New York Life Insurance Review (Companies + Rates)

New York Life Insurance reviews suggest that the company received an A++ rating from A.M. Best. You can find New York life insurance rates for as low as $12 per month. New York Life Insurance Company offers term, whole, and universal life insurance policies.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Life Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed life and health insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chr...

Licensed Life Insurance Agent

UPDATED: Feb 4, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Feb 4, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- New York Life Insurance Company offers term, whole, and universal life insurance

- New York life insurance quotes start from $12 per month

- New York life insurance rating with A.M. Best is A++

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1854 |

| Current Executives | CEO - Theodore A. Mathas Co-COO - Craig DeSanto Co-COO - Matthew Grove |

| Number of Employees | 11,388 |

| Total Sales / Total Assets | $43,425,300,000 / $311,449,300,000 |

| HQ Address | 51 Madison Avenue, New York, NY 10010 |

| Phone Number | 1-800-225-5695 |

| Company Website | www.newyorklife.com |

| Premiums Written - Individual | $7,331,015 |

| Premiums Written - Group | $2,054,828 |

| Financial Standing | $13,348,310 |

| Best For | No Exam |

New York Life insurance company brings not only years of experience, financial stability, and strength, but also 164 consecutive years of dividend payouts to their policy owners due to their life insurance ranking and the yearly increase in premiums written.

New York Life brings a wide array of insurance policies that will be covered in detail, along with additional survivorship and guaranteed acceptance policies. With this knowledge, you will be better able to navigate New York Life’s policies based on your financial needs.

Want to see what New York Life Insurance Company can offer you for life insurance? Get a quote right now with our FREE tool above.

New York Life’s Ratings

As you look for the right fit with an insurance company, it is important that you take into consideration their financial credit ratings. New York Life Insurance holds very high to superior ratings from all credit rating agencies, confirming their leading position in the U.S. life insurance market.

A.M. Best

New York Life received an A++, a superior rating, from A.M. Best which rates an insurance company’s ability to meet its obligations to its policyholders. New York life was highlighted for its creditworthy liability profiles and very strong risk-adjusted capital for its policyholders.

Better Business Bureau (BBB)

New York Life Insurance is not accredited with the Better Business Bureau but does receive an A+ rating from them. The BBB rates businesses on their performance and reliability based on specific data and complaints received. New York Life received 74 complaints in the last three years and New York Life addressed all complaints made against them.

Moody’s

New York Life Insurance scored AAA which equals the highest quality with the lowest level of credit risk from Moody’s. They rate debt securities, economic analysis, and risk analysis. New York Life Insurance was noted to have a well-diversified investment portfolio and holds a leading position in the U.S. life insurance market.

Standard & Poor’s (S&P)

S&P rates the creditworthiness of a company that issues debt. New York Life Insurance earns an AA+, meaning they have a very high capacity to repay loans with a very low likelihood of default. New York Life Insurance has a strong financial risk profile along with wide brand recognition.

NAIC Complaint Index

NAIC Complaint Index allows individuals to search for different insurance companies to see if any complaints have been made against them. The median number used is 1.00 and insurers want their index number below 1.00. New York Life Insurance had a Complaint Index of 0.14 for individual life and 0.32 for group life in 2018.

J.D. Power

J.D. Power looks at many factors when measuring a company’s customer satisfaction rating, such as communication, customer interaction, product offerings, and pricing. New York Life ranks 770 out of 1,000 points in overall customer satisfaction index ranking with a 4 Power Circle Rating out of 5, meaning “better than most.”

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Company History

New York Life Insurance Company first operated in 1841 as Nautilus Mutual Life, also selling fire and marine insurance; however, in 1845, James De Peyster Ogden, the company’s first president, renamed the company New York Life Insurance Company and focused its efforts more on life insurance.

In the first 100 years of business, New York Life’s growth was due mostly to its introduction of field agents to garner new business for the company and using field offices to serve as a connection between headquarters and field agents.

With this growth came other opportunities for New York Life. They were the first to offer policies of the same cost as men to women and Susan B. Anthony was one of the first females to hold a policy issued by New York Life.

1n 1994, NYL Direct, a division of New York Life, began offering insurance that was AARP branded specifically suited for ages 50 and higher. This relationship continues today.

New York Life Insurance Company is the third-largest life insurance company in the United States and is ranked no. 71 on the 2018 Fortune 500 list.

New York Life’s Market Share

Group life premiums increased from 2015 to 2018; however, individual life premiums fluctuated from year to year, with 2017 having the highest amount of premiums written at $7,416,451.

Take a look at the table below detailing the market shares for individual life insurance policies.

| Year | Market Share | Rank |

|---|---|---|

| 2015 | 5.8 | 2 |

| 2016 | 5.6 | 2 |

| 2017 | 5.8 | 2 |

| 2018 | 5.7 | 3 |

From 2015-2017, New York Individual Life Insurance ranked number two in premiums written, earning over $7 million two out of the three years, but maintained over 5 percent of the market share. In 2018, they dropped to number three but still earned over $7 million with over 5 percent of the market share.

The following table shows the market shares for group life insurance policies.

| Year | Market Share | Rank |

|---|---|---|

| 2015 | 5.4 | 5 |

| 2016 | 5.9 | 4 |

| 2017 | 5.7 | 4 |

| 2018 | 6.1 | 4 |

For New York Group Life Insurance, in 2015 they were ranked number five with total earnings over $1.8 million and 5 percent of the market share. However, they moved up into position four in the years 2016-2018 with rising earnings and over five percent market share for 2016 and 2017 and ending with a 6 percent share in 2018.

New York Life’s hard work, training, and development programs, along with mentoring support, proved positive momentum for New York Life over a four-year time period.

New York Life is an American company that made its first debut in Manhattan’s financial district as Nautilus Mutual Life in 1841. Today, its primary focus is on mutual life insurance, but they have other affiliates that provide securities products and services, investments, and mutual funds. Its affiliates are:

- NYLIFE Securities, Inc.

- New York Life Investments

- Candriam Investors Group

- New York Life Insurance and Annuity Corporation

- New York Life Enterprises LLC

- The Nautilus Group

- NYL – Advanced Markets Network

- NYL Investors, LLC

- New York Life Foundation

- New York Life Global Funding

- Madison Capital Funding LLC

- NYLIFE Distributors LLC

- New York Life Investment Management Holdings LLC

- NY Life Insurance Company of Arizona

- NYLIFE, LLC

- Reep-Ofc Corporate Pointe Ca LLC

- NYLIFE Realty Inc.

- Msvef-Mf Evanston II LP

- NYLIM Quantitative Strategies

- NYLIFE LLC Annuity Corporation

- New York Life Trust Company

- Garnet LIHTC Fund XXX, LLC

- Garnet LIHTC Fund LLLII, LLC

- Occidental Tower Corporation

- REEP-OFC ONE Bowdoin Square MA LLC

- New York Life Group

- New York Life Insurance Co., Asset Management Arm

- New York Life Worldwide Ltd

- Reep-Ofc Von Karman Ca Llc

- Reep-Ofc Drakes Landing Ca Llc

- Reep-Ofc 525 N Tryon Nc Llc

New York Life’s Position for the Future

New York Life is known for delivering on its promise to customers by investing wisely, building a diversified mix of businesses and investing companies, and staying true to their customer base without being influenced by outside investors.

New York life also has the highest financial strength rating which brings comfort and trust to the millions of customers and businesses they serve every day.

