TIAA Life Insurance Review (Companies + Rates)

Although TIAA life insurance no longer sells new policies, this TIAA life insurance review details the types of policies the company still offers to existing clients, including rates starting at $10 per month for a 20-year TIAA term life insurance policy with $100,000 worth of coverage.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Oct 27, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Oct 27, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

TIAA Company Overview

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1918 |

| Current Executive | CEO – Roger W. Ferguson, Jr. |

| Number of Employees | 17,500 |

| Total Sales / Total Assets | $41,052,100,000 / $568,190,200,000 |

| HQ Address | 730 3rd Ave, Suite 2A New York, NY 10017 |

| Phone Number | 1-800-842-2733 |

| Company Website | www.tiaa.org |

| Premiums Written - Group Life / Individual Life | $88,203,942 / $355,692,556 |

| Financial Standing | $1,492,000,000 |

| Best For | Employees in Education, Research, or Medical Fields |

Buying life insurance can be a tough process, but the life of a teacher is even tougher. That’s why the Teachers Insurance and Annuity Association of America (TIAA) focuses on helping academic, medical, and research professionals. Also, the process of finding sample life insurance rates can be fast and easy.

Unfortunately, and as you’ll learn in this TIAA life insurance review, as of January 1, 2020, TIAA no longer issues new life insurance policies. However, the company still manages existing life insurance products.

If you already have a policy through this company, then our TIAA life insurance review will answer all of your questions. If you’re a teacher who needs a life insurance policy, don’t worry. There are tons of options out there. The perfect place to start is by using the FREE quote tool above to compare rates from various companies.

How do you shop for TIAA Life Insurance quotes?

The life insurance underwriting process can also be fast and easy. Simplified underwriting doesn’t require an exam, and your application is approved within hours or a few days. More than half of all consumers are more likely to purchase life insurance if there is no required medical exam.

The only downfall of simplified underwriting is the average life insurance cost tends to be higher. Let’s take a look at some average rates.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the average TIAA Life Insurance rates by age?

Often the first question people ask is: who sells the best life insurance? Usually, the answer depends on who the life insurance is for, but looking at the different rates is a good place to start. Let’s look at the average TIAA life insurance rates by age chart using rates from 2019 because the company no longer offers new life insurance policies.

TIAA Sample Monthly Term Life Rates

| Age & Gender | $100,000/20-Year Monthly Rates | $250,000/20-Year Monthly Rates | $500,000/20-Year Monthly Rates | $1,000,000/20-Year Monthly Rates |

|---|---|---|---|---|

| 25-Year-Old Female | $10 | $13 | $19 | $32 |

| 25-Year-Old Male | $11 | $15 | $22 | $38 |

| 50-Year-Old Female | $22 | $36 | $62 | $115 |

| 50-Year-Old Male | $28 | $49 | $84 | $158 |

Typical TIAA life insurance rates by age resemble the averages of other companies too. The table below shows the average monthly term life rates from other top life insurance companies. The rates are based on a $100,000, 20-year term life policy for healthy individuals.

$100,000/20-year Term Life Insurance Average Monthly Rates by Age & Gender

| Age |  |  |  |  |  | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| 25-Year-Old Female | $8 | $8 | $9 | $9 | $10 | $10 | $11 | $11 | $12 | $13 |

| 25-Year-Old Male | $9 | $9 | $10 | $11 | $13 | $11 | $11 | $11 | $15 | $15 |

| 50-Year-Old Female | $18 | $18 | $25 | $20 | $22 | $23 | $20 | $19 | $28 | $29 |

| 50-Year-Old Male | $22 | $22 | $31 | $24 | $27 | $28 | $26 | $23 | $39 | $36 |

As you can see, the cost of life insurance increases as you grow old. The tables also show that men pay more in life insurance.

Life insurance for smokers is super expensive, averaging three to four times more than non-smokers. We have seen which companies are the cheapest, but what is the most reliable life insurance company? Well, TIAA is the most reliable for teachers, doctors, and other non-profit organizations’ employees. Next, we take a look at the different types of life insurance policies.

What life insurance policies are offered by TIAA?

What is TIAA life insurance? As mentioned above, TIAA life insurance was only available to those in non-profit industries. Currently, TIAA has stopped issuing new life insurance policies, the company still offers a wide array of financial services, including retirement plans, annuities, and IRAs.

