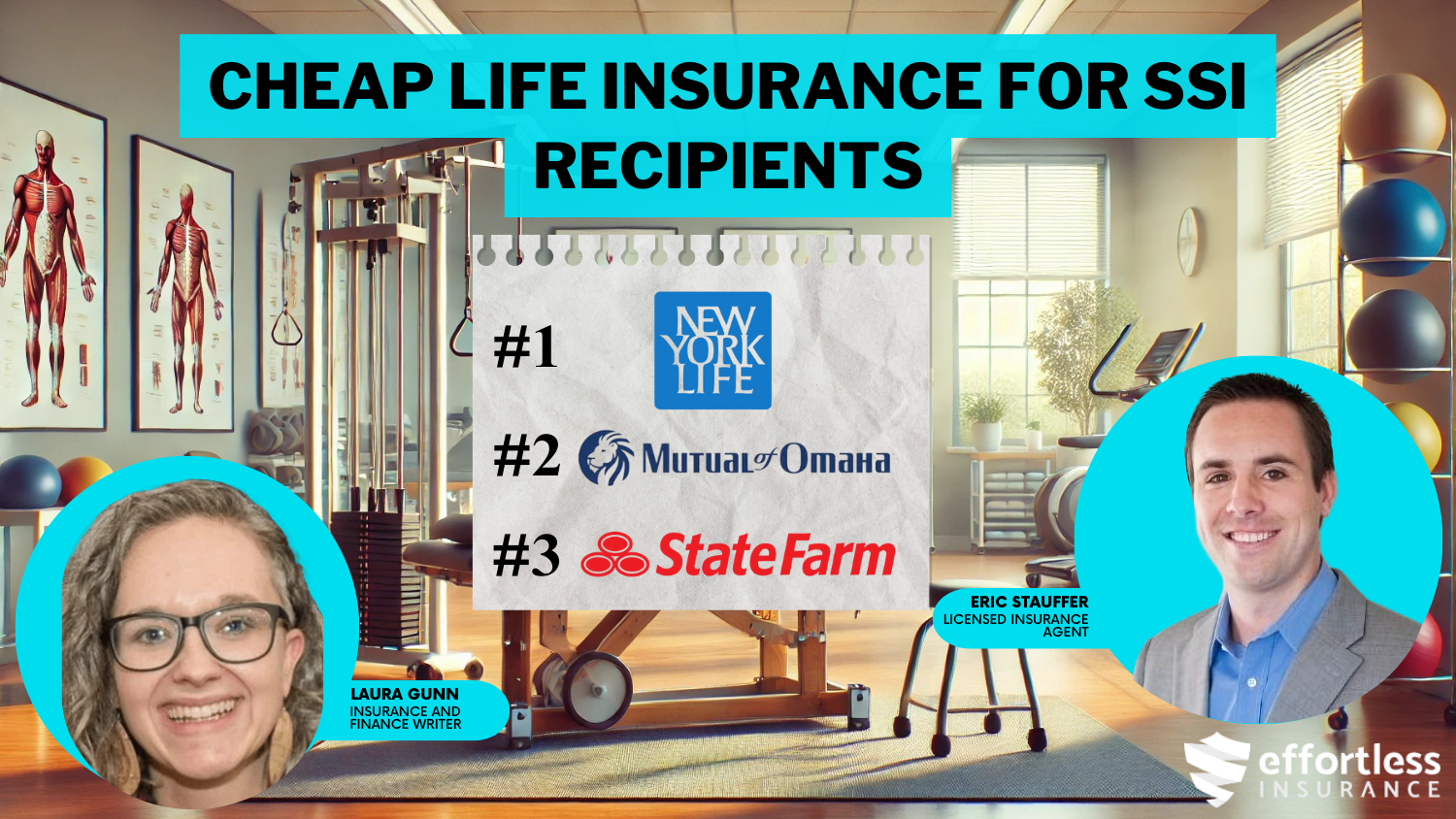

Cheap Life Insurance for SSI Recipients in 2025 (10 Most Affordable Companies)

If you’re looking for cheap life insurance for SSI recipients, rates start as low as $48 a month. New York Life is the best for low rates, Mutual of Omaha is great for burial coverage, and State Farm is top for burial policies. These companies offer affordable plans that fit different needs.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Jan 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

