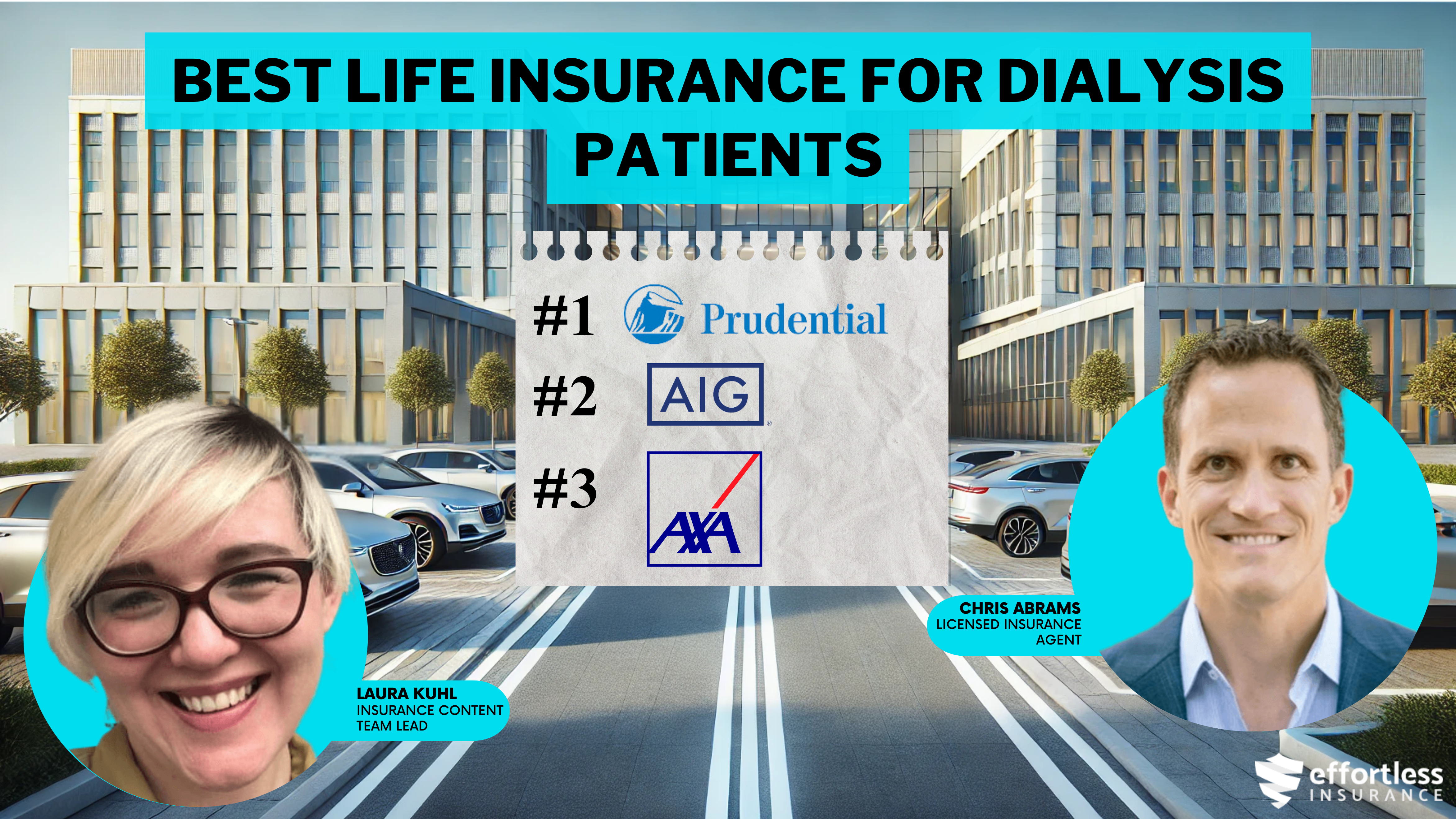

Best Life Insurance for Dialysis Patients in 2026 (Your Guide to the Top 10 Companies)”

The Best Life Insurance for Dialysis Patients includes Prudential, with rates from $38/month as the top pick, AIG for no-exam policies, and AXA for international coverage. These trusted providers offer tailored options to effectively and affordably meet unique health and coverage needs.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Life Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed life and health insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chr...

