Best Life Insurance for People With Hepatitis in 2025 (10 Standout Companies)

The best life insurance for people with hepatitis is from Mutual of Omaha, AIG, and Prudential, offering minimum coverage life insurance starting at a low $31/mo. If you have chronic hepatitis, are at high-risk, or are just looking for the best competitive rates, these three companies are your best choice.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Life Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Licensed Life Insurance Agent

UPDATED: Mar 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Mar 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

0 reviews

0 reviewsCompany Facts

Full Coverage for People With Hepatitis

A.M. Best Rating

Complaint Level

0 reviews

0 reviews 163 reviews

163 reviewsCompany Facts

Full Coverage for People With Hepatitis

A.M. Best Rating

Complaint Level

163 reviews

163 reviews 0 reviews

0 reviewsCompany Facts

Full Coverage for People With Hepatitis

A.M. Best Rating

Complaint Level

0 reviews

0 reviewsMutual of Omaha, AIG, and Prudential offer the best life insurance for people with hepatitis; minimum and full coverage start at just $31 and $98 per month, respectively.

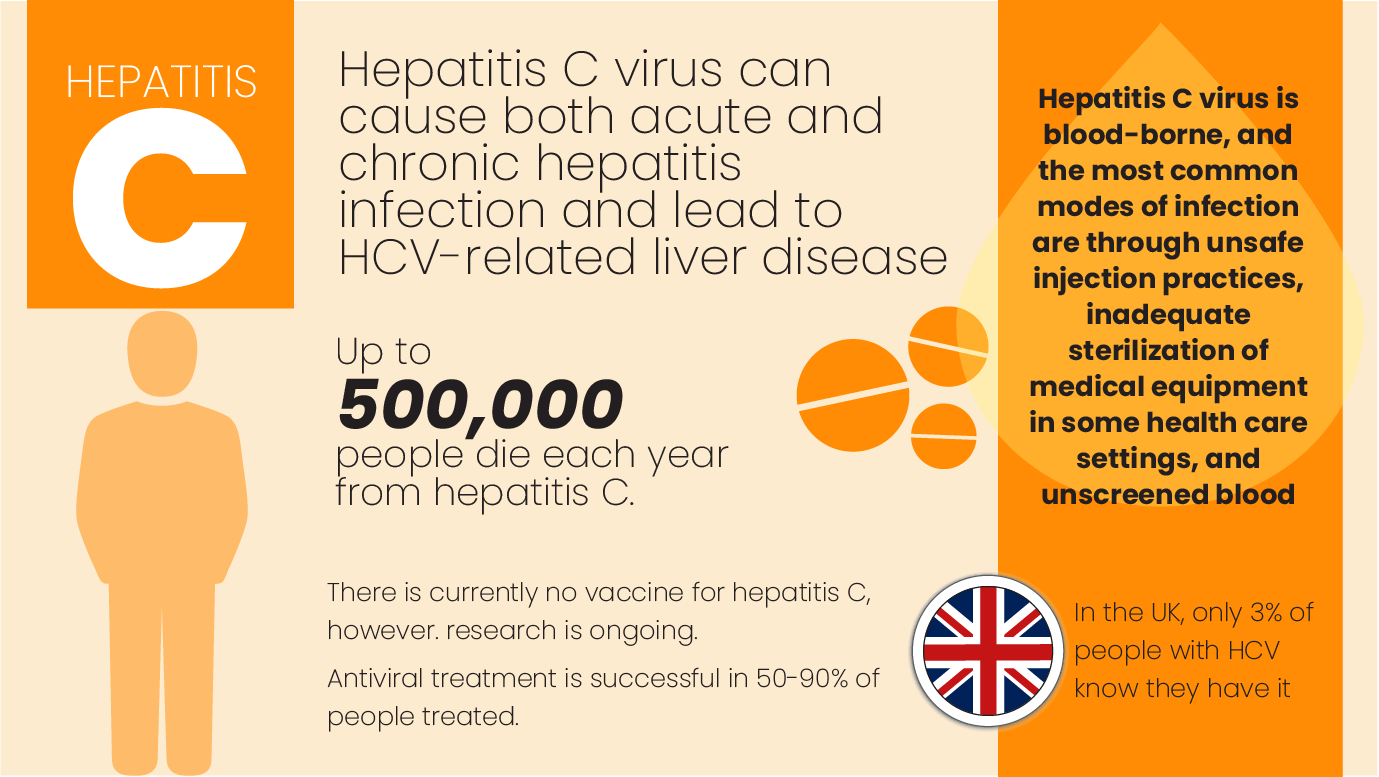

There are five types of hepatitis: hepatitis A through E. In every case, hepatitis is an indication of an inflamed liver. However, hepatitis B and C are the types your insurance company will focus on because these can lead to serious liver complications.

Our Top 10 Company Picks: Best Life Insurance for People With Hepatitis

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | A+ | Chronic Conditions | Mutual of Omaha | |

| #2 | 12% | A | High-Risk Applicants | AIG |

| #3 | 8% | A+ | Competitive Rates | Prudential | |

| #4 | 5% | A+ | Wellness Rewards | John Hancock | |

| #5 | 17% | B | Personalized Service | State Farm | |

| #6 | 5% | A++ | Older Adults | AARP | |

| #7 | 7% | A+ | High-Risk Coverage | Transamerica | |

| #8 | 5% | A | Financial Stability | Lincoln Financial | |

| #9 | 10% | A+ | Low-Cost Term | Banner Life |

| #10 | 15% | A- | Family Benefits | Foresters Financial |

If you’re reading this and have concerns about finding quality life insurance after a diagnosis of any hepatitis, this article should help put your fears to rest. We’ll help you find ways to improve your chances of qualifying when buying term life insurance.

When looking for life insurance, enter your ZIP code in our free comparison tool and obtain a quote in seconds.