This is evidenced by the number of individual premiums written in a four-year period in the amount of nearly $7 million each year.

| Year | Premiums Written - Individual |

|---|---|

| 2015 | $7,015,574 |

| 2016 | $6,923,144 |

| 2017 | $7,416,451 |

| 2018 | $7,331,015 |

Among their financial accomplishments, New York Life paid out $10.6 million in benefits and dividends in 2017. There was over $24 billion in surplus, allowing New York Life to be there for their customers at a vulnerable time and when they needed New York Life the most.

New York Life feels so secure in its products and services that its Board of Directors has projected a $1.9 billion dividend payout to their whole life policy owners in 2020, though this dividend payout is not a guarantee.

| Year | Premiums Written - Group |

|---|---|

| 2015 | 1,806,693 |

| 2016 | 1,870,870 |

| 2017 | 2,010,464 |

| 2018 | 2,054,828 |

New York Life is also able to maintain its continuity of customer care for its group life insurance customers as evidenced by their solid performance of premiums written over a 4-year period as well.

New York Life strives for the highest ratings for financial strength and continues to meet these top ratings, leaving its customers taking comfort that New York Life will continue to meet all current and future financial obligations promised.

New York Life’s Online Presence

New York Life has embraced the need for social media to level up their marketing strategies without sacrificing their commitment to staying true to their brand. With this plunge into social media, they have garnered increased interest in its products and services and driven online engagement upward.

How, do you ask?

They empower their employees to be online advocates for their brands. Employees are trained on how to build effective relationships and generate new leads online.

They write and create effective content regularly that sets them apart from their competitors. The content focuses on the commitment of service and value provided to customers.

They encourage positive feedback and experiences from customers. When customers leave feedback, they always follow up, asking if they would share their experience further on the company website or Facebook page.

New York Life’s website is comprehensive and easy to navigate. You are able to start a claim, download a multitude of service forms, and make a payment. They provide detailed information about all of their services, including life insurance, retirement income, long term care, investments, and premier services.

Their website also offers a tool that allows you to start putting together your own personalized plan, along with educational information to answer any questions you have during the process. You also have the ability to be put in touch with a local agent should you need further guidance or more information.

They also have a heavy presence on Facebook, Twitter, LinkedIn, Instagram, YouTube, and Pinterest.

New York Life’s Commercials

New York Life has created a new advertising campaign: “Start a plan that flexes with yours,” meaning it will flex with the consumer’s ever-changing needs, especially in today’s ever-changing world.

New York Life has created multiple commercials advertising the “Start a plan that flexes with yours,” as well as putting this content on their social media channels.

This plan is about not being afraid or intimidated by taking control of your finances now instead of waiting until a major life event happens. Their agents are there, trained, and ready to help you put a plan in place that can flex with yours.

New York Life in the Community

Since its beginning in 1979, the New York Life Foundation has provided over $275 million to national and local nonprofit organizations. Their charitable contributions, but more importantly, the employee and agent volunteerism, is focused on bereavement support, middle school transitions, and supporting their workforce.

Along with charitable contributions, New York Life also offers grants that totaled $25 million in 2018. Some of these grants included Education and Bereavement Partners, Volunteer Grants, Community Impact Grants, New York Life Family Scholarships, and Disaster Relief Grants.

New York Life understands the positive impact their employees can make in the communities where they work and live. That is why you find them volunteering at community events, schools, and Foundation Initiatives. They understand and take seriously the social responsibility to help those in need.

New York Life’s Employees

In reading the reviews of New York Life employees, it is quite clear the work atmosphere is one of support, praise, training, charitable acts, and forward momentum. In fact, 81 percent of New York Life employees report it is a great place to work, and 93 percent feel good about their contributions to the community in which they work and live.

| Generation | Age Range | Percentage |

|---|---|---|

| Baby Boomer | Born Between 1945-1964 | 23% |

| Generation X | Born Between 1965-1980 | 39% |

| Millennial | Born Between 1981-1997 | 37% |

| Generation Z | Born After 1998 | 1% |

Many employees, 89 percent, felt that upon joining New York Life they immediately felt welcomed into a family. If they were sick or needed to care for a sick child, 87 percent felt they were encouraged to take time off when necessary.

Lastly, 86 percent agreed that management’s business practices are honest and ethical and are a huge factor in employee satisfaction.

| Employee Tenure (Years) | Percentage |

|---|---|

| Less than 2 years | 18% |

| Between 2-5 years | 23% |

| Between 6-10 years | 19% |

| Between 11-15 years | 15% |

| Between 16-20 years | 9% |

| Over 20 years | 16% |

New York Life readily embraces and supports diversity and inclusion in their company. They hire employees and agents from very diverse backgrounds that bring unique and different views to the everyday experience for their customers.

The company’s culturally sensitive approach has made them a valuable “company of the community” as well as a place of acceptance for all who work there.

Overall, employees have a positive outlook on their work environment, peer relationships, and management support at New York Life Insurance Company.

Shopping for Life Insurance

New York Life Insurance is a mutual insurer, meaning it is owned by its policyholders, and as policyholders, they are eligible to receive annual dividends.

New York Life’s annual dividends have led to a large profit for them recently, reinforcing New York Life’s promise that they put their customers first.

This high dividend rate also shows its strong financial stability within the insurance industry.

New York Life Insurance is optimal for seniors and their financial needs and goals. They offer policies that are flexible and affordable. New York Life also partners with AARP, giving retirees even more affordability in the form of low-cost, no-exam individual and group policies.

New York Life offers whole and universal life policies in a variety of options and price ranges. They also offer term life insurance, but no more than a period of 20 years, so you are limited with these policies. However, their term insurance does offer the option for term conversion to a permanent life insurance policy.

Since more than a third (35 percent) of households would feel the financial impact within one month if the primary income earner passed away, creating a plan for the future for such possibilities is crucial.

New York Life’s policies are flexible, diverse, customizable, and some are guaranteed through age 120, making their insurance policies accessible for almost anyone.

Average New York Life’s Male vs Female Life Insurance Rates

When looking at gender and smoking factors only, one can see how these factors affect premium rates, especially as a policy owner increases in age and they are a smoker.

| Demographic | Average Premium: Male | Average Premium: Female |

|---|---|---|

| 25-Year-Old: Single, Non-Smoker | $152.00 | $158.00 |

| 25-Year-Old: Single, Smoker | $346.00 | $210.00 |

| 35-Year-Old: Married, Non-Smoker | $160.00 | $164.00 |

| 35-Year-Old: Married, Smoker | $416.00 | $252.00 |

| 45-Year-Old: Married, Non-Smoker | $245.00 | $262.00 |

| 45-Year-Old: Married, Smoker | $739.00 | $464.00 |

| 55-Year-Old, Married, Non-Smoker | $696.00 | $414.00 |

| 55-Year-Old: Married, Smoker | $864.00 | $864.00 |

If you are a smoker, doing your best to quit is one way to lower your rate.

Coverage Offered

New York Life offers a wide range of life insurance policies to meet your financial goals and needs at different times in your life. They also offer policies to protect families, as well as survivorship policies for parents.

New York Life has many options to fit your needs so be sure to research all of the different policies to find the perfect fit for your family and financial needs.

Types of Coverage Offered

New York Life Insurance Company offers term, whole, and universal life insurance policies.

Term

With term life insurance through New York Life, you can get the immediate coverage you need right now with the option to move into a different and more long-term policy as your needs change later in life.

With New York Life’s option to convert your term life policy to a more permanent one later, their products fit your budget as your needs change at each chapter of your life.

A lot of families purchase term life policies when they purchase a home and are worried about paying off the mortgage or they have children in college and want to make sure their education costs are covered in case something were to happen to them as the main income earner.