Licensed Life Insurance Agent

UPDATED: Jan 19, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 19, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

0 reviews

0 reviewsCompany Facts

Whole Policy for Dialysis Patients

A.M. Best

Complaint Level

0 reviews

0 reviews 163 reviews

163 reviewsCompany Facts

Whole Policy for Dialysis Patients

A.M. Best

Complaint Level

163 reviews

163 reviews 0 reviews

0 reviewsCompany Facts

Whole Policy for Dialysis Patients

A.M. Best

Complaint Level

0 reviews

0 reviewsThe Best Life Insurance for Dialysis Patients includes Prudential as the top overall pick with rates starting at $38/month, AIG for quick and hassle-free no-exam policies, and AXA for exceptional international coverage tailored to global needs.

These companies stand out for their affordability, flexibility, and commitment to meeting the unique challenges dialysis patients face, ensuring reliable protection tailored to their health and financial requirements.

Our Top 10 Company Picks: Best Life Insurance for Dialysis Patients

| Insurance Company | Rank | Bundling Discount | AM Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | A+ | Guaranteed Issue Policies | Prudential | |

| #2 | 12% | A | No-Exam Policies | AIG |

| #3 | 10% | A | International Coverage | AXA |

| #4 | 10% | A+ | Term Life Options | Banner Life |

| #5 | 10% | A | High-Risk Coverage | Transamerica | |

| #6 | 15% | A++ | Financial Strength | Northwestern Mutual | |

| #7 | 10% | A++ | Customization | Guardian Life | |

| #8 | 10% | A++ | Comprehensive Coverage | MassMutual | |

| #9 | 12% | A++ | Legacy Planning | New York Life |

| #10 | 10% | A+ | High-Coverage Policies | Lincoln Financial |

Prudential’s competitive rates make it accessible for most budgets, while AIG’s no-exam policies eliminate barriers for those with complex medical histories.

Together, these providers deliver solutions designed for peace of mind and comprehensive protection. When you’re ready, compare affordable life insurance for dialysis patients by entering your ZIP code into our free rate tool above.

- Offers tailored coverage options designed for dialysis patients’ specific needs.

- Simplifies approval with flexible underwriting for health conditions.

- Top picks are Prudential, AIG, and AXA for reliability and benefits.

#1 – Prudential: Top Overall Pick

Pros

- Great Coverage Options: Prudential has lots of coverage choices for dialysis patients, starting at $46.

- Customizable Plans: You can adjust your plan to fit your specific needs as a dialysis patient. Want to know more? Take a look at our guide, “Prudential Life Insurance Guide.”

- Flexible Premiums: They offer flexible payment options, so you can find a plan that fits your budget easily.

Cons

- Higher Premiums: Some people might find the premiums a bit higher compared to other options available.

- Not Available Everywhere: Prudential might not be available in all areas, so it may not be an option for everyone.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – AIG: Best for No-Exam Policies

Pros

- No Medical Exam Needed: AIG offers Life Insurance for dialysis patients without exams, starting at $50.

- Approval: Quick approval for Life Insurance for dialysis patients, perfect if you need coverage fast.

- Flexible Coverage: AIG provides customizable coverage options for Life Insurance for dialysis patients.

Cons

- Higher Premiums: Premiums for Life Insurance for Dialysis Patients are higher for older individuals.

- Limited Coverage: Severe dialysis-related issues may result in less coverage or exclusions. For all the details, check out our guide, “AIG Life Insurance Review.”

#3 – AXA: Best for International Coverage

Pros

- Global Reach: AXA offers solid international coverage for dialysis patients, making it a great choice for those who travel or live abroad, with plans starting at $48.

- Customizable Policies: AXA offers many options for customizing Life Insurance for Dialysis Patients to get coverage that fits their needs.

- Financial Stability: They are known for being financially strong, so life insurance for dialysis patients can feel safe with their coverage.

Cons

- Higher Premiums: Life insurance for dialysis patients is more expensive than a regular plan. Get more info in our guide, “AXA Equitable Life Insurance Company Review.”

- Complicated Application: Getting international coverage for life insurance for dialysis patients can be tricky and challenging for some.