- Hepatitis can be a lifelong condition affecting your life insurance rates.

- Your lifestyle can also be a major factor in contracting hepatitis

- Some hepatitis types can prevent you from receiving some medical services

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

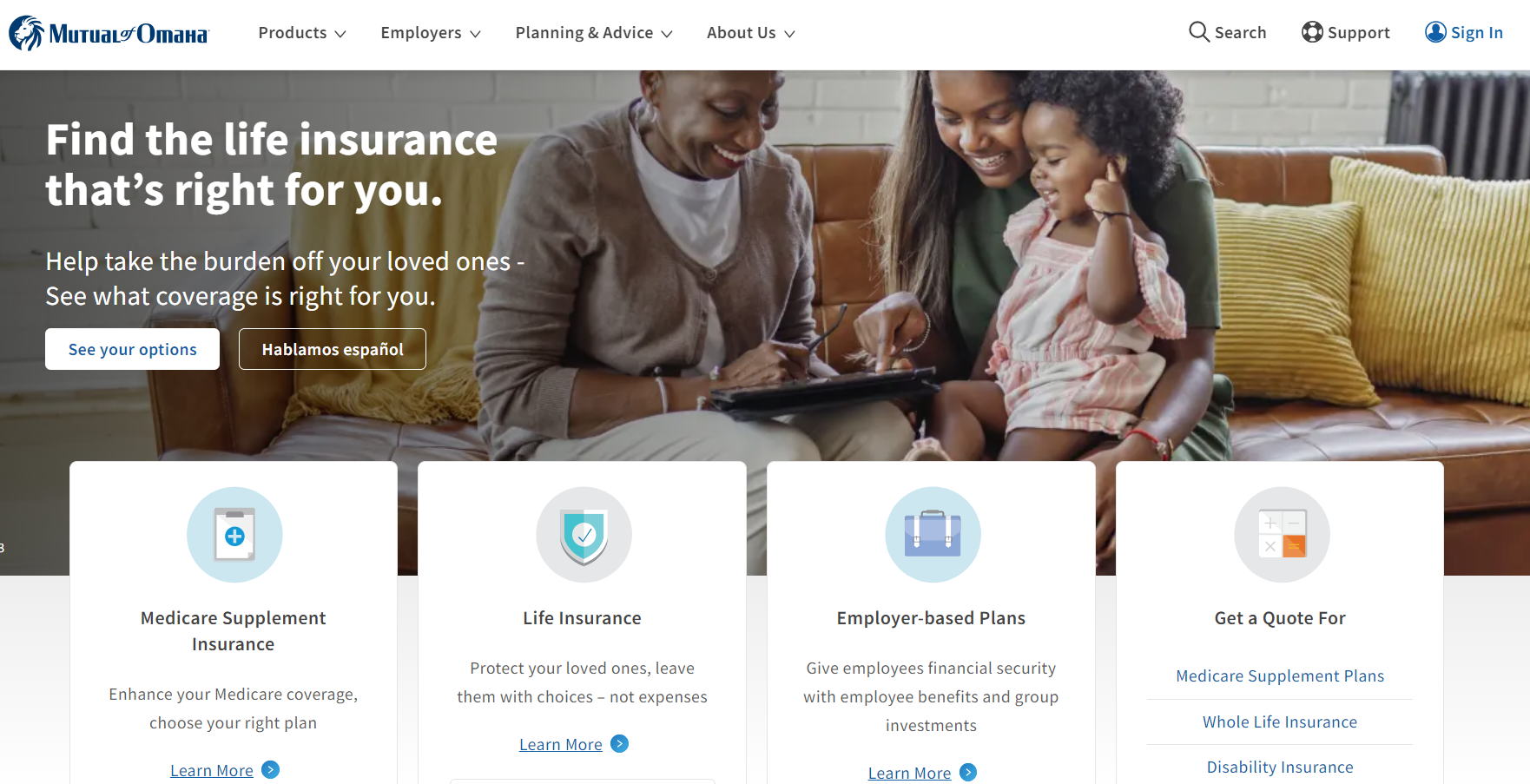

#1 – Mutual of Omaha: Best for Chronic Conditions

Pros

- Support for Chronic Conditions: Depending on the type of hepatitis and its severity, Mutual of Omaha may offer better rates for well-managed cases.

- Simplified Application: The application process for those with hepatitis can be quick and straightforward to find products, approvals, and guaranteed acceptance policies.

- Leniency for Health Conditions: Policies are designed for individuals with pre-existing conditions like hepatitis. Check our Mutual of Omaha life insurance review to know more.

- No Medical Exam Options: Some policies do not require a medical exam, contributing to its position as the best life insurance for people with hepatitis.

Cons

- Higher Premiums: Policies like guaranteed issues tend to have higher premiums than standard life insurance because they accept higher-risk applicants like chronic hepatitis.

- Coverage Limitations: Guaranteed acceptance policies have lower coverage amounts, which may not meet all your financial needs if hepatitis-related complications arise.

- Graded Death Benefits: High-risk individual policies have graded death benefits, so if a natural death occurs due to hepatitis within the first 2-3 years, it may not be fully paid out.

#2 – AIG: Best for High-Risk Applicants

Pros

- Specialized Underwriting for Hepatitis: AIG’s experience underwriting policies helps people with hepatitis by examining factors like type and treatment history.

- Flexible Policy Options: The policies available are flexible, especially with hepatitis B life insurance. Check out the AIG life insurance review to learn more about AIG’s policies.

- Potential for Standard Rates: If your hepatitis is well-managed, especially in successful treatment or remission cases, AIG offers more affordable standard rates.

Cons

- Higher Premiums for High-Risk Applicants: Active hepatitis or liver complications will cause AIG to classify you as a higher-risk applicant, increasing premiums.