Term life lets you choose exactly how long you want your coverage to last, and with term life, there is only a death benefit associated with it. There is only a payout of the death benefit if you pass away during the term of your policy. Also, once the policy ends, your coverage ends.

However, you are typically given the option to convert your policy to a permanent life insurance policy once your term life insurance ends.

There are four types of term life insurance policies offered by New Life Insurance:

- One-Year Nonrenewable Term – this coverage is for anyone between the ages 18-90, but coverage only lasts for one year with no option to renew the policy at the end of the year. There is one single premium and the minimum face value of this life insurance policy is $100,000.

- Yearly Convertible Term – coverage is for anyone between ages 15-75, but with this policy, it can be renewed each year until age 90. However, the premiums do increase yearly with this type of policy each year you renew. The minimum face value is $250,000 for a yearly convertible term policy.

- Level Convertible Term – this is New York Life’s most common term life policy and is for ages 15-75 for a five-year policy. During the term, you can convert the policy to a permanent one without having a new medical exam. If you choose not to convert after your term expires, you can renew your term until age 90 but premium rates will increase annually.

- Family Protection Term – this policy is for an entire family including children to age 17. Coverage amounts for adults age 18-50 start at $100,000 and max out at $1 million each, and children are restricted to coverage of only $10,000 each. Premiums are level for a period of 10 years but if you choose to renew, you can renew until age 90; however, premiums will increase annually.

Whole

New York Life offers whole life policy insurance that stays in effect for an individual’s lifetime and will pay out a life insurance death benefit to a designated beneficiary upon that individual’s death.

New York Life’s policies are guaranteed to grow with you and the changing needs of your family through the years. The policy builds cash value that can be accessed over time. Whole life policies offer lifetime protection with premiums that are guaranteed to never increase.

Along with protection, you also get a way to save for the future through the cash value benefit that grows tax-deferred.

Whole life policies qualify the policyholder to receive annual dividends, protection for the length of their lifetime, guaranteed rate to build their cash value, and level premiums. Learn how much whole life insurance costs.

There are three types of whole life policies:

- Standard Whole Life Policies – this policy offers coverage from birth to age 90, and premiums you pay remain level until age 100; once you reach 100, you no longer pay a premium but your coverage remains in force until you die. With this policy, you receive lifetime coverage, a death benefit, and a cash value component.

- Custom Whole Life Insurance – with this policy, you get to choose the number of years you want to pay for coverage. However, you must pay for a minimum of five years and cannot exceed 35 years of coverage. You are able to schedule your payments to fit your budget and still build cash value that can be used later for retirement or whatever needs you may have.

- Value Whole Life Insurance – is much like standard whole life insurance but at a cheaper rate because it offers a cash value component that grows at a much lower guaranteed rate.

Universal

Universal life insurance policy is a long-term insurance policy that offers protection with cash value that gives you the flexibility to adjust your payments as needed based on your budget, financial need, and life changes. You can use your cash value to pay your premiums, as well.

Those purchasing universal life policies are not concerned with building cash value but more with providing maximum long-term coverage for their family at an affordable rate. Universal life is flexible in that you can make changes to your policy as your needs and finances change.

There are three types of universal life insurance policies:

- Universal Life (Basic) – long-term protection with a cash value component. You can customize this policy to meet the changing needs of a family but still remain cost-effective.

- Custom Guarantee – a policy with a guaranteed death benefit but no cash value component. You pay the premium for as long as you need the coverage.

- Protection Up to Age 90 – Alternative insurance plan to permanent insurance for those that don’t need coverage past the age of 90 and is cost-effective. It allows for a considerable amount of insurance, $1 million, for a specific time period.

Variable Universal

Variable universal life insurance offers permanent protection for your family with the added benefit of choosing how your cash value is invested, but this does come with some risk.

This type of policy is risky in that if the market is doing well, your cash value can potentially grow at a faster rate. However, if the market dips, there’s a risk your cash value will be negatively impacted. To protect your beneficiary at your death, you can add a minimum death benefit rider to your policy to make sure they receive a guaranteed payout.

Burial & Final Expense

New York Life does not have insurance specifically named Burial and Final Expense Insurance, but through their partnership with The American Association of Retired Persons (AARP), there are policies sold as whole life insurance in amounts between $2,500 and $25,000 that can be used as such.

These policies as guaranteed acceptance, meaning there’s no medical exam and you cannot be turned down even if you an existing medical condition.

What is convenient about these policies is, even though they’re not outright called Burial Insurance, the beneficiary can use the money to pay for any burial or final expense insurance needed. There are no limitations on that.

Riders

Riders are options you can add to your policy for additional benefits and make your policy more customizable to you.

- Accidental death benefit – offers additional coverage if you die in an accident

- Children’s insurance – additional coverage on children

- Chronic Care – if you become chronically ill at any point, you can receive a portion of your death benefit to help with medical expenses

- Disability waiver of premium – with a qualifying disability, premiums are waived

- Extension of conversion period option – conversion period to convert term to permanent life insurance is extended

- Living benefits rider – also known as terminal illness rider, allows you to receive a portion of your death benefit if you are diagnosed with a terminal illness leaving you will less than a year to live

- Policy purchase option – ability to purchase additional coverage at given times during policy without additional underwriting

- Yearly convertible term rider – additional term insurance with level premiums for one year but then premiums increase annually

Factors That Affect Your Rate

Life insurance premiums are not the same from one insurance company to the next, but why is that? Your premiums are determined by an insurance company’s underwriters who take into account many different factors.

Demographics

Your age and gender are common factors for underwriters. Typically, women pay a lower rate than men because they live longer and generally live a healthier lifestyle. On top of that, the younger and healthier you are, the lower your premiums will be.

Life insurance premiums drop when individuals are married. They are buying one policy that covers the family and typically provides enough coverage for the main income earner of the family.

Current Health & Family Medical History

During the underwriting process, you may be asked about your medical history and your immediate family’s medical history. They may want to know about prescriptions you take, pre-existing conditions, and if you smoke.

You will be asked to get a medical exam and the following will happen:

- A medical history will be taken

- Blood pressure checked

- They’ll listen to your heartbeat

- Check height and weight

- Blood sample will be drawn

- Urine sample will be taken

If you are concerned about your medical history, stop smoking, lower your alcohol intake, and incorporate more exercise into your daily routine.

High-Risk Occupations

A high-risk occupation, such as a construction worker, firefighter, or racecar driver, can increase your premium compared to what would be considered a safe occupation, like an engineer or someone who sits behind a desk. If an occupation is considered too risky, you may even be declined coverage.

High-Risk Habits

Your lifestyle choices may put you into a higher risk category — for example, if you hunt on the weekends or skydive or enjoy rock climbing. However, each insurer looks differently at what activity falls into the risky category,

Veteran or Active Military Status

Veteran and military members have their own separate insurance which is very affordable.

All active military members are automatically enrolled in a group insurance plan named Service Members’ Group Life Insurance (SGLI) with a maximum coverage amount of $400,000. This coverage includes traumatic injury protection to include amputations, paraplegia, and blindness.

Premiums are deducted from their paycheck at $27 for the maximum coverage. For the Traumatic Injury Protection, an additional $1 is deducted that can pay a benefit of up to $100,000, depending on the severity of the injury to the service member.

Upon a military member’s death, the benefit is placed into an account in the beneficiary’s name in the amount of $400,000. The beneficiary can choose to take it as a lump sum or 36 monthly payments.

Getting the Best Rate with New York Life

Insurance companies are encouraged to follow similar formulas when determining premiums.

There are common state laws that all insurance companies should follow.