#4 – Banner Life: Best for Term Life Options

Pros

- Affordable Premiums: Banner Life has excellent rates starting at $38, making it a budget-friendly choice for dialysis patients who need term life insurance.

- Strong Financial Stability: Banner Life is financially solid, so you can trust it to be reliable when you need coverage.

- Easy Application: The process is simple and quick, making it easier for dialysis patients to get covered. For more details, see our guide, “Banner Life Insurance Company Review.”

Cons

- Limited Permanent Coverage: Banner Life mainly offers term life insurance, which might not work if you’re looking for a permanent policy.

- Fewer Customization Options: Compared to other companies, Banner Life has fewer options for customizing your policy.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Transamerica: Best for High-Risk Coverage

Pros

- High-Risk Coverage: Transamerica is excellent at offering life insurance to people in high-risk categories, like dialysis patients, with premiums starting at $40.

- Long-Term Coverage: They have policies that last a long time so that dialysis patients can stay covered for their entire life.

- Strong Customer Service: Transamerica provides strong customer support to help dialysis patients navigate their insurance needs.

Cons

- Higher Premiums: Premiums may be higher for older dialysis patients or those with health concerns. Learn more from our guide, “Transamerica Life Insurance Company Review“.

- Limited Riders: Transamerica offers fewer riders compared to other companies, which could limit customization options.

#6 – Northwestern Mutual: Best for Financial Strength

Pros

- Strong Financial Stability: It offers a secure option for life insurance for dialysis patients, with plans starting at $45. Find out more in our “Northwestern Mutual Life Insurance Guide.”

- Lots of Coverage Options. They have various coverage plans, so Life Insurance for Dialysis Patients can find one that works best for them.

- Helpful Financial Advice: Northwestern Mutual provides expert financial guidance to help Life Insurance for Dialysis Patients make the right choices.

Cons

- Higher Premiums: Because they’re so financially strong, the premiums for some life insurance for dialysis patients might be a little higher.

- Limited Availability: They might not offer coverage in all states, so some people could have trouble getting their policies.

#7 – Guardian: Best for Customization

Pros

- Customizable Plans: Guardian has lots of ways to customize life insurance for dialysis patients, starting at $38.

- Lifetime Coverage: They offer coverage that lasts for life, so dialysis patients can feel secure. See more in our guide, “Best Life Insurance Companies for Expats.”

- Financial Security: Guardian is financially stable, meaning dialysis patients can trust their coverage.

Cons

- Complicated Application Process: The Guardian application process may be more detailed, which could overwhelm some dialysis patients.

- Premiums May Be Higher: Customization options may have higher premiums than basic policies.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – MassMutual: Best for Comprehensive Coverage

Pros

- Lots of Coverage Options: MassMutual offers complete coverage plans for dialysis patients. Explore our “Life Insurance Recommendations by Demographic” guide for more insights.

- Well-Trusted: MassMutual is known for being reliable, so dialysis patients can feel confident about their coverage, starting at $50.

- Financial Stability: MassMutual’s strong economic standing means dialysis patients can trust they’ll have dependable coverage for the long run.

Cons

- Higher Premiums: Because its plans are more comprehensive, MassMutual’s premiums might be higher than those of other companies.

- Fewer Customization Options: MassMutual doesn’t offer as many ways to customize a plan as other insurers.

#9 – New York Life: Best for Legacy Planning

Pros

- Legacy Planning: New York Life helps with planning a financial legacy, which is great for dialysis patients who want to take care of their family, starting at $55.

- Great Customer Service: They offer helpful customer support to guide dialysis patients in making the right choices for their families.

- Long-Term Coverage: Their policies cover you for life, making sure dialysis patients are always protected. Discover answers in our guide, “New York Life Insurance Guide.”

Cons

- Higher Premiums: New York Life’s premiums could be higher because they focus on legacy planning and full coverage.

- Limited No-Exam Options: Unlike some competitors, New York Life may have fewer no-exam options, which could be a barrier for some dialysis patients.

#10 – Lincoln: Best for High-Coverage Policies

Pros

- High Coverage: Lincoln offers life insurance with lots of coverage, perfect for dialysis patients who need strong protection, starting at $48.

- Flexible Terms: They let you choose the length of your policy, so you can pick one that works best for your needs. Find extra info in our guide, “Life Insurance Resources.”