However, we’ll discuss the different types of life insurance policies, including the existing policies that the company still manages. The best life insurance companies offer both types of life insurance: temporary and permanent life insurance.

Life insurance policies for spouses are important even if only one person works.

One option is a survivorship life insurance policy that covers two individuals and pays a death benefit upon the death of the second person. It’s geared toward individuals who seek estate planning to help their heirs when they inherit a business or a large estate.

Before jumping into the various types of life insurance, let’s discuss life insurance policies for children. Under most circumstances, getting a life insurance policy for your child isn’t necessary. A death benefit is typically used to replace lost income, and children generally don’t create an income to be replaced. Sometimes you can add a child rider to your own policy, but opening a savings account might be a better idea.

Types of Life Insurance Offered by TIIA

Term Life Insurance

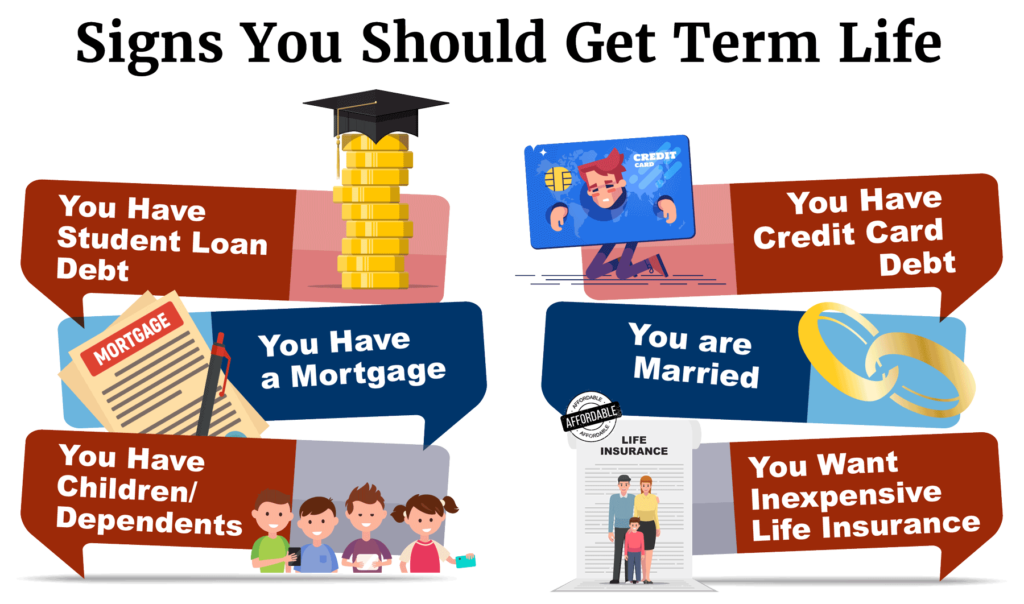

Term life insurance is temporary protection that provides a level death benefit and fixed premiums for the length of the contract. The best term life insurance will cover any possible financial needs as well as provide peace of mind.

Term life insurance policies for parents are a logical choice because they are often cheap and affordable. Life insurance should be a safety net, one that parents need the most while their children are still growing. The safety nets or death benefit can be used for anything from mortgage protection or income replacement to college tuition.

Term life insurance policies for adults, in general, can be helpful when someone is in debt upon their passing. Debt left behind for loved ones can add unnecessary stress on top of the grief. A few of those debts would be a mortgage, car note, or any other kind of loan.

TIAA offered typical term lengths for its policies: 10, 15, 20, or 30 years. The company also had a typical minimum death benefit of $100,000.

Another common feature of term life insurance is that most companies allow for the ability to convert term into permanent life insurance. Many companies often allow for the conversion without a medical exam or health questionnaire being necessary; this was TIAA practice as well. Sometimes there is the opportunity to renew a policy annually.

Annual renewable term life insurance guarantees fixed premiums for one year at a time. However, you’ll pay more each year as you get older. The pay-as-you-go gimmick is usually a bad idea, and one should instead consider a longer term, where your premium remains level each year.

Life insurance policies for seniors can be expensive, but if a term life policy is going to expire for someone near the age of 80, then settling for annual renewal can be a logical choice. It would still be wise to consult your financial advisor or insurance agent beforehand.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is whole life insurance?