0 reviews

0 reviewsCompany Facts

Term Policy for SSI Recipients

A.M. Best Rating

Complaint Level

0 reviews

0 reviews 0 reviews

0 reviewsCompany Facts

Term Policy for SSI Recipients

A.M. Best Rating

Complaint Level

0 reviews

0 reviews 18,157 reviews

18,157 reviewsCompany Facts

Term Policy SSI Recipients

A.M. Best Rating

Complaint Level

18,157 reviews

18,157 reviewsThe best cheap life insurance for SSI recipients comes from New York Life, Mutual of Omaha, and State Farm, with rates starting as low as $48 a month. Don’t let high premiums hold you back from securing your future. These options make life insurance more accessible.

New York Life is the top pick for low rates, while Mutual of Omaha and State Farm are great for burial coverage and policies. These companies balance affordability with solid coverage options.

Our Top 10 Company Picks: Cheapest Life Insurance for SSI Recipients

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $48 | A++ | Whole Life | New York Life |

| #2 | $52 | A+ | Burial Coverage | Mutual of Omaha | |

| #3 | $56 | B | Burial Policies | State Farm | |

| #4 | $59 | A+ | High-Coverage | AIG | |

| #5 | $61 | A++ | Flexible Options | Guardian Life | |

| #6 | $65 | A | Simplified Issue | Lincoln Financial | |

| #7 | $68 | A+ | Affordable Term | Banner Life |

| #8 | $70 | A+ | Affordable Plans | Prudential |

|

| #9 | $73 | A+ | Term Policies | Transamerica | |

| #10 | $75 | A | Guaranteed Issue | AIG |

Whether you need a plan for long-term security or final expenses, they offer flexible choices. Their policies are designed to meet the unique needs of SSI recipients.

You can count on reliable customer support and straightforward application processes. Choosing the right coverage doesn’t have to be complicated with these trusted providers. Find the best life insurance company for SSI recipients near you by entering your ZIP code into our free quote tool above.

- Cheap Life Insurance for SSI Recipients starts at $48 per month, offering affordable options.

- Mutual of Omaha and State Farm provide excellent burial coverage to meet specific needs.

- New York Life stands out as the top choice for low-cost life insurance with flexible plans.

#1 – New York Life: Top Overall Pick

Pros

- Affordable and Flexible Plans: Starting at just $48, New York Life is an excellent option for SSI Recipients on a budget.

- Solid Reputation: They are known for being financially strong and dependable, New York Life ensures your policy is in good hands, which gives peace of mind.

- No-Fuss Claims Process: New York Life is known for its smooth process, ensuring everything is handled quickly. Discover more in our guide, “New York Life Insurance Review.”

Cons

- Higher Premiums: You might want to look into other choices, like cheap life insurance for SSI recipients, that could work better for your needs because New York has limited options.

- Limited Online Access: Some of their services are not as readily available, so you might find it inconvenient if you prefer managing everything digitally.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Mutual of Omaha: Best for Burial Coverage

Pros

- Affordable Burial: They offer specialized burial insurance plans that are perfect for SSI Recipients, starting at $52 per month.

- Simple and Quick Application: There application process is easy and straightforward, making it a great choice for SSI Recipients.

- Trusted by Many: With a solid reputation in the insurance industry, the Mutual of Omaha life insurance guide gives SSI recipients confidence.

Cons

- Not Ideal for Larger Coverage Needs: While great for burial insurance, the coverage limits might not be enough for those looking for something more extensive.

- Higher Premiums for Additional Coverage: If you’re looking to add more coverage, you might find the premiums higher than some other options for SSI Recipients.

#3 – State Farm: Best for Burial Policies

Pros

- Burial Coverage: Starting at $56, State Farm offers burial insurance plans that make it easy to ensure all your final arrangements are taken care of, no matter what.

- Competitive Premiums: State Farm is known for offering great value for the price and providing affordable premiums that won’t break the bank for SSI Recipients.

- Great Customer Service: State Farm is widely praised for its customer service, which can be very helpful for SSI recipients. See more in guide, “State Farm Life Insurance Review.”