- A free look period, allowing the policyholder to review their policy during a designated time period and cancel if desired for a full refund.

- A grace period, so if policyholder misses a payment, they can pay it within so many days without the policy lapsing. Coverage remains intact.

- Timely payments on claims or the company can face fines and interest costs.

- Act in good faith, making sure investigations and claims happen in a reasonable timeframe; a written explanation is given for any claim denial or the company can face a bad-faith lawsuit.

Life expectancy is a key factor in determining insurance premiums. Your life expectancy is the day to which you are expected to live. The two most important factors to influence this are age and gender, but your race, current medical conditions, and family medical history can influence rate, as well.

Keep in mind that your life expectancy changes as you age, and once you get past a certain age and you’ve outlived others, your life expectancy goes up.

So, knowing this, the younger you are, the more likely you are to live a longer life, so your premium will be lower. If you wait until you are older, the opposite happens and your life expectancy shortens and your premiums are more expensive.

Best advice: purchase your policy now rather than later to get the best rates and also give yourself more time to grow your cash value component.

Avoiding riders and additional policies is another way to save money. Riders are options you add to your policy to give additional coverage, but usually at an additional cost. If your true reason for purchasing insurance is to protect your family and provide them with a benefit at the time of your death, the additional riders are really not needed.

Bundling policies can also be a cost saver. If you already have your car insurance, homeowners’ insurance, and other insurance policies with one company, check with them to see if they offer life insurance and bundle all the policies together.

| Demographic | $250,000/20-Year | $250,000/30-Year | $250,000/Whole |

|---|---|---|---|

| 30-Year-Old, Female | $135 | $194 | $2,150 |

| 30-Year-Old, Male | $152 | $227 | $2,403 |

| 40-Year-Old, Female | $182 | $284 | $3,037 |

| 40-Year-Old, Male | $212 | $343 | $3,572 |

| 50-Year-Old, Female | $364 | $621 | $4,611 |

| 50-Year-Old, Male | $473 | $819 | $5,548 |

Shopping around and doing your research is the best way to find an insurance plan that is within your budget.

New York Life’s Programs

New York Life offers many opportunities for success and ways for their employees to find their strengths and maximum potential.

One opportunity is the Management Development Initiative (MDI), which received the Leadership Excellence Award from HR.com in the Best Use of Mobile Technology Space.

Employees learn through various activities like interactive webinars, networking, and application exercises. They have a commitment to ongoing employee training and development to be the best they can be and give their customer base a high-level customer experience.

New York Life is known for investing in their employees, and they take every opportunity to provide the best development tools that allow every team member to reach their highest potential.

Their learning programs are on a digital learning platform so they can be accessed anywhere. These programs have also been recognized by Chief Learning Officer magazine (2014-2018), Training and Development (2013-2015), and HR.com (2017 and 2018).

New York Life also wants to see their agents advance and succeed in their careers, so they offer multiple opportunities for advancement.

- NYLIC University – an agent training program offering agents support, skills, and education that they can access throughout their careers.

- Professional designations – agents are encouraged to further their professional designations and even pursue new ones and New York Life will reimburse the cost of tuition.

- Mentoring program – New York Life offers a mentoring program called the Million Dollar Round Table (MDRT) that is recognized nationally and internationally in the insurance industry. Agents, both new and experienced, are encouraged to work together to strengthen and encourage each other to reach their highest potential each day.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Canceling Your Policy

To cancel a life insurance policy with New York Life Insurance, you will need to call the phone number on the Contact Us page of the website, 1-800-225-5695, to speak to one of their customer service experts to get the process started.

How to Make a Claim

When you lose a loved one it is very difficult to move forward with planning the next step and making the insurance claim. However, New York Life has the initial claim application on its website and it is straightforward and simple.

Once submitted, a claims specialist takes it from there and gets the process done as quickly as possible.

The first step is to fill out an online form that starts the claim. It will ask you for the following:

- Policy number (if you have it, but it’s not necessary to start the claim)

- Deceased’s name and basic information

- Beneficiary information

- Funeral home information

- Funeral home information

The second step is to hit “submit,” and your part is done.

Should you have any questions at any time, you can call a claim specialist at 1-800-695-9873 and have the following information ready when you call:

- Deceased policy owner’s name

- Last known address

- Date of birth

- Date of death

There is also a PDF that can be downloaded of FAQs concerning death benefit proceeds.

How to Get a Quote Online

New York Life Insurance does not offer an online quote tool; however, they do provide a life insurance calculator feature on their website. Their life insurance calculator helps you estimate how much protection you may need and the type of policy to help you achieve your goals.

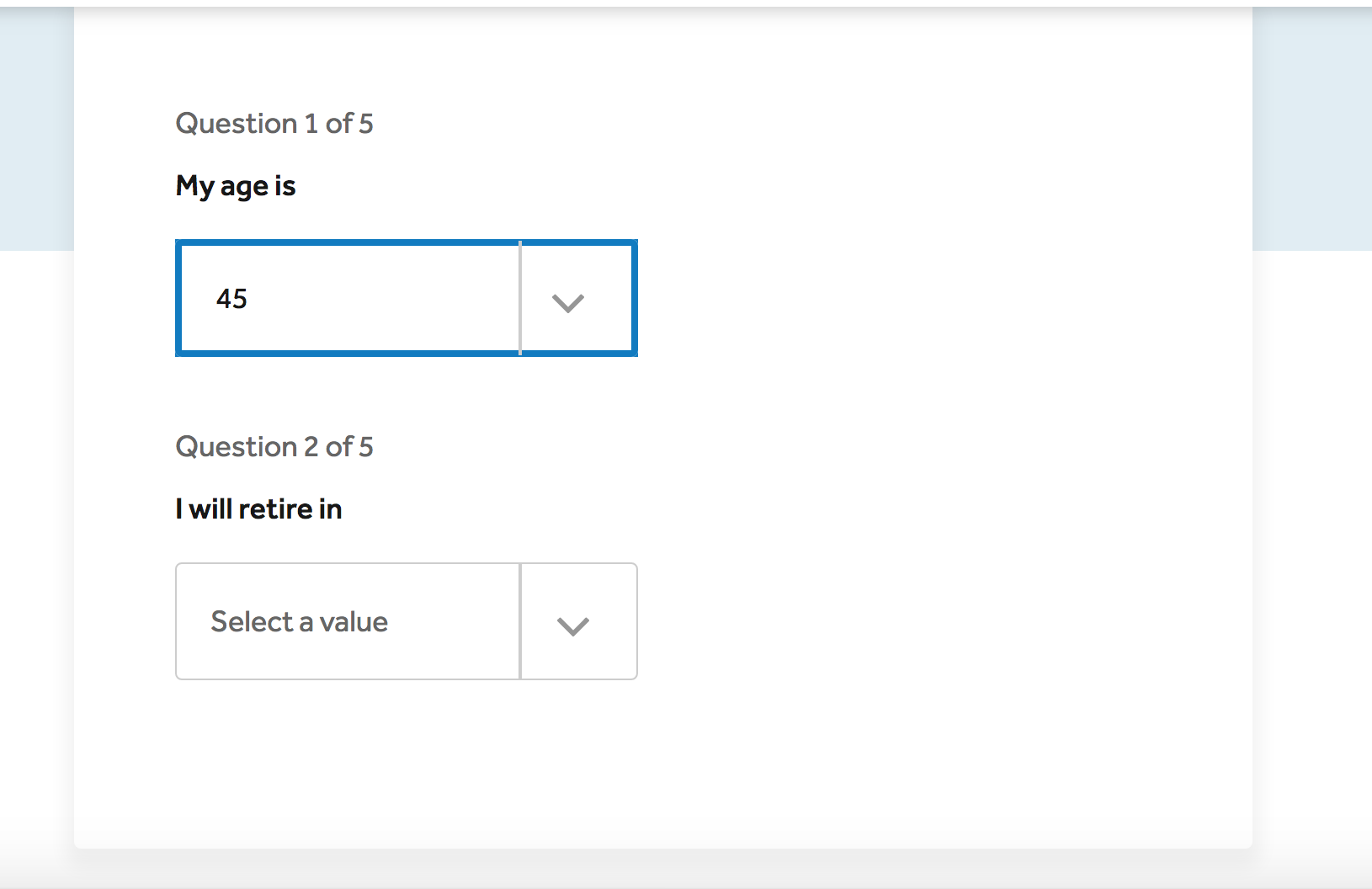

To access the life insurance calculator from New York Life’s website, click Learn and Compare, then Learn the Basics, and Insurance Needs Calculator from the drop-down menu. Once at the insurance calculator screen, you will answer the following five questions.

