Best Life Insurance for Seniors Over 85 (Top 10 Companies in 2025)

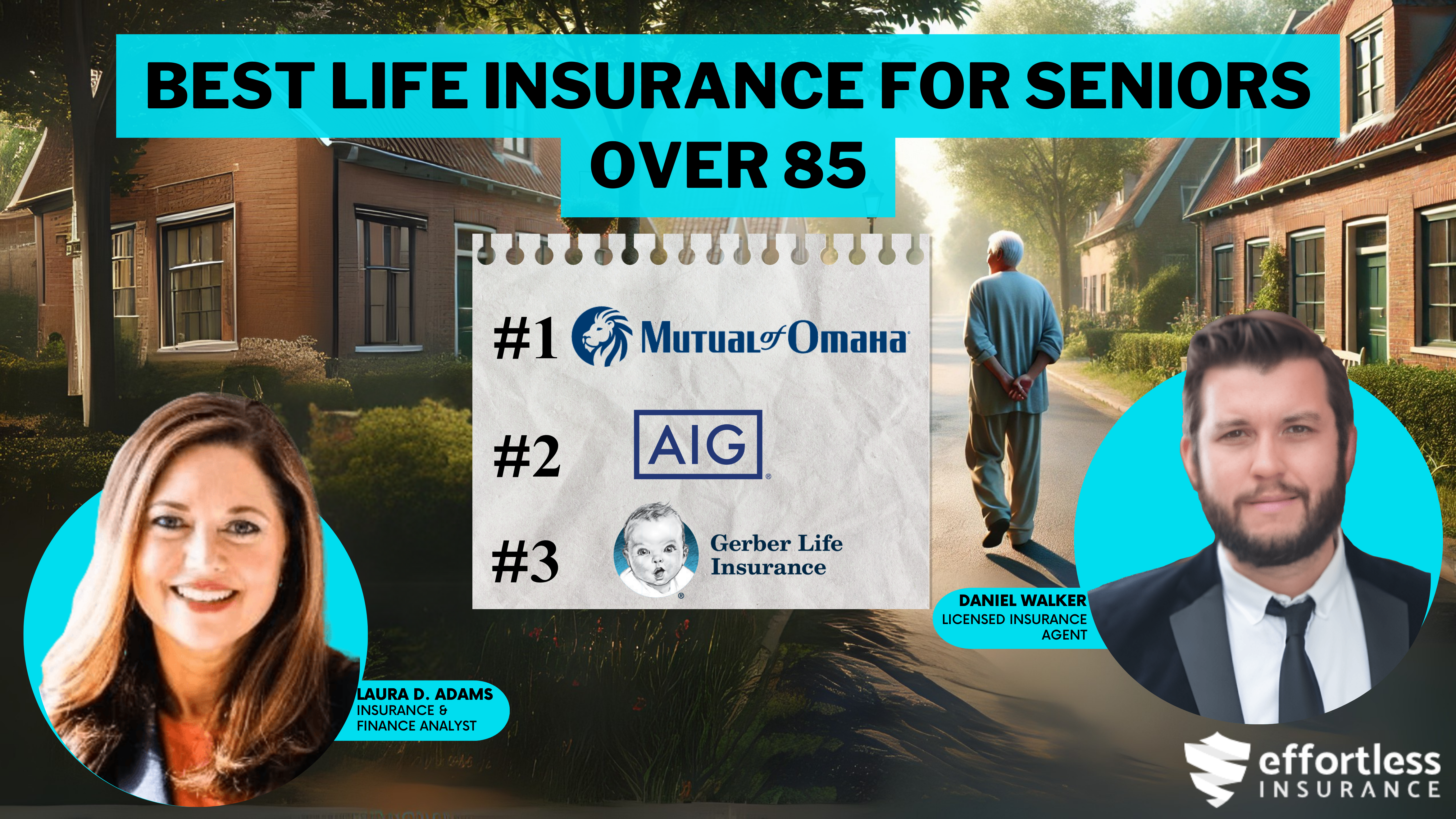

Mutual of Omaha, AIG, and Gerber Life have the best life insurance for seniors over 85, with rates starting at $39 per month. These companies provide straightforward applications, guaranteed acceptance, and reliable coverage designed specifically to meet the needs of seniors.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Jan 15, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 15, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