Whole life insurance is the most common type of permanent life insurance. TIAA did not offer whole life but rather universal life, which will be discussed in the next section. But first, here’s a short description of what whole life insurance is.

As the name implies, whole life insurance remains in place as long as all the required premiums are kept up to date. Just like term life, there is a level death benefit. However, whole life provides an additional benefit: a savings aspect.

The savings part of permanent life insurance policies is usually referred to as cash values. These portions of the policy are sometimes called living benefits because one can borrow against or withdraw from the cash portion.

Whole life policies can be 10 to 20 times the price of a term life policy. It’s usually better to buy term life and get a different kind of savings vehicle up and running like a 401(k) or IRA. A typical use of a whole life policy is to cover the taxes on large and expensive estates.

Let’s move on to a slightly more complicated and flexible type of life insurance.

What is universal life insurance?

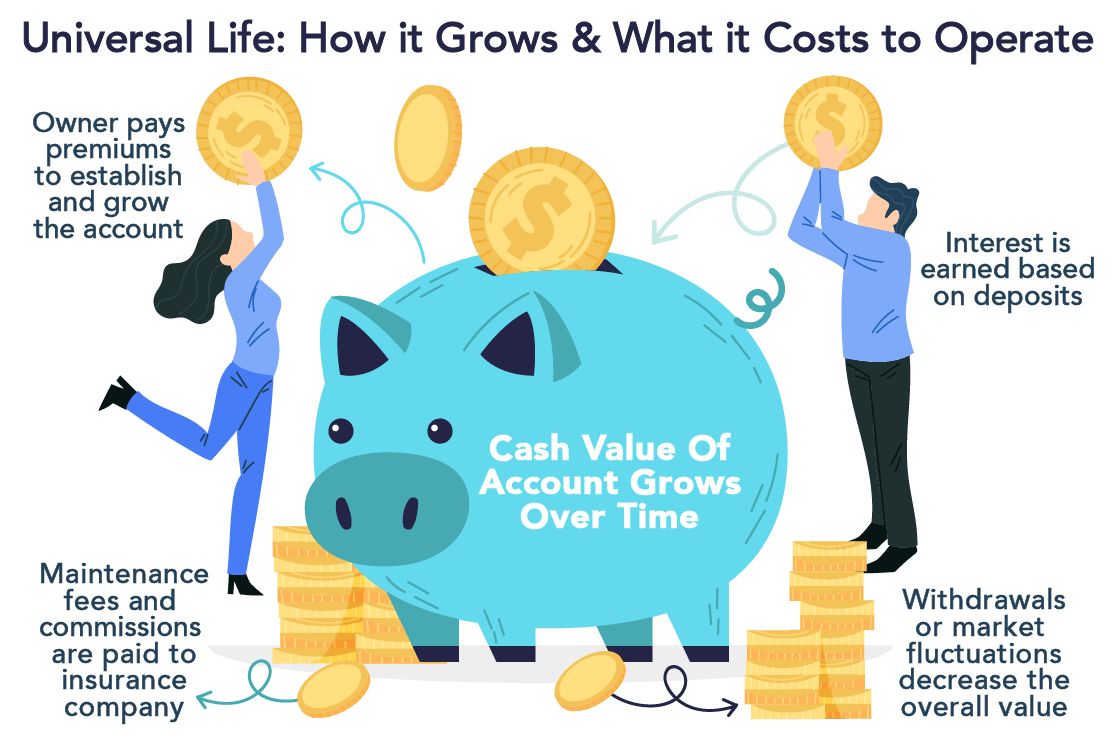

Universal life insurance provides flexibility when it comes to coverage and premiums, giving you complete control over the customization of the policy. Essentially, you can increase or decrease your death benefit to fit your needs while setting your own payment schedule.

Of course, there’s also a cash value portion of universal life policies that can be accessed by loan, withdrawal, or by surrendering the policy.

What is variable universal life insurance?

This type of policy offers a greater cash value accumulation option when compared to traditional universal life. TIAA investments within the stock market become further entwined with the cash portion. Many high-net-worth individuals favor this option. It isn’t recommended for those who aren’t stock market savvy because your cash value can decrease.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are life insurance riders?