- Potential Declines for Severe Cases: In cases where hepatitis has caused significant liver damage or cirrhosis, AIG may decline coverage for traditional life insurance policies.

#3 – Prudential: Best for Competitive Rates

Pros

- Flexible Underwriting: Prudential evaluates applicants on a case-by-case basis. If your hepatitis is well-managed, you may qualify for coverage at reasonable rates.

- Living Needs Benefit: Prudential policies allow early access to a portion of the death benefit if a terminal illness develops, which is beneficial if your hepatic condition worsens.

- Multiple Options: The options available allow you to choose based on your needs in coping with hepatitis. Learn more in the Prudential life insurance review.

Cons

- Strict Underwriting: Chronic conditions like hepatitis with elevated liver enzymes cause life insurance to have higher premiums or policy denial due to elevated liver enzymes

- Medical History Required: Comprehensive underwriting includes a medical exam and detailed health history, which may disadvantage applicants with severe hepatitis infection.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#4 – John Hancock: Best for Wellness Rewards

Pros

- Health Incentives: Policyholders can expect discounts and rewards for healthy behaviors that show management of hepatitis-related health issues.

- Case-by-Case Evaluation: Applicants are reviewed individually, and their management of hepatitis is checked. If there are no complications, they can expect reasonable rates.

- Guaranteed Issue Options: Hepatitis applicants are accepted regardless of their health condition or medical exam. For more options, check the John Hancock insurance review.

Cons

- Strict Underwriting for Hepatitis: Applicants with active hepatitis infections, elevated liver enzymes, or liver damage may face postponements, higher premiums, or coverage denial.

- Waiting Periods: Applicants who recently completed hepatitis treatments may need to wait six months to a year before reapplying, depending on their medical history and test results.

#5 – State Farm: Best for Personalized Services

Pros

- Wide Range of Policy Options: Term, whole, and universal life insurance policies are on offer, plus customizable options for riders related to people with hepatitis.

- High Customer Satisfaction: State Farm is known for its good customer support and knowledgeable agents who can help people with hepatitis find the best life insurance.

- Simplified Issue Options: Some term life policies offer coverage without a medical exam, which benefits individuals with hepatitis who seek approval on smaller coverage amounts.

Cons

- Limited No-Medical-Exam Coverage: Coverage amounts are capped at $50,000; hepatitis-infected individuals seeking more significant death benefits should look elsewhere.

- Agent-Only Access: Policies must be purchased via agents, which can slow the process of buying hepatitis life insurance. For more, check out the State Farm insurance review.

#6 – AARP: Best for Older Adults

Pros

- Guaranteed Acceptance Option: Customers can expect no healthy questions for their coverage if they have more severe health issues like chronic hepatitis.

- Simplified Application Process: Policies have easy requirements, and there is no waiting period for benefits for people with hepatitis under their permanent life insurance plans.

- Coverage for Seniors: Products suitable for seniors include managing chronic health conditions like hepatitis. To learn about AARP benefits, read our AARP insurance review.

Cons

- Low Coverage Limits: The maximum coverage amount for whole-life policies is $50,000, but if a hepatitis complication occurs, the policy may need to cover payments and debts.

- Age Restrictions: Coverage is primarily targeted at those aged 50-80, limiting options for younger applicants who may have hepatitis.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#7 – Transamerica: Best for High-Risk Coverage

Pros

- Policy Variety: Transamerica provides a range of life insurance options, including whole life with cash value accumulation if you need it after a hepatitis complication.

- Living Benefits: Trendsetter LB term life insurance includes accelerated death benefits for chronic or critical illnesses, perfect for any hepatic complications.

- No Medical Exam for Some Policies: Some policies, particularly final expense insurance, do not require a medical exam; individuals with hepatitis will find it easier to qualify.

- High Coverage Limits: Term policy coverage is up to $10 million, providing financial protection after hepatic problems. Our Transamerica life insurance review explains more.

Cons

- Medical Underwriting for Certain Policies: Eligibility for individuals with hepatitis may be affected by the required medical exam for policies.

- Higher Complaint Rates: Transamerica has a higher-than-average complaint index, indicating unsatisfactory customer service and claims for hepatitis life insurance.

- Limited Online Functionality: The company does not offer extensive online tools for hepatitis life insurance quotes, which might inconvenience tech-savvy users.

#8 – Lincoln Financial: Best for Financial Stability

Pros

- Support for Pre-Existing Conditions: Competitive rates are available for pre-existing health conditions, including hepatitis.

- Term Life Options Without Medical Exams: The process of their term life insurance products is straightforward, offering no exams and less stress for people with hepatitis.

- Financial Stability: Expect a reliable paying-out claims process for any complications that may appear with hepatitis.

Cons

- Application Process: Many policies, including those with hepatitis life insurance, require working with a financial advisor and do not have a complete online application process.

- Potential Premium Increases: Individuals with hepatitis may still face higher premiums as underwriting varies case by case.

#9 – Banner Life: Best for Low-Cost Term

Pros

- Competitive Term Policies: Banner Life has some of the most affordable term life insurance policies, especially for those with hepatitis with mild to moderate symptoms.

- Case-by-Case Underwriting: Applicants with hepatitis are assessed, and well-managed cases can expect potentially favorable rates.

- Flexibility in Coverage Options: They provide term and universal life insurance, especially for including high-risk hepatitis applicants. Check out the Banner Life insurance review.

Cons

- Higher Premiums for Risk: Those with active hepatitis with or without complications such as liver cirrhosis face substandard rates or table ratings, increasing premiums significantly.

- Lengthy Assessment Process: Detailed hepatitis medical evaluations, including liver function tests and biopsy results, are required, which can prolong the application process.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#10 – Foresters Financial: Best for Family Benefits

Pros

- Flexible Policies: Foresters provides term, whole, and universal life insurance options, plus final expense insurance, suitable for people with health concerns like hepatitis.