163 reviews

163 reviewsCompany Facts

Full Coverage for Seniors Over 85

A.M. Best Rating

Complaint Level

163 reviews

163 reviews 0 reviews

0 reviewsCompany Facts

Full Coverage for Seniors Over 85

A.M. Best Rating

Complaint Level

0 reviews

0 reviewsThe best life insurance for seniors over 85 comes from Mutual of Omaha, AIG, and Gerber Life, offering affordable rates and reliable coverage options.

Mutual of Omaha is the top pick overall, providing competitive pricing, guaranteed acceptance, and flexible policy tailored to seniors’ needs. AIG and Gerber Life also offer solid coverage with simple applications and dependable benefits.

Our Top 10 Company Picks: Best Life Insurance for Seniors Over 85

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | A+ | Guaranteed Issue | Mutual of Omaha | |

| #2 | 12% | A | Flexible Options | AIG |

| #3 | 8% | A+ | Final Expense | Gerber Life |

| #4 | 10% | A | Affordable Coverage | Colonial Penn |

| #5 | 9% | A+ | Flexible Coverage | Transamerica | |

| #6 | 11% | A++ | Member Discounts | AARP | |

| #7 | 10% | A | Member Benefits | AAA Life |

| #8 | 17% | B | Comprehensive Coverage | State Farm | |

| #9 | 8% | A+ | Strong Service | Prudential | |

| #10 | 9% | A- | Member Benefits | Foresters Financial |

This guide reviews the top 10 companies, comparing content and benefits to help you find the most money-saving life insurance for seniors. It ensures that you choose the best policy for your needs. View this guide, “10 Best Life Insurance Companies,” for more details.

For affordability, the cheapest life insurance for seniors over 85 and elderly life insurance offer practical solutions, particularly when buying life insurance for elderly parents or exploring life insurance for senior citizens. If you want to explore your life insurance options, enter your ZIP code in our free tool to get started.

- The best life insurance for seniors over 85 offers low rates at $39/month

- Policies are tailored to meet seniors’ health and financial needs

- Mutual of Omaha is the top pick for its competitive rates and flexible coverage

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Mutual of Omaha: Top Overall Pick

Pros

- Guaranteed Issue: Seniors over 85 do not need to undergo a medical exam.

- A+ Rating: Strong financial stability. Explore our “Mutual of Omaha Life Insurance Review” guide for additional details.

- Affordable Coverage: Minimum coverage starts at $49/month for seniors over 85.

Cons

- Limited Coverage Options: Fewer customization choices for seniors.

- Higher Premiums: A monthly premium of $125 for full coverage is considered relatively high for seniors.

#2 – AIG: Best for Flexible Options

Pros

- Flexible Plans: There are different policy options for seniors over 85.

- Strong rating: The company is financially stable. Visit our guide, “AIG Life Insurance Review,” for further insights.

- Discount: Save 12% when you bundle multiple policies for seniors.

Cons

- Higher cost: Minimum coverage starts at $54 per month for seniors.

- Fewer choices: Options are more limited for seniors over 85.

#3 – Gerber Life: Best for Final Expense

Pros

- Final Expense Focus: Simplified policies for final expenses for seniors over 85.

- A+ Rating: Strong financial stability. Refer to our guide, “Gerber Life Insurance Review,” for more information.

- Affordable: Minimum coverage starts at $43 per month for seniors.

Cons

- Limited Customization: Less flexibility in plans for seniors over 85.

- Lower Coverage: Coverage amounts might be insufficient for seniors.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#4 – Colonial Penn: Best for Affordable Coverage

Pros

- Low Rates: Minimum coverage starts at $39/month for seniors over 85.

- A Rating: Financially stable. For more information, take a look at our guide, “Colonial Penn $9.95 Plan Reviews.”