Cons

- Policy Discounts: While bundling other policies with State Farm can save you money, the multi-policy discount for SSI Recipients might not be as large as some competitors.

- Premiums Can Be Higher: Depending on the coverage level you choose, the premiums might still be high, especially if you’re looking for extensive burial policies.

#4 – Pacific Life: Best for High-Coverage

Pros

- High Coverage Options: Starting at $59, they offer higher coverage limits that suit SSI Recipients. Pacific Life is a great choice if you need more extensive coverage.

- Customizable Plans: You can adjust your coverage based on what you need, ensuring you’re getting exactly what works for your budget and situation.

- Reputable Insurance Provider: They ensure a long-term financial security and dependable customer service for SSI recipients in need.

Cons

- Policies Can Be Complicated: With so many choices out there, it can feel overwhelming to pick the right plan, especially for SSI recipients who want something simple.

- Higher Premiums: They offer steady financial support and reliable customer service, especially for SSI recipients. Discover more in our guide, “Cheapest Life Insurance.”

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Guardian Life: Best for Flexible Options

Pros

- Flexible Coverage: Starting at $61, Guardian Life offers policies allowing SSI recipients to choose the coverage that works best for them, whether burial or broader protection.

- Strong Financial Stability: Guardian Life is known for its reliability and stability, so you can trust that your policy will be honored when it comes.

- No Medical Exam Options: Guardian Life offers plans that don’t require medical exams, making it an easy process.

Cons

- Higher Costs: Guardian might have higher costs that could be tough for some SSI recipients. See our full guide here, “Life Insurance Resources.”

- Limited Online Tools: Guardian Life’s digital tools aren’t as robust as some competitors, which may be frustrating for those who like to handle everything online.

#6 – Lincoln Financial: Best for Simplified

Pros

- No Medical Exams: They offer simplified issue policies that don’t require medical exams, making it much easier for SSI Recipients to qualify for coverage starting at $65.

- Quick and Easy Application: With a straightforward application process, they are great for anyone looking to get covered quickly without dealing with complicated forms.

- Affordable Plans: Their plans are fairly priced, giving SSI recipients good coverage without breaking the bank. See more in our guide, “10 Best Life Insurance Companies for Collateral.”

Cons

- Not the Best Option: If you’re looking for long-term or whole life coverage, this might not be the right choice for you.

- Lower Coverage Limits: For those who want larger coverage amounts, Lincoln Financials’ simplified issue policies might not offer as much.

#7 – Banner Life: Best for Affordable Term

Pros

- Very Affordable Term Insurance: Banner Life offers some of the best rates for term life insurance, starting at just $68, which is perfect for SSI Recipients.

- Flexible Term Lengths: You can choose the term length that fits your needs, whether it’s 10 years or 30 years, which is great for different life situations.

- Simple Application Process: Banner Life makes it easy to apply for coverage with a hassle-free process. Read more in our guide, “Banner Life Insurance Company Review.”

Cons

- Limited Whole Life Options: If you prefer whole life insurance, Banner Life is more focused on term policies, which might not be ideal for everyone.

- Availability Issues: Depending on where you live, Banner Life may not be available in all states, which could be a dealbreaker for some SSI Recipients.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Prudential: Best for Affordable Plans

Pros

- Affordable Plans: Prudential’s life insurance starts at $70, giving affordable options for SSI recipients without losing quality.

- Lots of Choices: Whether you need term life, whole life, or burial insurance, Prudential has options for SSI recipients to fit their needs.

- Reliable: Prudential, as highlighted in the Prudential Life insurance guide, is a trusted company known for good customer service for SSI recipients.

Cons

- Premiums Can Go Up: Choosing more coverage can increase the cost, making it harder for SSI recipients to afford.

- Slow Application: The process application can take longer, which may be inconvenient for needing SSI recipients quick coverage.

#9 – Transamerica: Best for Term Policies

Pros

- Affordable Term Life Insurance: Transamerica offers affordable term life insurance options for SSI Recipients seeking basic coverage. Starting at $73 per month.

- Flexible Term Options: Choose a term that works for you, such as 10 or 30 years, depending on your life situation.

- Reputable Company: Transamerica is known for excellent customer service and financial stability. Get more info. from our guide, “Transamerica Life Insurance Company Review.”