- Consideration of Pre-Existing Conditions: Depending on their severity and management, pre-existing conditions, such as diabetes, are given potential leniency for hepatitis.

- Charity Benefit Provision: Hepatitis life insurance policies have a unique feature where 1% of the death benefit is donated to a charity chosen by the policyholder.

Cons

- Stringent Underwriting: Applicants are evaluated on hepatitis type, viral load, treatment history, and liver health. Advanced cases face higher premiums or exclusions.

- Policy Caps and Age Limits: Restrictions based on age and type of policy can be problematic for seniors with hepatitis. The Foresters life insurance review explains more.

Shopping for Life Insurance Quotes With Hepatitis

Is it possible to get life insurance with hepatitis? As with any life insurance with pre-existing conditions, it all depends on the type of hepatitis you might have and the extent of damage that the disease has caused to your liver.

People With Hepatitis Life Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $37 | $112 | |

| $42 | $128 |

| $29 | $92 |

| $33 | $86 |

| $41 | $118 | |

| $34 | $107 | |

| $31 | $98 | |

| $46 | $137 | |

| $39 | $116 | |

| $32 | $99 |

Hepatitis indicates liver inflammation; the cause is usually a viral infection, but abusing drugs or alcohol can also cause hepatitis. The disease can be acute, viral, or chronic, and even with the availability of vaccines in the United States, outbreaks still can occur. Most companies will look into viral hepatitis life insurance.

Outbreaks occur in populations that may be exposed to unclean food sources and drinking water. This can largely be prevented with vaccinations. So, if you’re shopping for the cheapest life insurance quotes, you can avoid unnecessary risks and costs by ensuring your vaccinations are up to date every few years.

Understanding the type of hepatitis you’ve been diagnosed with will not only help you manage your symptoms but also help you avoid having to seek impaired risk life insurance.

Sample Monthly Life Insurance Rates With Hepatitis

Before we examine how to get the best life insurance for people with hepatitis, let’s look at some sample rates quoted by insurance companies. Rate tables are listed for age groups: 40-year-olds, 55-year-olds, and 60-year-olds.

LIFE: 40-Year-Old Male / Female Nonsmokers with a 20-Year Term Life Insurance Policy

| Rating Class | $100,000 / Female | $100,000 / Male | $250,000 / Female | $250,000 / Male | $500,000 / Female | $500,000 / Male |

|---|---|---|---|---|---|---|

| Preferred | $11 | $13 | $19 | $22 | $32 | $38 |

| Standard | $16 | $18 | $29 | $33 | $52 | $60 |

| Table B | $20 | $23 | $34 | $42 | $63 | $76 |

| Table D | $25 | $30 | $44 | $54 | $82 | $99 |

| Table F | $27 | $36 | $52 | $64 | $94 | $120 |

| Table H | $31 | $42 | $62 | $76 | $112 | $144 |

You can see that the higher your risk, the higher your rating class will be, and the more your insurance will cost. To learn more, check out the best life insurance by age to find a good index of quality content based for specific points in your life.

LIFE: 50-Year-Old Male / Female Nonsmokers with a 20-Year Term Life Insurance Policy

| Rating Class | $100,000 / Male | $100,000 / Female | $250,000 / Male | $250,000 / Female | $500,000 / Male | $500,000 / Female |

|---|---|---|---|---|---|---|

| Preferred | $27 | $20 | $49 | $38 | $91 | $69 |

| Standard | $37 | $29 | $77 | $58 | $144 | $111 |

| Table B | $49 | $39 | $98 | $73 | $187 | $137 |

| Table D | $64 | $50 | $129 | $95 | $248 | $181 |

| Table F | $79 | $60 | $152 | $116 | $294 | $221 |

| Table H | $94 | $72 | $182 | $138 | $351 | $264 |

Monthly rates can almost double every 10 years. Take a look at the dramatic difference between the table above and below. Your incentive is to lock in low-cost insurance when you’re younger.

LIFE: 60-Year-Old Male / Female Nonsmokers with a 20-Year Term Life Insurance Policy

| Rating Class | $100,000 / Male | $100,000 / Female | $250,000 / Male | $250,000 / Female | $500,000 / Male | $500,000 / Female |

|---|---|---|---|---|---|---|

| Preferred | $65 | $43 | $128 | $93 | $243 | $170 |

| Standard | $92 | $66 | $205 | $144 | $393 | $274 |

| Table B | $126 | $86 | $251 | $176 | $493 | $338 |

| Table D | $166 | $113 | $333 | $233 | $655 | $448 |

| Table F | $197 | $137 | $403 | $283 | $795 | $551 |

| Table H | $235 | $163 | $483 | $338 | $953 | $660 |

Considering the different rates and costs, let’s look at managing your hepatitis symptoms to keep costs down.

Life Insurance Companies Check for Chronic Illnesses

A regular life insurance medical exam does not specifically screen for hepatitis. Life insurance companies look for indications of damage to the liver from a regular blood panel and can require follow-up testing for hepatitis B, C, or alcoholic hepatitis.

It's important to make a distinction between chronic and critical illness when it comes to life insurance. Chronic illnesses cause a person to be unable to perform certain daily living activities, on the other hand, critical illnesses are from specific illnesses and health condition which will require critical illness cover.Jeffrey Manola Licensed Life Insurance Agent

A chronic illness can be managed, although symptoms can progress over time. However, the patient can still lead a long and happy life and find it manageable to get life insurance with pre-existing conditions.

Will critical illness cover pay out for hepatitis B all depends on how far it’s progressed. A critical illness is uncurable and is expected to lead to a shorter lifespan. A pre-existing critical illness can disqualify an applicant from life insurance.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Life Insurance with Autoimmune Hepatitis

Autoimmune hepatitis indicates damage to the liver that is brought on by reactions triggered through a person’s autoimmune system. Usually, your autoimmune system targets infections and viruses in the body and releases pathogens to attack the damaged cells so that you can heal.