- No Medical Exam: Easy qualification for seniors over 85.

Cons

- Limited Coverage: Lower coverage amounts for seniors.

- Higher Full Coverage Cost: $109 per month for full coverage for seniors.

#5 – Transamerica: Best for Flexible Coverage

Pros

- Customizable Plans: Flexible coverage options for seniors over 85.

A+ Rating: Financially secure. Dive into our “Transamerica Life Insurance Company Review” guide for comprehensive details.

Reliable Coverage: Minimum coverage starts at $55/month, which is great for seniors looking for quality coverage.

Cons

Expensive Full Coverage: At $132 monthly, full coverage might be high for seniors over 85.

Limited Senior Plans: There are fewer options available to meet the needs of seniors.

#6 – AARP: Best for Member Discounts

Pros

- Member Discounts: The discounts are available for AARP members over 85.

- A++ Rating: Highest financial rating. See our “AARP Life Insurance Company Review” guide for a deeper understanding.

- Comprehensive Coverage: Various policy options tailored for seniors over 85.

Cons

- Higher Premiums: Minimum coverage starts at $59/month for seniors.

- Member-only: Available only to AARP members over 85.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#7 – AAA Life: Best for Member Benefits

Pros

- Member Benefits: Discounts are available for AAA members over 85.

- A Rating: Demonstrates strong financial stability. Find out more by reading our guide, “AAA Life Insurance Review.”

- Affordable: Minimum coverage starts at $45 per month for seniors.

Cons

- Higher Full Coverage Costs: Full coverage costs $113 per month for seniors.

- Member-only: Coverage is available exclusively to AAA members over 85.

#8 – State Farm: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Many coverage options are available for seniors over 85.

- B Rating: Long-established reputation. Head to our “State Farm Life Insurance Review” guide for additional resources.

- 17% Bundling Discount: Available for seniors over 85 with multiple policies.

Cons

- Higher Premiums: $123 per month for full coverage for seniors.

- Less Focus on Seniors: Not explicitly tailored for seniors.

#9 – Prudential: Best for Strong Service

Pros

- Strong Service: Excellent customer support, especially for seniors over 85.

- A+ Rating: Financially secure. Learn more by exploring our guide, “Prudential Life Insurance Review.”

- Customizable Plans: Various policy options for seniors.

Cons

- Higher Premiums: $62/month for minimum coverage and $149/month for full coverage might be costly for seniors.

- Limited Affordable Options: Higher costs may not fit all budgets for seniors over 85.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#10 – Foresters Financial: Best for Member Benefits

Pros

- Member Benefits: Extra benefits for members over 85.

- Rating: Financially stable. Get more details from our guide, “Foresters Life Insurance Company Review.”

- Affordable: Minimum coverage starts at $48 per month for seniors over 85.

Cons

- Limited Coverage Options: Fewer plans are available for seniors.

- Membership Required: Benefits are available only to members over 85.

Types of Life Insurance Available for Seniors

When you buy life insurance at 85 years old, your choices are restricted to burial and final expense policies. Final expense coverage is intended to help with the associated costs related to your death, such as burial, funeral, and medical bills, among others. The maximum death benefit amount you can purchase is $40,000.

Monthly Life Insurance Rates for Seniors 85+

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $45 | $113 |

| $59 | $138 | |

| $54 | $113 |

| $39 | $109 |

| $48 | $120 | |

| $43 | $99 |

| $49 | $125 | |

| $62 | $149 | |

| $52 | $123 | |

| $55 | $132 |

However, most individuals buy $25,000 or less. Plans like life insurance for 85-year-old individuals and AARP life insurance for seniors over 85 often feature options requiring no medical exam. These policies are called simplified issues because there is no test or exam required to apply, only a few health questions you need to answer.

Seniors over 85 should focus on life insurance options that provide stable coverage while considering their unique health and financial circumstances.Jimmy McMillan Licensed Insurance Agent

Since the carrier doesn’t have access to your medical tests, they will conduct a phone interview and use other public data reports to confirm your eligibility for coverage. Most companies will run reports from the Medical Information Bureau, driving history, and prescription search.