#1 – Your Age

The initial step to start the process and help you think about retirement age.

#2 – When You Plan to Retire

Choose how many years you plan to retire from today and try to be as specific as possible as this helps with your final breakdown of short- and long-term needs that you will receive once you answer the five questions.

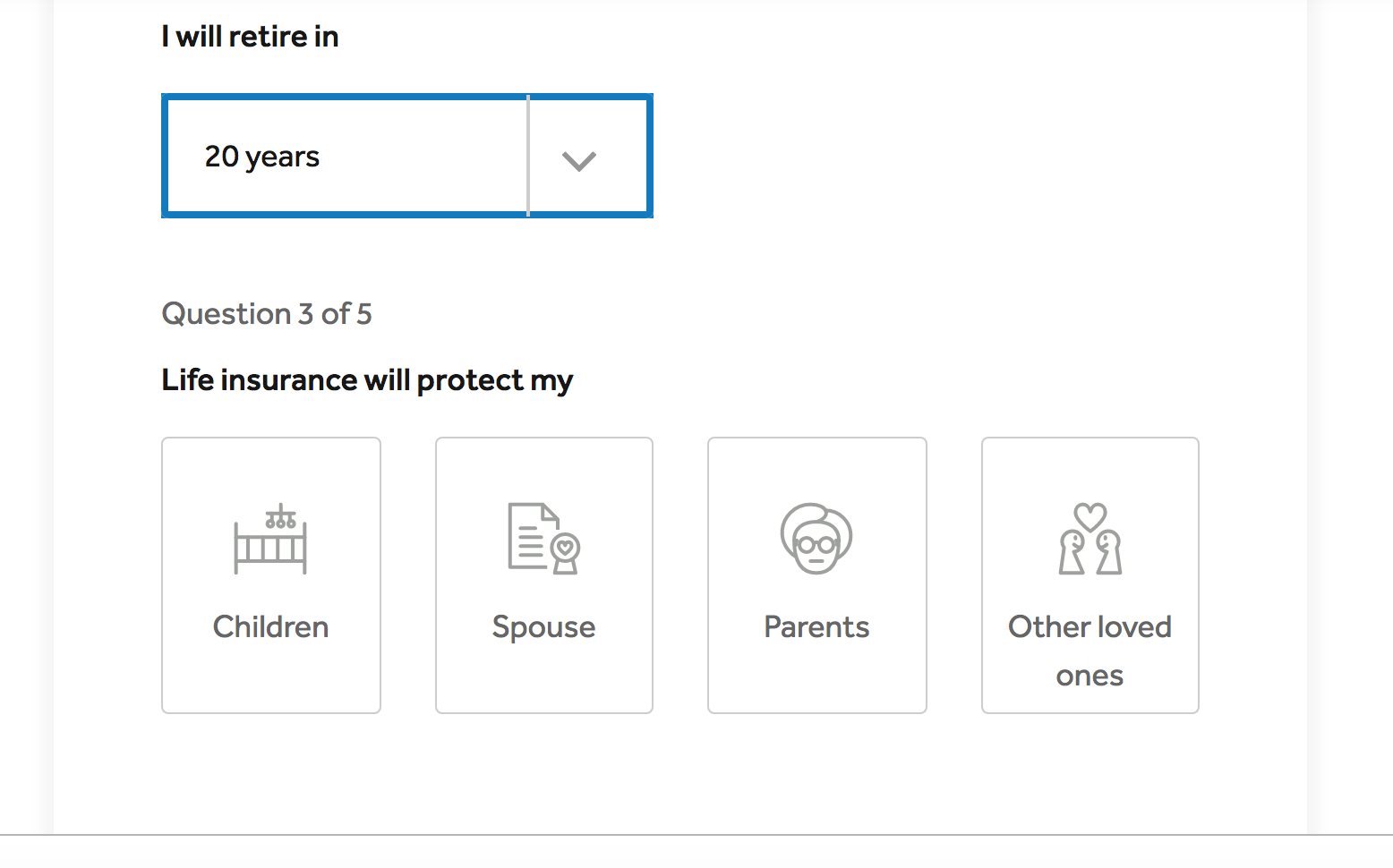

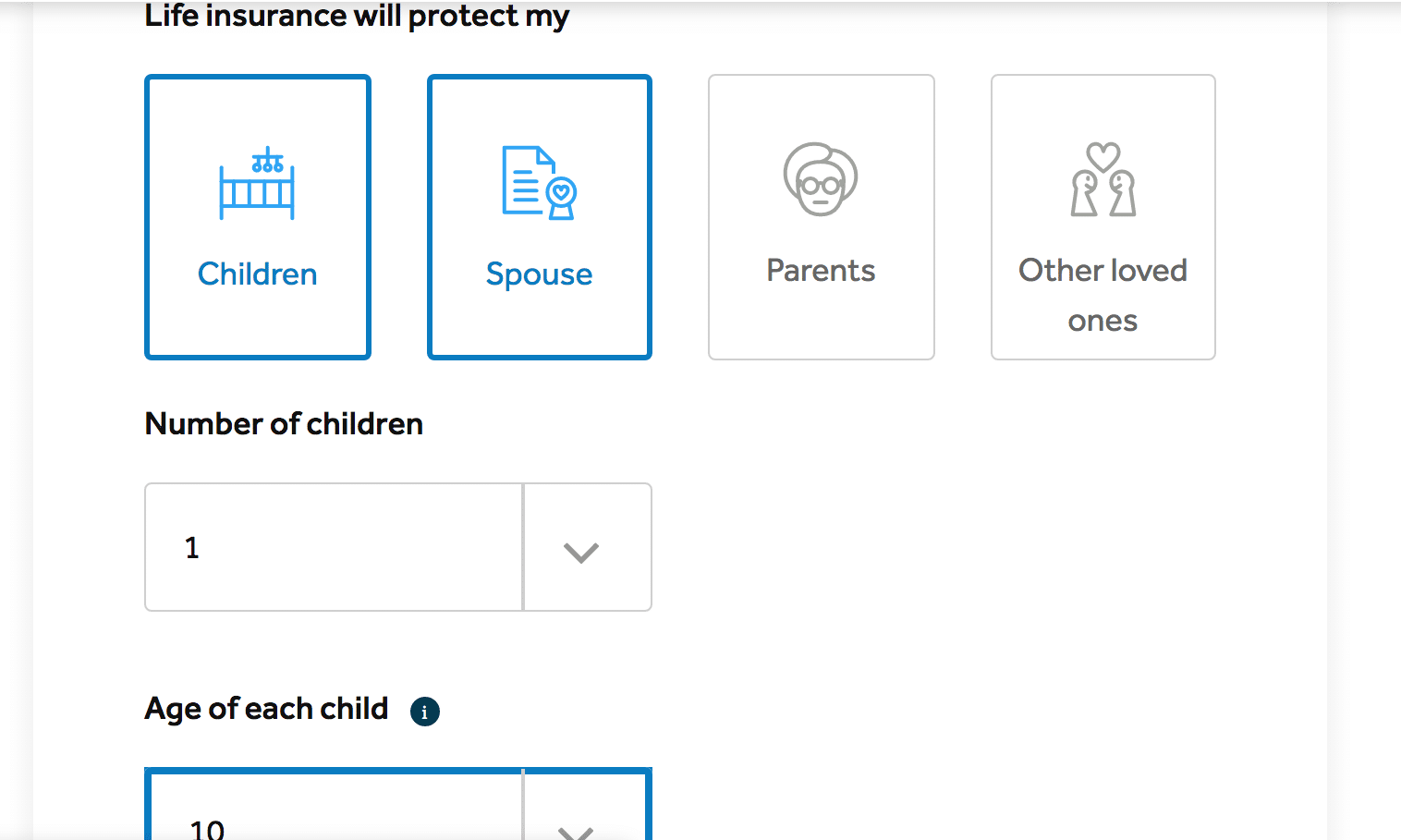

#3 – Life Insurance Will Protect

For this question, you can choose one or all of the following: children, spouse, parents, or other loved ones. For children, you will be prompted to tell how many and give their ages.

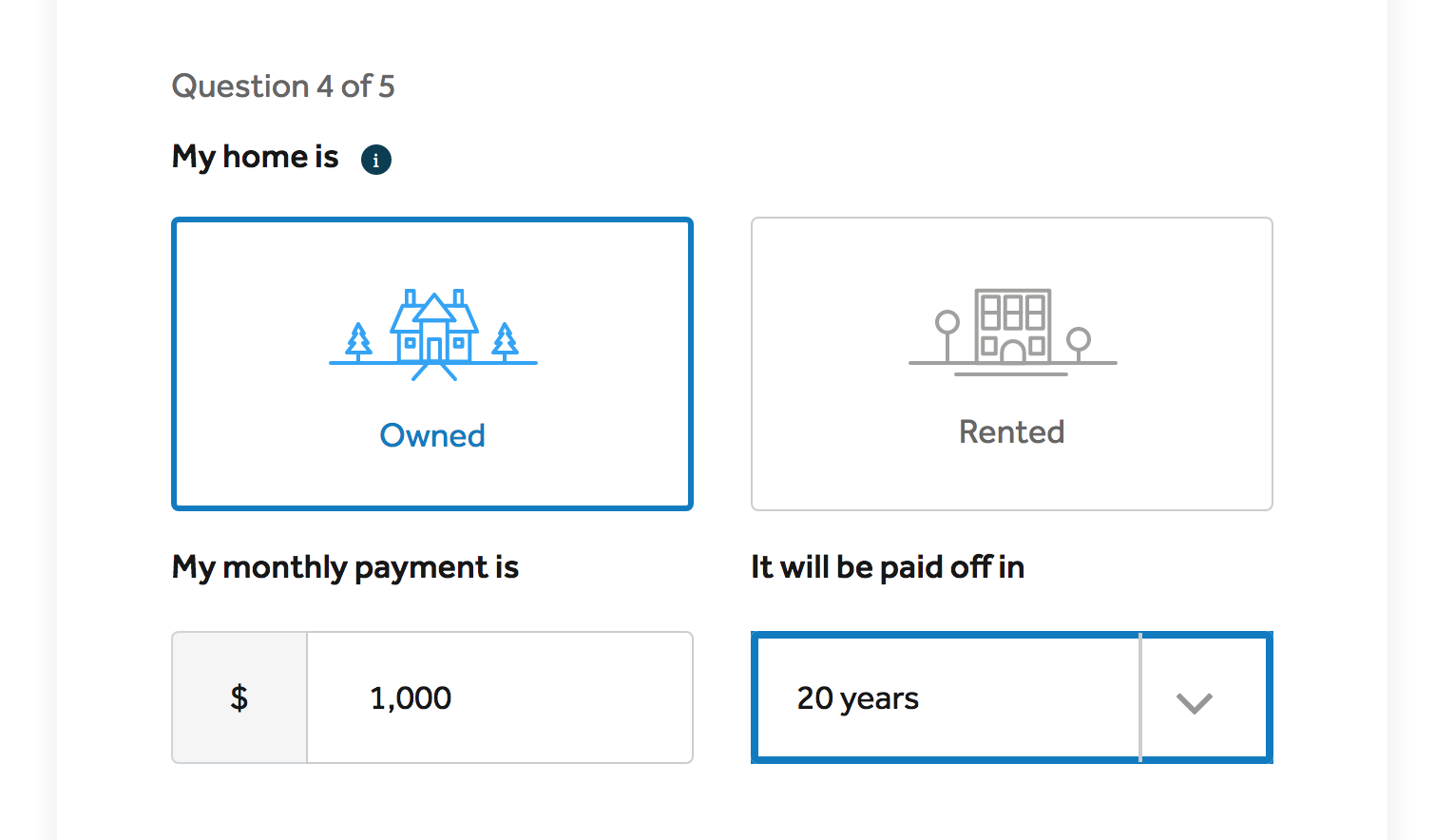

#4 – Home

You are asked if you own or rent your home. For both, you are asked the amount you pay each month, and if you own, when your home will be paid for.