In a person with an autoimmune disease, the autoimmune system misdiagnoses an issue and attacks a healthy organ and healthy cells. For example, in autoimmune hepatitis, the autoimmune system attacks an otherwise healthy liver. The video below provides more details on the disease.

There are two types of autoimmune hepatitis. Younger women are more at risk for the more common type 1, while type 2 predominantly affects girls in their childhood. Left untreated, autoimmune hepatitis can reduce life expectancy. For a person to qualify for preferred-rate life insurance with autoimmune hepatitis, a history of proper symptom management is necessary.

What Life Insurance Companies Look For With Hepatitis Patients

Life insurance conditions and criteria can change from company to company when qualifying for insurance. Life insurance has risk classes, insurance companies are taking a risk by insuring individuals.

They conduct a due diligence process called underwriting to expose any potential risk. In insurance lingo, it’s called “the underwriting process.” Each health ailment calls for different questions you must be prepared to answer. Let’s look at the issues the underwriter will address.

Date of First Diagnosis

The underwriter is trying to assess whether you can be insured. Typically, to be considered for coverage, a person must have had acute hepatitis (less than six months) and be fully recovered with or without treatment. However, obtaining a traditional term life insurance policy will be challenging any time you have chronic hepatitis (longer than six months).

Results of the Most Recent Liver Enzyme Tests

The underwriter will call for extra clarification if there are any liver abnormalities to see how you qualify for life insurance with elevated liver enzymes. Below are a few of the tests the underwriter will ask you about:

- AST

- ALT

- GGT

Each is an intricate enzyme test that may not be part of a regular blood panel. Your insurance company should advise whether your doctor will need to make a special request to deliver these results. Your AST levels and life insurance are closely related due to AST being a marker for liver problems.

Also, an elevated GGT affects life insurance in the same way. Expect your life insurance with high GGT to increase or be denied. This is why taking care of your management is so important as it can affect the prices of insurance in so many ways.

Usage of Medications

Medication usage indicates the severity and control of the ailment. Different medications can predict the severity of your condition, and insurers can assess risk from the medication you’re taking.

Don’t Drink A Drop of Alcohol

Remember that whether you have hepatitis or not, the underwriter will still ask this question. Nonetheless, any alcohol use for a hepatitis patient will most likely result in a declined application.

Past Diagnoses

Extreme liver damage can significantly impact your ability to obtain insurance. You may wonder if someone with cirrhosis can get life insurance.

- Chronic hepatitis is inflammation that lasts at least six months. With this situation, expect a table rating from B–H, depending on your age, liver enzyme elevation, and liver biopsy results.

- Cirrhosis is also called irreversible scarring: Anytime the liver is damaged, it tries to repair itself by creating new scar tissue, resulting in liver failure. With this condition, your application will be denied.

A surefire way to obtain affordable coverage is to get it when you are younger and don’t have any aggravated health issues.

Other Questions Life Insurance Companies Ask if You Have hepatitis

Hepatitis isn’t the only health issue the underwriter will ask about. Assessing the overall risk you pose to the insurer has many pieces. Below are a few more questions you should be aware of:

- High-risk hobbies and insurance (if any)

- Current and past health history

- Family history

- Foreign travel

- Smoking habits

You may want to keep records of any special diets or exercises you follow to control symptoms. Healthy eating keeps you healthy, improving your chances of getting a good quote for life insurance.

People at Risk for Hepatitis

The first thing you would ask is if hepatitis is permanent; depending on the type, it can be. In the United States, vaccinations are available and recommended for all children and adults with potential exposure to hepatitis A and B. The CDC estimates that 1.2 million people in the United States and 350 million people worldwide live with hepatitis B.

There is no vaccine for hepatitis C. Typically contracted through drug use or blood-to-blood contact, approximately 2.7 to 3.9 million Americans are living with chronic hepatitis C.

Hepatitis D is a rare form of the disease that occurs only in conjunction with a hepatitis B infection. Hepatitis E isn’t common in the United States and occurs from ingesting contaminated water. To show you how to get the best rate, let’s focus on the most prominent types of hepatitis.