Burial Insurance

Burial insurance is permanent coverage that remains effective as long as premiums are paid. The premium is fixed and doesn’t change with age or health.

It also accumulates cash value over time, which can be accessed through loans or by surrendering the policy. Policies like final expense insurance for seniors over 85, whole life insurance for seniors, and AARP burial insurance ensure funds for end-of-life expenses without burdening families.

Life Insurance Discounts From the Top Providers for Seniors Over 85

| Insurance Company | Available Discounts |

|---|---|

| Multi-Policy, AAA Member Benefit |

| AARP Member Benefit, Auto-Pay Benefit | |

| Multi-Policy, Healthy Living Benefit |

| Auto-Pay Benefit, Senior Benefit for Loyal Customers |

| Member Benefits, Multi-Policy Benefit, Healthy Lifestyle Benefit | |

| Multi-Policy, Auto-Pay Benefit, Family Coverage Benefit |

| Multi-Policy, Non-Smoker Benefit, Auto-Pay Benefit | |

| Multi-Policy, Healthy Living Benefit, Auto-Pay Benefit | |

| Multi-Policy, Non-Smoker Benefit, Safe Driving Benefit | |

| Multi-Policy, Healthy Living Benefit, Auto-Pay Benefit |

Don’t rely on this too much, as with most whole life insurance, it takes more than a few years to build cash, and if you take a loan, you will not have enough for your beneficiaries when the time comes. Here are the three types of burial insurance:

- Level Benefit Plan: The level benefit plan, or immediate death benefit plan, pays 100% of the death benefit with no waiting period. It’s available to applicants in good health, without serious medical conditions.

- Modified Death Benefit: Also known as guaranteed issue life insurance, this plan requires no health questions and guarantees coverage, but is costly. If the insured dies within two years (excluding accidents), beneficiaries receive premiums paid plus 10% interest. It should be a last resort.

- Graded Benefit Plan: The graded benefit plan offers partial payouts in the first two years: 40% in the first year, 75% in the second, and 100% after. It’s for those with minor health issues and has higher premiums. Learn more by exploring our guide, “How does a death benefit work?“

Choosing the right burial insurance plan ensures your loved ones are financially protected. Explore your options to find the best fit for your needs.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Applying for Coverage

After determining the coverage amount, carrier, and plan type, the process begins. You won’t undergo a medical exam for burial insurance coverage, but your broker will ask health questions to assess eligibility. They will help submit the application online or by fax. Browse our guide, “No Exam Life Insurance, for more details.

The insurer will conduct a background check, including a motor vehicle report, a Medical Information Bureau search, and a prescription history review to identify discrepancies. A phone interview, typically 15-20 minutes, will verify the application details. You’ll receive a decision, usually within 24 hours.

Life Insurance for Seniors Over 85

Life insurance for seniors over 85 typically includes guaranteed issue or whole life policies, as traditional options often require health assessments. These policies offer coverage without medical exams. Access our guide, “Life Insurance Cost by Age: How Your Age Impacts Life Insurance Premiums,” for full details.

🌟 Looking for hassle-free life insurance with guaranteed acceptance? No health questions, no medical exams, and no exclusions for pre-existing conditions. Watch now to learn more! 📽️ #LifeInsurance #ColonialPenn https://t.co/kNJkfe5ptY

— Colonial Penn Life Insurance Company (@Colonial_Penn) October 24, 2024

Premiums tend to be higher for seniors, but providers like Mutual of Omaha, AIG, and Gerber Life offer affordable plans starting at $39.

Selecting a life insurance policy with guaranteed benefits ensures peace of mind and financial security for seniors over 85.Tim Bain Licensed Agent Insurance

Options such as life insurance for seniors over 75, life insurance for seniors over 90, and life insurance for over 85 years old address the unique needs of older adults.