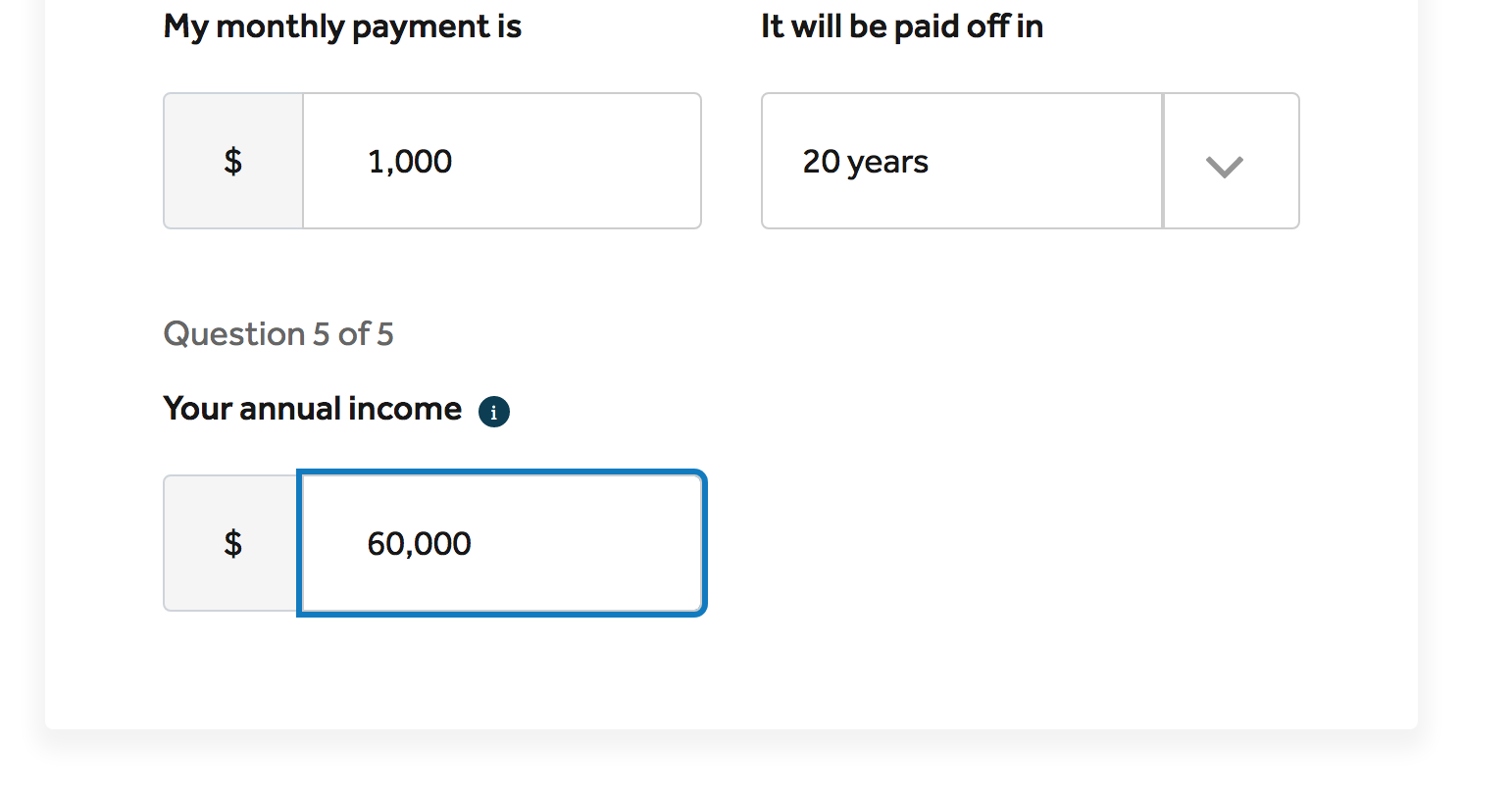

#5 – Annual Income

Input your annual income as the final step and hit submit.

