.

You can get a free Fitbit with GO or a deeply discounted Apple Watch with PLUS. With PLUS, you can save up to 15 percent on your annual life insurance premium cost. A deep-dive John Hancock Vitality review of their Vitality programs would be great for us to look into next.

John Hancock’s Employees

John Hancock has between 1,001 to 5,000 employees, according to Glassdoor. Glassdoor also reports that 84 percent of employees approve of the CEO. John Hancock life insurance company employee reviews total a 3.5 out of 5 stars. Well based on these good reviews, this seems an above-average type of review response.

Indeed reviews place it a little higher, with a 4.0 for work/life balance and a 3.8 for company culture (out of 5). It always crosses our minds when reviewing company Glassdoor reviews, who are the best life insurance companies to work for? This seems like a good one to consider as reviews themselves show that the company has good benefits, great compensation, the ability to work remotely, and excellent work/life balance.

Awards & Accolades

These awards and accolades are according to Glassdoor:

- Gold Stevie Award Winner for sales and customer service, 2017

- America’s Best Employers #67, Fortune, 2017

- Best Employers, Forbes, 2016

- Best Places to Work for LGBT Equality, Human Rights Campaign’s (HRC) Corporate Equality Index, 2016

- Gold Stevie Award Winner for sales and customer service, The Stevie Awards, 2016

- America’s Best Large Employers, Forbes, 2016

- 100 percent rating on Corporate Equality Index, Human Rights Campaign’s (HRC) Corporate Equality Index, 2015

We are particularly impressed by the 100 percent rating on the Corporate Equality Index by the Human Rights Campaign.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros & Cons of John Hancock Life Insurance

You might be wondering about the pros and cons of life insurance policies. All insurance companies have pros and cons. We’ll discuss both of them in the context of John Hancock’s life insurance.

Pros of John Hancock Life Insurance

- John Hancock has good ratings (A.M. Best’s A+, Moody’s A2, and BBB’s A+) with outside agencies.

- Consumers can buy a variety of policies for all types of scenarios, whether it’s permanent life insurance, term life insurance, or final expense insurance.

- John Hancock is a company that has a commitment to giving back to its Boston community.

- You can make a claim online.

- John Hancock is more than halfway below the NAIC’s Complaint Index, at a 0.36, indicating above-average service.

Cons of John Hancock Life Insurance

- Their website gives high-level overviews of the insurance options but doesn’t go into great depth explaining the nuances among the policies.

- Higher premiums than the national average; see the charts at the top of this page under the smoking versus non-smoking premium prices.

- They don’t have a life insurance-centric app, although they do have others.

- There is a class action lawsuit against John Hancock. According to ClassAction.org, the lawsuit claims that John Hancock filled its 401(k) plans with “poor-performing, high-cost investment options.”

- There was actually a prior class action lawsuit back in 2018 too — this one claimed that John Hancock had “improper mortality rate calculations that caused consumers to pay inflated rates,” according to TopClassActions.com. John Hancock settled in this suit and agreed to pay $91M, according to StollBerne.com.

John Hancock Life Insurance: The Bottom Line

John Hancock has many choices when it comes to the life insurance options you might want to consider.

There’s term life insurance, permanent life insurance, and final expense life insurance, but we hope this guide helped to cut through some of that chatter online to help bring you closer to a decision. Bearing in mind John Hancock’s good ratings and its NAIC Complaint Index ranking at 0.36 — it’s a good choice to consider.

We hope you enjoyed this guide to John Hancock’s life insurance review. To get a FREE life insurance comparison, enter your ZIP code in the box below to get started.

Frequently Asked Questions

Can I buy term and whole life insurance with John Hancock at the same time?

It’s legal to apply to more than one policy, but it’s probably not necessary.

I would like to take a loan or withdraw dividends on my policy. How long does it take to get money from John Hancock?

To make a disbursement by mail, you’ll need a policy loan form or a dividend withdrawal form. If your address has been updated within the last 30 days, the form will need to be notarized.

Note: General processing time is seven to 10 business days for traditional policies and seven calendar days for variable policies once the paperwork is received.

What is a PNO life insurance policy?

A PNO policy actually refers to car insurance, not life insurance. “PNO,” according to the California DMV, stands for a “Planned Non-Operation” vehicle. This refers to owning a vehicle but not actually driving it.

What are the differences between the permanent life insurance policies with John Hancock?

John Hancock offers universal life insurance, indexed universal life insurance, and variable universal life insurance. The main concept — lifetime coverage with a savings value — is true among the policies but there are small differences among them.

Can I convert my John Hancock term life insurance policy into a permanent policy?

John Hancock may offer conversion options for term life insurance policies. This allows you to convert your term policy into a permanent policy, such as universal life insurance or whole life insurance, without the need for a new medical examination. Conversion terms and conditions can vary, so it’s advisable to review your policy or consult with your insurance provider.

Can I customize my John Hancock life insurance policy?

Yes, John Hancock offers customizable life insurance policies to suit individual preferences and financial goals. You can often choose the coverage amount, policy duration, premium payment options, and additional riders to enhance your coverage. It’s best to discuss your specific needs with a licensed insurance agent or representative.

How can I determine the amount of life insurance coverage I need?

The amount of life insurance coverage you need depends on your personal circumstances, such as your income, debts, dependents, and future financial goals. It’s recommended to consider factors like your outstanding mortgage, educational expenses, living costs, and any existing savings or investments. An insurance professional can help you assess your needs and provide guidance.

How do I file a life insurance claim with John Hancock?

To file a life insurance claim with John Hancock, you typically need to submit a claim form along with the necessary documentation, such as a death certificate and any other required supporting documents. You can contact John Hancock’s claims department or visit their website to obtain the necessary forms and instructions. It’s recommended to notify the insurance company promptly after the insured’s passing to initiate the claim process efficiently.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.