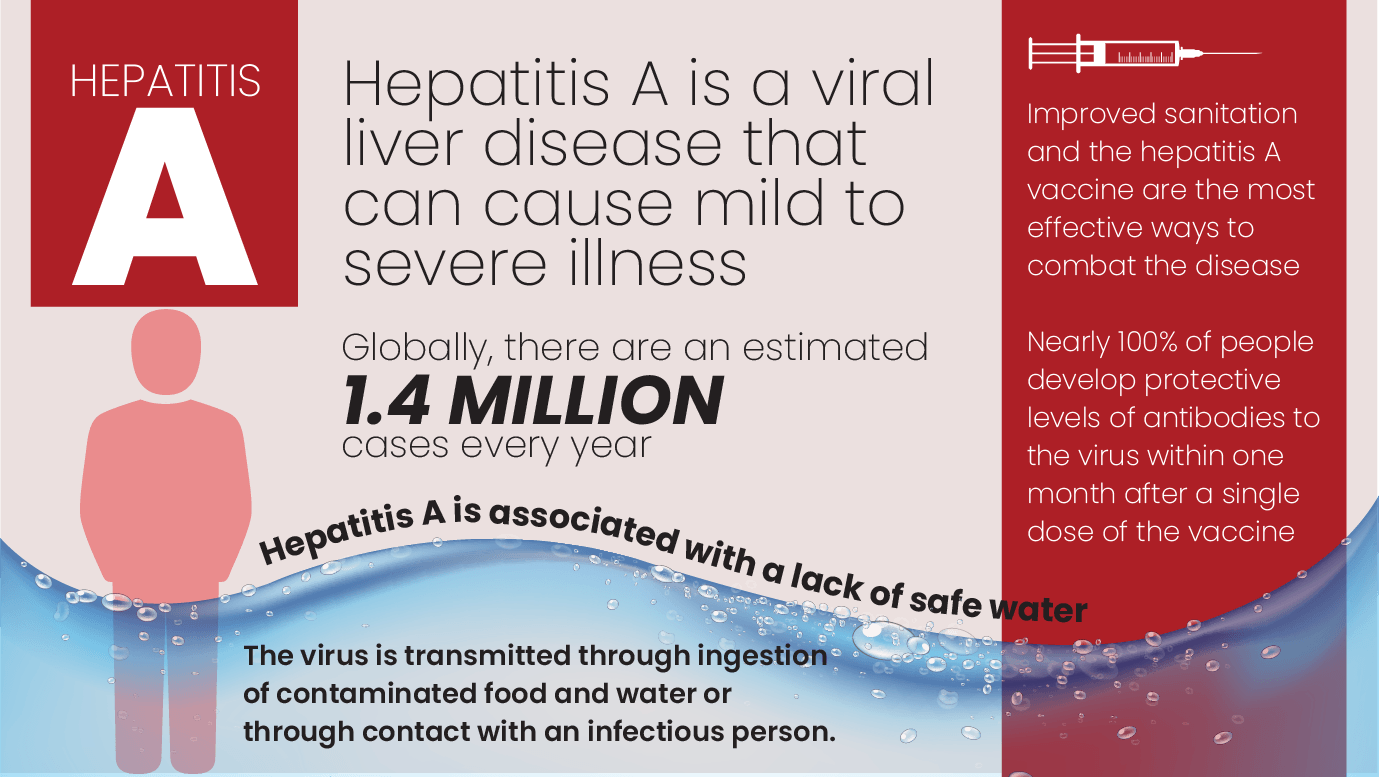

Hepatitis A is not Permanent

Now for some Hepatitis A facts. Hepa A (HAV) is curable and usually transmitted through contaminated food or water. Since treatment for patients will usually lead to a full recovery, hepatitis A doesn’t register as a significant concern when it comes to life insurance. However, if you’re diagnosed with hepatitis A, life insurance companies might want to understand the circumstances in which you contracted the disease.

Would I know if I had hepatitis A? As you can see from the graphic below, symptoms can range from mild to severe, but you will probably feel the effects—Hepatitis A symptoms ordinarily last two to six weeks with treatment.

People who travel or don’t have up-to-date vaccinations are at a higher risk of contracting the disease. Keeping good records of your treatment and documentation of all vaccinations to indicate a healthy liver and complete recovery isn’t necessary for hepatitis A life insurance but is an excellent practice to maintain.

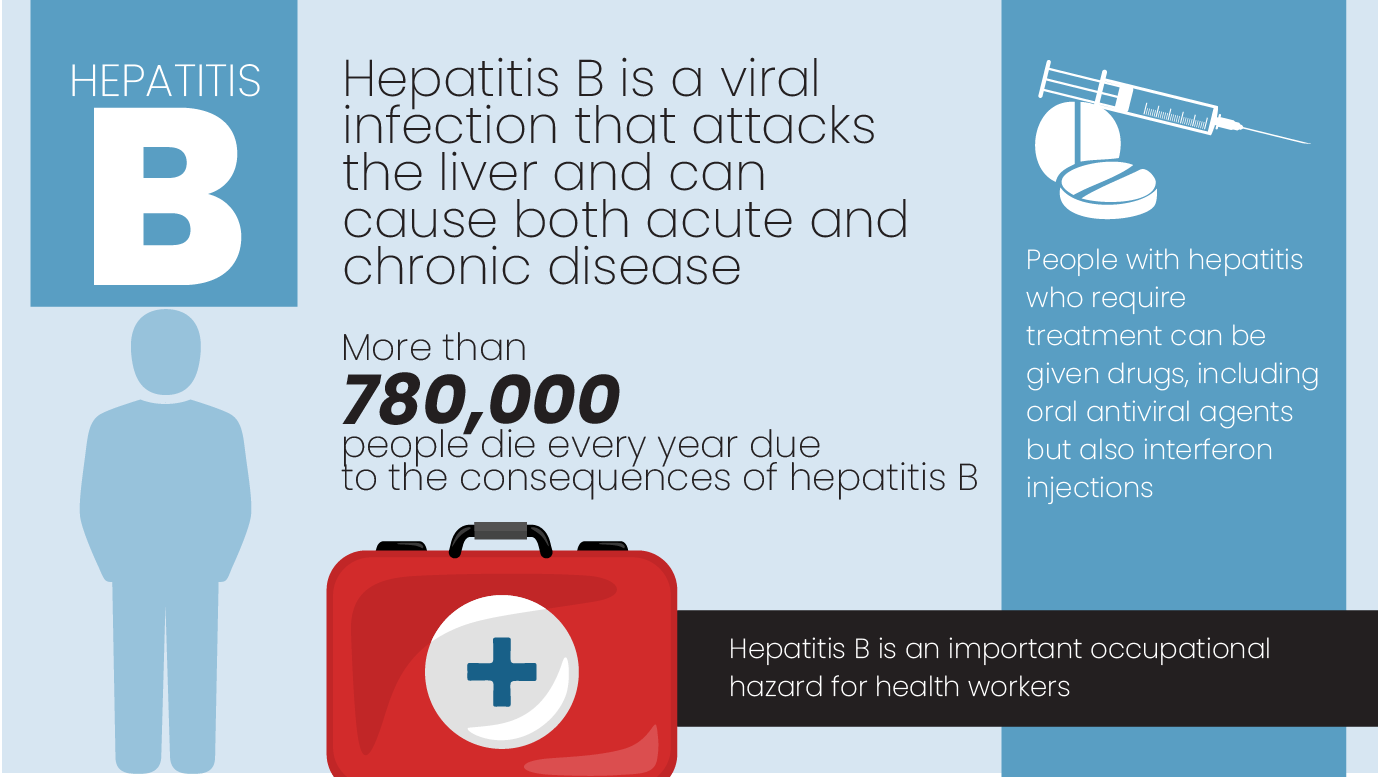

The Types of Hepatitis B

Hepatitis B (HBV) is transmitted through bodily fluids and can be transmitted from a mother to a child at birth or by adults who share intravenous needles or engage in unprotected sex. Will critical illness cover payout for hepatitis b? Although hepatitis B is not curable, it’s also not classed as a critical illness.