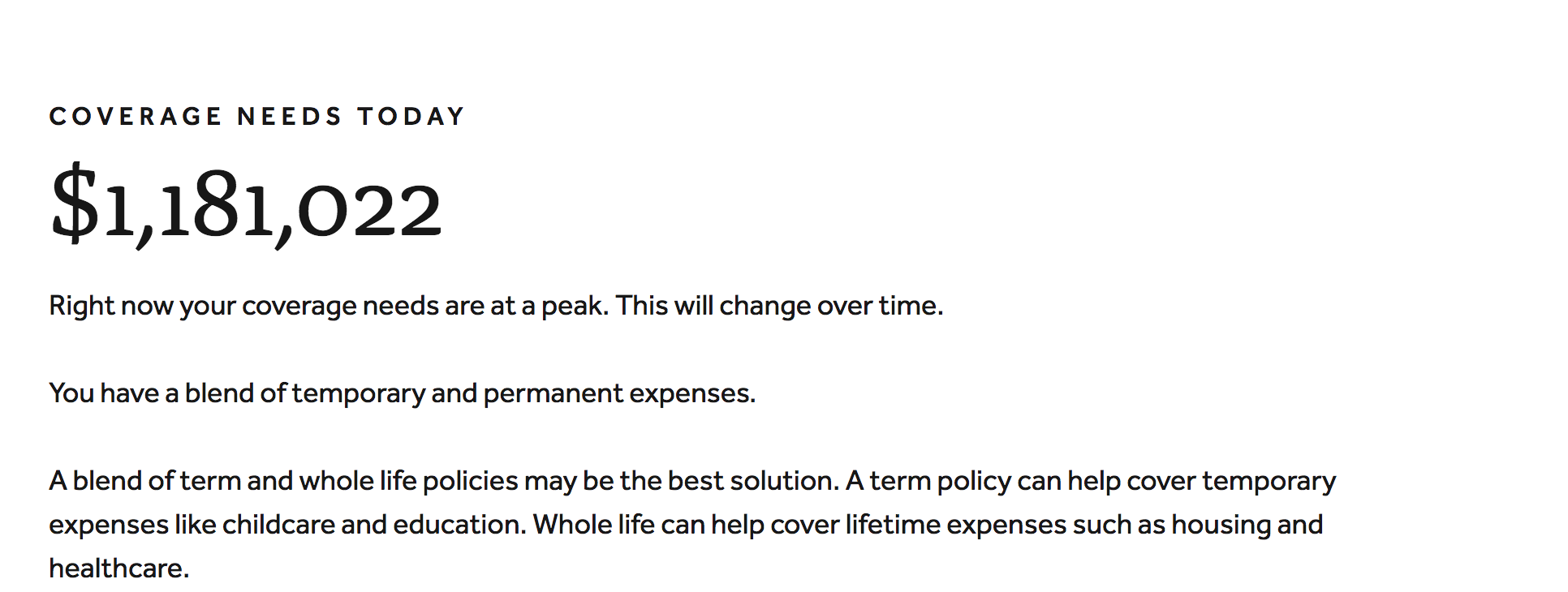

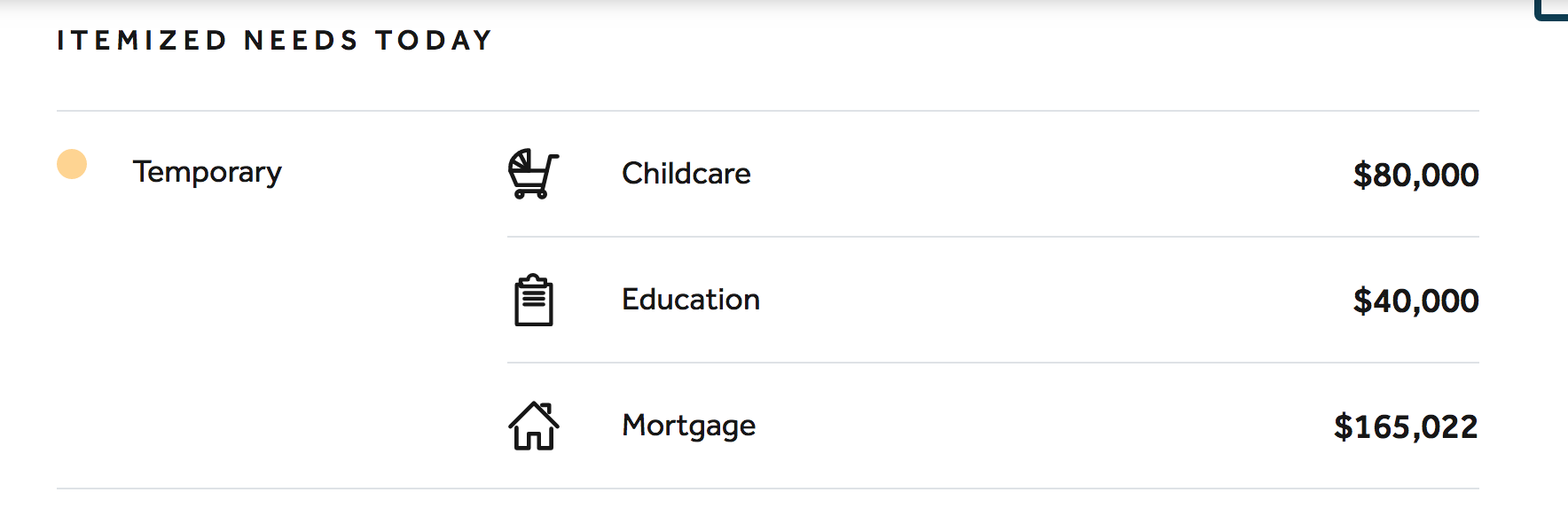

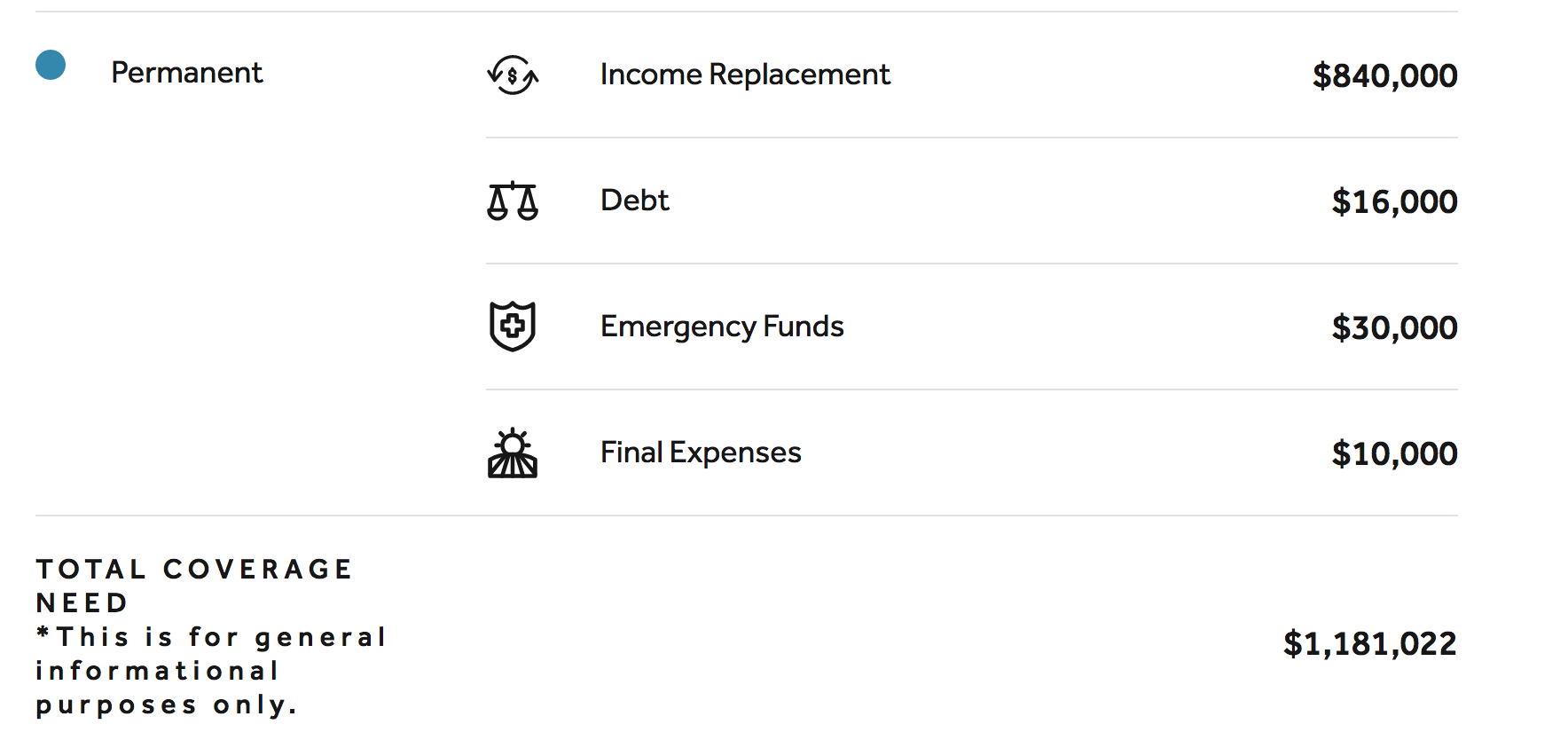

Once the five questions have been answered and submitted, you will receive a sheet that details your needs at different stages. You are given a breakdown of your temporary and permanent needs today, in 20 years, and at age 75.

Overall needs amount with a suggested idea of what types of coverage would be best suited for your financial needs.

The breakdown shows your itemized needs, both temporary and permanent, which is a good guide when you are ready to talk to a financial representative to purchase a life insurance policy that fits your financial needs.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Design of Website/App

The website is straightforward and easy to navigate, giving visitors comprehensive information on all products offered from life insurance, retirement, long-term care, investments, and premier services. They offer information to help prepare individuals for different stages of their lives, as well as comparison and calculation tools to help plan your financial future.

The claims page is straightforward, allowing individuals to easily start a claim, search for a policy, or update beneficiary information. There are also helpful PDFs offering bereavement support and answering questions regarding death benefit proceeds.

There is a New York Life app, but it only receives 1.6 out of five stars, with complaints mostly due to login issues and adding individuals to policies. The app offers mainly articles and informational pieces and is not user-friendly for members.

Pros & Cons

When considering your options for life insurance, there are many questions to answer and choices to make. Here is a quick list of pros and cons to guide you as you continue your research.

Pros

- offers a wide range of insurance products, as well as survivorship and guaranteed acceptance policies

- highly rated by the top rating companies and financially secure

- user-friendly website with comprehensive information on all products offered

Cons

- some customer complaints of delay in claim processing

- does not offer an online quote tool or online applications

- inadequate mobile app

The Bottom Line

New York Life Insurance Company has been in business for 174 years and is the largest mutual life insurance company in the United States. With their strong financial stability, they are a company that people have looked to and trusted as providers of both individual and group life insurance.

They offer a wide range of insurance policies that can fit the financial needs and budgets of young couples all the way to those nearing retirement age. Look to New York Life Insurance Company for their comprehensive coverage options.