- Strong Financial Stability: Lincoln is financially solid so that dialysis patients can rely on them for dependable coverage.

Cons

- High Coverage: The more coverage you want, the higher the premiums, which could be expensive for some dialysis patients.

- Fewer Rider Options: Lincoln doesn’t offer as many extra options (riders) as some other life insurance companies.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best life Insurance Policies for Dialysis Patients

Life insurance rates for dialysis patients cost around $474 per month on average. You cannot qualify for traditional whole life insurance or term life insurance if you receive dialysis treatments.

Dialysis Patients Life Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Term Policy | Whole Policy |

|---|---|---|

| $50 | $150 |

| $48 | $145 |

| $38 | $120 |

| $38 | $115 | |

| $48 | $135 | |

| $50 | $155 | |

| $55 | $160 |

| $45 | $150 | |

| $46 | $140 | |

| $40 | $125 |

You’ll also struggle to find a life insurance company for dialysis patients willing to sell you final expense insurance or no-exam life insurance.

Life Insurance Discounts From the Top Providers for Dialysis Patients

| Insurance Company | Available Discount |

|---|---|

| Multi-Policy, Member, Loyalty |

| Membership, Multi-Policy |

| Multi-Policy, Nonsmoker |

| Multi-Policy, Healthy Lifestyle | |

| Multi-Product, Financial Planning | |

| Multi-Policy, Preferred Health | |

| Bundle (Life and Annuities), Long-Term Client |

| Multi-Policy, Long-Term Client | |

| Preferred Customer, Multi-Policy | |

| Loyalty, Multi-Policy |

Your best and often only life insurance option is guaranteed issue whole life insurance. Unfortunately, premiums for this type of coverage are the most expensive, and the death benefit is often insubstantial.

According to the American Association of Kidney Patients (AAKP), the average age of a person undergoing dialysis treatments is 64. As you can see, it is challenging to secure cheap life insurance quotes for dialysis patients, especially if you’re older. While you might consider purchasing an accidental death policy as an alternative, this is not the same thing as life insurance and does not cover death from natural causes, disease, or illness.

Dialysis patients can benefit most from no-exam life insurance policies, which offer quicker approvals and tailored coverage options without the stress of medical underwriting.

Jeffrey Manola Licensed Insurance Agent

However, by comparing the different guaranteed issue life insurance companies online ahead of time, you’ll quickly find the provider most compatible with you.

Dialysis Treatments That Impact Life Insurance

Dialysis treatments indicate that a person is experiencing end-stage kidney failure or some other pre-existing and often life-threatening condition. According to the National Kidney Foundation, most people on dialysis live only five to 10 years. Therefore, most insurance providers are unwilling to invest in such a high-risk client.

Getting your finances to the next level? Good plan. Our advisors like Micah Engel take a comprehensive approach to financial planning—so the path to reaching your goals is completely clear. pic.twitter.com/Sss7S1hBjF

— Northwestern Mutual (@NM_Financial) November 1, 2023

On rare occasions, acute renal failure may improve after treatment. However, most people remain on dialysis permanently. If you receive a successful kidney transplant and stop treatments for three years, you may eventually qualify for traditional life insurance coverage.

To avoid a substandard rate, always follow up with your doctor and continue to take prescribed medications. Also, avoid smoking and other dangerous hobbies. Maintaining a healthy lifestyle, such as eating well and exercising regularly, can also make a big difference. Make sure to keep your medical records up to date and accurate.

Insurers often look at your health history, so staying consistent with your care is key. If you have a chronic condition, show that it’s being managed effectively. Lastly, compare policies from different providers to find the best value for your needs.

Life Insurance for Dialysis Patients

If you’re one of the 468,000 Americans undergoing dialysis treatments, your life insurance options are limited. If your health improves with a kidney transplant, you might successfully pursue traditional life insurance coverage after a few years of controlled health. For more details, check out our guide, “Types of Life Insurance: Find the Right Policy for Your Needs.”

Unfortunately, most people remain in treatment for the rest of their lives and can only purchase guaranteed issue whole life insurance policies.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Navigating Life Insurance for Dialysis Patients

Finding life insurance as a dialysis patient can be tough, but there are real stories that show it’s possible to get good coverage. Here are three examples of people who made it happen, even with their health challenges.