Cons

- Limited Whole Life Options: If you’re interested in whole life insurance, Transamerica focuses more on term life policies, which might not suit everyone.

- Complex Options: Some of their plans and coverage options might seem a bit complicated, which could make it difficult for SSI Recipients to navigate without help.

#10 – AIG: Best for Guaranteed Issue

Pros

- Guaranteed Coverage: AIG’s guaranteed issue policies start at $75, and you don’t need to worry about medical exams, making them ideal for SSI Recipients with health issues.

- Simple Application: The application is quick and straightforward so you can get covered without a long wait. Get some details in our guide, “AIG Life Insurance Review.”

- Trustworthy Provider: AIG is a trusted, well-known insurance company, so you can be sure you’re working with a reliable provider.

Cons

- Higher Premiums: The guaranteed issue option has higher premiums, which may not be affordable for every SSI recipient.

- Lower Coverage Amounts: These policies tend to have lower coverage limits, which may not meet the needs of some SSI Recipients looking for more comprehensive protection.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Does life insurance affect SSI benefits?

Unfortunately, any life insurance policy with a cash value impacts SSI benefits. SSI is a federally provided resource. To qualify, you must be blind, disabled, or at least 65 with limited income and resources. Learn more with our guide, “Types of Life Insurance: Find the Right Policy for Your Needs.”

SSI Recipients Life Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $75 | $140 |

| $68 | $105 |

| $61 | $118 | |

| $65 | $110 | |

| $52 | $120 | |

| $48 | $95 |

| $59 | $100 | |

| $70 | $130 | |

| $56 | $115 | |

| $73 | $125 |

According to the Social Security Administration (SSA), 7.8 million people received SSI payments in March of 2021. While receiving SSI, your income is limited.

Life Insurance Discounts From the Top Providers for SSI Recipients

| Insurance Company | Available Discounts |

|---|---|

| Safe Driver, Multi-Policy |

| Loyalty, Paperless Billing |

| Multi-Policy, Electronic Payment | |

| Multi-Line, New Driver | |

| Multi-Policy, Paid-in-Full | |

| Early Renewal, No-Claims |

| Multi-Vehicle, Good Student | |

| Multi-Policy, Safe Driver | |

| Early Renewal, Multi-Line | |

| Low Mileage, Safe Driver |

Does life insurance affect social security disability benefits or SSDI? No, SSDI payments depend on work history, not income. Income refers to more than a job. It also encompasses your financial investments.

While 50% of earnings per month valuing $65 or more are exempt, only the first $20 of unearned income per month is exempt.

SSI recipients should focus on affordable life insurance policies that provide essential coverage, like burial insurance, to meet their financial and personal needs.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

Most permanent or whole life insurance policies include something called a cash value. If a person receiving SSI accesses that cash value, it’s counted as unearned income, impacting your benefits. However, term life insurance and final expense insurance do not have a cash value and cannot impact your SSI.

Distribution of SSI Beneficiaries by Age

SSI helps people of all ages, and the breakdown by age shows who relies on it most. Younger adults, seniors, and kids all benefit, but the largest group is usually those 65 and older. Knowing the age groups that depend on SSI gives us a better idea of how it helps different generations.

Understanding the age groups that rely on SSI helps provide a clearer picture of who benefits from the program and how it supports different generations.

Seniors aged 65 and older make up the largest group of SSI recipients. Many of these individuals are retired and face financial challenges due to limited income or disabilities.

SSI provides a critical safety net for older adults who may not have sufficient retirement savings or who are unable to work due to age-related health issues. Explore our guide, “Life Insurance Cost by Age“, for answers

What life insurance policy should you purchase if you receive SSI?

As previously mentioned, look for term life insurance quotes for SSI recipients or burial and final expense coverage. Often, there’s an age limit associated with term life insurance. There’s also a chance you’ll outlive the policy term. Final expense insurance, on the other hand, is a permanent policy.

Compare monthly average burial life insurance rates for SSI recipients in the table below. Burial insurance usually covers the cost of a funeral, about $9,000. While there is an SSI death benefit paid to a surviving beneficiary, the amount is only $255.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Life Insurance Helps SSI Recipients

Life insurance can help, especially for people on SSI who need affordable options. Here are three real-life examples of how the right policy made a big difference for their families.

