Term Life Insurance Rates by Age (Exam & No-Exam)

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Mar 16, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Mar 16, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Sample life insurance rates are provided on this page because we believe it’s a good business practice to show all the rates before we ask for your personal information. It’s worth mentioning that prices are fixed by law, which means you can’t find a lesser rate for the same product offered.

So, whether you plan to buy life insurance through AIG or a broker who represents AIG, the rates will be the SAME. You may also want to keep in mind that these rates are for individuals in perfect health who are non-smokers.

Related: GUL life insurance sample rates.

Life Insurance Rates by Age

- 10-Year Term Life Insurance Rates

- 15-Year Term Life Insurance Rates

- 20-Year Term Life Insurance Rates

- 25-Year Term Life Insurance Rates

- 30-Year Term Life Insurance Rates

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Factors Determine Insurance Rates?

Life insurance rates are determined by many factors such as carrier’s statistics, height, weight, age, tobacco use, family medical history, and current health. The more risk you pose to the carrier, the more you will pay, or you may be declined altogether.

The idea of “getting a good deal” doesn’t apply when it comes to life insurance. Your rates will be an exact reflection of the risk (health-wise) you pose. The younger and healthier you are, the better rates you will get.

Below are the basic criteria:

- Your health condition: If you are healthy and take no medications, your insurance coverage costs will be less than if you have high cholesterol, high blood pressure or other health issues. Those with distinct risk factors have a hard time being eligible or may pay an increased premium based on the carrier’s underwriting guidelines along with the health ailment.

- Your age and gender: The younger you are when you purchase your coverage, the less expensive the cost of your term insurance will be because you are less likely to pass away. Also, women pay less for life insurance because they tend to live longer than men.

- Are you a smoker? Smoking is probably the most significant variable in determining your costs, mainly because smokers have more health problems and a decreased lifespan. You can reduce your life insurance charges by giving up smoking and remaining a non-smoker. The period you must be free of smoking differs by company.

- Outcomes of your medical exam or medical questionnaire: Life insurance companies generally involve a medical assessment before you can be considered for coverage. Several companies provide no-exam life insurance policies. Keep in mind that those plans cost more, and the max benefit is usually $500,000.

- Occupation and activities: If you have a high-risk occupation such as a pilot or take part in dangerous hobbies, such as motocross riding, diving or skydiving, you will pay higher rates due to your elevated risk.

I wrote a detailed post about why you get conflicting rates here.

Related: 5 uncommon ways to save money on life insurance.

10-Year Term Life Sample Monthly Rates

A 10-year term life insurance policy provides income replacement to your heirs in the event of your death – provided you pass away within the 10 years that the policy stays active. Why would a person pick a 10-year term? A 10-year policy is the least expensive to purchase.

Furthermore, there are instances in which a family would favor a smaller policy period. For example, if a family has a few kids from ages 12 to 18, the parents might prefer a 10-year term to guarantee financial protection for the high school and college years of their children.

15-Year Term Life Sample Monthly Rates

A 15-year term life insurance policy will provide coverage for 15 years. The premium will stay the same for the term. After 15 years, you may be able to convert the policy, but the premium will be higher.

One of the biggest benefits of 15-year term life term insurance is its lower initial cost in comparison to a 20- or 30-year term. You only pay for the protection you need. This allows you to afford larger coverage amounts. You may have 12 years remaining on your mortgage loan and simply need insurance protection for this particular timeframe.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

20-Year Term Life Sample Monthly Rates

A 20-year term life insurance policy is life insurance coverage which lasts for 20 years. Term insurance policies provide level premiums, which means your premium will stay the same for the chosen term. When shopping for term life insurance, you may want to consider two primary factors: the period of the term and the face amount that you are covered for.

Many people pick 20-year term life insurance mainly because they want to be certain their children will be taken care of financially should something happen to them. However, after 20 years, children will support themselves, and this type of coverage is no longer required.

25-Year Term Life Sample Monthly Rates

A 25-year term life insurance policy is life insurance coverage that lasts for 25 years. This type of plan will also provide a guaranteed premium for the term. Young couples looking to have children in the near future might use this insurance policy to take care of the financial requirements of the family if the breadwinner dies.