You may have heard of a life insurance rider, but what are life insurance riders? In short, they are add-ons to customize your life insurance coverage to cover all your needs. Some of the most popular riders that TIAA used to offer and other companies still do offer are:

- Accelerated death benefit – if the insured is diagnosed with a terminal illness, they will receive a payment equal to part or all of the death benefit.

- Charitable giving benefit – the life insurance provider would pay up to 1 percent of the policy’s death benefit, up to $100,000, to the charity of choice.

- Over-loan protection endorsement – ensures that coverage won’t lapse due to insufficient funds in the savings portion of the account.

- Level cost of insurance endorsement – allows the insured to lock in the rates for a 10- or 20-year period as opposed to the rates increasing each year based on your age. TIAA only offered this on variable universal life plans.

- Waiver of monthly charges – waives the policy’s premiums and keeps it in force if the insured becomes disabled; also known as a disability rider.

- Last-survivor policy split option – allows the splitting of a survivorship policy into two separate life policies in the event of divorce or dissolution of a partnership.

- Estate transfer protection – offers additional funds to relieve the tax burden on a survivorship policy if the second insured dies shortly after the first one.

Just like the policies they attach to, riders aren’t available from every company across every state.

How do you get a quote from TIAA online?

Unfortunately, TIAA no longer offers life insurance coverage and therefore can’t offer quotes. The best way to get life insurance quotes is online, but not through just one company like TIAA. Figuring out how to get multiple life insurance quotes is also easy because you can do it without leaving this page. By using our quoting tool, you can compare multiple quotes all at once.

Can you cancel your TIAA life insurance?

A common question is: Can you cancel your life insurance policy? The answer is yes, but depending on when you cancel you may face surrender fees, which are applied when the policy is canceled within a few years after it was put in place. Here’s a more specific question: how can I cancel my TIAA life insurance?

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How do you cancel your policy?

You’ll want to contact your agent, or you can call customer service at 1-800-842-2252. After you explain that you wish to cancel your policy, make sure you submit a written copy of your request to the company via fax or mail. It’s important to stop automatic payments and monitor to make sure more money is not taken.

Throughout the process, keep in contact with your agent frequently until you receive your payment.

How do you make a claim with TIAA?

With TIAA, the first step is to notify the company of the passing. Make sure to have the policyholder and beneficiary’s information. How long does it take to make a life insurance claim? It shouldn’t take more than 30 minutes. The best way to make a life insurance claim is to call and speak to a representative directly.

What do people say about TIAA’s customer experience?

Some of TIAA’s worst customer experience reviews come from the BBB’s website and often center on TIAA holding people’s money hostage. It’s hard to find the best customer experience reviews when so many are negative from a consumer standpoint.

This is strange considering TIAA has a 0.15 complaint index on the National Association of Insurance Commissioners (NAIC) Complaint Index. The purpose of the NAIC Complaint Index is to compare the performances of different companies. To determine a company’s index, you must divide the number of complaints by the number of premiums written.

The national average is 1.00, so with a 0.15 TIAA is considered to have a lot fewer complaints than most other insurance companies.

Under resources, you’ll find tools, calculators, forms, and FAQs. There is even a link to specific resources regarding information about the coronavirus and how it affects the company and its customers.

TIAA’s Programs

On TIAA’s website, there is a “Learn” tab which has links for:

- Personal finance 101

- Retirement & beyond

- Life milestones

- Prepare for the unexpected

- Resources

Under resources, you’ll find tools, calculators, forms, and FAQs. There is even a link to specific resources regarding information about the coronavirus and how it affects the company and its customers.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are the website and app simple to use?

TIAA’s website is huge. On the main page for the public, there are six main topic links: bank, borrow, invest, retire, learn, and about TIAA. However, there are different pages for advisors and consultants.

There are also specific pages for TIAA CREF URMC (University of Rochester Medical Center) and TIAA CREF Yale retirement benefits. The TIAA intranet is accessible from any of these pages which all have a “log in” button.

With the company’s app, you can access your TIAA statements and upload documents with ease. The app is rated a 4.5 on Google Play.

What more should you know about TIAA Life Insurance?

The history of TIAA begins in 1918 when Andrew Carnegie and his Foundation for the Advancement of Teaching created a funded pension for professors the Teachers Insurance and Annuity Association of America (TIAA). The goal was to produce a sustainable and guaranteed income for individuals in the academic, government, and non-profit fields.