There are two types of hepatitis B: acute and chronic. In either case, a carrier can spread the disease, so regular check-ups are required for treatment which may make you wonder will life insurance cover for hepatitis b. So, how does life insurance work with hepatitis B? Insurance companies are interested in monitoring customers with chronic hepatitis B.

Acute hepatitis B patients typically resolve symptoms within six months, so life expectancy with hepatitis B is expected to be well into retirement years. Although the disease will continue to exist in their systems and they can continue to transmit it, they are usually safe from long-term liver damage or liver cirrhosis.

The real danger of acute hepatitis B patients is carrying and transmitting the disease; this speaks volumes about the importance of having everyone vaccinated.

Insurance companies must manage chronic hepatitis B cases differently from carrier cases. Chronic hepatitis B can lead to severe liver damage and is not curable. Can I get life insurance with hepatitis B? Will life insurance cover hepatitis B? Patients often ask these life insurance questions about hepatitis B when seeking coverage.

Insurance companies may not want to take a risk on individuals who have a history of dangerous behavior. In these instances, a patient may wish to work with a high-risk life insurance agent to ensure the life insurance pays out for hepatitis B.

If you’re seeking life insurance, you should keep good records of all medical history and medications for your life insurer. If you can prove that you’re managing your symptoms responsibly and are at a low risk for dangerous behavior, you may qualify for preferred rates.

How much is life insurance with hepatitis B? Use our comparison tool below to check for hepatitis b covered life insurance in seconds.

How to Qualify for Term Life Insurance With Liver Disease

While hepatitis A and B are primarily preventable through modern medicine, other types of hepatitis and fatty liver diseases can be a problem for life insurance companies. In these different cases, life expectancy can be reduced because of aggressive liver damage, cirrhosis, or cancer of the liver.

Hepatitis C (HCV), alcoholic hepatitis, and fatty liver disease all indicate red flags for insurance companies. There are no preventative vaccines in each case, although treatments are available. However, in three of these types of hepatitis, the method of contraction can impact a person’s insurability.

- Hepatitis C (HCV)

- Alcoholic hepatitis

- Fatty liver disease

In these cases, an insurance company can see a longer-term risk in insuring a person even if the disease is cured. For example, a cured Hepatitis C life insurance customer may be completely healthy during a check-up. However, the patient is at high-risk if the disease is contracted from drug use. Life insurance for drug abusers can be difficult to obtain.

In these cases, an insurance company might not want to qualify the candidate for insurance or might require a higher premium.

If you have concerns about your liver, consider taking special precautions, especially if you plan to travel. Often, vaccines are required for hepatitis A and B. If you plan to travel to places where hepatitis C might be an issue or where you may be inclined to use too much alcohol, you might consider travel insurance for fatty liver or other means of travel insurance.

In countries where medical standards are not as high, travel insurance can help you pay for the best possible medical care should anything happen. If you’re looking for what companies can cover for hep c treatment, enter your zip code below in our comparison tool to get quick quotes.

How to Get a Life Insurance Quote

If you were recently diagnosed with hepatitis, you’ll want to see your doctor before getting a life insurance quote. It’s always better to secure life insurance earlier than later. Getting quotes at a younger age will save you money. If you’re considering getting life insurance, ask yourself if you can afford to wait.

By getting insurance early and staying on top of your condition by working with doctors and taking your medications, you can not only offset symptoms of hepatitis but also get insurance companies to consider you for lower-risk plans. The best way to get quotes for life insurance for people with liver disease is to use our comparison tool below.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Life Insurance Companies for Hepatitis

The rate tables provided in this article should give you a good idea of how rates increase if your symptoms aren’t well managed. Regardless of your condition, you’ll always want to compare rates from a few companies to get the best rates. The table below lists the top 10 insurance companies by discounts available.

Life Insurance Discounts From the Top Providers for People With Hepatitis

| Insurance Company | Available Discounts |

|---|---|

| Multi-Policy, Automatic Payments, Healthy Lifestyle, Age-Based Discounts | |

| Multi-Policy, Non-Smoker, Healthy Lifestyle, Annual Payment Discount |

| Multi-Policy, Healthy Lifestyle, Annual Payment, Non-Smoker |

| Family Membership, Multi-Policy, Non-Smoker, Annual Payment |

| Vitality Program (Wellness Rewards), Multi-Policy, Non-Smoker | |

| Multi-Policy, Non-Smoker, Annual Payment, Healthy Lifestyle | |

| Multi-Policy, Non-Smoker, Annual Payment, Paid-in-Full | |

| Multi-Policy, Non-Smoker, Healthy Lifestyle, Annual Payment | |

| Multi-Policy, Non-Smoker, Annual Payment, Safe Driver | |

| Multi-Policy, Non-Smoker, Healthy Lifestyle, Paid-in-Full |

You need to check what discounts are available from life insurance companies. If you already have a pre-existing condition, like hepatitis B or hepatitis C, Getting life insurance for hepatitis B carriers can significantly increase your rates. When looking for the best life insurance companies for hepatitis B, make sure you get the best rates by checking the number below.