30-Year Term Life Sample Monthly Rates

A 30-year term life insurance policy protects you for 30 years. If you die before the term is up, your beneficiaries collect payment of the coverage face amount. A 30-year term policy is also the most common policy to buy.

It can be a method for individuals to continue supplying for their households after they have died and are not able to generate income. It may be used to pay property taxes. Additionally, it provides a sum of cash to pay final expenses and any other costs associated with the death of a family member.

*All rates quoted on this page are for a super-preferred healthy individual who does not use tobacco. Monthly rates are updated as of Feb 2017 and are subject to underwriting approval.*

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Insurance Industry

Case Study 1: John’s Term Life Insurance Decision

John, a 35-year-old non-smoker, recently got married and started a family. Concerned about securing his family’s financial future, he decided to explore term life insurance options.

John compared quotes from multiple insurance providers and discovered that a 20-year term life insurance policy offered the best coverage at an affordable premium. By selecting this policy, John ensured that his family would be financially protected for the next 20 years, providing peace of mind and security.

Case Study 2: Sarah’s Car Insurance Comparison Experience

Sarah, a 28-year-old professional, recently bought her first car. Excited about hitting the road, she knew that getting car insurance was a priority. Sarah used a free car insurance comparison tool, entering her ZIP code to receive multiple quotes from top insurance companies.

After comparing the coverage options and premiums, she found an insurance policy that met her needs and fit within her budget. By taking the time to compare quotes, Sarah saved money while ensuring she had adequate coverage for her new car.

Case Study 3: Michael’s Financial Planning With 30-Year Term Life Insurance

Michael, a 45-year-old homeowner and sole breadwinner of his family, wanted to secure their financial stability in the long run. He considered a 30-year term life insurance policy to protect his family’s future in case of his untimely death. By opting for a longer-term policy,

Michael ensured that his family would be financially supported throughout his working years and beyond. He compared quotes from various insurance providers to find the best rates and coverage options. With the 30-year term life insurance policy in place, Michael gained peace of mind, knowing that his loved ones would be taken care of financially.