The company underwent a name alteration in 1952 when it added the College Retirement Equities Fund to become TIAA-CREF. While leaving the TIAA headquarters in New York, the company expanded by opening offices in Atlanta and San Francisco in 1982. A few years ago, TIAA dropped the CREF part of its title.

In 2020, the company changed again by discontinuing its life insurance policies.

How are TIAA’s ratings?

TIAA’s financial strength ratings are overall fairly high. The table below shows TIAA life insurance ratings for 2019 from all the major rating agencies.

TIAA Life Insurance Ratings

| Ratings Agency | Rating |

|---|---|

| A.M. Best | A++ (Superior) |

| Better Business Bureau (BBB) | A- |

| Moody's | Aa1 (Very Strong) |

| Standard & Poor's (S&P) | AA+ (Very Strong) |

| FitchRatings | AAA (Exceptionally Strong) |

With the A++ rating given to TIAA, we can see that A.M. Best believes that TIAA is extremely capable of fulfilling all financial obligations.

The BBB gave TIAA an A- rating, meaning that TIAA’s customer interaction is pretty good overall.

The TIAA received a very strong rating of Aa1 from Moody’s. At Standard & Poor’s (S&P), TIAA is not seen as a credit risk and is given a very strong rating of AA+.

Fitch Ratings’ opinion is that TIAA is exceptionally strong and capable of meeting financial commitments, translating to an AAA rating.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is TIAA’s market share?

TIAA has locations all across the country as well as 17 subsidiaries including Nuveen, Film Library Holdings LLC, and Westchester Group, Inc. The company may be large and well-established, but there is room for improvement in TIAA’s market share compared to the competition.

The table below has the top 10 life insurance companies market share, all of which are typical TIAA life insurance competitors.

TIAA & Top 10 Life Insurance Companies by Market Share

| Rank | Companies | Direct Written Premium | Market Share |

|---|---|---|---|

| 1 | Northwestern Mutual Life | $10,517,115,452 | 6.42% |

| 2 | Metropolitan Group | $9,821,445,953 | 6.00% |

| 3 | New York Life | $9,295,848,300 | 5.68% |

| 4 | Prudential | $9,128,805,060 | 5.57% |

| 5 | Lincoln National | $8,769,303,174 | 5.36% |

| 6 | MassMutual | $6,854,713,057 | 4.19% |

| 7 | Aegon | $4,809,856,650 | 2.94% |

| 8 | John Hancock | $4,640,905,017 | 2.83% |

| 9 | State Farm | $4,633,004,963 | 2.83% |

| 10 | Minnesota Mutual Group | $4,422,100,028 | 2.70% |

| 55 | TIAA-CREF | $677,755,784 | 0.41% |

At number 55 for market share, TIAA is seen as a medium-sized company that has been around for a while. The two years previous, TIAA ranked 50 and 49 respectively, meaning each year the company continues to drop.

Although the company has a good reputation, the fact that the company no longer is offering new life insurance policies is cause for some concern. When a company starts to discontinue products, it generally means the money isn’t there. The outlook of the company does not seem very bright.

Does TIAA have an online presence?

TIAA has successfully built profiles across the major social media platforms Facebook, Instagram, Twitter, LinkedIn, and YouTube.

Insurance company social media campaigns are serious business now that technology has taken over many aspects of life.

On Facebook, TIAA has 90,751 followers, with over 1,000 photos and videos uploaded, and posts are made several times a week. The company has 30,900 Twitter followers and 12,600 tweets. Instagram is clearly TIAA’s newest profile with only 192 posts and 3,601 followers.

However, its YouTube channel is less popular, with only 6,230 subscribers. As it turns out, TIAA’s LinkedIn profile has the most followers with 99,864, and the company posts weekly.

Does TIAA run commercials or ads?

Insurance company TV commercials can often include catchy jingles or humorous anecdotes, but all the good commercials make you feel like you need it. Insurance company TV ads are also often easier to digest when they are short, factual, and include some emotional factors.

The life insurance TV commercials from TIAA are short and to the point of why you need to buy life insurance. Most commercials focus on how the company’s product can help you.

Now we’ll talk about how TIAA helps the community.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What does TIAA do for the community?

In 2018, TIAA gave back in a huge way. Across 60 offices, 663 projects by 15,205 volunteers over 29, 439 hours impacted over a million lives. Companies that do good for the community often get recognition for their contributions.