Want to know more about New York Life Insurance Company? Get started now and compare insurance quotes below with our FREE quote tool.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Frequently Asked Questions

Is New York Life insurance reliable?

Yes. They are the oldest mutual life insurance company being established in 1845. They are a financially sound company with strong credit ratings from the top rating agencies.

Does New York Life pay out dividends to their policy owners?

Yes. They have been for the last 164 years. Based on their payout in 2018 of $1.78 billion and a solid year so far in 2019, they already project a dividend payout in 2020.

How is the death benefit proceeds form obtained?

The death beath benefit proceeds form will be sent to the beneficiary on record or you can call 800-695-9873 or report the death online at www.newyorklife.com and the form will be mailed to the beneficiary.

Where is the death benefit proceeds form mailed?

Mail a fully completed death benefit proceeds form with one certified original death certificate along with any additional requested documentation to:

New York Life

Attn: Death Benefit Proceeds Administration

P.O. Box 130539

Dallas, TX 75313-0539

For overnight mail:

New York Life

Attn: Death Benefit Proceeds Administration

51 Madison Avenue

New York, NY 10010

How can I get a quote for New York Life Insurance?

To obtain a quote from New York Life Insurance, you can visit their official website or contact a licensed insurance agent affiliated with the company. You will need to provide information about your age, health, lifestyle, and desired coverage amount to receive an accurate quote.

What factors affect the rates for New York Life Insurance?

The rates for New York Life Insurance are influenced by various factors, including your age, health condition, lifestyle choices, occupation, and the type and amount of coverage you choose. Additionally, factors such as smoking habits, medical history, and family health history may also impact the rates.

What types of insurance does New York Life offer?

New York Life Insurance offers a wide range of insurance products, including term life insurance, whole life insurance, universal life insurance, variable life insurance, and long-term care insurance. They also provide annuities and other retirement planning options.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Life Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed life and health insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chr...

Licensed Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.