Compare Quotes From Top Companies and Save Secured with SHA-256 Encryption

Case Studies: Life Insurance With Hepatitis (Companies + Rates)

Case Study 1: John’s Story

John is a 45-year-old individual who was diagnosed with chronic hepatitis B several years ago. Despite managing his symptoms and receiving regular medical check-ups, he has faced challenges in finding hepatitis B-covered life insurance coverage. John approached several insurance companies but was denied coverage or offered high-paying policies.

However, John was able to find a suitable life insurance policy with the help of an impaired-risk life insurance agent specializing in high-risk cases like hepatitis. The agent gathered all the necessary medical records, including John’s history of symptom management and treatments.

John secured preferred rates by providing detailed information about his condition and demonstrating responsible behavior, significantly reducing his monthly premiums.

Case Study 2: Sarah’s Story

Sarah, a 38-year-old woman, was diagnosed with autoimmune hepatitis, a condition where the immune system mistakenly attacks the liver. She had been managing her symptoms effectively and leading a healthy lifestyle. When Sarah decided to apply for life insurance, she was concerned about how her condition would affect the process.

Sarah worked with an independent insurance agent specializing in pre-existing conditions like autoimmune hepatitis. The agent helped her navigate the underwriting process and advised her on the best insurance companies to approach. Sarah disclosed her diagnosis and provided all the necessary medical documentation to demonstrate her responsible management of the condition.

Based on her healthy lifestyle and well-controlled symptoms, Sarah was able to obtain a life insurance policy with favorable rates. The insurance company recognized her efforts in managing her autoimmune hepatitis and considered her a low-risk applicant.

Case Study 3: Michael’s Story

Michael, a 55-year-old man, was diagnosed with hepatitis C several years ago. He had undergone treatment and achieved a sustained virologic response, meaning the virus was no longer detectable in his blood. However, Michael was concerned about his ability to secure life insurance due to his previous diagnosis.

Michael sought the assistance of an impaired risk life insurance agent specializing in hepatitis cases. The agent collected all of Michael’s medical records, including the details of his treatment and the results of his follow-up tests. They worked together to present a comprehensive picture of Michael’s health and demonstrate that he posed a low risk for the insurance company.

Michael could secure a life insurance policy at standard rates with the agent’s guidance and thorough documentation. The insurance company recognized that his hepatitis C was effectively treated and that he was no longer at high-risk for liver complications.

Life Insurance with Hepatitis

Life insurance may be one of your most important decisions for your loved ones. Life insurers always get phone calls in which they have to say, “Sorry, I don’t have any policy to offer — you won’t be able to receive a traditional policy because of your health conditions.”

The point is simple: If you have someone who depends on you financially, you must buy life insurance. We never know when our time will arrive or how we will pass away, but at least you won’t find yourself in a situation where you need a life policy but can’t get it.

If you’re looking for the best life insurance for hepatitis B, C, or any pre-existing condition such as diabetes, enter your ZIP code to run the quotes and get an idea of the prices.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Frequently Asked Questions

Can a person die from hepatitis A?

According to the World Health Organization, most people will recover from hepatitis A. However, symptoms can be severe, and death is possible in rare cases.

Which one is the bad hepatitis?

Each type of hepatitis can be considered “bad” for different reasons. For example, hepatitis A could be bad for economic reasons, while hepatitis B and C can indicate a drug epidemic or crisis in a community.

When it comes to life insurance, if you maintain your health and manage your symptoms effectively, you can usually obtain quality life insurance. However, if you’re contending with advanced hepatitis that has caused liver damage or cirrhosis, life insurance can be challenging to get.

Can I get life insurance before surgery?

You can get life insurance at any time with your pre-existing condition. However, you’ll want to be upfront and honest with your insurance company. It’s in your best interest to disclose any required and planned surgical procedures to prevent the disqualification of any claim. Often, a life insurance company might not write a policy if the surgical procedure is deemed high-risk.

Does life insurance test for hepatitis C?

A regular blood panel from a physical exam won’t test for hepatitis C. Typically, regular screening will identify any liver abnormalities, and then additional tests might be requested to test for hepatitis C or other exposures for the liver.

Can you get life insurance with hepatitis B?

It’s possible to get life insurance with hepatitis B, but any insurer will make an assessment based on your condition and how well you can manage your symptoms. Check the comparison tool below to learn which life insurance companies you can get.

Are there any specific types of life insurance that are more accessible for individuals with Hepatitis?

Some insurance companies offer guaranteed-issue life insurance or simplified-issue life insurance, which may be more accessible for individuals with pre-existing conditions, including Hepatitis. These policies typically have less stringent medical underwriting requirements but may have limitations on coverage amounts or higher premiums.

Should I disclose my Hepatitis diagnosis when applying for life insurance?

It is crucial to provide accurate and complete information when applying for life insurance. Failure to disclose your Hepatitis diagnosis may result in the denial of a claim in the future. Additionally, intentionally providing false information can be considered insurance fraud, a serious offense.

Can my life insurance policy be canceled if I develop Hepatitis after purchasing the policy?

Once a life insurance policy is issued and in force, it generally cannot be canceled or modified due to changes in your health, including the development of Hepatitis. The terms and conditions of your policy will remain in effect as long as you continue to pay the premiums on time.

Can I improve my chances of getting affordable life insurance with Hepatitis?

You can improve your chances of obtaining more affordable life insurance with Hepatitis. Simple steps include maintaining a regular medical check-up schedule, following prescribed treatments, managing overall health, and getting high-risk life insurance.

Will my premiums be higher because of hepatitis?

Premiums are likely higher due to increased risk. However, maintaining good overall health and providing successful treatment can reduce costs.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Life Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Licensed Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.