- Case Study #1 – Maria Finds Peace of Mind: Maria is 55 and on SSI. She wanted a life insurance plan that wouldn’t break her budget but would still take care of her family. She found a plan with New York Life for just $52 a month. It fit her budget and gave her peace of mind that her loved ones would be cared for when she was gone.

- Case Study #2 – James Covers Final Expenses: James is 63 and doesn’t want his kids to worry about paying for his funeral. He got a burial insurance plan from Mutual of Omaha. The low monthly cost gave him the coverage he needed, and the relief of knowing his kids wouldn’t face that burden.

- Case Study #3 – Linda Plans Her Way: Linda is 60 and wants a burial plan that fits her needs. She found an affordable option with State Farm to ensure everything would be handled how she wanted without breaking the bank.

These stories show how life insurance can be a real help for people on SSI. Whether covering final expenses or giving your family security, finding the right plan can make a big difference.

Life Insurance for SSI Recipients

Ultimately, you can qualify for social security and life insurance if you purchase a policy with no cash value or dividends. Look for term policies or burial insurance with enough coverage to pay for all of your final expenses. Dive deeper with our guide, “Life Insurance Coverage Question.”

What we provide is more than a “thing.” It’s the comfort of knowing someone will be there for your family. Speak to a dedicated agent today. https://t.co/OK7NNN2phV #LoveTakesAction #GoodAtLife pic.twitter.com/LOPp7k9LbI

— New York Life (@NewYorkLife) August 11, 2022

Find affordable life insurance for SSI recipients right now by entering your ZIP code into our free rate tool below.

Frequently Asked Questions

What is the best life insurance for SSI recipients?

The best life insurance for SSI recipients is one that fits within the SSI asset limits. Options like term life insurance or whole life insurance are commonly chosen for those who need affordable coverage without affecting their benefits. Finding cheaper insurance rates is as easy as entering your ZIP code into our free quote comparison tool.

Can you have life insurance while on SSI?

Yes, you can have life insurance and social security while on SSI, but the value of your life insurance policy must not exceed the asset limit set by SSI. It’s important to choose a policy that aligns with your financial situation without jeopardizing your SSI benefits.

Can you have a life insurance policy on SSI?

Yes, you can have a life insurance policy on SSI, but it’s important to ensure that the policy’s cash value does not exceed the asset limits for SSI, as this could affect your eligibility for other benefits. See guide, “Life Insurance Company Reviews” for details.

Does having life insurance affect SSI?

Yes, having life insurance can affect SSI if the cash value of the policy exceeds the asset limits set by SSI. It’s crucial to select life insurance that does not interfere with SSI eligibility.

What is life insurance and SSI?

Life insurance and SSI can coexist, but SSI recipients must be mindful of the asset limits. Term life insurance policies are often preferred as they don’t accumulate cash value and therefore don’t affect SSI eligibility.

Can you have life insurance while on SSDI?

Yes, you can have life insurance while on SSDI. However, just like with SSI, you must ensure that the life insurance policy does not exceed SSDI’s asset limit to avoid affecting your benefits. Access our guide, “What is permanent life insurance?” for more details.

Is life insurance available for people with disabilities?

Yes, life insurance for people with disabilities is available. There are many life insurance options tailored for individuals with disabilities, including life insurance for disabled adults or life insurance for a disabled person.

What is SSI life insurance benefits?

SSI life insurance refers to life insurance policies available for individuals receiving SSI benefits. These policies must meet the specific requirements of SSI’s asset limits and affordability. Enter your ZIP code to start comparing premiums from highly-rated insurers in your area.

Can IHSS recipients get life insurance?

Yes, life insurance for IHSS recipients is available. Individuals receiving In-Home Supportive Services can access life insurance policies that suit their needs without interfering with their benefits. For more knowledge, just click our guide, “Life Insurance Recommendations.”

What is life insurance, social security?

Life insurance, social security refers to the potential for life insurance to work alongside Social Security benefits, like SSI or SSDI, without impacting eligibility. While Social Security doesn’t provide life insurance, it offers survivor benefits, and private life insurance can be added for further protection.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.