Unfortunately, TIAA was not named one of the best workplaces for giving back to the community in 2019. However, from 2015 to 2018, TIAA was named one of the world’s most ethical companies.

In 2018, TIAA’s sustainability efforts saved 4,124 yards of landfill space, 15,216 trees, 70,836 gallons of oil, and 6,276,648 gallons of water.

Examples of businesses giving back to the community include how environmentally conscious and sustainable the offices and operations are. TIAA has Energy Star Rated and LEED Gold Certified office buildings. Next, we’ll discuss how employees feel about TIAA as well as the other awards the company has received.

Who are TIAA’s employees?

By finding the best life insurance companies to work for, you can gauge how well that company will treat its customers as well. TIAA is one of the world’s most ethical companies that also landed on these well-renowned lists in 2018:

- Best Employers for Women, Forbes

- Best Workplaces for Diversity, Fortune

- Top 50 Companies for Diversity, DiversityInc.

- Best Places to Work for LGBTQ Equality, 100 percent Corporate Equality Index

These recognitions are supported by employee feedback as reported by Great Place to Work. Roughly 89 percent said they were proud to tell others where they work. Inclusion and diversity seem to be TIAA’s strong suit. 88 percent felt welcome from day one. On top of a great environment, most TIAA life insurance company employee reviews mention great benefits.

Popular TIAA life insurance company employee benefits listed include 401(k) plans, health insurance, vision, life insurance, maternity and paternity leave, discounted gym membership, and education reimbursement.

Some of the negative comments in TIAA employee reviews focus on micromanagement, excessive bureaucracy, and the lack of urgency for the company to progress in such a technological world.

What are the pros & cons of TIAA life insurance?

The pros and cons of a life insurance company is a great tool to help form an opinion about the company. Highlighted below are the top pros and cons of TIAA.

Pros & Cons of TIAA Life Insurance

| Pros | Cons |

|---|---|

| Strong financial ratings | No longer issuing new life insurance policies |

| Created for education, medical, and research field workers | Specialized membership |

| Large community contributions | Declining market share |

Evaluating the pros and cons of life insurance policies is also important before making a decision.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is the bottom line on TIAA Life Insurance?

TIAA is a well-renowned company that helps take care of those in the professions that take care of everyone else. Even though the company does not offer new life insurance policies, they are still in the business of honoring the existing policies as well as annuities, retirement, and other types of services.

So when someone asks: Is TIAA an insurance company? The answer is no, they are much more.

If you’re still looking for life insurance, don’t worry. Even though based on our TIAA life insurance review, this company isn’t an option, you can compare multiple life insurance quotes today. Start by entering your ZIP code into our FREE quote tool below.

Frequently Asked Questions

How do you shop for TIAA life insurance quotes?

You can no longer obtain quotes directly from TIAA since they no longer offer new policies. However, you can use our free online quote comparison tool to compare quotes from multiple life insurance companies. Simply enter your ZIP code on the quote tool to get started.

What are the average TIAA life insurance rates by age?

As of 2019, TIAA’s average life insurance rates by age were similar to the averages of other top life insurance companies. The rates vary based on factors such as age, gender, and coverage amount. Generally, life insurance rates increase as you get older and men tend to pay more than women.

What life insurance policies are offered by TIAA?

While TIAA no longer offers new life insurance policies, they still manage existing policies. In addition to life insurance, TIAA offers a wide array of financial services, including retirement plans, annuities, and IRAs. The types of life insurance policies they previously offered include term life insurance, universal life insurance, and variable universal life insurance.

Can you cancel your TIAA life insurance?

Yes, you can cancel your TIAA life insurance policy. However, depending on when you cancel, you may face surrender fees if you cancel within a few years of purchasing the policy. To cancel your policy, you should contact your agent or call TIAA’s customer service at 1-800-842-2252. It’s important to submit a written copy of your cancellation request and stop automatic payments.

How do you make a claim with TIAA?

If you need to make a life insurance claim with TIAA, the first step is to notify the company of the policyholder’s passing. You should have the policyholder and beneficiary’s information ready when contacting TIAA. To make a life insurance claim, it’s best to call TIAA’s customer service and speak to a representative directly. They will guide you through the claims process and provide the necessary information and forms.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.