Case Studies: Life Insurance for Seniors Over 85

Here are examples of how seniors over 85 found affordable life insurance to suit their needs and protect their families. To discover more, check out our guide, “Types of Life Insurance: Find the Right Policy for Your Needs.”

- Case Study #1 – John and Mutual of Omaha: At 87, John wanted an affordable life insurance policy. He chose Mutual of Omaha because of its low rates, starting at $39, and no medical exams. It gave him guaranteed coverage and peace of mind.

- Case Study #2 – Susan and AIG: Susan, 90, needed life insurance but had health problems. She went with AIG because their guaranteed issue policy didn’t ask for a medical exam and still gave her the coverage she wanted to take care of her family.

- Case Study #3 – Robert and Gerber Life: At 85, Robert chose Gerber Life for its simple process and affordable payments. Now, he feels good knowing his family will have extra support when they need it.

These examples show that even seniors over 85 can find reliable, affordable, and easy-to-get life insurance with the right provider. Simplify your life insurance shopping by entering your ZIP code into our free quote comparison tool and find coverage that fits your budget and needs.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Frequently Asked Questions

What is the best life insurance for seniors over 85?

Finding the right life insurance for elderly individuals can be challenging, especially when considering options like life insurance for elderly parents or burial insurance for seniors over 85. Mutual of Omaha, AIG, and Gerber Life offer the best life insurance for seniors over 85. These providers offer affordable coverage and whole-life policies, with no medical exams required.

What are the benefits of whole life insurance for seniors over 85?

Whole life insurance provides permanent coverage with fixed premiums and cash value growth. It offers long-term protection for seniors and their families. Compare term life insurance rates by entering your ZIP code into our free tool today.

What are guaranteed issue life insurance policies?

Guaranteed-issue life insurance doesn’t require a medical exam or health questions. It guarantees coverage, though premiums are usually higher, and there may be a waiting period for full benefits. Refer to our guide, “Best Guaranteed Issue Life Insurance Companies,” for more information.

Can seniors over 85 qualify for life insurance?

Seniors over 85 can get life insurance with plans made for their needs. Many ask, “Can you get life insurance at age 85?” The answer is yes, as some companies offer life insurance for people over 85, ensuring they can still get coverage.

What is the cost of life insurance for seniors over 85?

Life insurance for seniors over 85 can start at $39 per month. Costs vary depending on the policy type, coverage amount, and the insurance company. Finding life insurance 85 years old or older can feel challenging, but options are available to meet specific needs. Many providers offer life insurance for individuals over 85, including specialized plans like life insurance for 86-year-old individuals.

What types of life insurance are available for seniors over 85?

Seniors over 85 can choose from whole life, guaranteed issues, or burial insurance for permanent coverage tailored to their needs. Also, life insurance for over 80 years old provides peace of mind, while funeral insurance helps with final expenses. Government life insurance for seniors offers affordable options. Find out more by reading our guide, “Open Care Senior Plan Review.”

Can I get life insurance if I have health problems at 85?

Yes, seniors with health problems can get life insurance, and it doesn’t require a medical exam but may have higher premiums. Life insurance for seniors over 85 with no medical exam plans can provide coverage without complex health checks. Also, life insurance for 86-year-old females can find tailored options with life insurance for seniors over 85.

What should seniors consider when choosing life insurance?

When choosing the right life insurance, consider health, budget, and coverage needs. Compare the options from companies like Mutual of Omaha, AIG, and Gerber Life to find the best coverage fit for your needs. Life insurance for people over 50 ensures long-term financial security, meeting the specific needs of aging individuals.

Why is Mutual of Omaha a top choice for seniors over 85?

Mutual of Omaha is a great choice for seniors over 85 due to its affordable rates, flexible coverage options, and no medical exam requirements for some policies. Find out more by reading our “Mutual of Omaha Term Life Insurance Policies Review” guide.

How does guaranteed issue life insurance work?

Guaranteed-issue life insurance offers coverage without a medical exam. It guarantees acceptance but may have higher premiums, and full coverage might not begin immediately. Enter your ZIP code into our free comparison tool to explore affordable life insurance rates today.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.