Bottom Line

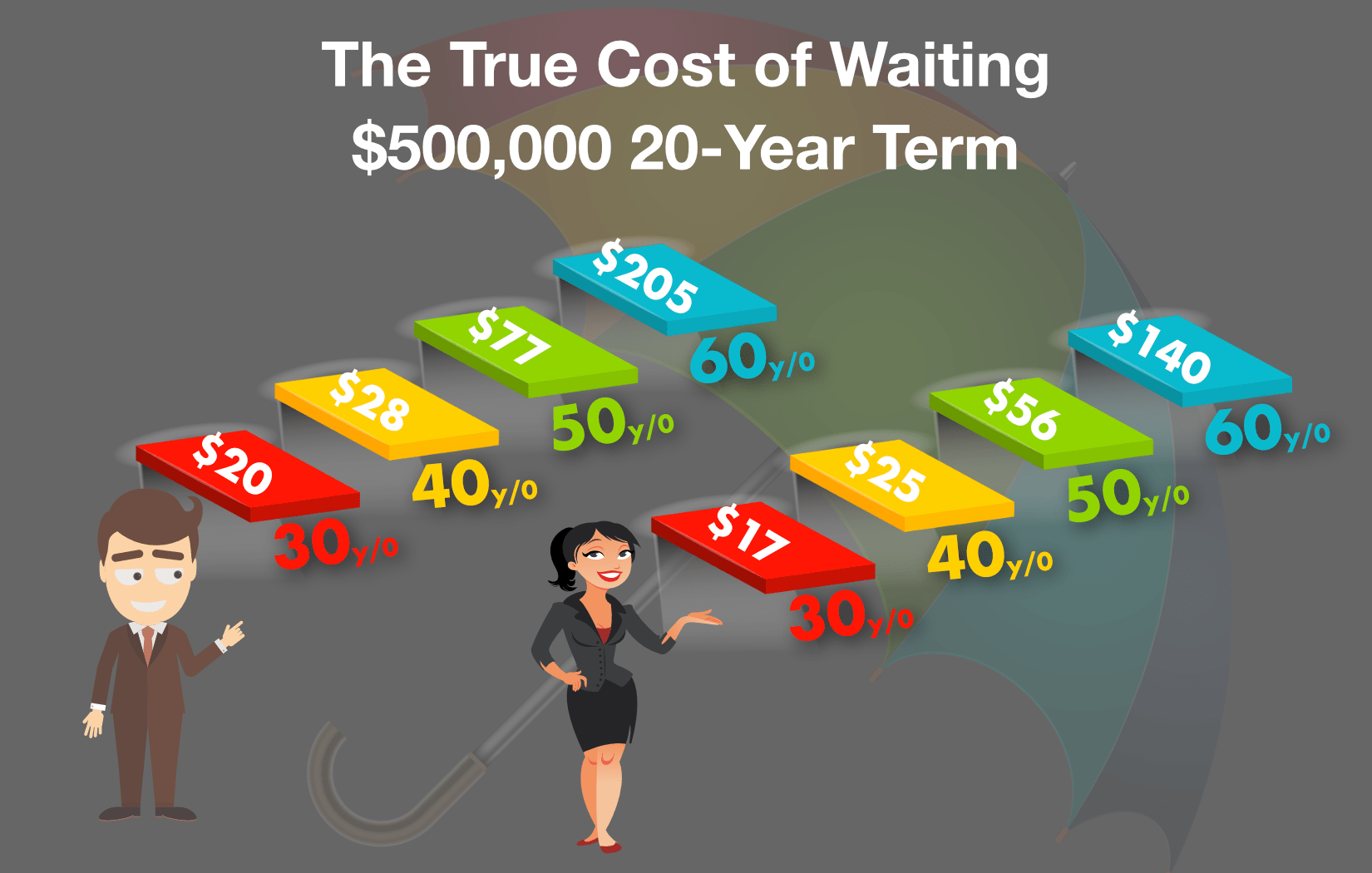

Like everything else in life, if you buy something when you need it most, it will cost you more. The person who has a terminal illness and wants to buy life insurance NOW will either be declined or opt for a guaranteed issue policy, which will cost a lot more.

Make sure you aren’t forced into buying life insurance by life events. Buy it when you need it the least. Usually when are young or just bought a house, just get a small policy; it may be needed in the future, and you will pay the least for it now.

As they say, you can either pay now or pay later, but later, it will cost a lot more. You can run the quotes yourself on this page.

Frequently Asked Questions

What factors determine life insurance rates?

Life insurance rates are determined by several factors, including the carrier’s statistics, age, height, weight, tobacco use, family medical history, and current health. The risk you pose to the insurance carrier is a significant factor in determining your rates. Younger and healthier individuals typically receive better rates.

Why would someone choose a 10-year term life insurance policy?

A 10-year term life insurance policy is often chosen because it is the least expensive option. It provides coverage for a specific period of 10 years, making it suitable for individuals who want income replacement for their heirs in the event of their death within that time frame. For example, parents may choose a 10-year term to financially protect their children during their high school and college years.

What are the benefits of a 15-year term life insurance policy?

A 15-year term life insurance policy provides coverage for 15 years with a fixed premium throughout the term. It offers lower initial costs compared to longer-term policies like 20 or 30 years. This type of policy allows individuals to afford larger coverage amounts and is often chosen to provide financial protection for specific timeframes, such as the remaining years on a mortgage loan.

Why do people often select a 20-year term life insurance policy?

A 20-year term life insurance policy provides coverage for 20 years with level premiums. Many individuals choose this policy because they want to ensure their children are financially supported if something happens to them. After 20 years, children typically become financially independent, reducing the need for this type of coverage.

What is the purpose of a 30-year term life insurance policy?

A 30-year term life insurance policy offers protection for 30 years, with the coverage face amount paid to beneficiaries in case of the policyholder’s death during the term. It is the most common policy to buy and serves as a way for individuals to provide for their families after their death, ensuring financial stability. It can be used to pay property taxes, cover final expenses, and meet other costs associated with the death of a family member.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.