- Case Study #1 – Sarah Finds Relief with a No-Exam Policy: John, 62, has been on dialysis for kidney failure for three years. He knows getting regular life insurance is tough because of his health. But John looks into other options and finds guaranteed issue whole life insurance.

- Case Study #2 – David Secures Comprehensive Coverage: Mary, 45, was recently diagnosed with kidney failure and started dialysis. She wants life insurance to protect her family’s future but knows she might not qualify for regular term life insurance because of her health. However, Mary discovers a term life insurance policy with a conversion option.

- Case Study #3 –Linda Gains International Flexibility: Robert, a 72-year-old man, has been receiving dialysis treatments for several years. He understands that obtaining traditional life insurance coverage at his age and with his medical condition is challenging. However, Robert learns about final expense insurance, which is designed to cover funeral and burial expenses.

These examples illustrate that with the right provider and persistence, dialysis patients can find life insurance that meets their needs and provides peace of mind for their loved ones. You can buy life insurance for dialysis patients right now by entering your ZIP code into our free quote tool below.

Frequently Asked Questions

Can I Get Life Insurance with Kidney Disease?

Yes, can I get life insurance with kidney disease? It is possible to get life insurance for kidney disease, but the premiums may be higher. Insurers will assess your health condition, including the stage of the disease, to determine eligibility and coverage options.

What Is Life Insurance for Chronic Kidney Disease?

Life insurance for chronic kidney disease (CKD) is designed for individuals with CKD. While coverage may be available, life insurance with chronic kidney disease could come at higher premiums due to the risks associated with the condition. Enter your ZIP code to start comparing premiums from highly-rated insurers in your area.

Is Dialysis Covered by Insurance?

Many health insurance plans provide dialysis insurance coverage in India, but coverage can vary depending on the insurer. If you are wondering, is dialysis covered by insurance in your country, it’s essential to review your policy to see if dialysis treatments are included. Find answers in our guide, “10 Best Life Insurance Companies.”

What Is the Best Health Insurance for Dialysis Patients in India?

The best health insurance for dialysis patients in India is one that covers kidney disease treatments, including dialysis. Insurance providers like Star Health, Max Bupa, and HDFC ERGO offer policies specifically designed for insurance for dialysis patients in India.

What Is Kidney Disease Life Insurance?

Kidney disease life insurance is a policy designed to offer life coverage to individuals with kidney disease. Depending on the severity of the condition, the premiums and coverage may vary. It’s important to explore different options for life insurance for CKD patients.

What Is the Cost of Dialysis Without Insurance?

The cost of dialysis without insurance can be quite expensive, often ranging from ₹2,000 to ₹10,000 per session in India. If you’re wondering how to pay for dialysis without insurance, government aid or personal savings may be helpful, but it can be financially challenging. Learn more by checking our guide, “Types of Life Insurance.”

Can You Get Life Insurance with Chronic Kidney Disease?

Yes, can you get life insurance with kidney disease? If you have chronic kidney disease (CKD), it is still possible to secure life insurance, although coverage and premiums will depend on your specific health condition and the stage of the disease. This is where life insurance for chronic kidney disease becomes crucial, as it helps provide financial protection.

Why Is End-Stage Renal Disease Covered by Medicare?

In the United States, why is end-stage renal disease covered by Medicare? Medicare covers end-stage renal disease (ESRD) because it is a life-threatening condition that requires ongoing treatments such as dialysis or a kidney transplant, which are costly without coverage. Start comparing affordable insurance options by entering your ZIP code into our free quote comparison tool today.

What Is Dialysis Liability Insurance?

Dialysis liability insurance is designed to protect dialysis providers from financial and legal risks associated with providing treatment to kidney patients. Clinics that provide dialysis services typically need this type of insurance to ensure they are protected in case of any liability issues. Get all the details from our guide, “Life Insurance Resources.”

What Is Kidney Failure Insurance?

Kidney failure insurance is a policy that helps cover the costs associated with kidney failure, including treatments like dialysis and possible kidney transplants. It is especially important for individuals who may struggle with the high costs of treatment, offering protection against the financial burden of kidney failure.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Life Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed life and health insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chr...

Licensed Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.